Dear Readers,

Welcome to our weekly company result update note. We understand the importance of staying up-to-date with the latest financial developments of the companies you have invested in. That’s why we are committed to providing you with short and insightful information about the earnings and performance of the companies in our coverage.

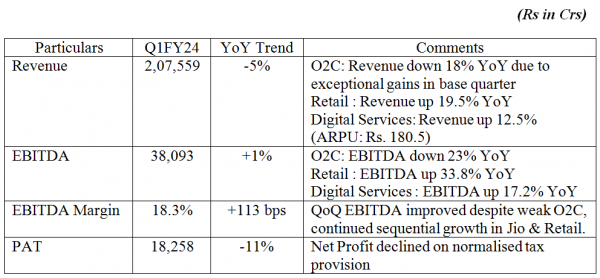

Reliance Industries

Muted O2C performance and higher tax expense has dragged overall profitability, positive sequentially.

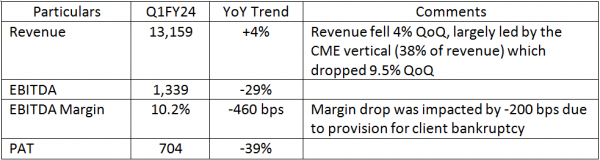

Tech Mahindra

Net new deal TCV declined sharply at USD 359mn, -50% YoY which shall impact near term growth. Disappointing results, recovery might take longer than expected.

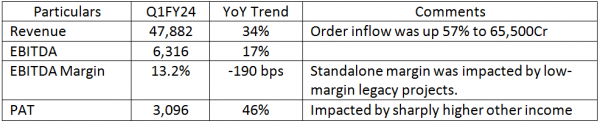

Larsen & Toubro

Strong results on all major fronts, robust orderbook gives good visibility of growth.

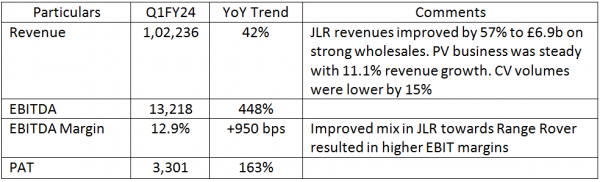

Tata Motors

Strong results led by JLR. Steady pipeline of CNG/EV Models in PV space provides pipeline for further growth. Tata Motors Board has approved a proposal for converting its DVR (Differential Voting Rights) shares into ordinary shares (7 TTMT shares for every 10 DVR shares). This will reduce the share capital by 4% making it EPS accretive.

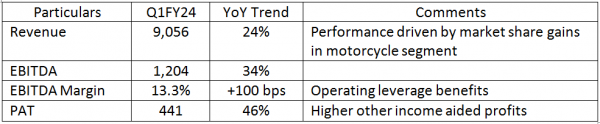

Bajaj Auto

Good performance even after the slowdown in exports.

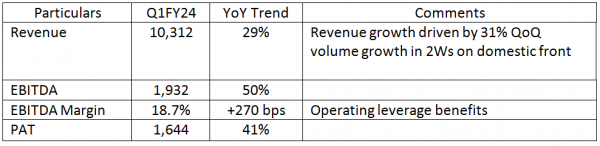

TVS Motors

Healthy performance on market share gains and ramp up of EV sales.

Check, 10-Year X-ray Now!

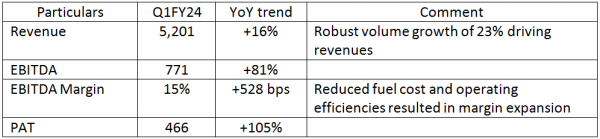

ACC Ltd

Strong performance as a result of volume growth supported by reduced fuel cost, we expect sustained performance going forward.

Check, 10-Year X-ray Now!

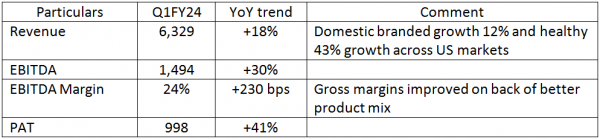

Cipla Ltd

Stellar performance on all fronts. Traction driven by chronic therapy solutions in domestic market as well as better execution in base business. Higher-than-expected revenue contribution from gRevlimid (myeloma cancer medication) also aided growth.

Check, 10-Year X-ray Now!

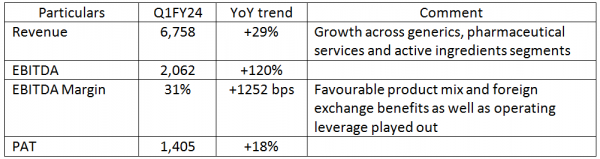

Dr Reddy’s Laboratories Ltd

Good performance on uptick in exports across North America business and favorable seasonality in the Russia business.

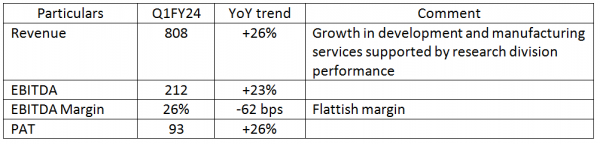

Syngene International Ltd

Healthy results aided by currency benefits (7% positive impact).

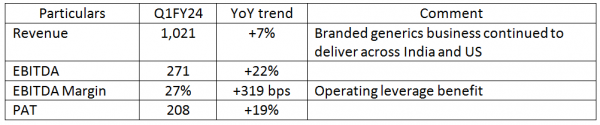

Ajanta Pharma Ltd

Company reported good results on performance across therapeutic brand portfolio.

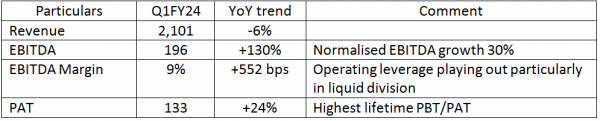

Mahindra Logistics Ltd

In line performance- while operating margins were not hurt, PAT losses are due to IND 116 (lease accounting) which results in front loading of interest cost (flattish QoQ).

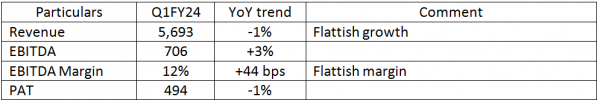

Aegis Logistics Ltd

Overall good performance, minor decline in revenues is not to be read into.

Blue Dart Express Ltd

Weak results but freight cost pass through expected in coming few quarters will lead to margin recovery.

Coromandel International Ltd

Steady performance on back of strong volumes and sustained margins despite challenging business environment.

BASF India Ltd

Subdued results on account of industry wide low demand scenario and weak performance in key segment.

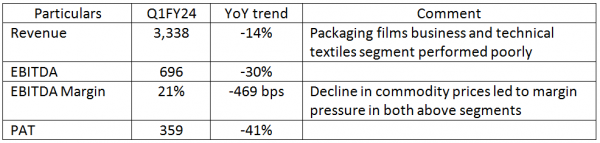

SRF Ltd

Weak results and near term headwinds due to down cycle in packaging film business as well as China dumping issues in chemical segment.

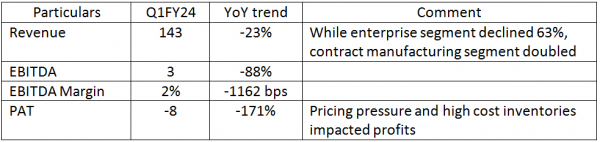

Astec Lifesciences Ltd

Poor results on sluggish demand environment impacting volumes.

All Weather Alpha Case Screener Alpha Cases Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory