Dear Readers,

Welcome to our weekly company result update note. We understand the importance of staying up-to-date with the latest financial developments of the companies you have invested in. That’s why we are committed to providing you with short and insightful information about the earnings and performance of the companies in our coverage.

In addition to the weekly company result update, after the end of the earnings season, we will also be sending you a quarterly sector result review. This will give you a broader understanding of how these sectors are performing and help you make informed decisions about your investments.

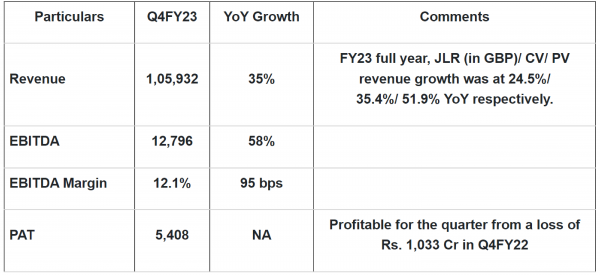

Tata Motors

Broad-based revenue growth seen across all 3 verticals backed by margin improvement.

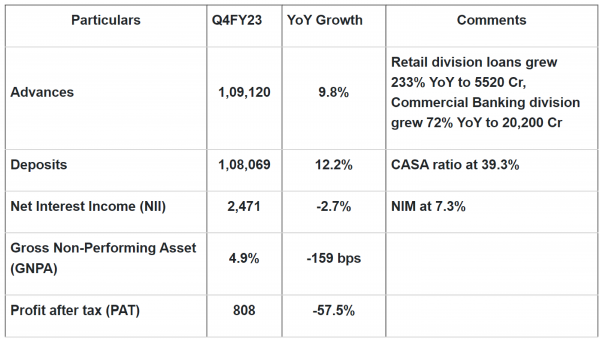

Bandhan Bank

Good results are driven by improvements in asset quality and yields. Visible positive trends in NPAs & credit costs moving downward, change in loan book mix towards housing & commercial, and lower slippages in the microfinance segment.

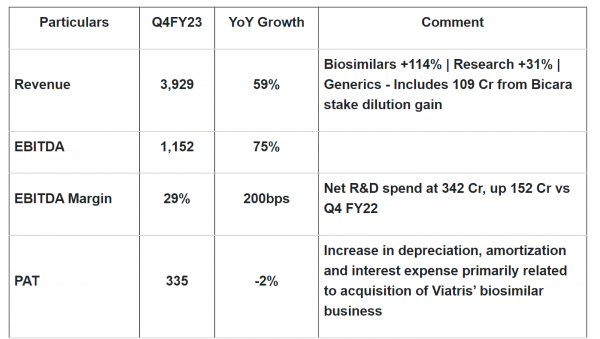

Biocon Ltd

Muted Result on account of lower than expected traction in biologics and generics business.

Prince Pipes

Below par result as Q4 is a seasonally strong quarter.

We have recently included this company in our coverage. Click to read the detailed Coverage Note

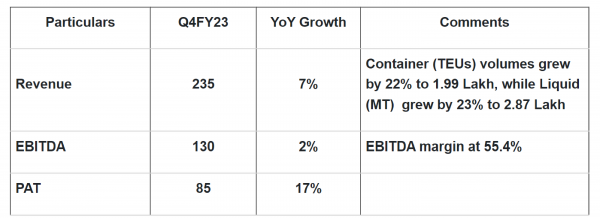

Gujarat Pipavav Port Ltd

Weak quarter due to global uncertainty and correction in the logistics sector. Container volumes are to remain muted, while the liquid is to be robust. Capex of $90 million for LPG capacity expansion.

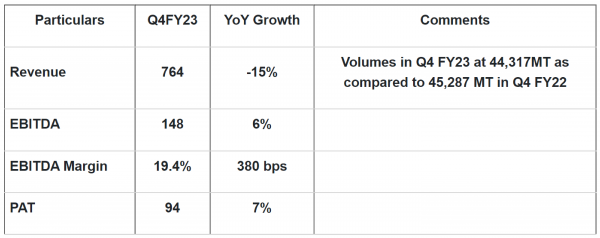

Divis Laboratories Ltd

Despite an increase in sales sequentially, margins were disappointed on account of high inventory costs and elevated pricing pressure in generic APIs. Overall weak numbers.

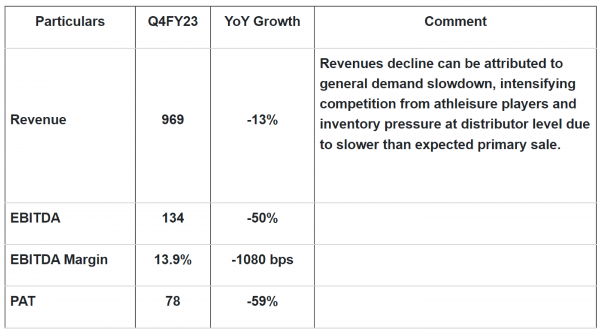

Page Industries

Howler results. 4QFY23 was significantly below estimates visible from the results of other company results in the apparel industry. This comes despite a 9% YoY increase in total reach and a 14% YoY rise in the number of Exclusive Brand Outlets (EBOs).

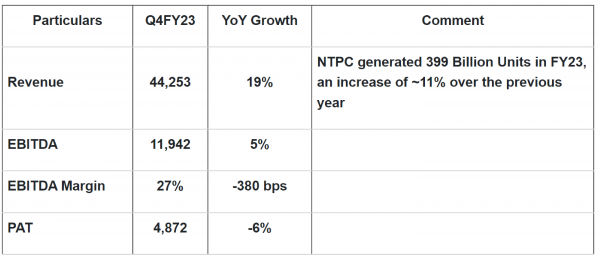

NTPC

A good set of numbers. The company remains aggressive on renewables with a vision to become a 130 GW+ company by 2032 (currently 130 GW) of which 60 GW would be contributed by renewable energy.

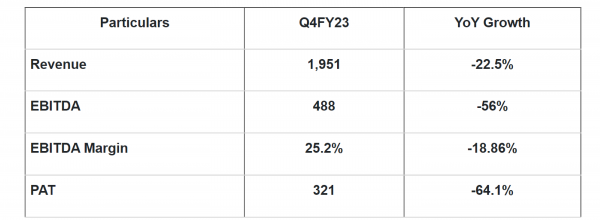

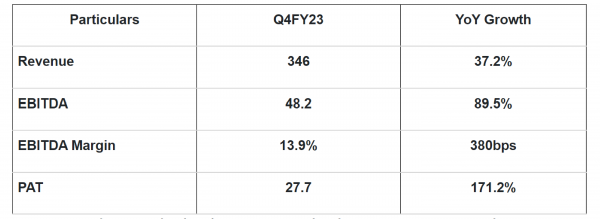

Mrs Bectors Food Specialities Ltd

Strong Numbers. Both the Biscuit segment and Bakery segment reported strong revenue and PAT numbers.

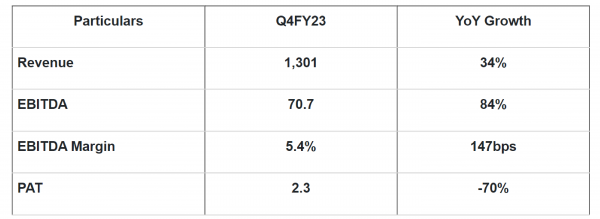

FSN E-Commerce Ventures Ltd

The muted result on account of a decrease in PAT despite an increase in revenue.

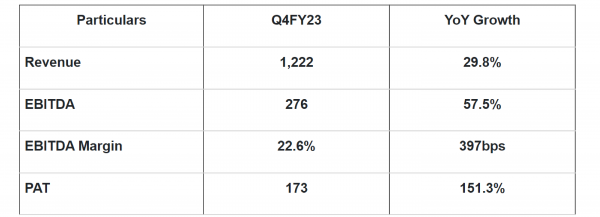

Narayana Hrudayalaya Ltd

The strong number with sequential improvement in average revenue per occupied bed (ARPOB).

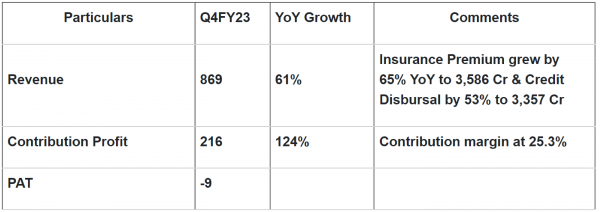

PB Fintech

Encouraging results aided by insurance premium & credit growth. Improvement in EBITDA margins and new business segment losses reducing.

Best Stocks From:

All Weather Alpha Case Screener Alpha Cases Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory