Dear Readers,

Welcome to our weekly company result update note. We understand the importance of staying up-to-date with the latest financial developments of the companies you have invested in. That’s why we are committed to providing you with the short and insightful information about the earnings and performance of the companies in our coverage.

Sector index

- BFSI (Banking and financial services)

- Auto and auto ancillaries

- Information technology

- Pharma

- Agrochemicals and chemicals

- Oil and Gas

- Others

BFSI (Banking and financial services)

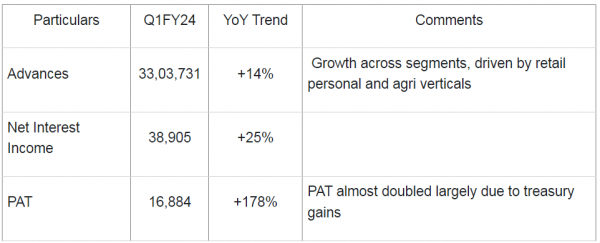

State Bank of India

The company delivered a strong performance with healthy PAT growth and 1.22% RoA (return on assets). Management guided ~15% YoY credit growth for FY24.

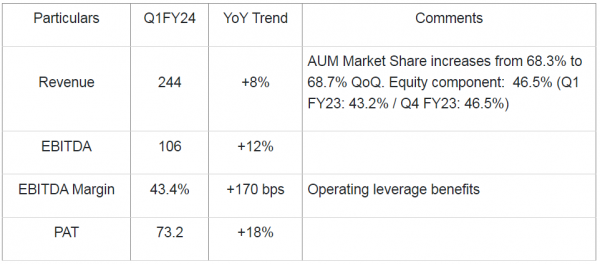

CAMS

Good results on all parameters, sustaining performance with a healthy focus on new product additions.

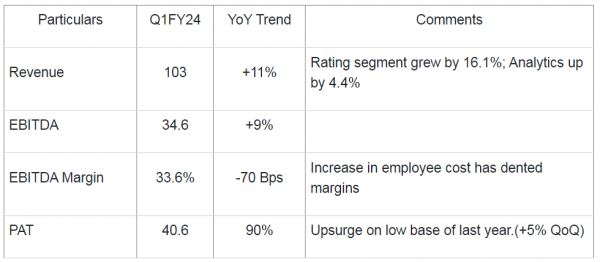

ICRA

Bank credit (key business driver) grew on demand from Retail, NBFC, and Industrial segments. Overall good results.

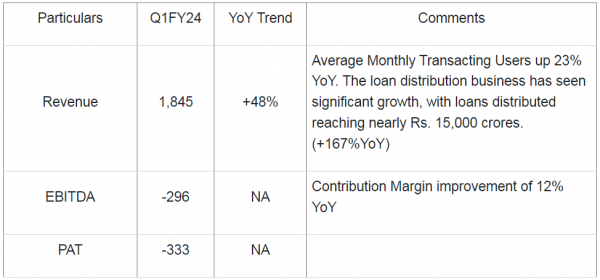

One 97 Communications (Paytm)

Healthy revenue growth led by payments & financial services. We remain watchful of Innovations in the payment ecosystem & scale-up of the loan distribution business.

Auto and auto ancillaries

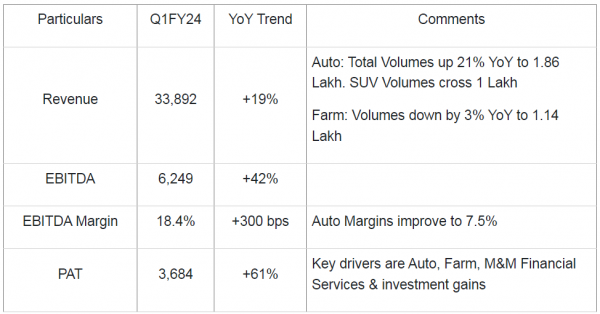

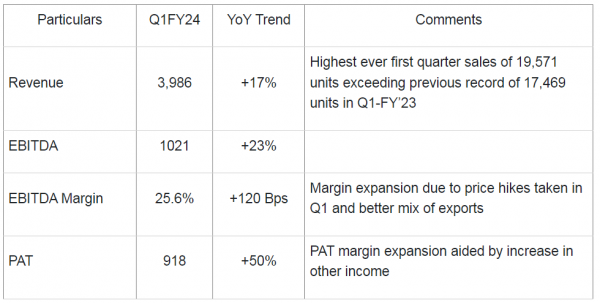

Mahindra & Mahindra

Stellar result. Investment in RBL Bank is not a concern (Refer to Note). Revenue share in the SUV segment shall be a key parameter to monitor.

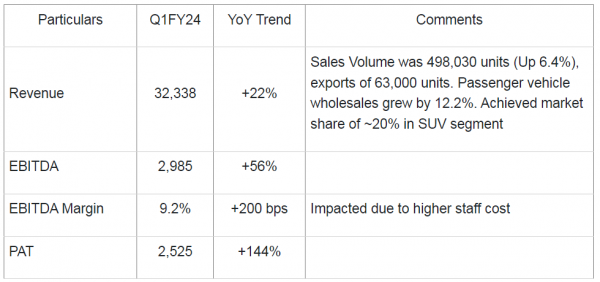

Maruti Suzuki

Good overall results with a slight miss on the margins. In order to bring in operational synergies, Maruti Suzuki has approved the termination of its contract manufacturing agreement with SMG (Suzuki Motor Gujarat) and would acquire the shares of SMG from Suzuki Motors. Positive step with respect to (a) Optimal use of cash on the books & (b) higher operational control on core assets.

Ashok Leyland

Numbers were a big beat on all parameters, revenue has fallen QoQ because of seasonality.

Eicher Motors

Healthy performance on all major parameters. Given that premium biking segment is expected to grow, management expects the business to continue growing despite new entrants.

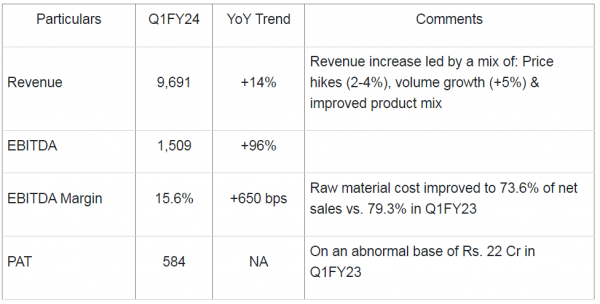

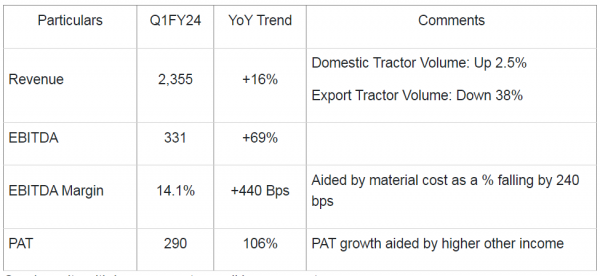

Escorts Kubota

Good results with improvements on all key parameters.

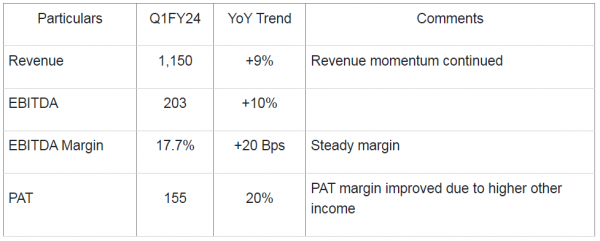

SKF India

Good results.

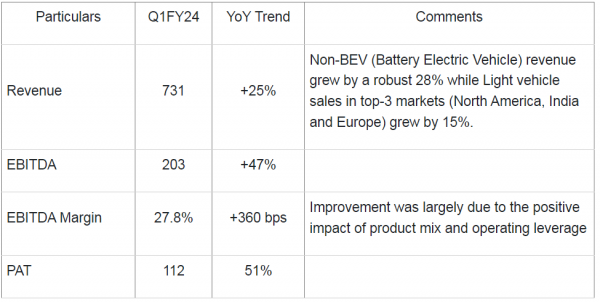

Sona BLW

EBITDA Margin in the quarter was higher on some one-offs, long term guidance was maintained at 25-27%.

Swaraj Engines

Stable results as expected.

Information technology

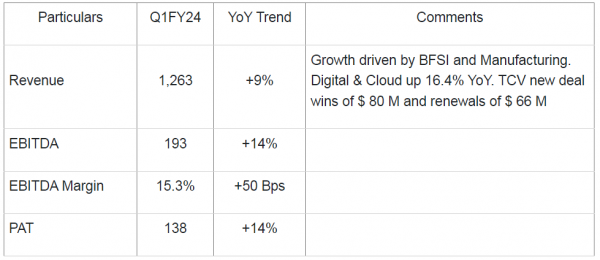

Persistent Systems Limited

Improvement in Revenue even on a QoQ level was impressive on the back of the slowdown in the industry; margin decline looks short term and shall recover in the coming quarters.

