As investors, we are used to seeing the Sensex fluctuate every minute. And to make investing more profitable and not a game of mere chance we need a solution. A solution which could help us ascertain whether the market is over-reacting or under-reacting, whether it is grossly depressed or irrationally exuberant. This is exactly what Sensex@MRP is!

Considering that the Sensex stocks are the top traded stocks of the country, we can expect them to be traded at their MRPs. Thus Sensex@MRP gives an indication of whether the Sensex is fairly valued or whether irrationality is driving the markets. Most of you must have gone through our earlier reports about Sensex@MRP which explained to you how the concept works and can help individual investors.

So, with the December 2010 quarter results out for the Sensex companies, where does the Sensex@MRP stand?

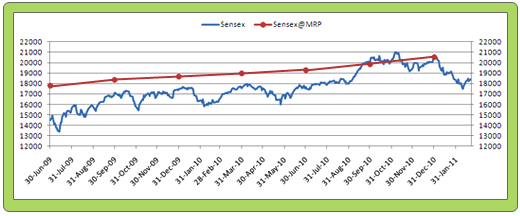

The free float market capitalization at the MRP of the individual stocks as computed by us at MoneyWorks4me.com and using share data as on 16th February 2011 is Rs. 1,639,868 Cr. Using the index divisor 79.98 (as on 16th February 2011) the Sensex@MRP comes out to 20,504.

So, currently, the Sensex, which is close to 18,300 (as of 21st February), is 11% or 2200 points below the Sensex@MRP.

Sensex@MRP has gone up by around 3% from its September level of 19,861. This, when Sensex has infact corrected considerably since the 20,000 levels seen at the start of the New Year 2011. The last couple of months have seen major selling especially by FIIs; this was on the back of headwinds such as fear of a high inflation acting as a spoil sport for the profitability of India Inc., interest rates which are expected to move up, governance issues for both the country & companies and expectations of better performance by US markets. So, while expectations for a not-so-rosy performance by the Indian companies in the next few quarters are rampant, let’s have a look at the December quarterly results of the Sensex companies to see how they actually performed?

A closer look at earnings

The December 2010 quarter saw an increase of around 16.7% (Y-o-Y) in Net Sales for the Sensex. The Y-o-Y growth rate trend for Net Sales has been decreasing over the last four quarters and has come down from around 32% in March 2010 to 16.7% currently. The high growth in March 2010 was also partly because of the low base seen in 2009 the effect of which is now over. Going forward, the Net Sales growth rate is therefore expected to stay more or less stagnant.

As far as the profitability of the Sensex companies is concerned, adjusted PAT grew by close to 25% (y-o-y) and by around 8.5% on a q-o-q basis. Just like last quarter, the average earnings growth for the Sensex companies stood at close to 15%. Among the 30 companies, as many as 21 companies recorded a Y-o-Y growth in earnings whereas 9 companies recorded a drop.

Analysis of the 9 month performance of the Sensex companies reveals that the leaders from the Sensex pack have been Sterlite Inds, Tata Steel, Bajaj Auto, Jindal Steel and DLF. Sterlite Inds. reported robust numbers on the back of high copper prices and an increase in refined zinc sales volume. Though steel companies like Jindal Steel and Tata Steel have posted good numbers, they have witnessed a decrease in the operating profit margins due to high raw material prices. Bajaj Auto too saw a decrease in the operating profit margin due to high raw material costs; however it managed to record impressive numbers due to higher contribution of high-end motorcycles and a spurt in other income.

Analysis of the 9 month performance of the Sensex companies reveals that the leaders from the Sensex pack have been Sterlite Inds, Tata Steel, Bajaj Auto, Jindal Steel and DLF. Sterlite Inds. reported robust numbers on the back of high copper prices and an increase in refined zinc sales volume. Though steel companies like Jindal Steel and Tata Steel have posted good numbers, they have witnessed a decrease in the operating profit margins due to high raw material prices. Bajaj Auto too saw a decrease in the operating profit margin due to high raw material costs; however it managed to record impressive numbers due to higher contribution of high-end motorcycles and a spurt in other income.

The telecom companies continued their woes with Reliance Communications and Bharti Airtel featuring in our list of ‘Laggards’ once again.. Bharti Airtel has seen a 20% (y-o-y) fall in profits in 9MFY2011 whereas Reliance Communication has been reporting losses for 3 consecutive quarters now. While JP Associates managed to record good numbers for its real estate division, its cement and construction division suffered considerably. Auto majors Maruti Suzuki and Hero Honda recorded robust growth in topline but could not manage to maintain profitability as once again the high raw material costs hit profitability.

So, what should we as investors do??

The common theme across all the companies has been the increase in raw material costs leading to a fall in operating margins. Majority of the companies have yet managed to maintain their profitability but going forward this number is expected to decrease. Inflation, though expected to moderate in the coming quarters, will still have an impact on the margins. This combined with the higher base seen in the last few quarters can lead to subdued growth for a large number of companies. The market seems to have factored this possibility and as a result we have seen the Sensex fall over the last couple of months. Currently, 19 companies are quoting below their MRP (this number was 14 for the September quarter) whereas the rest 11 are quoting above their MRP.

The gap between Sensex and Sensex@MRP has widened over the quarter. While fears of inflation affecting profits are correctly placed judging from the results of the companies, how long this effect will last remains to be seen. Thus, even though in the short term, the view on Sensex is not very bullish, over the long term there are not many reasons to worry. The Union Budget which is around the corner could trigger the next rally or correction depending on whether it meets expectations or not. Whatever maybe the case, one thing is for sure – the drop over the last 2 months has led to a lot of stocks, especially mid-cap and small-cap, trade below their MRP; some are even available at a healthy margin of safety. As investors, the best thing to do now is:

Be on the look-out for buying opportunities. Make sure that the company is fundamentally strong and is available at a healthy margin of safety.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

Log on to http://www.MoneyWorks4me.com to find the MRP of these stocks.

You are right that Value Investing principles suggest buying a stock at a 50% discount to MRP. However, with an index like Sensex, this may not always be possible. Sensex is composed of 30 of the top companies in the country. So, it is possible that even if Sensex is at say a 15% discount to Sensex@MRP, you can have some companies which are available at a 50% discount to their respective MRP or which are quoting considerably above their MRP.

Also, historically Sensex was at a 50% discount to Sensex@MRP only during crises in 2000 (when the IT bubble burst) and more recently in 2009 (Sub-prime crisis). Investing in an index fund during these times would have surely given you handsome returns. But such opportunities don’t occur very frequently and hence you can also consider entering if the Sensex is at say a 25-30% discount to Sensex@MRP.

We are working on the latest report on Sensex@MRP and it will be out in a few days.