As investors, we are used to seeing the Sensex move every minute. And to make investing more profitable and not a game of mere chance we need a solution. A solution which could help us ascertain whether the market is over-reacting or under-reacting, whether it is grossly depressed or irrationally exuberant. This is exactly what Sensex@MRP is!

Considering that the Sensex stocks are the top traded stocks of the country, we can expect them to be traded at their MRPs. In reality, the stocks are driven by their earnings over the long terms. Hence, it is said that Market is a slave of the corporate earnings. Sensex@MRP gives an indication of whether the BSE Sensex is fairly valued or whether irrationality is driving the markets.

Most of you must have gone through our earlier reports about Sensex@MRP which explained to you how the concept works and can help individual investors. So, with the June 2011 quarter results out for the Sensex companies, where does the Sensex@MRP stand?

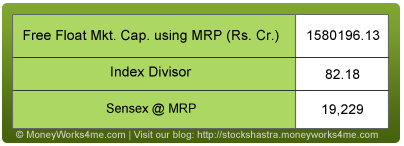

The free float market capitalization at the MRP of the individual stocks as computed by us at MoneyWorks4me.com and using share data as on 8th September 2011 is Rs. 1,580,196.13 Cr. Using the index divisor 82.18 (as on 8th September 2011) the Sensex@MRP comes out to 19,229. So, currently, the BSE Sensex, which is close to 17,165 (as of 8th September), is 10.73% or 2065 points below the Sensex@MRP.

This is the first time that Sensex@MRP has fallen below the level seen in a preceding quarter; it is down by more than 7% from its March level of 20,718. While the BSE Sensex companies have reported weaker performance as compared to the previous quarters, the major reason for this drop has been the reduction in Reliance Industries MRP by our research team owing to reduced growth estimates. Reliance is a Sensex heavyweight accounting for close to 11% of the total free float market capitalisation of the Sensex companies; no wonder then that we have a drop of close to 1500 points in Sensex@MRP. (For more on this read ‘Reliance Industries revaluation’ at the end of the article)

While Sensex@MRP has fallen, the Sensex has also been on a see-saw ride over the last few months. Infact, stock markets the world over have witnessed volatility and seen panic selling on some days only to be followed by correctional rallies in the days to follow. Even as the global economies have been struggling with the aftereffects of the last crisis, they are seeing another one knocking on their doors. And this time the stakes are much higher as entire economies could collapse. The trouble which began with the Euro countries has also moved into the US. The last quarter saw the US sovereign debt rating being downgraded from AAA to AA+ leading to a renewal of fears in the global markets.

While things look grim on the global front, the domestic situation is also far from encouraging. On one side as high inflation eats into corporate profits, the interest rate hikes taken by the central bank are also hurting the bottom line. Interest rate sensitive sectors like Auto, Banking are expected to be affected going ahead and their share prices have seen the impact of this. As a result, the Sensex fell from 19500 levels to close to 16000 (a fall of close to 19%) only to recover the fall a bit over the last few days. So, how have these problems affected the earnings of the Sensex companies? Let’s have a look at the June quarterly results of the Sensex companies to see how they actually performed.

A closer look at earnings

Quarterly Performance:

Out of the 30 Sensex companies, 20 companies registered a growth of more than 12% in Net Sales on a Y-o-Y basis while others reported marginal growth. The growth was largely supported by sectors like IT and Mining. The sectors, where growth was below average included Power, Pharma, Real-Estate, and Telecom. Going forward, the Net Sales growth rate is expected to come down due to global headwinds, weak domestic demand, rising interest rates and inflation.

On an operating level, the operating profits of the Sensex companies came down by 5.05% in June 2011 as compared to June 2010 quarter but were up by around 1.41%% as compared to March 11. The operating profit has been affected due to higher raw material prices, leading to an increase in cost of goods sold. As far as the net profitability of the Sensex companies is concerned, adjusted PAT grew by close to 11.74% as compared to June 2010 and by around 2.78% as compared to March 11 quarter. Among the 30 companies, 18 companies recorded over 12% growth in earnings Y-o-Y basis while only 8 companies recorded over 12% growth in earnings Q-o-Q basis.

Analysis of the quarterly performance of the Sensex companies reveals that the leaders from the Sensex pack have been TCS, Coal India, Bajaj Auto, Hindustan Unilever and HDFC Bank. Bajaj Auto outperformed in the automobile space with around 23% profit growth as compared to Q1FY-11 on back of highest ever quarterly sales volume and increased sales realizations. Coal India, has grown its Net Sales and Adjusted Net profit by ~27% and ~63% respectively on a consolidated basis. This is because of higher realization and other income. TCS and HDFC Bank have outperformed in its respective sector IT and banking sector. TCS grew its net sales and net profit by ~34% and ~32% respectively while HDFC Bank grew its net sales and net profit by ~60% and ~33% respectively. Hindustan Unilever has posted good numbers on Q-o-Q basis as well as Y-o-Y basis.

Analysis of the quarterly performance of the Sensex companies reveals that the leaders from the Sensex pack have been TCS, Coal India, Bajaj Auto, Hindustan Unilever and HDFC Bank. Bajaj Auto outperformed in the automobile space with around 23% profit growth as compared to Q1FY-11 on back of highest ever quarterly sales volume and increased sales realizations. Coal India, has grown its Net Sales and Adjusted Net profit by ~27% and ~63% respectively on a consolidated basis. This is because of higher realization and other income. TCS and HDFC Bank have outperformed in its respective sector IT and banking sector. TCS grew its net sales and net profit by ~34% and ~32% respectively while HDFC Bank grew its net sales and net profit by ~60% and ~33% respectively. Hindustan Unilever has posted good numbers on Q-o-Q basis as well as Y-o-Y basis.

The quarter has been worse for the high debt companies and highly competitive industries. Bharti Airtel has grown its Net Sales by ~9% but has seen a 25% (y-o-y) fall in profits. The highly capital intensive industry, Construction & Real Estate, has been the worst affected with high interest rates delaying projects and also leading to higher interest payouts. Companies like JP Associates and DLF Ltd. have shown negative growth in its Net profit and feature amidst the laggards for the quarter.

So, what should we as investors do??

On the global front, the ongoing debt crisis in Europe is expected to remain a major concern. With this, the global sentiment is expected to remain negative in the short term. This has already been reflected in a weakening Euro against the dollar.

The rupee has also depreciated against the dollar over the last few days. The rupee depreciation could further increase inflation and also increase the fiscal deficit. Companies will have to pay more in rupee terms for their raw materials, despite the fall in global commodity prices, due to a depreciating rupee. More importantly, a weak rupee could negatively impact FII flows into the Indian markets. Concluding, we can say that companies could witness testing times in the next few quarters. Majority of the companies have been affected and going forward this number is expected to increase due to tight monetary policy and persistence of global crisis.

Currently, 21 companies are quoting below their MRP (this number was 24 for the March quarter) whereas the rest 9 are quoting above their MRP.

The gap between Sensex and Sensex@MRP has continued to widen over the quarters. Considering global and domestic economic situation, we expect that the gap will widen further as selling pressure continue across all segments due to decline in investors’ confidence. Hence, the market looks very volatile in the short term, but looks attractive for the long term.

If the situation deteriorates further, the discount offered by the Sensex companies could widen even further. As investors, the best thing to do now is to look for these blue chip companies which are not highly leveraged and command pricing power. Investors should look to buy these companies if the discount is attractive and increase exposure if the discount increases further. But remember to make sure, that the company is not facing any structural problems.

Look to buy fundamentally strong blue-chip companies available at a discount in small amounts. Consider increasing exposure if the discount increases.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

I Think the best course would be exit from direct equity investment & reinvest the proceeds in GOLD

funds. The loss incurred on exit

can be made up in gold funds or debt funds.

I Think the best course would be exit from direct equity investment & reinvest the proceeds in GOLD

funds. The loss incurred on exit

can be made up in gold funds or debt funds.