Birlasoft

Good results even on QoQ basis amidst ongoing sector slowdown.

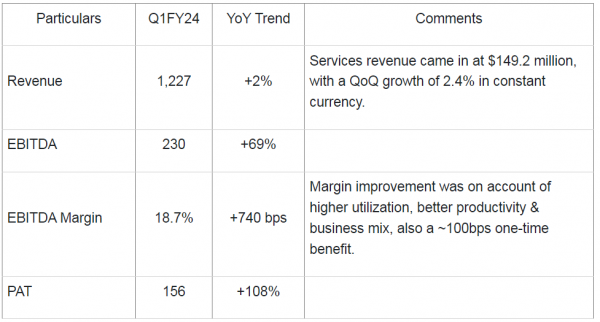

Zensar Technologies

Good margin improvement amidst industry margin pressure concerns.

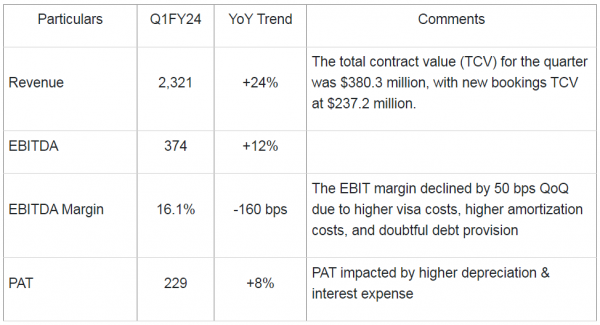

Coforge Limited

Stable revenue growth. However, margins were a miss.

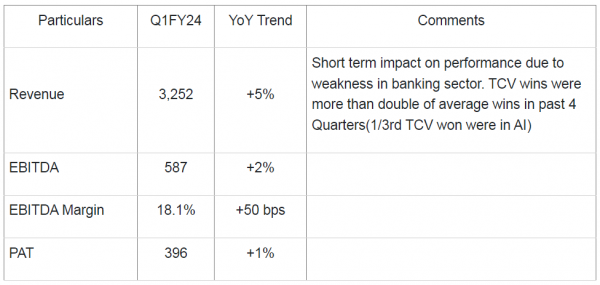

Mphasis Limited

Miss in revenue as well as profitability due to weakness in banking and capital markets which is about ~50% of total revenue.

Cyient

Under DET, Aerospace (+2.3% cc QoQ), Sustainability (+4.5% cc QoQ), and Automotive (+3.1% cc QoQ). Though there was a slowdown in the sector, growth momentum was stable.

Latent View

Good revenue growth, however margins were a miss.

Pharma

Sun Pharmaceuticals

Favourable performance was driven by revenue growth and margin expansion.

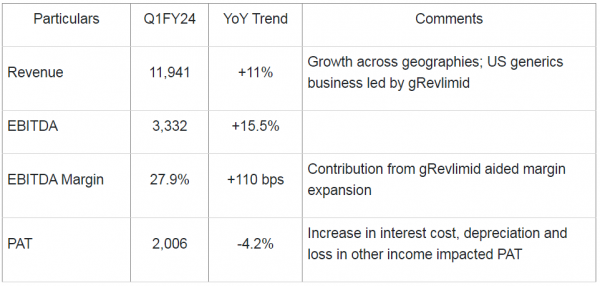

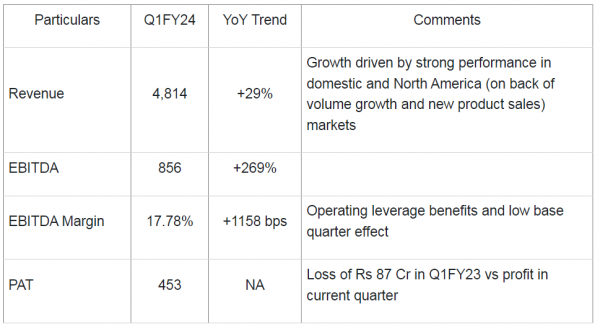

Lupin

Stellar performance across all parameter’s revenue growth, EBITDA margin and PAT.

Agrochemicals and chemicals

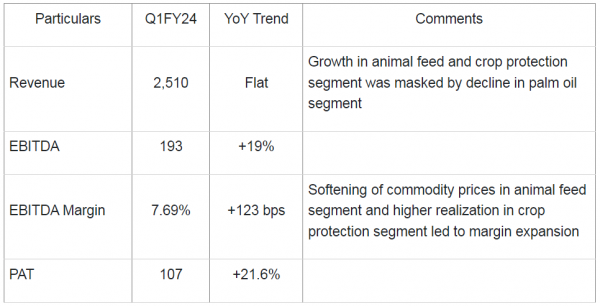

Godrej Agrovet

Though revenues growth was not achieved overall, margin expansion sets a healthy precedence for performance ahead.

Dhanuka Agritech

Degrowth in first quarter (late monsoon) has converted into a positive growth in July month, we remain watchful of new molecule introductions and capacity expansion at Dahej plant.

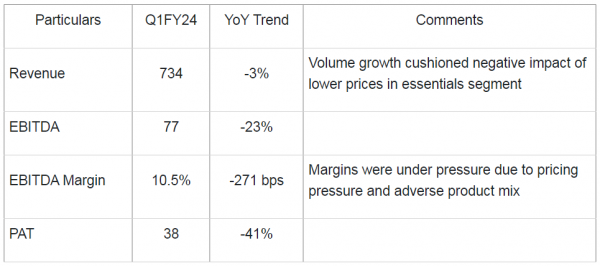

Laxmi Organics

Muted performance on change in mix (lower contribution from exports vs. essentials segment).

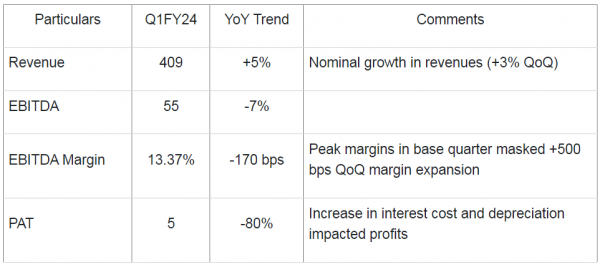

Privi Speciality Chemicals

While we wait for management remarks, the turnaround in QoQ performance (Rs 15 Cr loss in Q4FY23 vs Rs 5 Cr profit in Q1FY24) is to be noted.

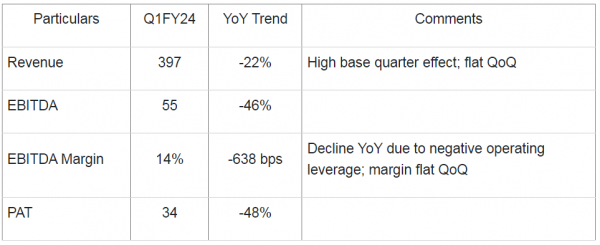

NOCIL

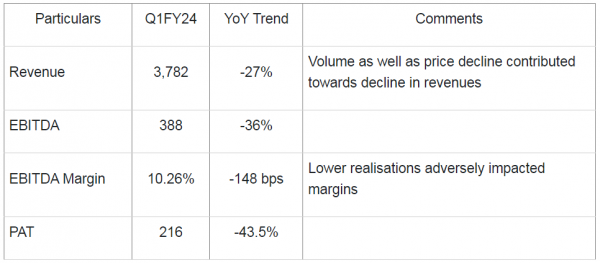

Poor quarterly performance on pricing pressure due to Chinese exports and the global recessionary environment.

Oil and Gas

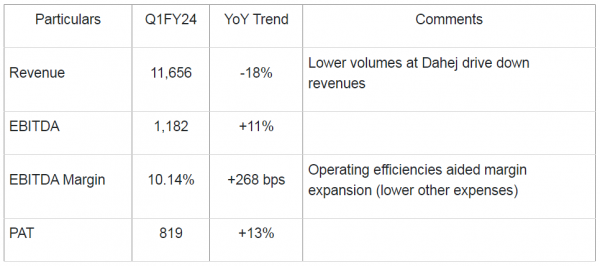

Petronet LNG

Mixed bag results on volume driving down revenues but operating efficiencies expanding margins.

Gujarat State Petronet

While revenues declined, margins remained flat, overall poor performance.

Gujarat Gas

Overall weak results as revenues and margins declined.

Indraprastha Gas

At par numbers despite lowering the price of CNG, limited impact on volumes.

