What is Nifty@MRP?

As research analysts, we constantly track the Nifty movements. To make investing more profitable and not a game of mere chance, we need a solution, a solution that could help us identify whether the market is grossly depressed or irrationally exuberant. This is exactly what Nifty @ MRP is for!

What is the latest value of Nifty@MRP? Or What is Nifty’s fair value?

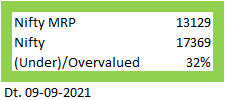

For Q1 2022, considering the free-float market capitalization and the MRP of individual stocks as of Sep 6, 2021, the Nifty@MRP is at 13129. On the day of writing 6/09/2021, the Nifty closing index value is 17369, which implies 32% overvaluation.

The market rally has been broad, with companies across sectors and market capitalization rising. High-quality companies were expensive before the March 2020 crash and continue to remain expensive even today. However, cyclical stocks remain not too far behind, with stock prices rising multi-fold from March lows.

Where do we go from here?

MoneyWorks4me Opinion

The last decade has been disappointing for India in terms of economic growth. Things are starting to look up now. India’s demographics form a good tailwind for high GDP growth in the coming several years. What remains to be seen is the pace of growth, which has suffered in the past 2-3 years. The ongoing government reforms and increasing demand should improve capital availability to Indian entrepreneurs, thus driving future growth. The quality of corporate balance sheets in terms of leverage and cash flow generation has also improved significantly.

With the lower cost of capital, subdued crude oil prices to keep inflation in check, we believe India might be at the cusp of a multi-year growth cycle (we have discussed this in several of our monthly outlook letters).

We continue to advise our clients to stay invested in the market, despite high valuations. We have time and again said that one cannot time the markets. High valuations do not mean markets are going to correct tomorrow. You may switch between stocks that have a poor risk-reward scenario or wait till a reasonably priced stock comes by.

Time to be selective

Needless to say, it is becoming increasingly difficult to find undervalued themes/sectors. Our strategy remains to invest in Good Quality companies, with structural growth trends and trading at reasonable valuations. We have found that sticking to a process delivers superior returns in the long term.

Remember, in the short term, prices go up across the board, but only a handful of them have earnings growth backing them. Why does this happen? Because at the start of the recovery, few of the companies post high growth and investors start to extrapolate this growth for the other sectors. And when the tide turns, these very investors rush to exit their investments, causing a sharp drop in prices. As a result, many investors end up losing all gains made in the upcycle.

So ensure your gains are backed by sustainable sales/earning growth in the underlying company. If you have taken care of these points, just be patient with your investments and stay diversified.

To do this, stick to what you know. For example, we have avoided investing in the metals sectors, despite rising commodity prices and increasing demand, because it is simply not our cup of tea. We have no ability to predict global metal prices.

Rather, if we think a theme is too good to pass, we may look for proxy plays in allied sectors. We added Building materials and housing finance companies last year when we saw the housing market pick up in the US and early signs of real estate registrations in India due to i) higher savings & ii) low interest rate.

If you can’t do it on your own, then find a good advisor you can trust and teaches you how to build a portfolio.

Until next time,

Happy Investing.

Investing successfully to reach your goals:

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463