Of late, many have been talking about the Index and find solace in the fact that, Nifty and Sensex have fallen just 25% since 2008 or 2011 highs which is not really bad.

Everyone around the street is taking their best guess on where would Nifty/Sensex will bottom out. There are too many camps out there, some expecting 12000/3800, another at 14500/4500 and rest at 15500/4700 as to be possible a bottom.

My view has been 4500/14500 to be the worst in case, but would prefer to stop guessing the bottoms for the Index, I believe, we have already seen the worst in many of the stocks & are away by a mere 5-10% from the bottoms for many stocks.

I was surprised and astounded by the findings on analysis of data of past few years.

1) Majority of the Indices did not reach highs equivalent of 21k Sensex and 6.3k Nifty.

Bse Midcap is down 42.6% in comparison to 2008 highs and down 33.13% from 2010 highs. Is now equal to what it was in May 2006 ( Sensex equivalent high of 12700 )

In case of Foreign Money (funds invested by FIIs ) they too are down 40% from 2008 and if I were to take a direct comparison in dollar terms Sensex and Nifty have already touched 4500 / 14500.

And now with USD-INR at 49-50, it is really a good proposition for long term foreign money to start flowing back into India.

2) Some of the Indices have outperformed and are way beyond 2008 highs vis-à-vis Sensex / Nifty !!

Many indices are still way above 21k/6.3k equivalent levels namely — BSE FMCG 48.5% , BSE Auto 41% , BSE Healthcare 29%.

3) At the same time, BSE consumer durable (–13%) & IT Index (– 8%) have also fallen less in comparison to benchmark indices.

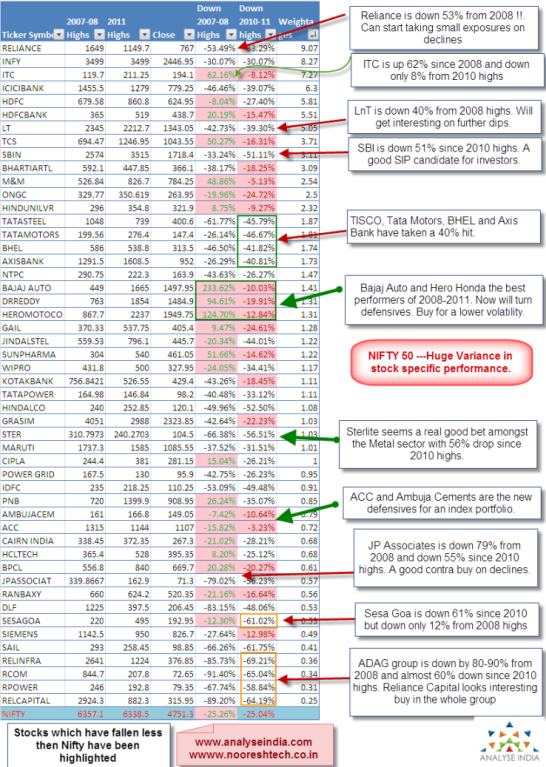

Above statistics shows us that an outperformance in few constituents of the benchmark indices like Auto, FMCG, IT and total underperformance by Capital Goods, Metals, Oil and Gas, Real Estate, Infrastructure has created two groups which are moving in opposite directions.

For example, Reliance is down from a high of 1630 to 767 which is a 53% drop and also has the highest weightage in the Index!!!

Bottomline :

If you would have bought a Hero Honda at the peak of 2008, you would still be up 120% in this fall too!! But remember Hero Honda was not a great performer in 2004-2008 bull market ( it returned less than double in 3 years whereas Reliance Inds did 8 times in the same 3 years ).

The markets have already corrected a lot more then what it looks like from the benchmark indices and there are a lot of stocks that are available at 2006 prices !!! ( Midcaps and Smallcaps ). So for a long term or even a short to medium term investor, the thing to look out for is stock specific valuations and prices.

Themes will change over the next 2-3 years and one should be on lookout for quality stocks irrespective of the INDEX !!!! Focus on buying quality stocks !!! or else you might be left waiting for index bottom.

Expect MORE, Always!

CEO – Analyse India

This guest post has been written by Mr. Nooresh Merani, CEO of Analyse India which is a website that focuses on Technical Analysis for Equity & Commodity markets in India.

Disclaimer : The views expressed by the author in this post are entirely his own and do not necessarily reflect the views of MoneyWorks4me.This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

Bse MidCap at May 2006 level , Bse Small cap at Sep 2005 level, Great analysis. Quick comments are a great take aware.