Others

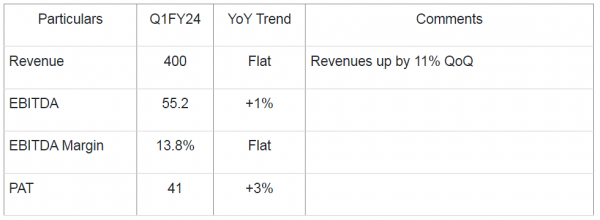

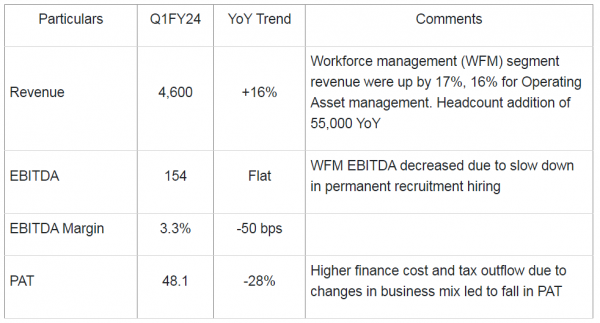

Quess Corp

Weak results as expected. Recovery in hirings shall take some more quarters.

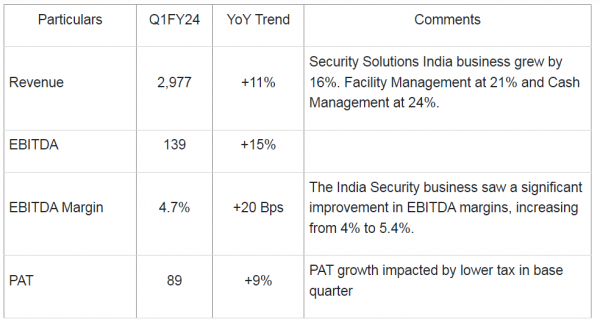

SIS

Stable Results.

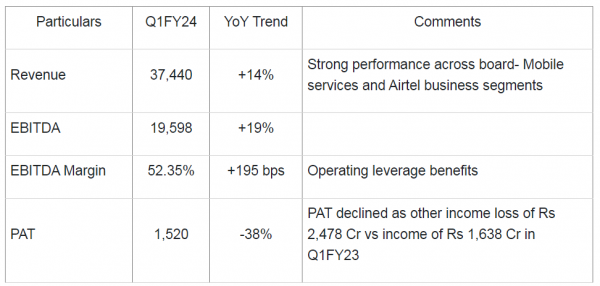

Bharti Airtel

Healthy performance with mobile segment revenues driven by an increase in ARPU (average revenue per user); PAT (after exceptional items) remains flat.

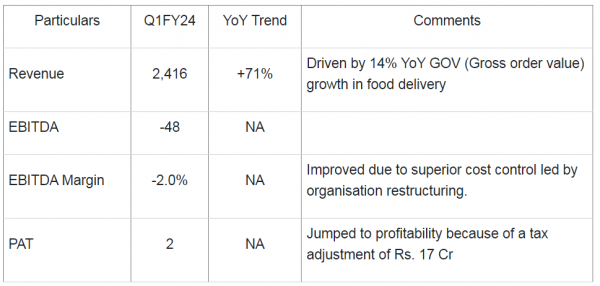

Zomato

Big beat on all parameters. The tilt to profitability has been done well ahead of the timeline. Quick commerce (Blinkit) business has turned contribution positive as well. Management has guided for adjusted revenue growth of >40% over the next 2-3 years.

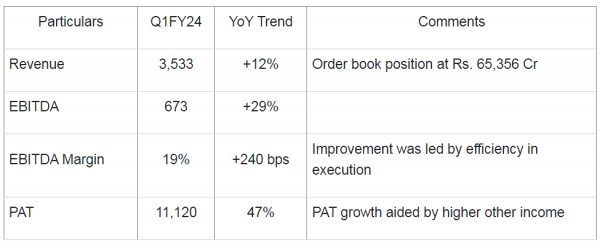

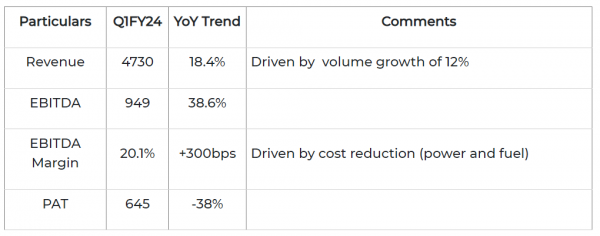

Bharat Electronics

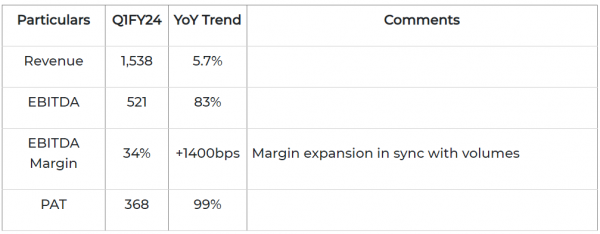

Stellar performance. Management guidance on revenue growth (17%), order flow (20,000Cr) as well as margins (21-23%) provides good visibility of earnings growth.

