What is Nifty@MRP?

As investors, we constantly track the Nifty movements. To make investing more profitable and not a game of mere chance, we need a solution, a solution which could help us identify whether the market is grossly depressed or irrationally exuberant. This is exactly what Nifty @ MRP is for!

What is the latest value of Nifty@MRP?

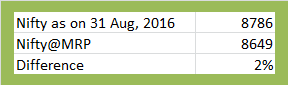

For Jun’16, considering the free float market capitalization at the MRP of individual stocks and the share price data as of 31 August 2016, the Nifty@MRP is at 8649. On 31h Aug, NSE Nifty index closed at 8783, which is ~2% or 137 points above the Nifty@MRP. It indicates that the index is slightly overvalued.

For Jun’16, considering the free float market capitalization at the MRP of individual stocks and the share price data as of 31 August 2016, the Nifty@MRP is at 8649. On 31h Aug, NSE Nifty index closed at 8783, which is ~2% or 137 points above the Nifty@MRP. It indicates that the index is slightly overvalued.

On similar lines, the Sensex@MRP value is at 28741. On 31 August, 2016, the Sensex closed at 28452, which is about 1% or 288 points below Sensex@MRP.

On similar lines, the Sensex@MRP value is at 28741. On 31 August, 2016, the Sensex closed at 28452, which is about 1% or 288 points below Sensex@MRP.

Future Outlook

The nifty has gained almost 15% since we last released our last Nifty@MRP on Mar 18, 2016, catching up with our Nifty@MRP. We would have been elated if the reason for this had been fundamentally driven (like earnings recovery).

Sadly, though, strong FII inflows and global liquidity have been the major reasons driving the markets. For the first eight months FIIs have invested Rs 35905 Cr in Indian markets (Rs 55000 Cr excluding Jan & Feb 2016). Other triggers include a good monsoon, hopes of a rate cut by RBI and supportive global cues.

This accelerated funds flow in all emerging economies including India may be about to slow down as US Fed normalizes interest rates (as the strengthening US economy and Fed comments suggest) and yield arbitrage declines (drawing out funds). Also, there is increasing sense that expansionary policies have limited impact on economic growth (even among Central Banks), which may reduce liquidity in markets.

Coming to fundamental’s, consumption demand is expected to improve. However, constraints in the form of low capacity utilization, private sector debt overhang and fiscal limitation will keep the structural recovery path through higher investments relatively tepid.

The RBI has also cautioned on upside risks to inflation even though it held hope that the monsoon would help soften price pressures. The RBI is focused on bringing inflation down to 4%. Growth drivers remain biased towards agriculture and consumption which will likely lead to higher capacity utilization and in turn private investment. However, we remain cautious on the inflation trajectory though we cannot rule out another rate cut of 25 bps.

However, as stated earlier, the fair valuation of markets suggest that all such event have already been factored in by the market.

MoneyWorks4me Opinion

Though the Nifty is fairly valued/slightly overvalued with respect to Nifty@MRP, we believe there are pockets of overvaluation and undervaluation in individual stocks. For example, cyclical stocks that seem overvalued at the first glance are actually undervalued/fairly valued on a cyclically adjusted PE basis. Similarly, FMCG sector that may seem fairly valued is actually overvalued.

These fair market valuations may seem appropriate for an index investor. However, we are extremely cautious in our view on individual stocks, as the margin of safety at current valuation seems to be non-existent.

We believe Investors should continue buying quality stocks at a sufficient margin of safety. Market correct now and then, thereby creating opportunity. High uncertainty across the globe spells good news for value investors like us, as it gives us an opportunity to buy quality stocks at a cheap price.

We also advise investors to hold some part of their portfolio in cash, which will help them invest when the opportunity arises.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

Although market is overvalued FII always start entering in big way when market is up and take it to higher levels. May be there is still some scope in individual stocks.Waiting for your guidelines for future buys.

Surveyor

Good unbiased analysis