Dear Readers,

Welcome to our weekly company result update note. We understand the importance of staying up-to-date with the latest financial developments of the companies you have invested in. That’s why we are committed to providing you with short and insightful information about the earnings and performance of the companies in our coverage.

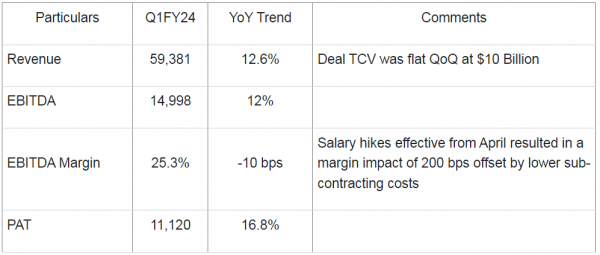

TCS

An overall positive result with stable deal TCV and no major negative surprises.

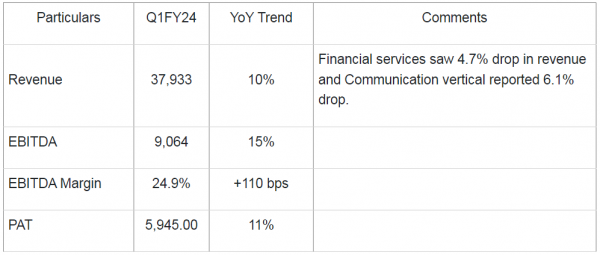

Infosys

The quarterly result was in line with the estimates. However, poor FY 24 guidance of 1-3.5% Constant Currency (CC) growth v/s 4-7% previous guidance led to a significant fall in the stock price. The current pain may persist over the next few quarters, but we remain cautiously optimistic given (a) the growing digitisation needs of businesses and (b) early signs of revival in a global economy.

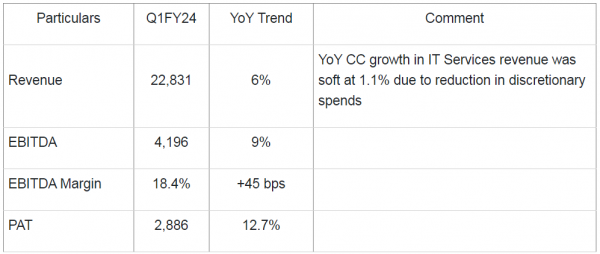

Wipro

Weak results with total bookings of US$3.7bn & disappointing revenue guidance for Q2FY24 (between -2% to +1% QoQ CC).

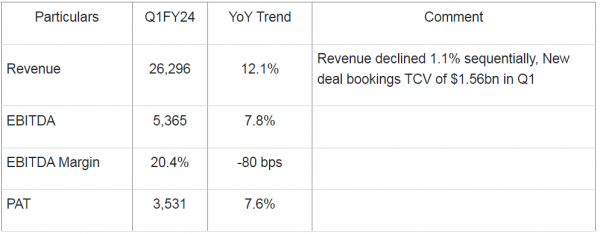

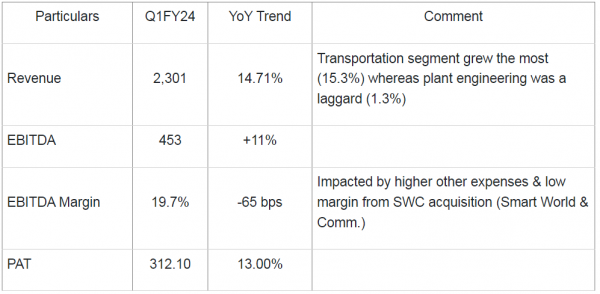

LTIM

Results were in line with estimates. Merger-related synergy benefits and operational efficiencies need to be monitored.

HCL Technologies

Weak operational performance due to reduction in Digital spends. ER&D segment declined by 5% CC sequentially. However, management commentary is positive with an expectation of strong deal bookings in Q2.

Tata Elxsi

A soft quarter with flat sequential margins. Demand revival is expected in the second half of FY24.

LTTS

Lower than expected growth due to slowdown in North America and Europe (~5% & 9%YoY growth respectively). Results were a miss in accordance with expectations.

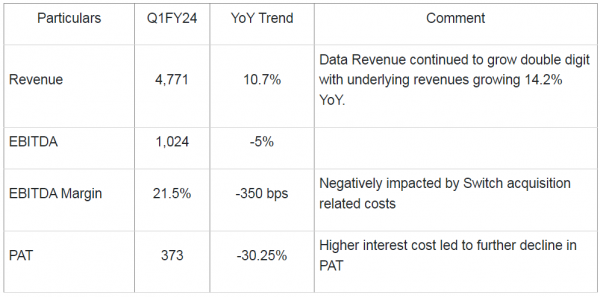

Tata Communications

The margin was a miss against the targeted range of 23-25%, however 37.5% growth in the digital portfolio was a big positive.

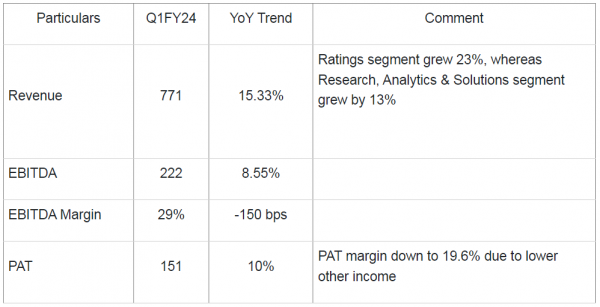

CRISIL

Good results driven by improvement in the Rating segment.

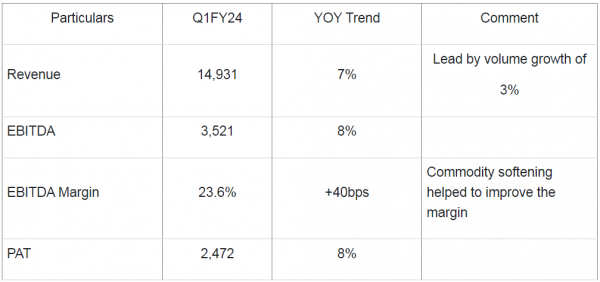

Hindustan Unilever

At par numbers. Home care as well as Beauty & personal care segment delivered mid-single-digit volume growth. The food and refreshment segment delivered near flat underlying volumes. HUL has stepped–up advertisement spend to 10% for gaining market share.

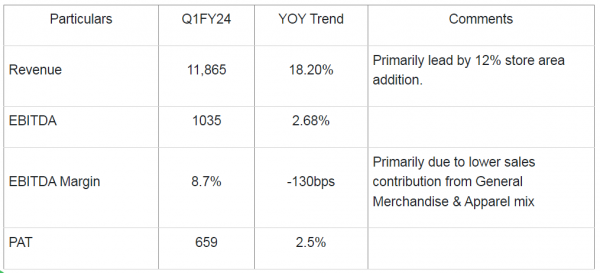

Avenue Supermarts

Healthy revenue growth driven by store additions leads to good performance. The adverse impact from the larger-sized stores appears to be bottom out with revenue/sqft and revenue/store rising 4% YoY and 5% YoY, respectively.

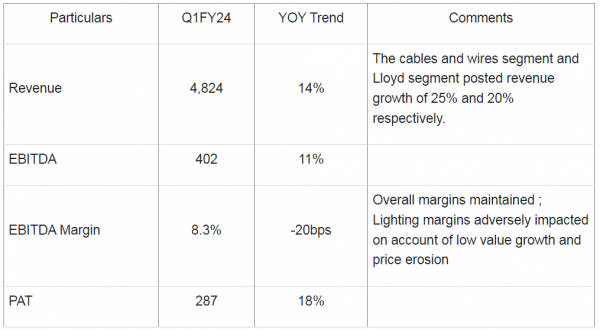

Havells India Limited

Robust revenue numbers despite sluggish consumer demand.

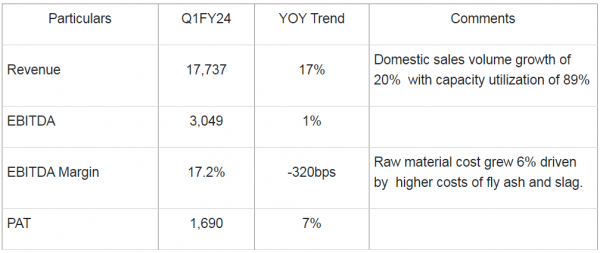

UltraTech Cement Ltd

The muted result on account of realization/ton being marginally lower on a QoQ basis while the cost remains flat. This impacted EBITDA/Mt by Rs 26/Mt.

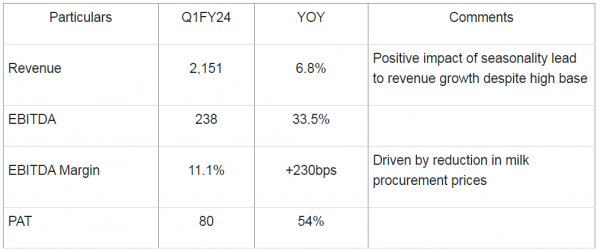

Hatsun Agro Product Ltd

Sustained performance despite weak sales of value-added products.

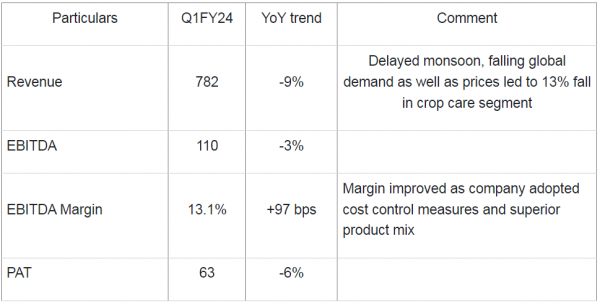

Rallis Ltd

Weak results on the back of delayed monsoon and muted exports (volumes down 30% YoY due to existing global inventories). Recovery in an export segment to be a key driver going forward.

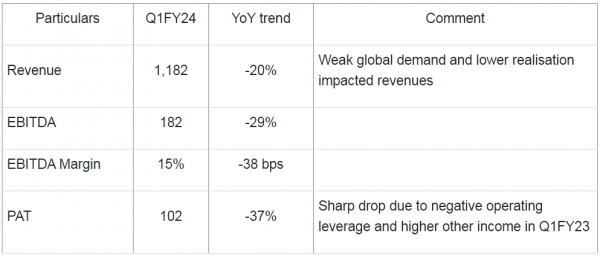

Atul Ltd

Poor results were driven by a decline in the Performance chemical segment (~17% YoY), dragged further by a 27%YoY decline in the life science chemical segment.

Best Stocks From:

All Weather Alpha Case Screener Alpha Cases Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory