This article covers the following:

Review

As of Nov 30, 2020, Nifty closed at 12,969, around 7% higher over last year. In the last 3 years, Nifty is up 27% translating into ~8% CAGR.

Nifty has bounced back 70% from its intraday lows with healthy participation across the board.

Recently US election outcome and optimism around vaccines have led to new highs for Nifty. The timeline for Vaccine approval and distribution remains uncertain for now. This optimism has led to a rally in Nifty well past old highs, led by banking stocks. Unabated FII inflows are leading to new highs for Nifty, as this subsides we may see some profit booking. We have written a note on What are FIIs seeing?

Stocks that benefitted from the Covid crisis may cool off but individual stocks that report good results will continue to perform well in lines with earnings.

FII bought all-time high Rs. 65,238 Cr worth of shares in Nov’20 while DII sold Rs. 48,339 Cr.

GDP contracted by 7.5% in the second quarter of the calendar year 2020. For this financial year, the contraction is around 15%. With an expected recovery in key parameters like e waybills, auto sales, cement offtake, IIP, and GST collections, it appears the next half will see good GDP recovery closer to pre-covid levels.

Outlook

As of date, the average upside of our coverage universe is likely to be less than 10% CAGR over the next 3 years basis based on current estimates. If we see growth improving next year, we may see an upward revision in our estimates.

Nifty 50 index trades above its fair value while there are pockets of extreme overvaluation and undervaluation. A lot of liquidity helped beaten-down stocks to rally however, the economic indicator does not show full recovery in all sectors.

Even if there is news of reopening or Vaccine, focus on companies that have good earnings growth over the next few years. Companies in sectors like chemicals, pharmaceuticals, IT, Telecom, utilities, and rural-focused companies will report good earnings growth this year.

We are looking at companies that have good earning triggers over the next 2 years as we are not certain whether broad-based recovery will happen immediately. We are investing in companies i) coming out of sector consolidation/debt reduction, or ii) introducing new products, or iii) commissioning new capacities, or iv) executing orders in hand. This gives certainty of growth rather than plain anticipation.

We are looking at opportunities in building materials, export-oriented textile or light engineering, and import substitute ideas. We have increased allocation to the Power sector and building material space where incremental data suggesting an improvement in the sector’s prospects.

Register FREE | Schedule a DEMO | Solution Enquiry | Subscribe

Risks

Indian Economy

GDP data saw two-quarters of year-on-year decline, while the recent quarter was more reasonable 7.5% versus the previous quarter decline of 23%. Unfortunately, the cases are still on the rise as more people returned to work and started traveling.

Many sectors have reached at least 80% utilization in Nov’20. Popular high-frequency data like car registration, toll roads, diesel usage, and electricity generation show month-on-month improvement. A lot of the demand is coming from pent-up as well as festivity.

Beyond a point, forecasting macroeconomics is tough. We remain optimistic that the pandemic will affect only near-term economic parameters but it won’t dampen the demographics of the country nor can it stop the long-term momentum in GDP growth and rising consumerism.

With Vaccine news stocks have rallied further, will they correct?

Currently market rallied on the back of the US election outcome and Vaccine news on Monday, 9th November 2020. While Vaccine news certainly is very positive, the market has already rallied pricing economic recovery in the next financial year.

Low-interest rates and liquidity is fuelling rallies across emerging markets. While the market does look expensive wherein few stocks are pricing in a very optimistic near-term future, we will see a pullback if the not deep correction in the near term. However, since the overall market is not in correction mode anymore, we expect individual stocks to do well based on business performance.

Is it not wise to sell stocks now? Is it 2003 or 2007?

No, because we don’t know whether it is the start of the next upcycle or the end of the past cycle. In short, we don’t know whether are we in 2003 or 2007?

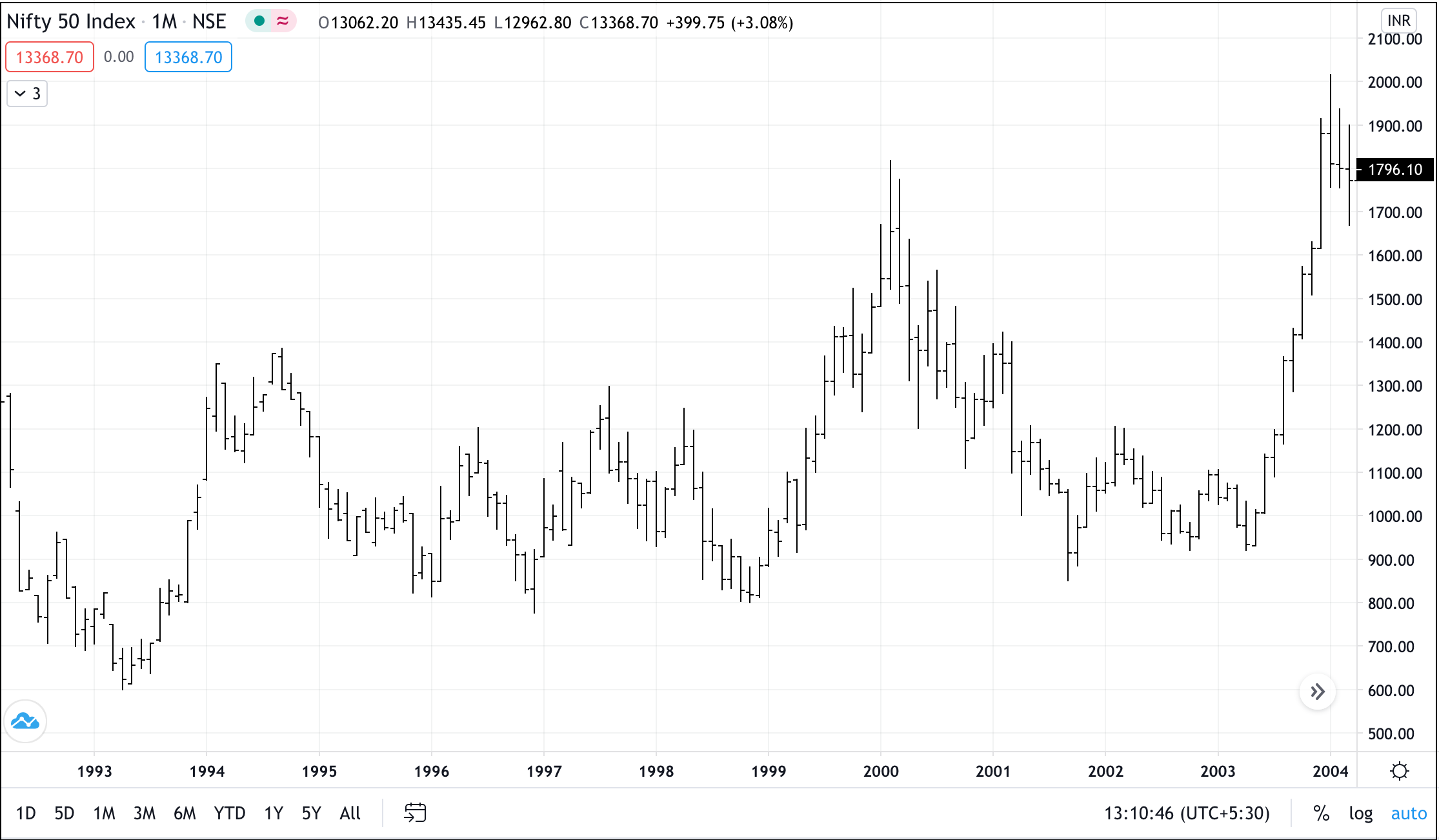

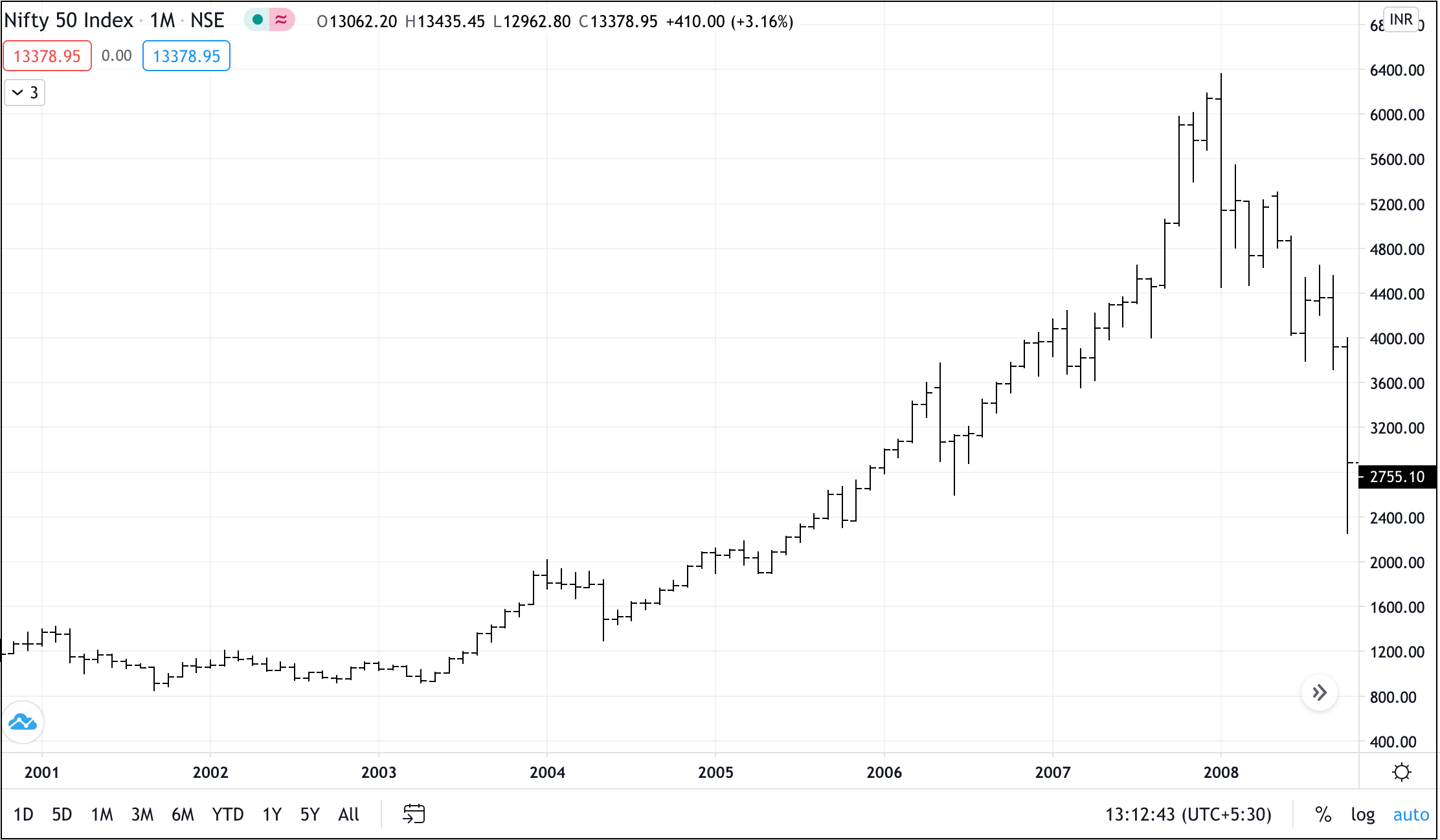

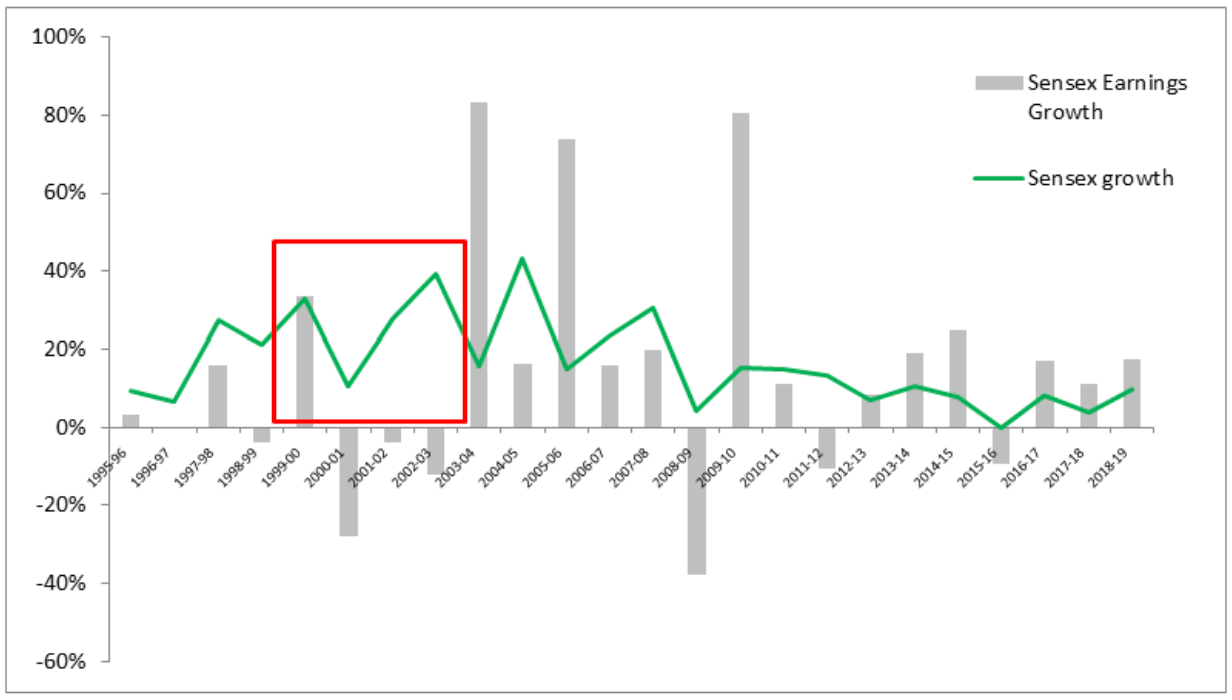

If someone sees the economic data and companies earning growth prior to 2003, it was terrible. But market rallied 100% from lows before fundamentals reflected the same optimism. Later when the earning growth of the company followed, the market retained this appreciation and climber higher in lines with earning growth. After a 100% rally from lows, Nifty went up another 200%+, from 2000 to 6400 over the next 3 years.

Today we might be at a similar juncture where we have had poor earnings growth and GDP growth for the last 2-3 years. It could be a cyclical recovery leading to higher GDP and earnings growth over the next 2 years.

This is the reason not to get carried away by the price appreciation. The majority of the stocks are not yet at all-time highs. Based on market valuation and the number of opportunities available, we believe it is time to be cautious but not so much to liquidate existing holdings.

How to think about market valuation:

Let’s assume Nifty is indeed 20% expensive (As per our MRP, Nifty – a concentrated portfolio – is around 20% higher than its fair price, not true for all stocks).

If Nifty were to give 13% CAGR returns over the next 10 years, buying 20% above fair value reduces your returns by 2% CAGR i.e. it will earn 11% CAGR versus 13% CAGR. Now it doesn’t look so bad. Our portfolios are expected to deliver better than Nifty as their growth rates and quality is better than Nifty.

It is fair to hold/raise 10-20% cash in the portfolio, we will inform you which stocks to be sold if we see evidence of correction. The rest of the portfolio can be held despite volatility based on news flow or a rise in the number of Covid cases. We can’t avoid volatility completely as markets move in unpredictable patterns.

We recommend equity investing only for long term savings so that near term events become irrelevant. We do not find any merit in second-guessing what’s going to happen in the next 6 months-1 year. If the shortlisted stocks are good companies, with good growth prospects, they will deliver returns in line with business performance. Picking the right stocks is easier than predicting the market direction.

We continue to recommend Gold Fund/Gold (up to 5-10% of the portfolio) as a hedge from contagion risks.

If you are afraid about the economy, people losing jobs, your own finances, commit lower than usual in equity. Say instead of Rs. 100 inequity in normal times, commit only 60 or 70. But don’t get scared of volatility.

How to allocate funds:

Restrict your allocation to 3-5-7% in each stock and diversify across 20-25 names. And not more than 25% in each mutual fund. This will keep you at peace, and not significantly dent your portfolio performance.

Avoid any type of regret while investing. Regret can come either missing stock or not adding enough to a winning stock. Rather focus on overall strategy as explained above.

Beyond this, tinkering with asset allocation will only reduce long-term returns thereby missing one’s target corpus. We have diversified our stocks portfolio, we have diversified assets and we have a long term horizon. Together this takes care of all potential risks in investing.

MoneyWorks4me Outlook:

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Register FREE | Schedule a DEMO | Solution Enquiry | Subscribe

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call 020 6725 8333 | WhatsApp 8055769463