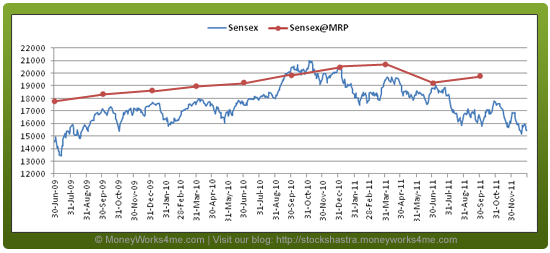

As investors, we are used to seeing the Sensex move every minute. And to make investing more profitable and not a game of mere chance we need a solution. A solution which could help us ascertain whether the market is over-reacting or under-reacting, whether it is grossly depressed or irrationally exuberant. This is exactly what Sensex@MRP is!

Considering that the Sensex stocks are the top traded stocks of the country, we can expect them to be traded at their MRPs. In reality, the stocks are driven by their earnings over the long terms. Hence, it is said that Market is a slave of the corporate earnings. Thus Sensex@MRP gives an indication of whether the Sensex is fairly valued or whether irrationality is driving the markets.

Most of you must have gone through our earlier reports about Sensex@MRP which explain to you how the concept works and can help individual investors. So, with the September 2011 quarter results out for the Sensex companies, where does the Sensex@MRP stand?

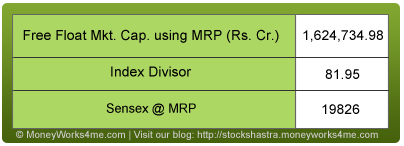

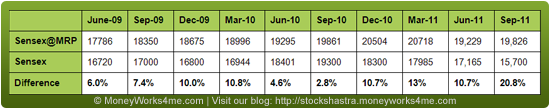

The free float market capitalization at the MRP of the individual stocks as computed by us at MoneyWorks4me.com and using share data as on 28th December 2011 is Rs. 1,624,734.98 Cr. Using the index divisor 81.95 (as on 28th December 2011) the Sensex@MRP comes out to 19828.

So, currently, the Sensex, which is close to 15,700 (as of 28th December), is ~20.8% or 4126 points below the Sensex@MRP.

The last 12 months saw major selling, especially by FIIs. While domestic headwinds such as high inflation and increasing interest rates affected the profitability of the Indian companies, fears of the European debt crisis deteriorating added to the weak sentiment. Considering the weak global and domestic market, the Indian companies have postponed their expansion plans. The index of industrial production (IIP) was representative of this and came down by 5.1% for October month. Apart from this, the Indian currency has also depreciated drastically over the last few months affecting India Inc.

So, in this turbulent market condition, how did the Sensex companies actually perform? Let’s have a look at the September quarter results of the Sensex companies

A closer look at earnings

Quarterly Performance:

For the September 2011 quarter, the cumulative Net Sales of all Sensex companies has grown by 25.89% (Y-o-Y) to Rs. 3,01,059 Cr. from Rs. 2,39,151 Cr in September 2010. Out of the 30 companies, 24 registered a growth of more than 15% in Net Sales on a Y-o-Y basis while others reported marginal growth. The growth was majorly supported by sectors like Oil & Gas, Pharma and FMCG. The sectors, where growth was below average included Auto, Steel, and Telecom.

On an operating level, the operating profits of the Sensex companies came down by 2.58% in September 2011 as compared to September 2010 quarter. The operating profit has been affected due to higher raw material prices, leading to an increase in cost of goods sold. As far as the net profitability of the Sensex companies is concerned, adjusted PAT grew by close to 19.74% as compared to September 2010 and by around 10.40% as compared to June 11 quarter. Among the 30 companies, 20 companies recorded over 12% growth in earnings Y-o-Y basis while only 13 companies recorded over 12% growth in earnings Q-o-Q basis.

To summarise, while growth has been good on a year-on-year basis, it has slowed down on a quarter-on-quarter basis.

Half-yearly performance:

Analysis of the half-yearly performance of the Sensex companies reveals that the cumulative Net Sales of Sensex grew by 25.71% (Y-o-Y), while the operating profit were down by around 4% (Y-o-Y) – a result of increased raw material costs and currency fluctuations.

The leaders from the Sensex portfolio for this quarter are Coal India, BHEL, ITC, HDFC Ltd, and Hero Motocorp. BHEL outperformed in the electric space with around 23% profit growth as compared to Q2FY-11 on back of robust sales growth. Coal India, the largest coal mining company in India, has posted robust performance on back of higher sales and significant increase in other income. ITC Ltd, the FMCG giant, continued its good performance in this half year too. HDFC Ltd, largest housing finance company in India, has been consistently posting good results over the last two years. Hero MotoCorp has posted 30% sales growth on back of growing demand but its profit was affected a bit by higher depreciation.

Predictably, the laggards include companies highly affected by raw material costs, high leverage and currency depreciation. Many companies have incurred heavy forex losses due to unexpected and significant depreciation of rupee against US dollar. Bharti Airtel posted around 32% fall in profit due to higher interest outgo. Though Tata Motors posted sales growth of 25%, its net profit fell by 7% due to increased raw material cost and foreign exchange loss. Maruti Suzuki was affected by labour unrest at its Manesar plant. It posted 5% fall in net sales and 25% fall in net profit due to lower production, heavy discount on cars and lower demand of petrol cars. Though SBI has posted good growth in total income, but its net profit was affected by higher NPA provisions and higher interest expense.

Overall, the Sensex companies have posted decent growth in net sales in the first half of FY-12. But, the operating profit has been hit by domestic concerns such as higher interest rates, inflation and depreciation of rupee. The adjusted PAT of Sensex companies has shown moderate growth for the first half.

So, what should we as investors do?

The Indian market has been affected by the ongoing European debt crisis. It is expected to remain a big concern for the global markets in the short term as well. The Indian currency has depreciated more than 20% against the dollar. Interest rates continue to remain high. Though, this has brought the primary article inflation to 3.78% (lowest since 2005), the depreciation of the rupee will hit the prices of fuel and manufactured goods keeping inflation high.

Another major concern has been government inaction. The Government announced the decision to allow 51% FDI in multi-brand retail (leading to a cheer in the markets) only to put it on hold after a big uproar and opposition in the Parliament, especially from its allies. A similar fate was destined for the Lokpal Bill and it got stuck in limbo after the government failed to get support for the bill and tried to avoid a vote over the bill. To make matters worse, the Government introduced the Food Security Bill which seems to be more of a strategy to garner votes and will most likely increase the fiscal deficit.

Concluding, the New Year is not expected to bring cheer to the markets in a hurry. While fundamental issues will further dampen the earnings for India Inc., negative sentiments are expected to continue and keep the markets jittery.

Looking at the numbers, Sensex is quoting at the highest discount to Sensex@MRP since we introduced the concept. Currently, 25 companies (this number was 21 for June 2011) are quoting below their MRP, whereas the rest 5 are quoting above their MRP. The gap between Sensex and Sensex@MRP has continued to widen over the quarters and looking at the global and domestic scenario, it is not expected to narrow down soon.

Many blue-chip companies have been beaten down, and the near future could see their prices fall further. Decreasing inflation may prompt the RBI to re-look at the interest rates but this will take some time to happen. Until then, the stock market can be expected to remain depressed. However, this does present investors with buying opportunities. The thing to do now (like last quarter) is to look at buying fundamentally strong blue-chip companies especially those which aren’t leveraged.

Buying opportunities on the rise. Look to buy fundamentally strong blue-chip companies available at a discount in small amounts and increase on dips.

To do this make sure you check the MRP of your stock on MoneyWorks4me.com.

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463