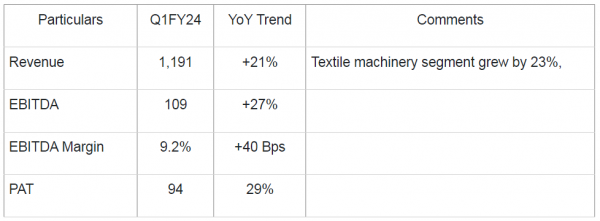

Lakshmi Machine Works

Good performance on account of growth in the textile machinery segment & doubling of revenues from Advance Technology Centre to Rs. 40 Cr.

Sterlite Technologies

Stable results, the Order book of Rs. 10,938 provides revenue visibility.

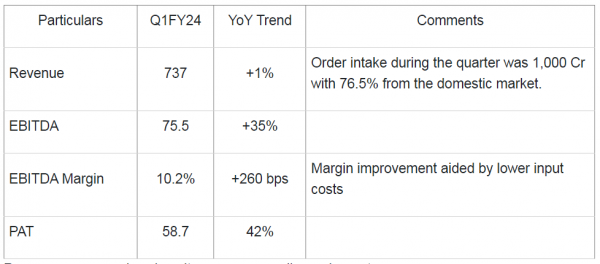

Praj Industries Limited

Revenues were a miss given it was a seasonally weak quarter.

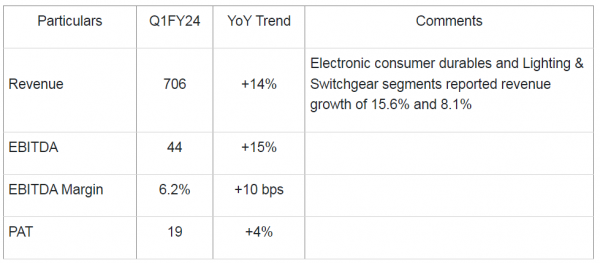

Orient Electric Limited

While material costs as a % had fell by 300bps due to a correction in commodity prices, the EBITDA margin was up just 10bps due to higher staff cost and other expenditures. Good results after adjusting for one-offs.

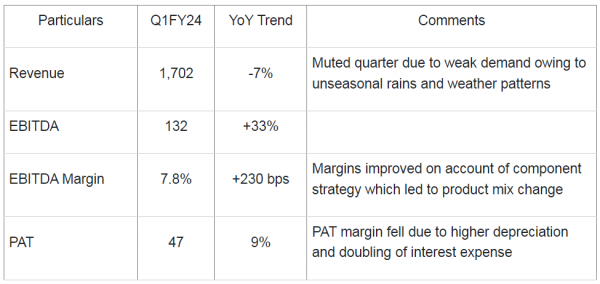

Amber Enterprises India

Muted revenues due to the cyclicality of the industry, however margin improvement remains positive.

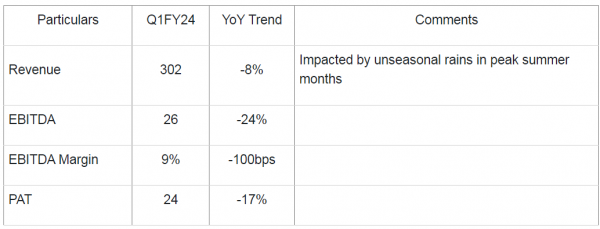

Symphony Ltd

Weak performance on account of the disrupted summer season.

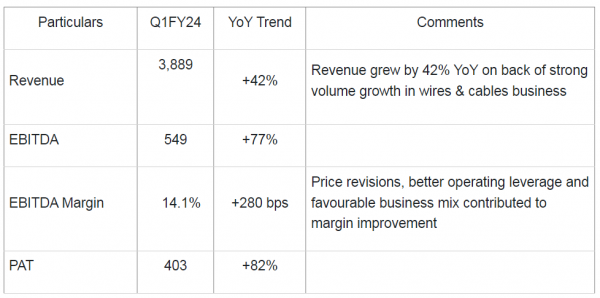

Polycab India

Revenues have fallen QoQ by 10% due to seasonality, big beat YoY, and margin improvement is commendable.

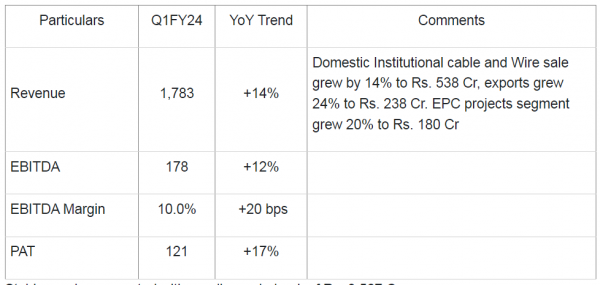

KEI Industries

Stable numbers were reported with a pending orderbook of Rs. 3,567 Crore.

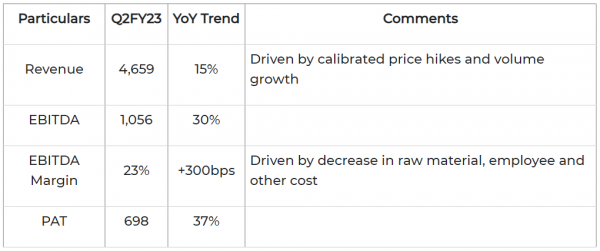

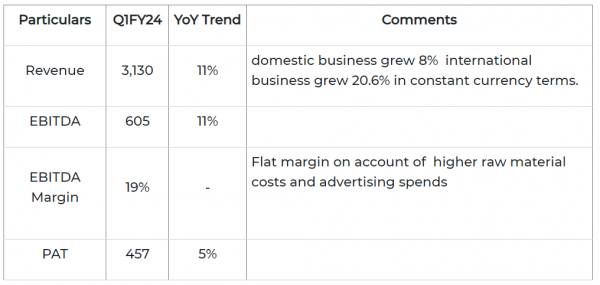

Nestle India

Robust performance on account of prudent pricing supported by volume growth.

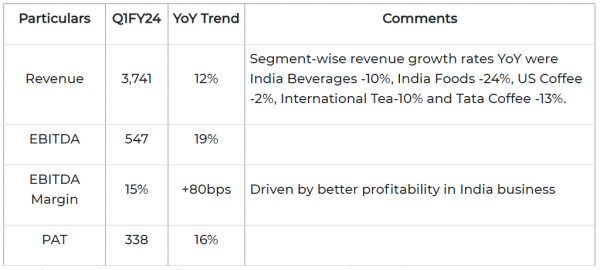

Tata Consumer Product

Sustained performance with most segments reporting healthy growth. Tata Sampann, Tata Soulful, and NourishCo collectively grew 58% YoY in Q1FY24.

Marico

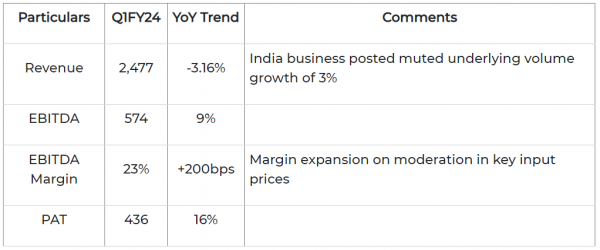

The subdued quarter due to destocking and trade scheme rationalization which management believes will correct in coming quarters.

Dabur

Healthy results supported by growth across all categories excluding beverages.

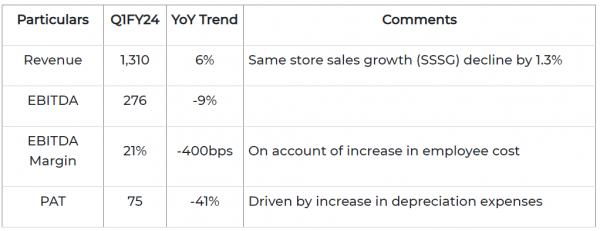

Jubilant Foodworks

At par result on account of negative SSSG and flat dine-in and take away.

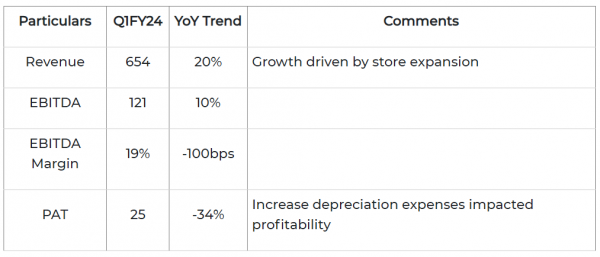

Sapphire Foods India Ltd

Sub par performance driven by retail expansion while Same Store Sales Growth (SSSG) continues to be under pressure.

Shree Cement

Muted performance; EBITDA/ton for cement remains flattish QoQ.

Ambuja Cement (Standalone)

Good results on the back of improvement in EBITDA/ton realization.

Dr. Lal Path Lab

Good performance was driven by lower SG&A expense, better test mix, and a seasonality boost.

