Since childhood we have heard and internalized this saying, “No risk, No gain”. We have learnt that Fixed Deposits in State Bank of India is the safest. And without doubt it is but the returns we earn does not beat inflation. So we are required to find an asset that would increase the value of our savings over the rate of inflation. And that’s where we remember the old saying about risk-gain and accept that we now have to deal with risk. And equity asset class is known to be the best to deliver inflation-beating returns.

Now, most people don’t feel confident about taking equity investment decisions. Therefore many invest in mutual funds and think they have gotten rid of the risk. Even after reading the statutory warning ‘Mutual Funds are subjected to market risk’ most investors do not comprehend what it means. Many display the nonchalance similar to cigarette smokers when they light a cigarette…until the risk materializes.

Let’s remember this when buying an equity mutual fund: You have given your money to a fund manager who is going to invest it in stocks and therefore is exposed to the same risks as you would be. Any risk he is taking is being taken on your behalf. And equity is a high risk investment and will remain so. Period. All you have done is delegated the task of risk management to a fund manager.

What is risk in equity?

Risk in equity especially when done through mutual funds/advisors is not so much about losing capital (the original amount you invest). Over 10 years the chances of this happening are close to nil. However risk is that equity may not generate returns as high as our need/expectation and/or in our desired timeframe.

Risk management simply means that fund manager/advisor will take calculated risks and participate only in those opportunities whose returns compensate well for the risks. When you earn higher than FD returns, you are basically got compensation for the risk you took. If you earned higher returns remember that it means even higher risks were taken. You may not be aware of it but they existed and maybe some of these risks did not materialize-which could be just plain luck.

So when you encounter an advisor or fund manager generating or promising very high returns, it is fair to conclude he is/will be taking higher risk too. The most common stocks or funds they recommend are all small cap.

What does it mean to invest in Small Cap stocks/funds?

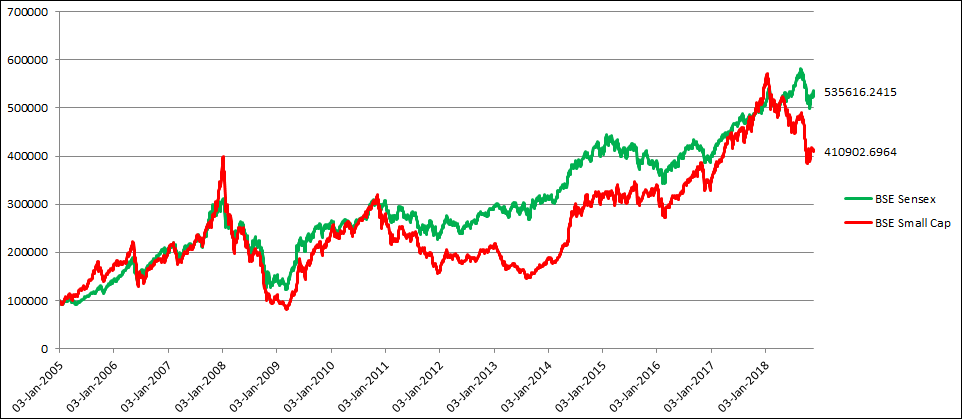

If you had bought the BSE Small-Cap index/stocks in 2005, they rose 4 times in 3 years till the end of 2007. So far, so good. By Jan 2009, they corrected 80% from the peak, back to 2005 levels. They did recover half way through by the end of 2009. This may not have been painful for some who invested in 2005. The painful part is what followed. Index reached the 2007 peak in Mar-2017, 10 years later. So if you had invested in 2005, your returns were still 10.5% CAGR but it came with lots of pain. Even one of the best small-cap funds corrected 70% in 2008 and took another 7 years to attain 2007 highs.

But this looks very academic, let’s put some money into this rollercoaster ride and see if you have the stomach for it.

If you invested Rs. 10 lacs in Jan’2005 in the BSE Small Cap index it would have become 40 lacs in Dec’07. It would have become Rs. 8.2 lacs in Mar’09- a loss of Rs. 31.8 lacs from the peak. It would reach the peak of Rs. 40 lacs but only 8 years later, in Mar’17. Again it would rise to Rs. 55 lacs to fall back to RS—41 lacs by Nov’2018.

Imagine the plight of someone who invested in small cap index at its peak in 2007- he would have suffered for 8 years just to come back to his original investment, seen it grow for some time only to fall back to its original value .

What would have happen if you had invested this in the Sensex 30 Index?

Rs. 10 lacs invested would have become Rs. 30 lacs in Dec’2007; fallen to Rs. 16.5 lacs in Mar’09 (a fall of almost 50% from the peak) and back to Rs. 30 lacs in Nov’10 much before small cap index recovered. As on date Nov’18, that would have become Rs. 52.3 lacs. Recovery to peak value happened a lot earlier and the journey for the last 8 years relatively relaxed compared to the small cap investor.

So if you find that small cap stocks/funds giving higher returns, it is a compensation for the risk investors took of losing 70-80% capital in short time and remaining under water for another 7-10 years. And you need to ask yourself if you are up to it.

Though 2008 like correction is an exception as such crisis are rare it is important to note that even if one had one of the best fund manager, his experience would have been similar. It is nothing to do with the fund manager being wrong (he can’t sell the entire fund even if he wanted to because he thought the prices were irrational). Hence, be careful what returns you ask for because very high returns expectations can become a stumbling block.

We believe that investors must not aim for maximizing returns. They must gauge the risk-reward before jumping into any asset class and whether they have the stomach for it. The role of the fund manager is to deliver good returns while managing the risk all as per the mandate of its category. It’s not the job of the fund manager to manage risk for you specifically. That’s the job of your advisor-yes you need to have one even if you are investing in mutual funds only.

A good advisor would have managed a lower downside for you through smart asset allocation-converting some/much of the equity gains of 2007-08 when they were expensive into a liquid fund and re-entering after they started getting reasonable mid-2008-09. Though you would have still faced some correction as stocks went down much lower than their fair value too, but you would have retained some of the gains because you would have moved out of equity thanks to asset allocation. Here it is important to note that smart asset allocation must be rigorously implemented as a pre-set program and not left to human decision making.

Retail investors are better off taking moderate risk and earning moderate returns (a good lot better than FD). Given that their goals are quite unescapable like retirement or child’s education, it is very risky to put these in jeopardy by trying to earning high returns by taking high/higher risks. Once investments for these goals are done, only then they can aim to take higher risk in small cap/private equity with the hope that you earn higher returns.

Useful Links:

Undervalued Nifty 50 Mutual Fund Screener Stock Screener Alpha Cases 5 Stars Rated Stocks from Nifty 500 Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463