We have read the India Growth Story report by Phillip Capital so you don’t have to. We have highlighted some key points and figures, which strongly support India as a global powerhouse with an increase in manufacturing to export share.

This report highlights how the Indian economy with various Public linked Incentives (PLIs), Free trade agreements (FTAs), Capex (both government & private), credit growth, robust banking system, and domestic demand is placed for growth for years to come.

Domestic Investment

The investment expansion cycle has begun in various sectors -> specialty chemicals, led by environmental curbs in China, followed by demand-driven expansion in metals, cement, and capital goods. PLIs are supporting domestic manufacturing of consumer electronics, automobiles, pharmaceuticals, textiles, and semiconductors sectors, while the indigenization of defence has begun. 5G investments from telecom and allied infrastructure are coming in. Meanwhile, infrastructure investment in logistics, supply-chain, ports, and railway are on-going along with a renewable infrastructure push.

All these investments are redirected towards increasing the GDP and export share of India in global trade.

Private Sector Capex

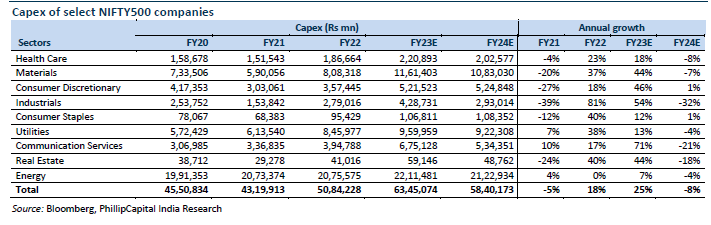

Capex for 289 NIFTY-500 companies (expect financials & IT) will witness an estimated cumulative capex of Rs 17 Tn in FY22-24E.

Infrastructure & Capital goods Company’s order book inflows are likely to grow by 28%/5% to Rs.4.9 Tn/5.2Tn in FY23/24.

Public Sector Capex

The government had allocated 25% higher capex in FY23 over the 27%/39% capex growth seen in FY21/22; the 4-year CAGR was at 30%, doubled pre-covid levels. The main motive of government capex is infrastructure development and economic progress while creating a multiplier effect in the economy. The government has targeted a fiscal deficit of 4.5% by FY26, implying government capex will continue to expand, and without any hurry to tighten liquidity and policies. Rising revenues, along with asset monetisation will provide fund support to the government’s expansionary capex plans.

The Combined Capex of Central, Internal & Extra Budgetary Resources (IEBR) and State will be Rs 700,000 Cr which will be invested between FY22-24.

PLI & FTA

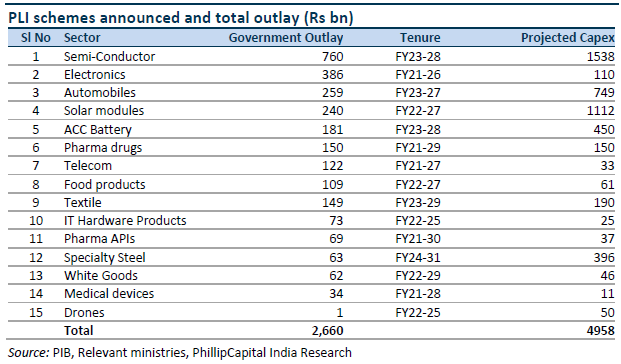

Various PLI schemes with a total government outlay of Rs 2.66tn have been launched; it expects capex to the tune of Rs 4.96tn in the initial years of the project. Several other PLIs are in line to be launched in February Budget next year.

FTAs are signed with varies trade partner nations to tap the wider exports market. With fewer trade restrictions and tariffs between signatories, trade can be enhanced. India is currently a signatory to 13 FTAs and 6 Preferential Trade Agreements (PTAs) – with its FTAs. Out of the top 20 exports partners, India has bilateral FTAs with seven countries. With several FTAs are in negotiation with the UK, Canada, and the EU to finalize soon.

IMF Outlook

According to IMF’s World Economic Outlook, global GDP growth will average 3.3% during 2024-2027 from 2.7% in 2023 (monetary policy tightening). While Emerging Markets and Developing Economies are to grow by 4.3% during 2024-27 vs. 3.7% in 2023. India will grow faster than major economies with 6.1% growth in 2023 followed by an average of 6.6% growth during 2024-2027.

India accounts for 2% of Global exports (China at 15%, the US at 8% & Germany at 7%), providing visibility and growth potential for India. While it estimates Indian exports to achieve 3rd highest share in global export volumes over the next 5 years, with a value of $500 Billion+ by FY26.

Credit Growth

With sustained double-digit credit growth this fiscal year, currently at 16% indicating expansion and sound economic activity. Industrial Credit growing at 13% on yearly basis, highlighting an increase in manufacturing activity and capex.

Credit disbursal has been strong among various sectors with the infrastructure sector (38%), followed by metals (10%), textiles (7%), chemicals (7%), food processing (5%), and engineering industries (5%) as of September 2022.

These are some highlights from the reports that support India’s growth story this decade and road to become a manufacturing powerhouse.

Best Stocks From:

Undervalued Nifty 50 Nifty 500 – Quality with Price Strength Screener Alpha Cases 5 Stars Rated Stocks from Nifty 500 Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463