Dear Readers,

Welcome to our weekly company results update note. We understand the importance of staying up-to-date with the latest financial developments of the companies you have invested in. That’s why we are committed to providing you with short and insightful information about the earnings and performance of the companies in our coverage.

Sector index

- FMCG

- Auto and auto ancillaries

- Retail

- Healthcare

- Capital goods and Industrial consumables

- Power

- Logistics

- Pharma

- Chemicals

- Other

1. FMCG

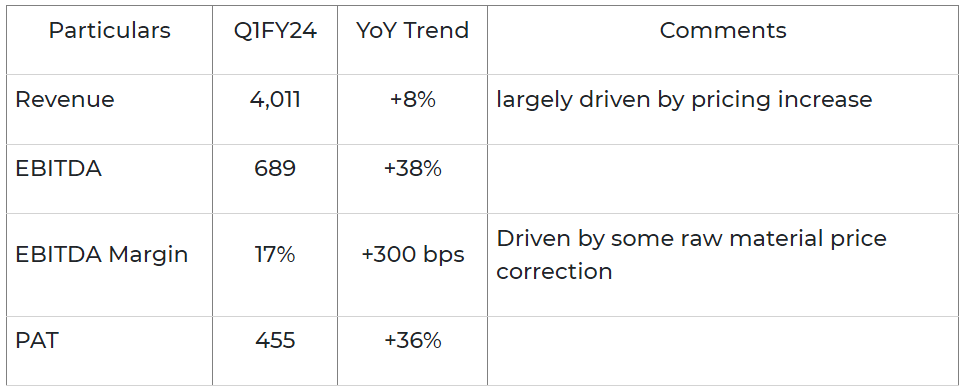

Britannia Industries Ltd

The muted result on account of flattish volume growth and increased local competition decelerate growth.

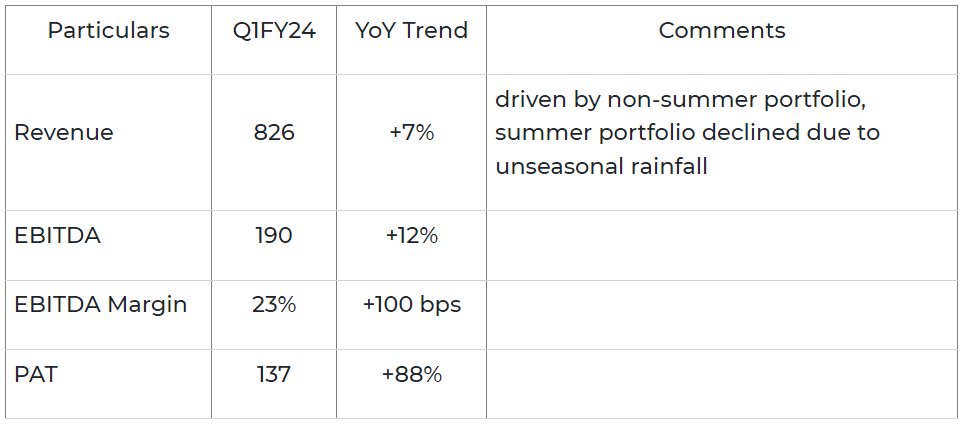

Emami Ltd

Good results on all parameters, double-digit growth in pain management and healthcare range which is encouraging.

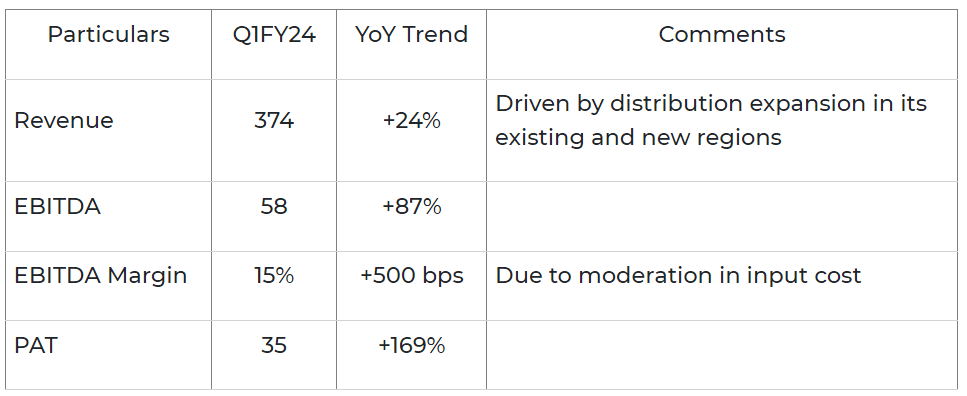

Bajaj Consumer Care Ltd

Healthy performance, with broad-based growth across SKUs.

Mrs Bectors Food Specialities Ltd

Consistently strong performance, maintaining effectiveness across all parameters.

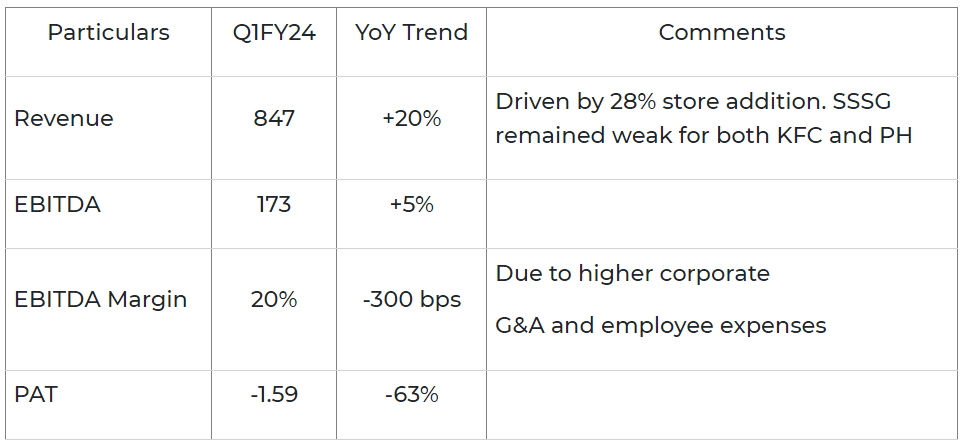

Devyani International Ltd

The subpar result on account of revenue primarily influenced by store additions in response to weak same-store sales growth (SSSG).

