This article covers the following:

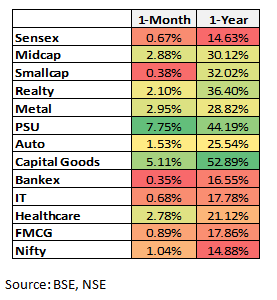

Sensex has given 0.67% returns in the last month and 14.63% on a yearly basis

As we write this note in October, Sensex has given 0.67% returns in the month of September and 14.63% returns in the last one year. The major contributors to this growth in the last month are PSU, Capital Goods, and Metals. The major performing sectors in the last one year are Capital Goods, PSU, and Realty. Major events we talk about in detail below include India’s Inclusion in the JP Morgan Global Bond Index and the upcoming general election’s impact.

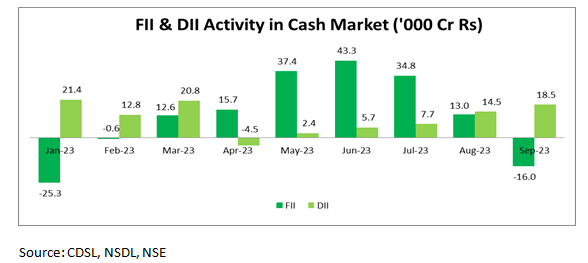

FIIs turned net sellers with a total net sell of Rs. 16,026 Crore in September. DIIs showed a positive trend as net buyers, purchasing Rs. 18,512 Crore during the previous month. DII participation basically demonstrates domestic optimism and confidence in our market.

As per the IMF’s estimates, the global economy is expected to slow down, with growth going from 3.5% in 2022 to 3.0% in 2023 and 2.9% in 2024, which is lower than the average in a decade. Developed economies will slow down more, from 2.6% in 2022 to 1.5% in 2023 and 1.4% in 2024, due to tighter monetary policies. Emerging markets and developing economies will see a slight decrease in growth from 4.1% in 2022 to 4.0% in 2023 and 2024.

The US Federal Reserve has maintained its policy rate at a range of 5.25% to 5.50%, but they’ve also indicated their openness to raising rates in 2023 if it’s necessary. On the other hand, the European Central Bank (ECB) has increased its policy rate by 0.25 percentage points to 4.00%.

In a significant move, JP Morgan has announced that India will join the JP Morgan Government Bond Index for Emerging Markets (GBI-EM) starting from June 28, 2024. Initially, India’s weightage will be 1%, and it will gradually increase by 1% each month until it reaches 10% by March 2025. This inclusion will make India the second-largest emerging market in the index, following China. As a result, it’s anticipated that passive Foreign Portfolio Investment (FPI) flows could amount to $20-$22 billion during that period, along with active flows of approximately $3-$4 billion in the lead-up to this change.

Consumer confidence remains robust, as evidenced by the significant surge in personal loans, even in the face of rising lending rates. The notable increase in the consumption of petroleum products can be largely attributed to the substantial volumes sold.

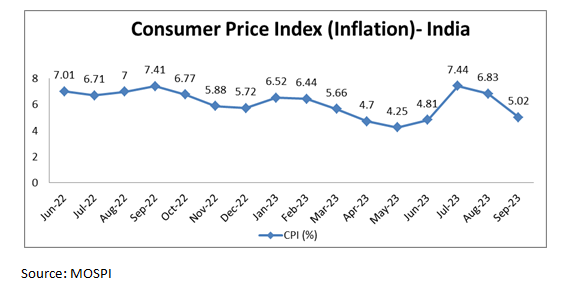

In September, India witnessed a reduction in retail inflation, primarily driven by a drop in vegetable prices. According to the MOSPI’s data, the Consumer Price Index-based inflation for September stood at 5.02%, showing a notable decrease from August’s 6.83%.

While the Rupee depreciated against the USD, it has appreciated against some of the major currencies. Oil price increases due to supply disruptions have led to a major increase in the Crude Indian Basket. Non-oil and Non-gold Imports contributed the most to the widening merchandise deficit.

Despite a worldwide economic slowdown, the Services PMI remains strong. The growth in railway freight traffic has increased significantly, reaching its highest point in 11 months.

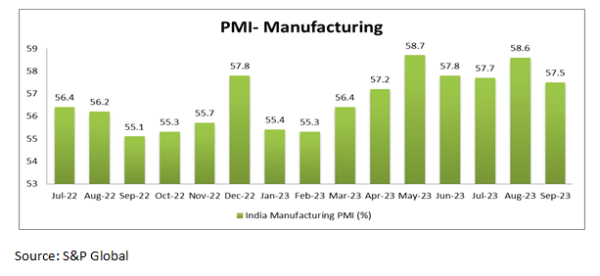

Manufacturing PMI continues to be in the expansionary zone but declined slightly month on month. A decrease in new orders of goods contributed to a decline in September.

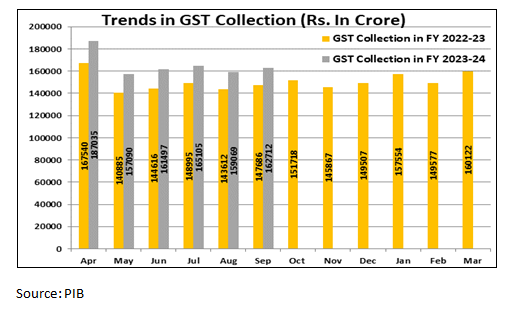

In September, the combined collection of GST by both central and state governments reached ₹1.62 trillion. This is the fourth-highest monthly collection since the introduction of the GST system and shows a 10% increase compared to the same period last year. The GST receipts for this year align with the finance ministry’s expected 10.5% nominal GDP growth rate. This shows the efficiency of the tax administration and increased consumption.

Lastly, the immediate consequences of the Israel-Palestine war are already evident, primarily affecting crude oil prices, which have jumped by almost 5% since the war began. In the case of India, if this upward trend in crude oil prices persists, it may exert a substantial influence on certain individual stocks as well as the overall economy.

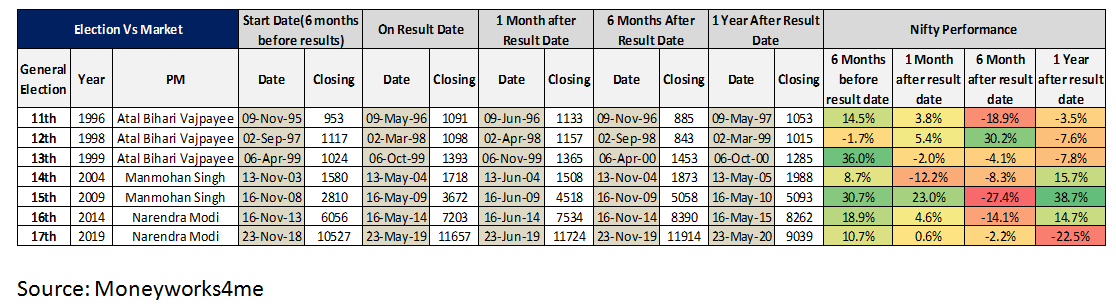

Election vs Market (Nifty 50 index)

Upcoming elections are the talk of the town now. Historically, we’ve noticed that in the lead-up to these elections, the markets tend to react positively. Additionally, if the current leader is re-elected, there’s a good chance that the market momentum will continue afterward. What’s particularly noteworthy is how the markets react to government policies. When significant, yet necessary, reforms are introduced, they can sometimes lead to market declines. Conversely, when the government enacts policies that support the economy, it usually makes investors happy. Upon closer examination of the data, it becomes evident that elections are just one milestone in the market’s continuous journey. Market fluctuations occur, and they are not always dependent on election outcomes. The data doesn’t provide a clear conclusion, indicating that investors need not be overly concerned about market volatility during the election period.

Economic activity remains strong, and the recent improvement in the monsoon situation during September is a positive development. The prices of select food items that contributed to inflation exceeding 7% in July are now declining. The private sector is in good health as data on advance tax payments for the second quarter confirm.

However, there is a growing concern regarding the recent increase in oil prices, which could pose challenges. Additionally, the stock market faces some risks of a potential downturn, and geopolitical developments may affect investment sentiment in the latter half of the fiscal year. Nevertheless, the impact of these events on India’s underlying economic activity is expected to be relatively limited.

It’s worth noting that interest rates in many countries have reached their highest levels in the past two decades. Several nations are grappling with the consequences of this, as it increases interest costs and affects government debt and corporate earnings. India is better positioned to handle this situation than most other countries due to its de-levered balance sheets. Among major nations, India has the least amount of debt, providing it with an advantage in navigating the unpredictable global financial landscape.

Indian economy continues to be a steady ship in choppy waters

India appears to be in a favourable position compared to the rest of the world, both in terms of cyclical and structural factors. Healthy growth in various domestic high-frequency indicators, such as GST collections, retail spending, consumer demand, credit growth, and PMI, indicate a significant level of economic activity.

Projections suggest that India is expected to be among the fastest-growing economies in 2023. Recent policy reforms, government-led capital expenditure focus, and stronger corporate balance sheets have potentially established a robust foundation for sustained growth over multiple quarters. However, in the short term, volatility may persist until global uncertainties subside.

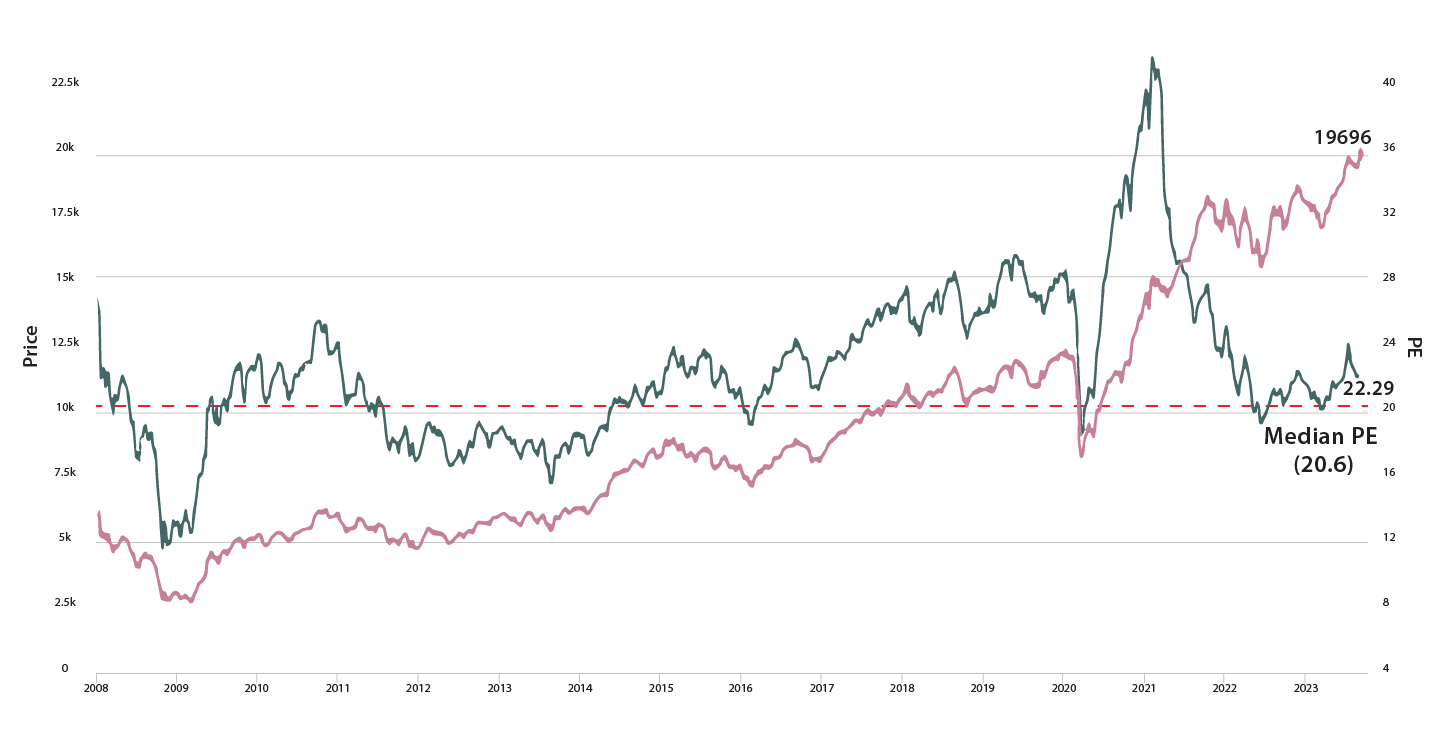

Nifty is trading marginally above long-term averages

On a PE basis, Nifty is trading at 22.29, above the historical median of 20.63. It basically shows positive sentiment and bullishness in the market.

What is MoneyWorks4me’s action plan for its subscribers?

We stay on course to look at individual securities with strong future outlooks and growth. While taking a portfolio view to diversify and make the most of the rising economy. We have been bullish on the power sector and a few ideas are looking attractive on account of demand surge and policy reforms.

Best Stocks From:

Undervalued Nifty 50 Nifty 500 – Quality with Price Strength Screener Alpha Cases 5 Stars Rated Stocks from Nifty 500 Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | About | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory