‘’The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.” And this is exactly what we have been telling you in the last few months!

But does this mean, you should invest in any stock? Definitely not! You can end up losing your hard-earned money. Especially, in volatile times like now, it is imperative that you invest in safe stocks!

So, what are safe stocks?

There is no set definition for safe stock, as it might have different meaning for different people. However, some stocks and sectors might be considered relatively safe compared to others. A good starting point to identify such safe stocks can be to look at large cap, fundamentally strong companies that have proved to be market leaders in their respective sectors. Now, most of you must be wondering where you can find these stocks in one place.

A good starting point would be the well known indices like the BSE Sensex, the Nifty 50 stock or the NSE 100 stocks. These indices provide a great list to look at where you can find a good handful of investment-worthy safe, large cap stocks. But world-over, there is a belief that safe large cap stocks, cannot give you great returns. They can probably only give you ‘’enough’’ returns. But much against this belief we at MoneyWorks4me.com think otherwise. Want to know why??

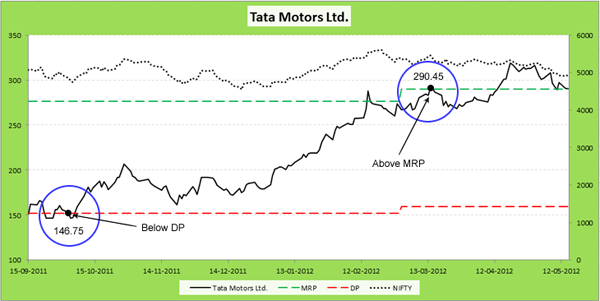

Let’s rewind a little… Cut to Oct’2011. Tata Motors (a Nifty 50 stock), India’s largest automobile company fell to Rs. 146.75. This was mainly due to the fact that Tata Motors poor performance in June and September quarters. Tata Motors being a fundamentally strong company offered a great buying opportunity at this point, more so because it was at Rs. 146.75 which was below our MoneyWorks4me’s Discount Price (ideal buying price).

From there the Tata Motors stock saw some negativity till mid Dec and was hovering around the same levels. This was because of the general negativity in the market in the months of November and December. The factors responsible for this were global fears of the European debt crisis deteriorating further, the rupee taking a beating and the domestic problems of high inflation and interest rates along with a government handicapped with corruption allegations and policy paralysis.

But surprise surprise!!!… With the New Year setting in, investors were showered with good news. The Sensex and the Nifty saw a rally that lasted from mid-December right upto mid-February taking the Sensex to 18000 levels and the Nifty to 5600 levels. This rally was on the back of positive developments around the world and the Indian economy. Also, Tata Motors posted good results in the next 2 quarters due to higher global sales. This led the stock spurt to Rs. 290.45 in March 2012. This price was above the MoneyWorks4me MRP (Right Price) which would have proved to be a good selling price for Investors.

Another such example is that of HDFC Bank.

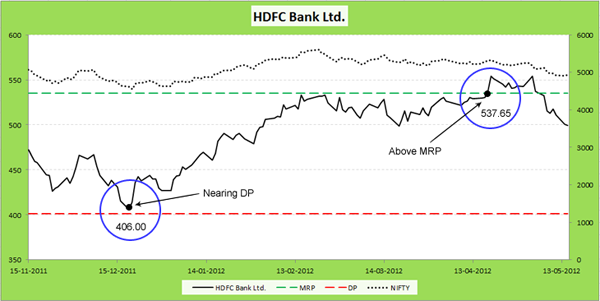

HDFC Bank is one of India’s leading private sector banks. It has been one of the most reliable and consistent performer’s in the banking space. Due to the general pessimism prevailing in the markets in the month of Nov-Dec, the Nifty index was in a free-fall. In keeping with the general market trend, the stock price touched Rs. 406 (close to the MoneyWorks4me Discount Price) in December, 2011 creating a good buy opportunity for investors.

From this point, as the markets recovered, the stock price of the company too moved upwards to Rs. 537.65 (above its MRP), in a time-period of 4 months.

These are just few examples of Nifty 50 stocks. There are a good handful of stocks in the Nifty 50 which have proved to be gold mines for investors. The truth is that when such safe large-cap stocks fall below their fair price, especially during a market fall they offer amazing investing opportunities!

But are all large cap companies worth investing?

No, not all large cap companies are worth investing into. Some of them may have not done so well in the past and are still facing problems currently. Many investors have often lost money by investing in such companies.

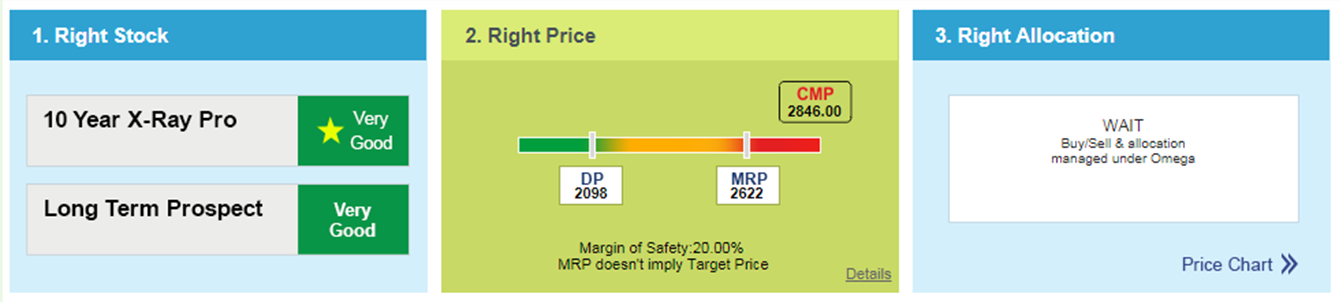

So, to help you find out the best and the safest stocks from these indices, MoneyWorks4me has launched new offerings -the Nifty 50 Superstars. These plans offer you the distilled list of potential stocks drawn from popular indices. We track these stocks for you from day 1, so that, as and when the opportunity arises, you can put your money to work quickly. This offers you an exclusive space where every large cap stock comes with a COLOUR CODE (financial strength) and an MRP (real worth) so you instantly know which companies are available at the Right Price and the Right Timing.

So, do check out these plans and earn great returns!

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

The examples given are good. However, one needs to understand that it is in retrospect that we can say you have earned 97% or 32%. The point is if the investor had sold at those rates only then he would have earned. The moot point is how many would have disposed these shares at the material point. Every one keeps telling where and at what price one should invest but hardly anyone tells one should exit. Yes people with gut feeling do exit but others deep hoping that the prices will increase further and thereby miss the bus.

Agreed finally an investor makes money when he/she sells. And hence it is important for an investor to know when to sell. From the graph you can see that there is an MRP for the stock, which when crossed indicates that the price is now above the full price and hence it is in the sell zone. The suitable time to sell can be gauged only from the technical charts. All this is what is available to a paid subscriber

I agree with you when you say that large caps can give great returns. They are much safer and stable than mid and small caps. Further they carry the weight of good fundamentals behind them.

Nice article. Would be great if you can provide a readymade list of such safe stocks.

Thanks a lot for your appreciation. The different MoneyWorks4me plans provide you such a list and also track them for you so that you don’t miss any investing opportunity

I believe that large caps can give us great returns. Though I have small caps I think large caps are more safer and stable than the mid and small caps.

@greyhudson785:disqus Your understanding of large cap stocks in

terms of them being safer and more stable then mid/small caps is

correct! At the same time, they also give great returns over the

long-term. However, choosing stocks from amongst these different

market caps, is a matter of your risk appetite and your return

expectations.

To assess your risk-profile for FREE, you could

visit: http://www.moneyworks4me.com/stock-market/risk-analysis/risk-profile-equity-game-plan