Bata India Ltd

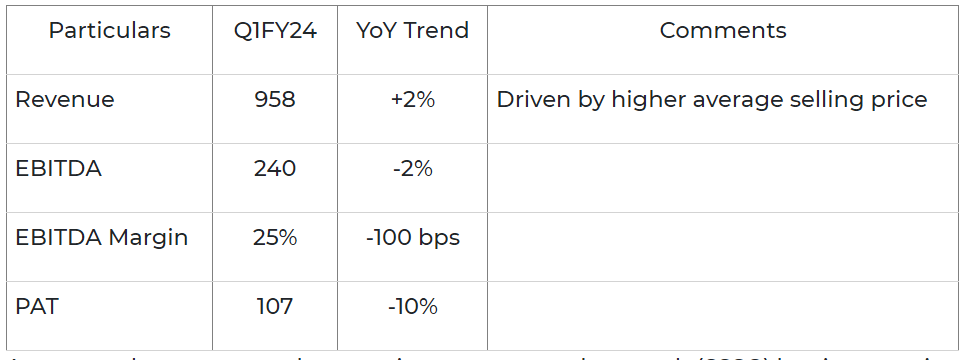

At par result on account of decrease in same-store sale growth (SSSG) but increase in average selling price.

2. Auto and auto ancillaries

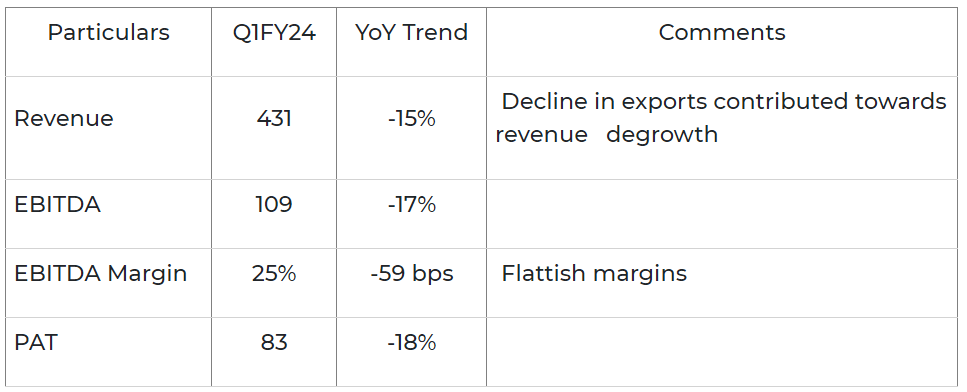

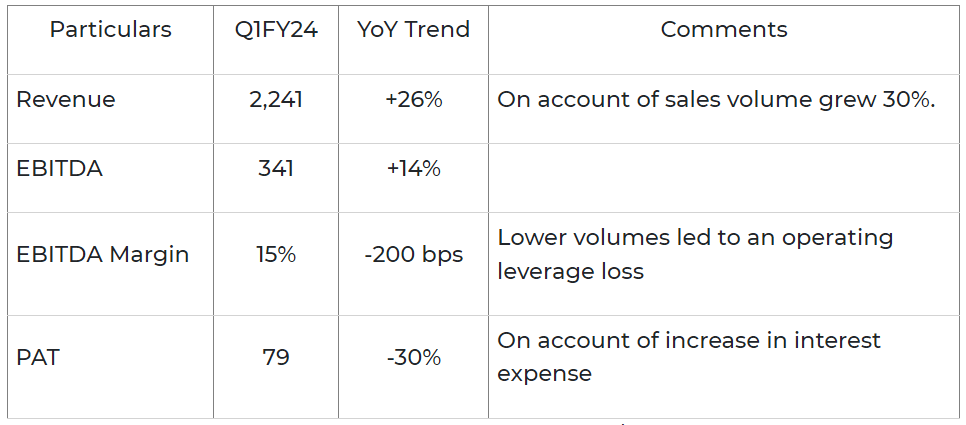

Balkrishna Inds

Weak results due to channel inventory-related challenges & recessionary pressures in key regions. The margin improvement was positive.

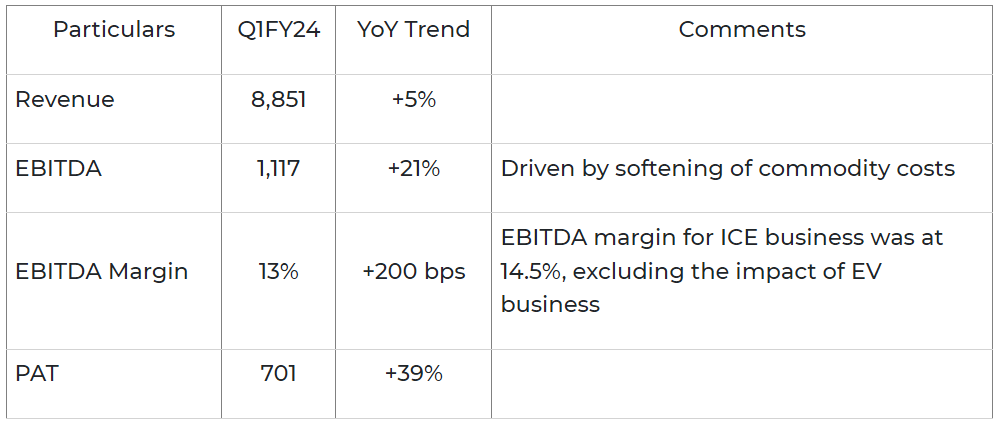

Hero MotoCorp Ltd

Steady results.

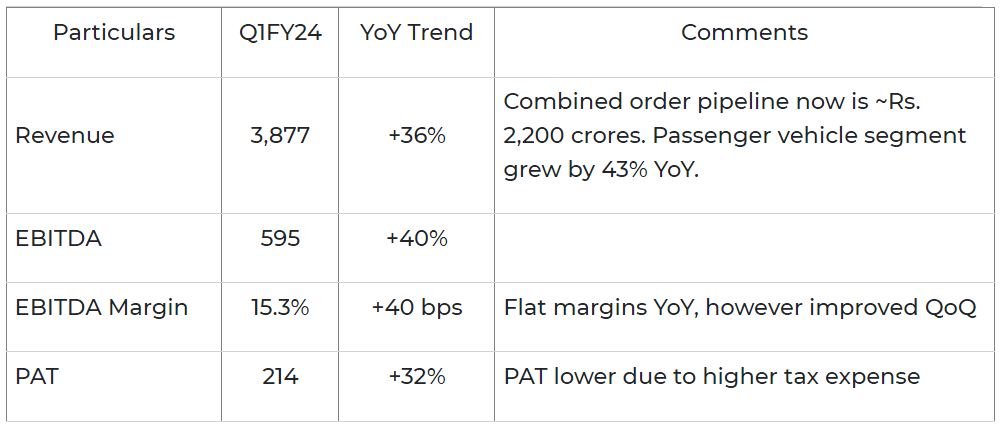

Bharat Forge

Good results. Diversification of the revenue base & Defense segment turning profitable will be key metrics to track.

3. Retail

V-Mart Retail Ltd

The muted result is on account of the decline in SSSG and also the decline in the average selling price.

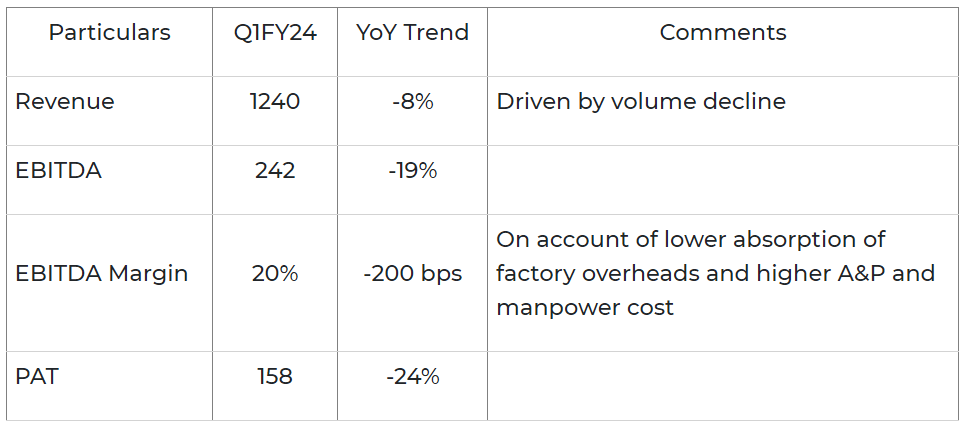

Page Industries Ltd

A weak set of numbers on account of slower recovery in demand and increase in competitive intensity.

Trent Ltd

Robust numbers. Sustained performance with healthy retail expansion.

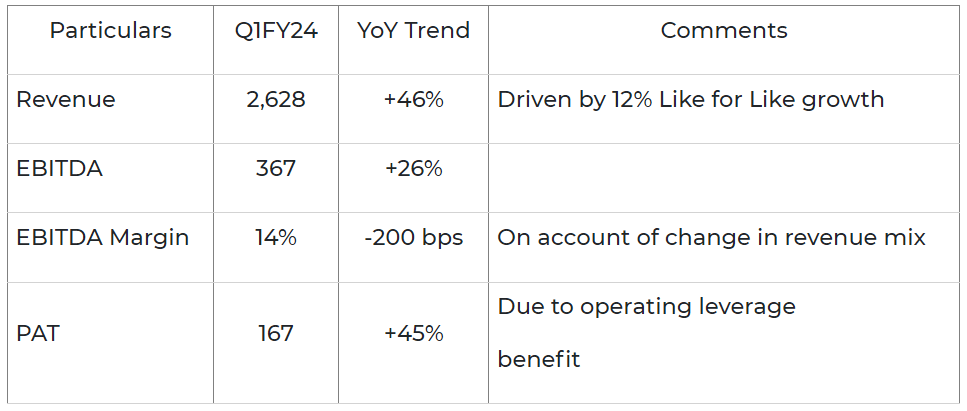

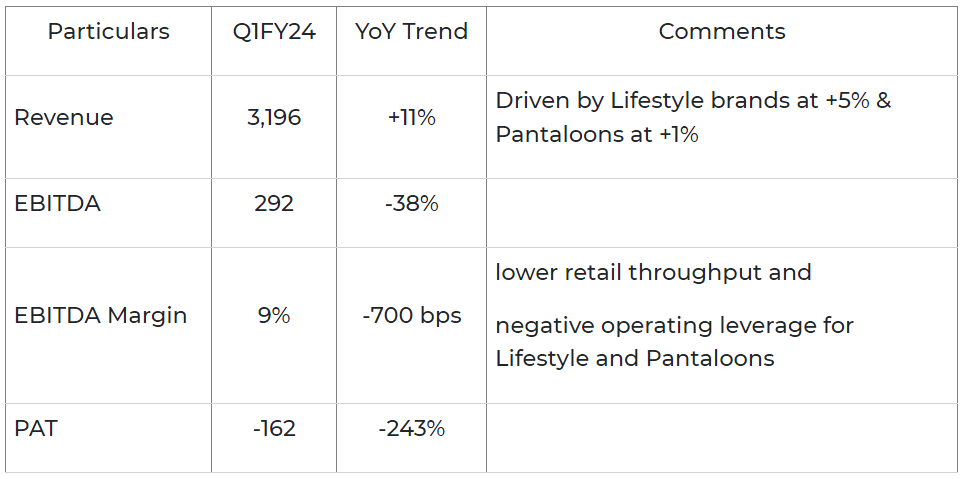

Aditya Birla Fashion & Retail Ltd

Subpar financial results due to investments in emerging brands, which negatively impacted the core business performance.

4. Healthcare

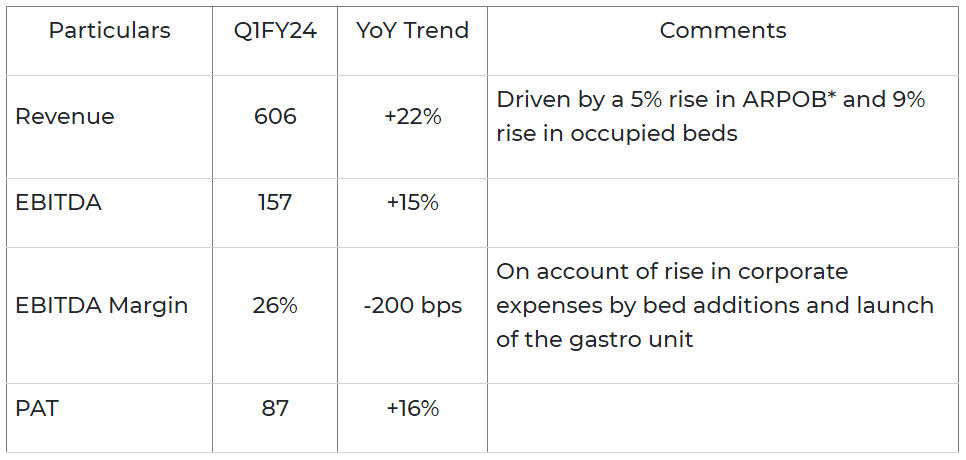

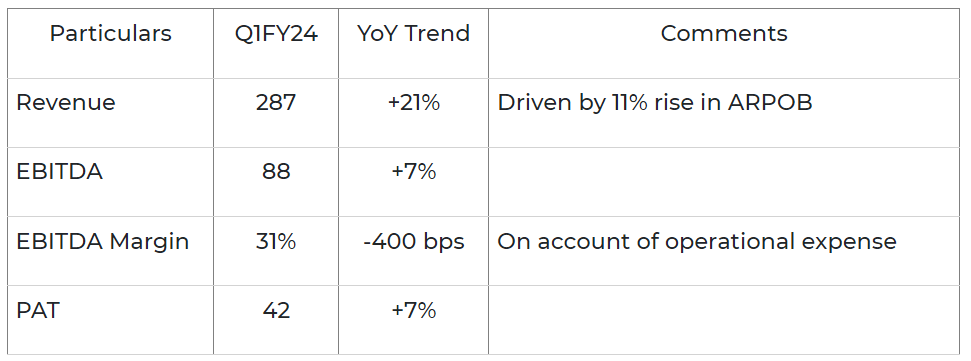

Krishna Institute of Medical Sciences Ltd

Healthy performance. Increase in Average Revenue Per Occupied Bed* and expansion in capacity.

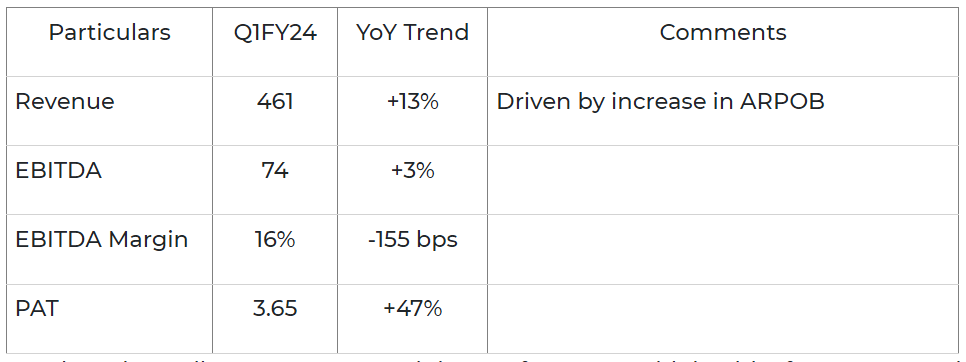

Rainbow Childrens Medicare Ltd

Subpar performance on account of rise in Average revenue per occupied bed* but decrease in EBITDA margin.

Healthcare Global Enterprises Ltd

Good result on all parameters, sustaining performance with a healthy focus on capacity expansion.

5. Capital goods & industrial Consumables

V-Guard Industries

Steady results.

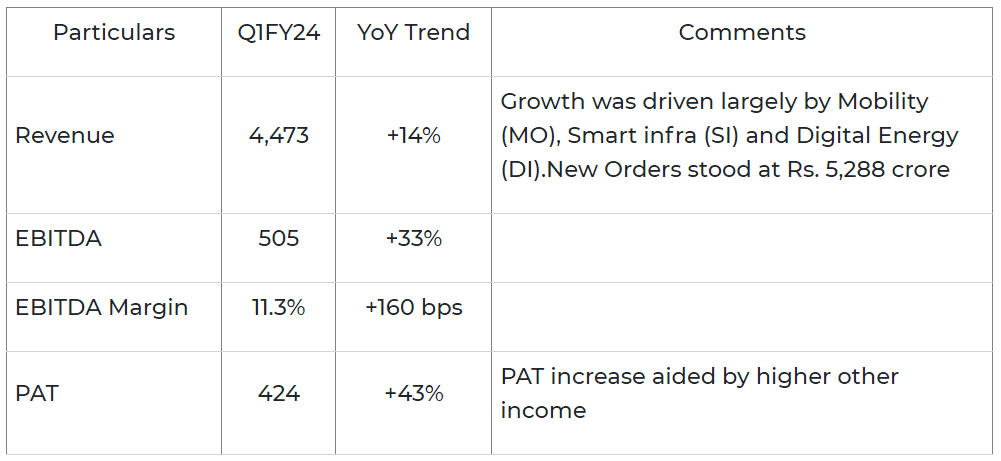

Siemens

Muted results on the margin front with the sequential drop of 110 bps.

6. Power

Tata Power Company Ltd

Good result on all parameters, sustaining performance with a healthy focus on capacity additions.

Torrent Power Ltd

Positive financial results. Good performance across all metrics.

7. Logistics

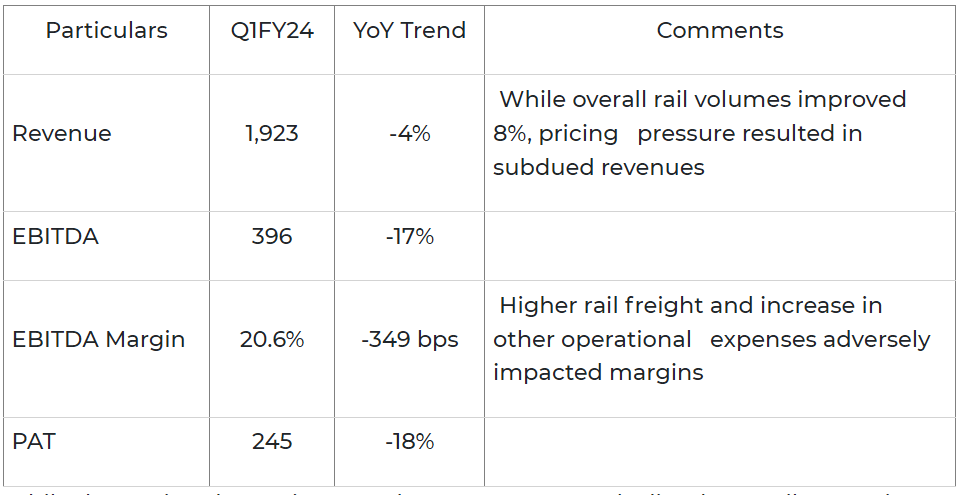

Container Corporation

While domestic volumes increased 10% YoY, revenue declined 5%. Rail export-import (EXIM) volumes increased 7% and revenue was flattish. Despite the fact that quarterly performance was sluggish, we will keep an eye out for realizations to normalize.

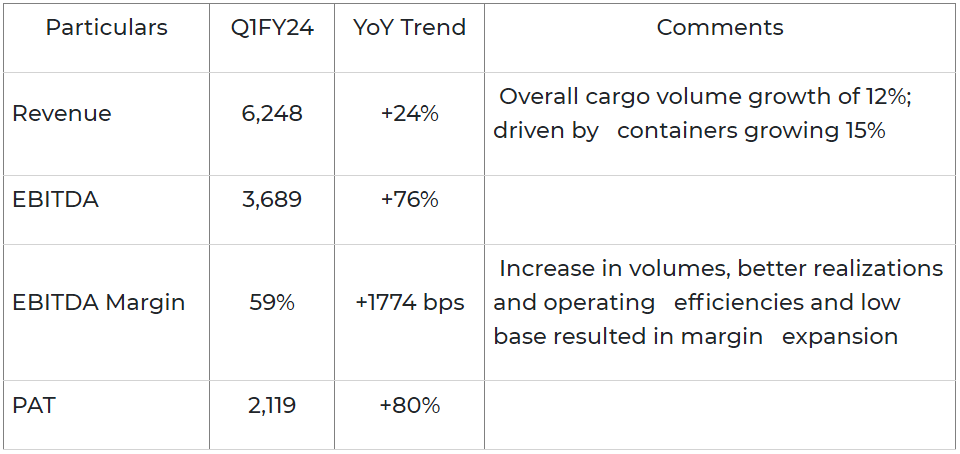

Adani Ports and SEZ

Strong performance on healthy volume growth as well as margin expansion. Both port and logistics segment delivered good results.

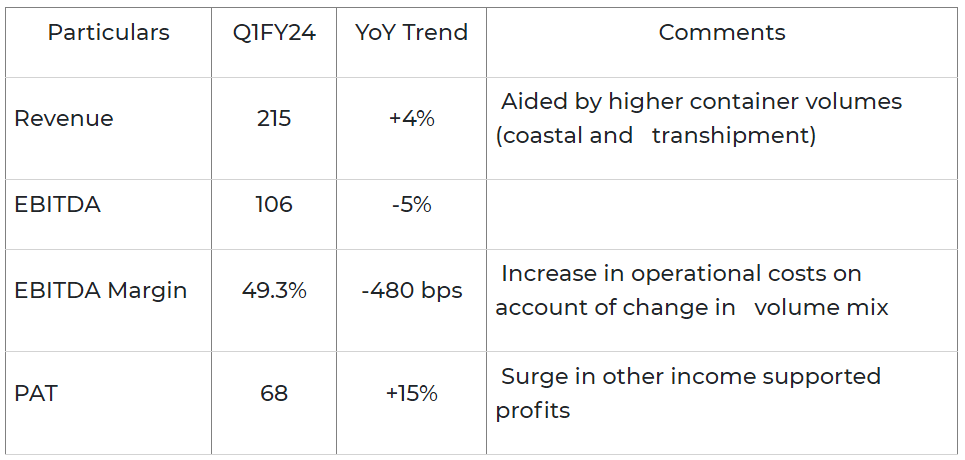

Gujarat Pipavav Port

Taking into account that operations were suspended for 16 days (power outage and cyclone), the company delivered even results.

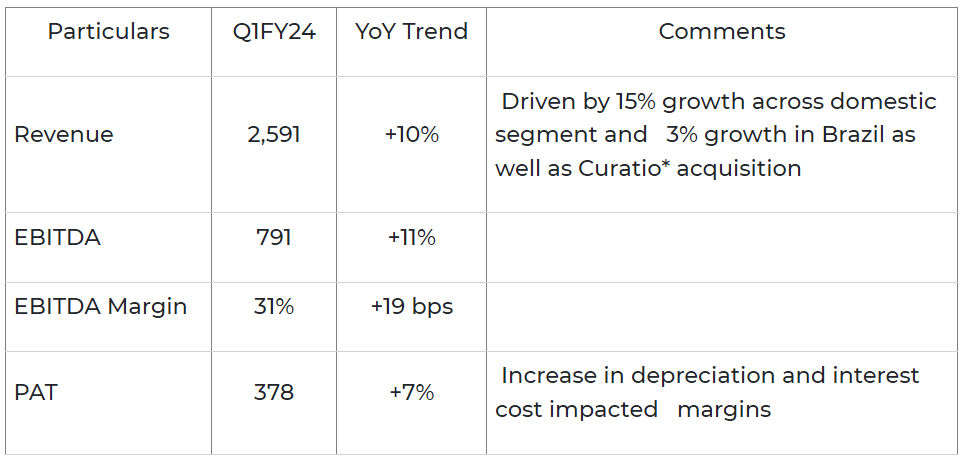

Allcargo Logistics

Poor result as export-import (EXIM) volumes declined due to subdued global trade activity and increased competitive intensity.

8. Pharma

Zydus Lifesciences

Stellar results on the back of performance across segments, margin expansion, and cost control.

Biocon

Good results, growth in the Biosimilars business aided by acquisition (Viatris’ biosimilar).

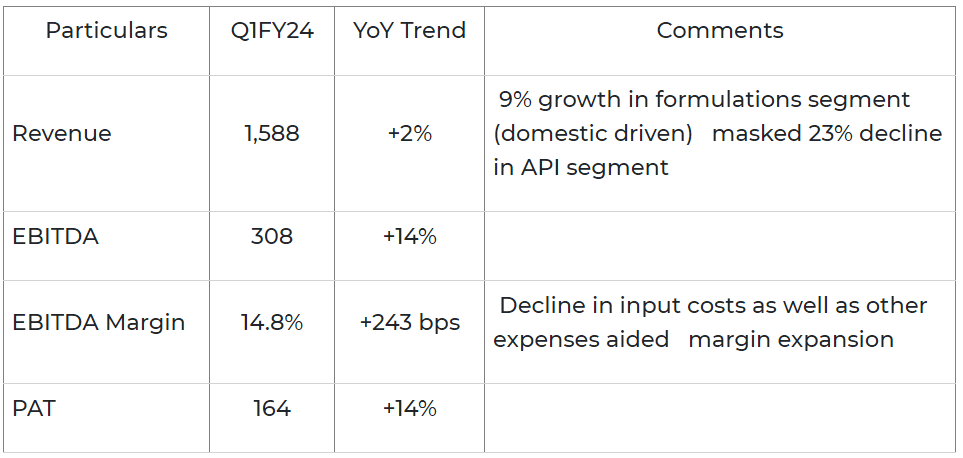

Aurobindo Pharma

Good results, with performance across markets (excluding antiretroviral therapy). *Active pharmaceutical ingredients.

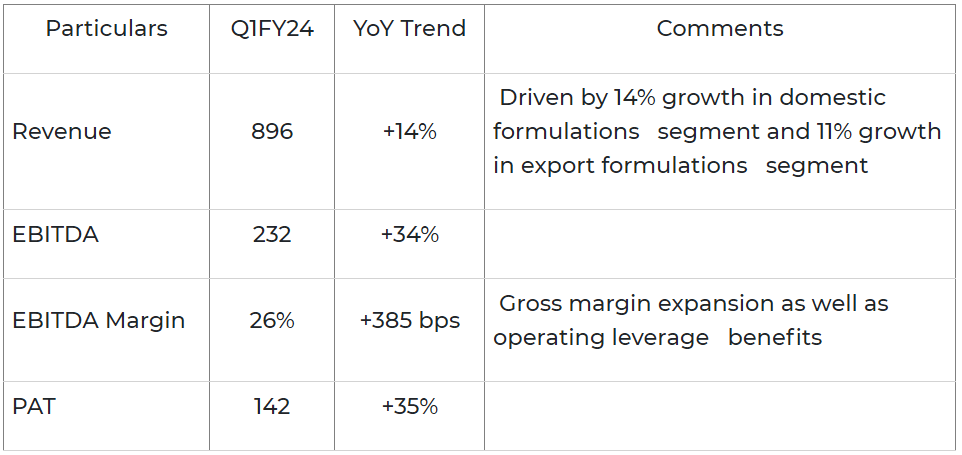

Torrent Pharmaceuticals

Steady results. *Operating in the cosmetic dermatology segment.

Ipca Laboratories

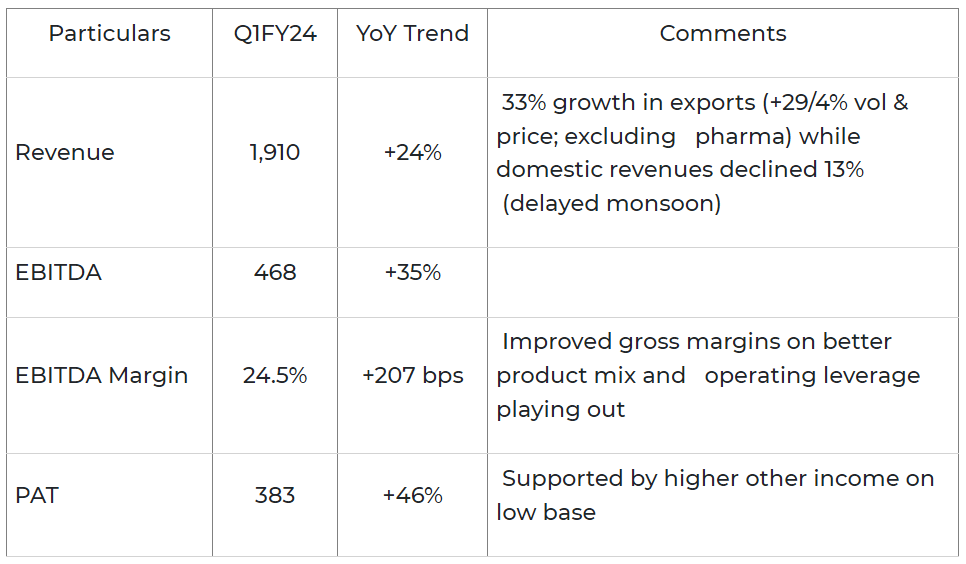

Good results, with overall revenue growth and margin expansion.

Abbott India

Performance was above expectations on better product mix and margin expansion.

Natco Pharma

Good results.

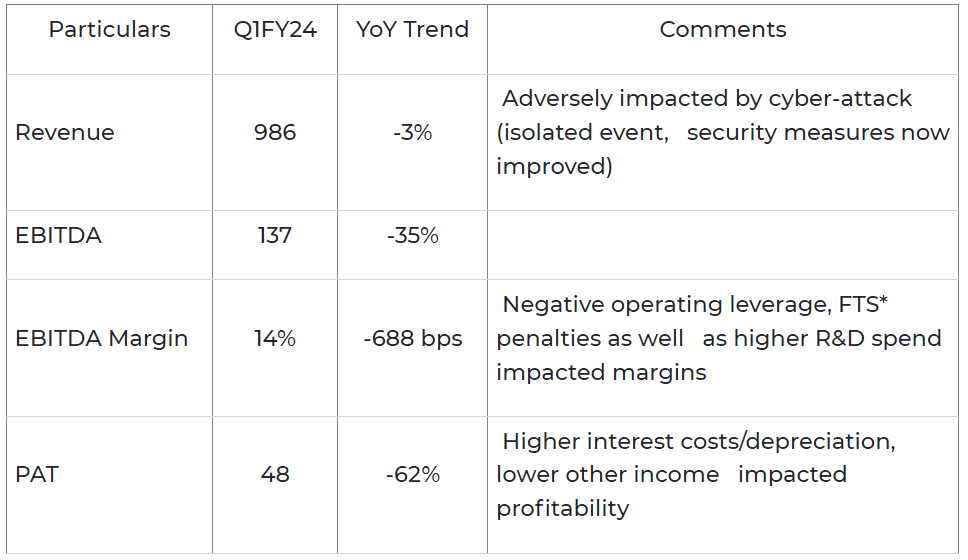

Granules

Poor results due to isolated event, recovery expected. *Failure to supply.

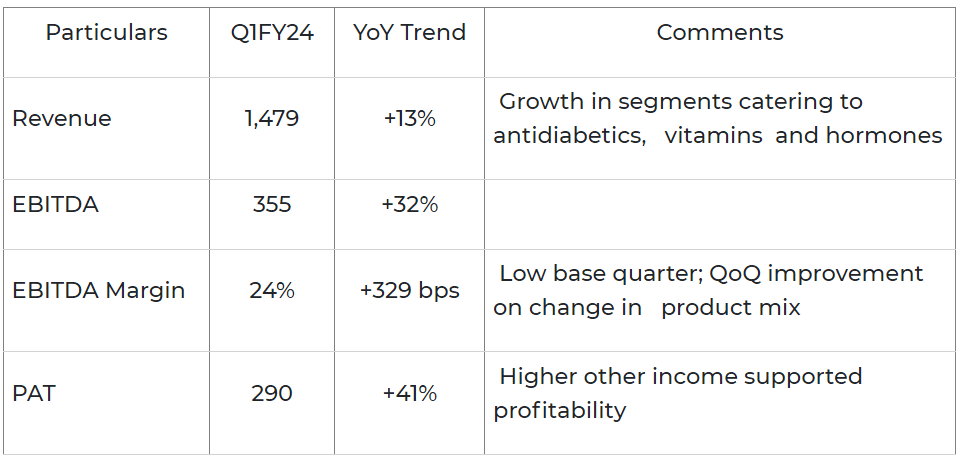

J B Chemicals & Pharmaceuticals

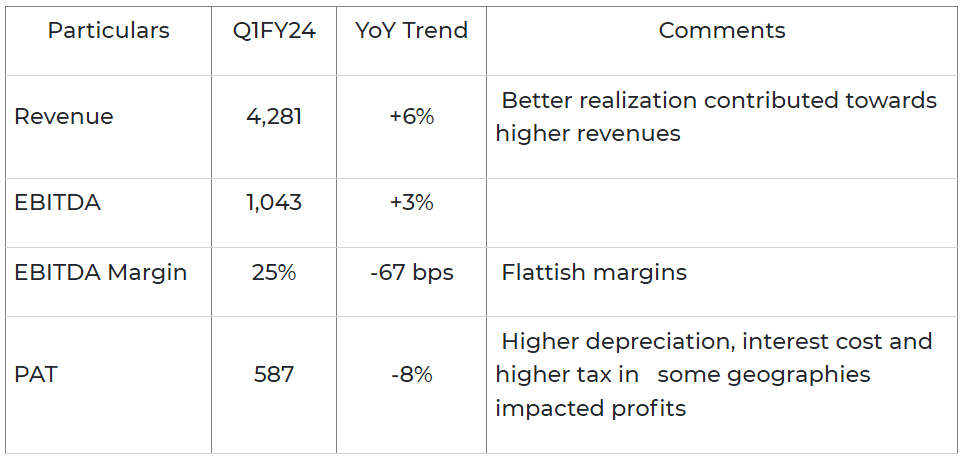

Good results with continued momentum.

FDC

Results were startling, particularly in terms of the EBITDA margin. We will be closely monitoring its margin trajectory moving forward.

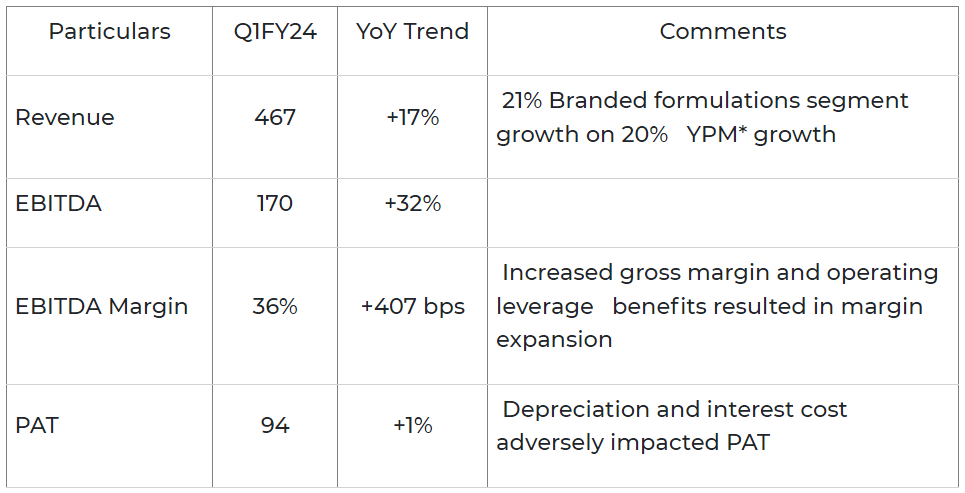

ERIS Lifesciences

Healthy results, on growth in key markets except US. *Yield per man.

Sequent Scientific

Poor results, although EBITDA before exceptional items and acquisition cost was positive.

Poly Medicure

Strong results, with sustained demand and healthy margins.

Shilpa Medicare

Muted results with mixed bag performance.

9. Chemicals

Tata Chemicals

Overall results were steady with lower volumes shadowed by better realizations.

Aarti Industries

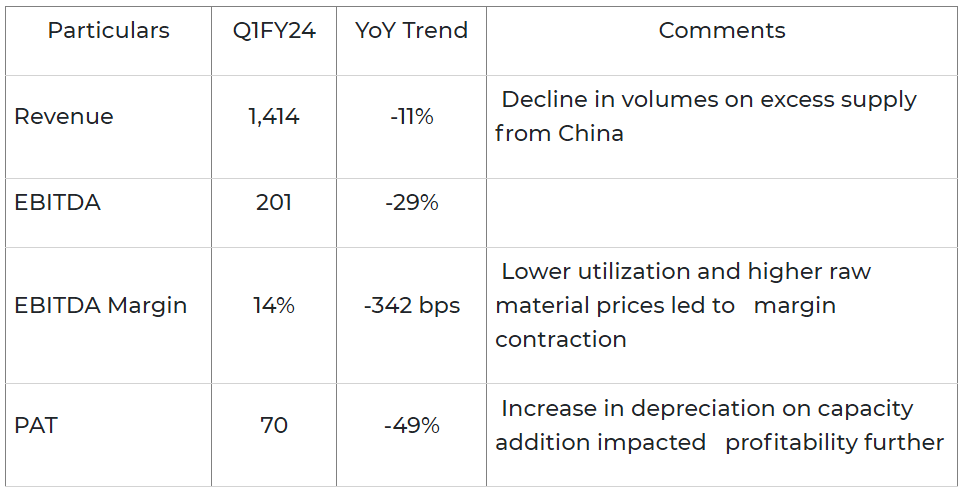

A slowdown in end-user industries, China’s oversupply, and inventory correction across export markets contributed to weak performance.

Chemplast Sanmar

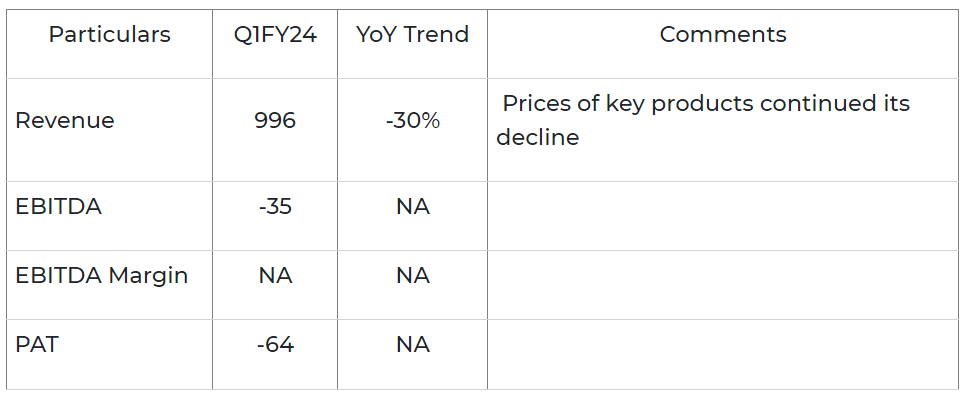

Poor results, management guided that prices of key products have bottomed out, which could result in performance recovery.

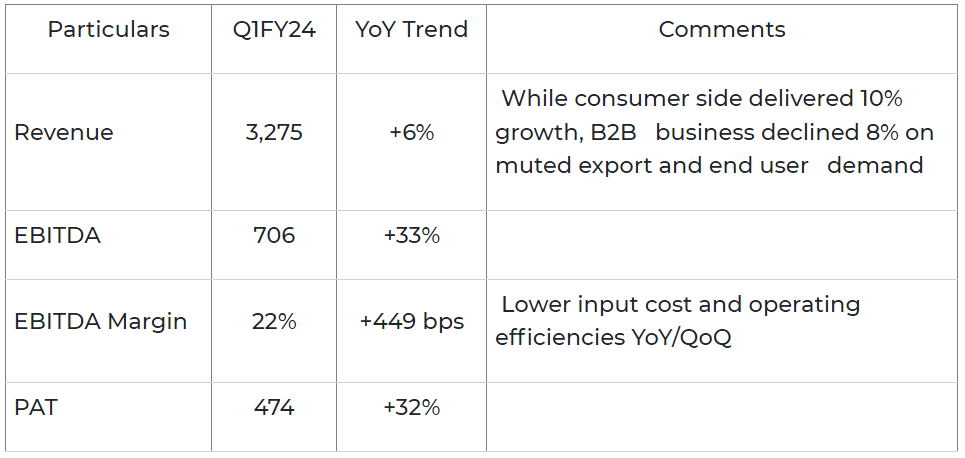

Galaxy Surfactants

Domestic demand was steady but export markets are under inflationary pressure leading to a decline in performance.

Sudarshan Chemical Industries

Good performance in export and specialty segments.

Vinati Organics

Sluggish results.

Alkyl Amines Chemicals

Muted results.

Advance Enzymes

Good results, as guided by management earlier- growth is without compromising margins further.

10. Other

Pidilite Industries

Good results on double digits volume growth in domestic business with rural markets growing faster than urban.

PI Industries

Good results, a company acquired a pharma business and ~3% of revenue contribution are from the same.

PB Fintech (Policy Bazar)

We remain watchful of an accelerated ramp-up in revenues and the company becoming PAT positive. * Includes Policybazaar and Paisabazaar.

CARE Ratings

Continued traction seen in other businesses. Good results with margins expected to improve.

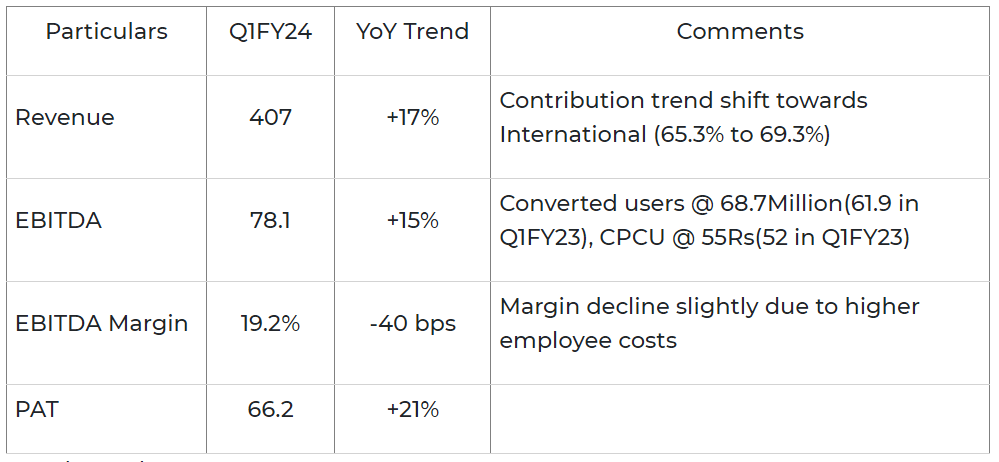

Affle India

Steady results.

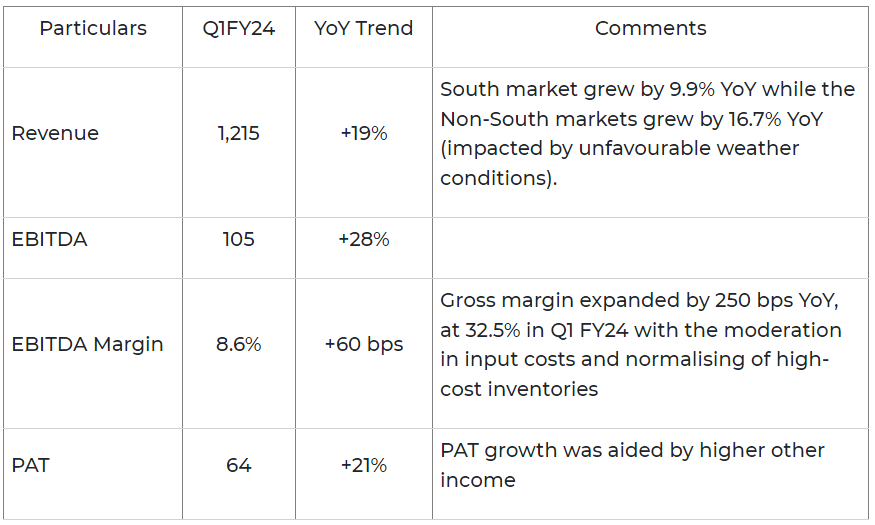

Berger Paints India Ltd

A good set of numbers on all parameters, with market share gains in East, West India.

The Ramco Cements Ltd

Muted numbers on account of a decrease in realisation/ton and also volume hit by supply disruptions.

Whirlpool of India Ltd

Subdued results. Elica has consistently demonstrated robust performance.

La Opala RG Ltd

Good performance on all parameters.

Zee Entertainment Enterprises Ltd

Weak Numbers on account of overall ad revenue was down 3.6%. An increase in employee costs and publicity expenses leads to losses.

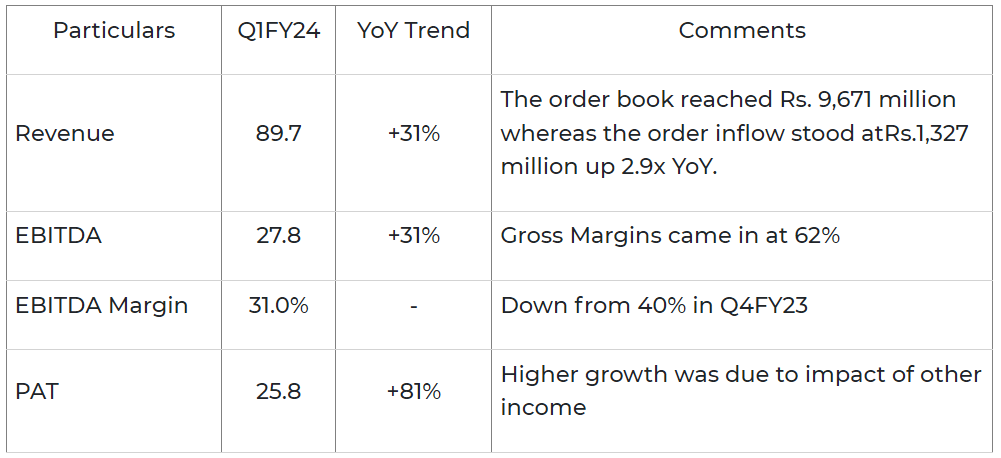

Data Pattern

Steady results.

Best Stocks From:

All Weather Alpha Case Screener Alpha Cases Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory