Nuvoco Vistas Corporation Ltd IPO Details:

IPO Date: August 9th to August 11th, 2021

Total Shares for subscription: ~8.8 Crs

IPO Size: ~Rs. 5000 Cr

Lot Size: 26 shares

Price Band: Rs. 560-570/ share

Market Capitalization: ~20,400 Cr

Recommendation: Subscribe for long term

Purpose of Nuvoco Vistas Corporation Ltd IPO

Promoters selling their stake; Fresh issue for paying off debt

About Nuvoco Vistas Corporation Ltd

Nuvoco Vista Corporation Limited (Nuvoco) is promoted by Dr. Karsanbhai K. Patel of Nirma Group. The Nirma Group is a diversified conglomerate that manufactures products ranging from chemicals to detergents, soaps, healthcare products and real estate development. Nirma Group forayed into the cement business in 2014 through a Greenfield cement plant in Nimbol. Thereafter, through acquisition of 11mtpa Lafarge Holcim in 2016 and 8mtpa NU Vista in 2020, it now has an installed cement capacity of 22.3 million tonnes (MT).

Business of Nuvoco Vistas Corporation Ltd

Nuvoco is fifth largest cement company in India with cement capacity of 22.3mtpa (78% in East India and 22% in North India). Nuvoco has capacity share of approximately 17% in terms of consolidated capacity in East India and a capacity share of approximately 4.7% in terms of consolidated capacity in North India. ¾ In FY21, Nuvoco sold 17.26mtpa cement with 78% sold in East India, 15% in North India and 7% in Central India.

It has total of 11 Cement Plants (8 in East India and has presence in all East Region states like West Bengal, Bihar, Odisha, Chhattisgarh and Jharkhand and 3 plants in North India i.e. in Rajasthan and Haryana). Three of its plants in East India are integrated units and five plants are grinding units. Two of its plants in North India are integrated units and the third is a blending unit. North India) and 16,076 dealers in India (10,091 in East India and 5,985 in North India).

Positives:

- Presence in underpenetrated market ensure high utilization and pricing power in future

- Strong Promoter Background

Risks

- Single geography risks

- High debt to equity from acquisition (Expect reduction through IPO proceeds and cash flow from operations)

Management of Nuvoco Vistas Corporation Ltd

Jayakumar Krishnaswamy – He has been on the Board since September 17, 2018. He is responsible for the cement, RMX and modern building materials divisions of Company. He holds a bachelor’s degree in engineering (mechanical) from the University of Delhi. He has experience across FMCG, paint, and coating industry. He has previously been associated with Hindustan Unilever Limited and Akzo Nobel India Limited.

Maneesh Agrawal (CFO) He holds a bachelor’s degree in commerce from Hansraj College, University of Delhi. He is a qualified chartered accountant. He joined Company as Chief Financial Officer with effect from October 10, 2017. He has over two decades of experience primarily in cement, RMX and paper businesses. He has previously been associated with Dalmia Bharat Limited and Ballarpur Industries Limited.

Madhumita Basu (Strategy & Marketing officer) She holds a bachelor’s degree in commerce and a master’s degree in management studies from the University of Bombay. She joined Company in the year 2010 as senior vice president – marketing and was appointed as the Chief Strategy & Marketing Officer with effect from July 1, 2020. She has previously been associated with Chloride Industries, Exide Industries and Eveready Industries India Limited.

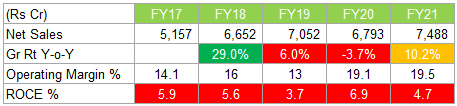

Financials of Nuvoco Vistas Corporation Ltd

Nuvoco Vistas has grown its capacity from just 3 Mt to 22 Mt through acquisitions. Since acquisition, the growth rate of economy as well as that of company is modest. Going forward, with increase in utilization and price hike post full utilization has scope to increase sales growth as well as margins. ROE/ROCE is subdued from Goodwill as well as high interest cost on debt used to fund acquisition. As cash flow improves, debt will reduce and improve ROCE. We rate Nuvoco Vistas financials as “Somewhat Good”.

Past acquisitions may have high accounting goodwill, but investor today benefits from all the cash flows she receives from today. Company’s valuation is arrived at by adding up future cash flows. Impairment of goodwill or amortization of intangibles doesn’t impact cash flows in future. So while valuing a company that has grown through acquisition, one has to compute ROCE after removing Goodwill. Warren Buffett has explained it here (Goodwill and its Amortization: The Rules and The Realities) *Management’s capital allocation needs to be analysed using accounting goodwill.

MoneyWorks4me Opinion

How is the business model? Good, Great or Gruesome?

Good. Cement manufacturing is an above average business with local oligopoly markets even if large number of small player may exist in any region. Costs of transportation add up as cement is transported to long distance, hence Cement remains a local business with 200-300 km. Every region has known capacity so relative competitive intensity may not be very high in each market. However, Cement business exhibits high degree of variability as it supplies to cyclical sectors like infrastructure and real estate.

Nuvuco has grown to 5th largest cement player in the country through acquisitions. It acquired plants from Lafarge (11 Mt) (2017) when Lafarge divested its India operations after merging with Holcim. Recently, it acquired Emami group’s cement plants of 8 Mt (2021).

Due to acquisition in East, Nuvoco has become one of the leaders in Eastern India. Thanks to underdevelopment of East India, there is huge demand for Cement for infrastructure as well as real estate. This bodes well for future growth and pricing power as capacity utilization inches up. Also, concentration in East (70%) also brings its risk as its fortune will be tied to East’s economic development.

As on date, ROCE, ROE ratios of Nuvoco look subdued due to i) high Goodwill from acquisition ii) high interest cost from debt raised to acquire. With steady operations and high cash flow generations, debt will come down over next few years.

The management has taken various measures to improve efficiency of plants to increase operating margin and hence return on equity.

Currently Nuvoco is earning 20% lower margins and 30% lower EBITDA/tonne versus peers. We expect the gap to narrow over time as the company improves efficiency and streamlines acquired capacities.

Valuation

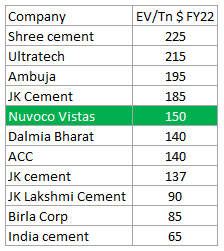

After adding debt of Rs. 6000 Cr, current valuation of Nuvoco Vistas is $150/tonne. Replacement cost of cement plants is approx. $120/tonne. Valuation of peers are as follows:

Compared to peers’ , Nuvoco Vistas’s valuation is in average range.

We recommend Subscribe the IPO for long term to benefit infrastructure spends in India and particularly Eastern region. As the company reduces its debt and improves efficiency, market capitalization will increase from operating leverage (increase in profit as costs remain constant) and debt reduction (Fall in Interest costs and gain in Market cap equivalent to debt reduction)

In recent past we had recommended ACC and Birla Corp as they traded at substantial discount to peers. However, we can not expect to buy an issue at a discount price in IPOs as informed sellers (eg. Promoters) seldom sell their stake below its fair value.

| IPO Activity | Date |

| IPO Open Date | Aug 9, 2021 |

| IPO Close Date | Aug 11, 2021 |

| Basis of Allotment Date | Aug 17, 2021 |

| Refunds Initiation | Aug 18, 2021 |

| A credit of Shares to Demat Account | Aug 20, 2021 |

| IPO Listing Date | Aug 23, 2021 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 26 | ₹ 14,820 |

| Maximum | 13 | 338 | ₹ 192,660 |

| Date | QIB | NII | Retail | Total |

| Aug 09, 2021 | 0.00x | 0.01x | 0.31x | 0.16x |

| Aug 10, 2021 | 0.11x | 0.04x | 0.51x | 0.29x |

| Aug 11, 2021 | 4.23x | 0.66x | 0.73x | 1.71x |

When will the Nuvoco Vistas Corporation Ltd IPO open?

Nuvoco Vistas Corporation Ltd IPO will open for subscription on Monday, August 9, and will close on Wednesday, August 11.

What is the price band of Nuvoco Vistas Corporation Ltd IPO?

The price band for Nuvoco Vistas Corporation Ltd IPO is Rs. 560-570.

What is the lot size for Nuvoco Vistas Corporation Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 26 shares, up to a maximum of 13 lots i.e. Rs. 1,92,660.

What is the issue size of Nuvoco Vistas Corporation Ltd IPO?

The total issue size is ~ Rs. 5,000 Cr.

What is the quota reserved for retail investors in Nuvoco Vistas Corporation Ltd IPO?

The quota for retail investors in Nuvoco Vistas Corporation Ltd IPO is fixed at 35% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on August 17th and refunds will be initiated by August 18th. Shares allotment will be credited in Demat accounts by August 20th.

What is the listing date of Nuvoco Vistas Corporation Ltd IPO?

The tentative listing of Nuvoco Vistas Corporation Ltd IPO is August 23rd.

Where could we check the Nuvoco Vistas Corporation Ltd IPO allotment?

One can check the subscription status on Link Intime India Private Ltd.

Who are the leading book managers to the issue?

Axis Capital Limited, HSBC Securities & Capital Markets Pvt Ltd, ICICI Securities Limited, J.P. Morgan India Private Limited, SBI Capital Markets Limited.

What does Nuvoco Vistas Corporation Ltd do?

Nuvoco Vistas Corporation Ltd is fifth largest cement company in India with cement capacity of 22.3mtpa (78% in East India and 22% in North India).

Who are the peers of Nuvoco Vistas Corporation Ltd?

Ambuja Cement, ACC, Ultratech Cement, Shree Cement are key peers of Nuvoco Vistas Corporation Ltd

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me PRO solution which provides you with exhaustive research-backed recommendations on strong companies, mutual funds, and index funds. You get all this for a price which can be as low as Rs. 4,999. The MoneyWorks4me PRO provides a guide to building a strong portfolio for beginners to become PRO.

Click here, for the Recent IPO complete list and IPO Historic data 2021.

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463