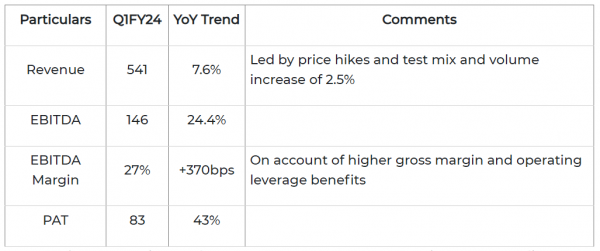

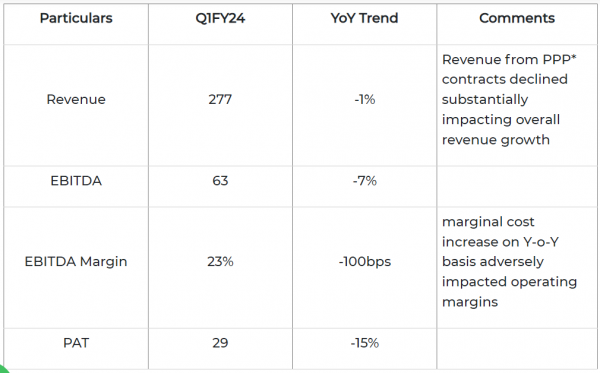

Metropolis Healthcare Limited

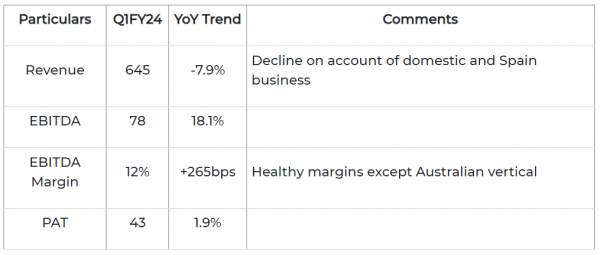

Healthy performance; core business revenue growth of ~12% on YoY (excludes revenue from Covid & Covid Allied tests and *public-private partnership contracts; including Hi-Tech). Revenue per test (Core Business) for Q1FY24 was up by 3% on a YoY basis.

Indraprastha Gas

At par numbers despite lowering the price of CNG, limited impact on volumes.

Mahanagar Gas

Strong numbers supported by volume growth.

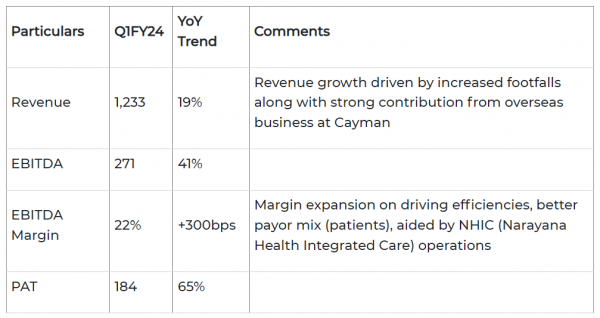

Narayana Hrudayalaya Ltd

Strong numbers are supported by an increase in average revenue per occupied bed for the period (ARPOB) from Rs. 1.22 Cr in Q1FY23 to Rs. 1.36 Cr in Q1FY24.

Titan

Weak numbers, though management guidance for FY24 remains strong.

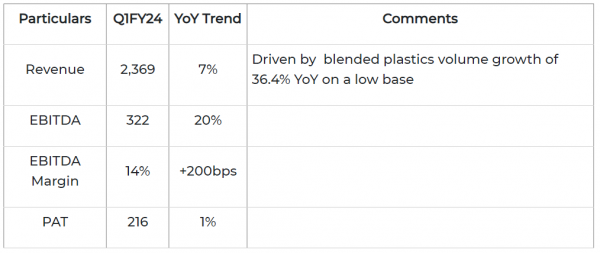

Supreme Industries Ltd

Favorable performance, management has guided for +20% vol. growth along with an EBITDA margin of 14% in FY24, mainly with good demand from real estate and infra sectors.

Sheela Foams

At par result. The acquisitions of Kurlon Enterprises Ltd and House of Kieraya Private Limited are expected to be accretive to earnings.

Kajaria Ceramics Ltd

At par result driven by tiles volume growth of 7.2% YoY while realisation declined 1.8% YoY. Management has maintained its guidance of 14% to 16% EBITDA margin for FY24.

V I P Industries Ltd

Weak numbers, despite an increase in revenue, EBITDA margin contracted on account of increased other expenses and higher brand & channel investments.

Best Stocks From:

All Weather Alpha Case Screener Alpha Cases Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory