This article covers the following:

Sensex has given negative returns in the last month but held its head high on a yearly basis

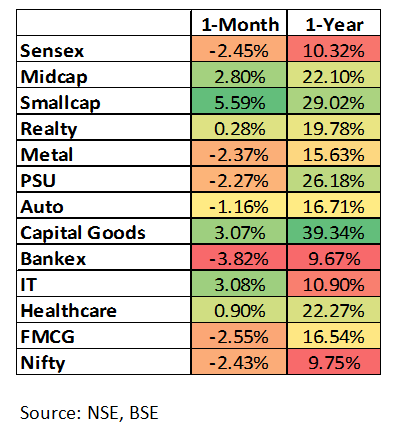

As we write this note in September, Sensex has given -2.5% returns in the month of August and 10.3% returns in the last one year. Capital goods, IT, and healthcare sectors gave a positive return in the last month while Banks, metal, PSU, and FMCG; had negative returns. Major events described in detail below include China’s economic slowdown and post-earnings season commentary.

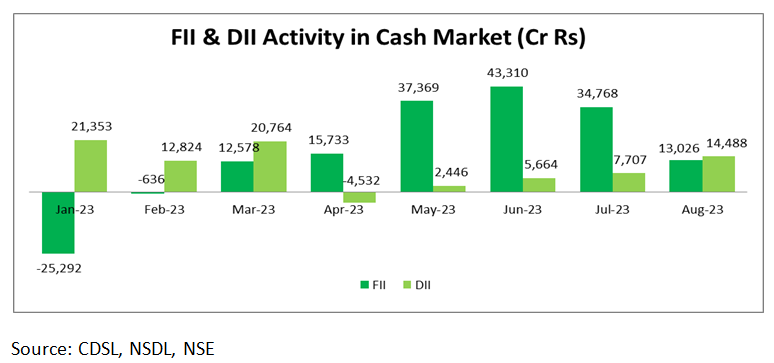

FIIs were net buyers totalling to Rs. 13,026 Crore in August. DIIs have also exhibited a positive trend, purchasing Rs. 14,488 Crore during the previous month. DII participation nearly doubled in the last month, which demonstrates domestic optimism and confidence in our market.

As mentioned in the earlier month’s market outlook, Fitch, the credit rating agency, lowered the credit rating of the US securities from AAA to AA+. This action was attributed to concerns about unsustainable debt and deficit trends, as well as heightened political discord. While this decision sparked intense discussions in political and economic circles, it had a limited effect on the 10-year US Treasury yields; rather it saw a marginal increase following the announcement. Afterward, yields did rise later in the month owing to positive economic data and robust bond issuance.

In China, economic activity performed worse than anticipated. In July, the Consumer Price Index (CPI) registered a -0.3% year-on-year decline, while the Producer Price Index (PPI) experienced its tenth consecutive month of deflation. Retail sales grew at a slower rate than expected, with a 2.5% year-on-year increase compared to the anticipated 4.5%. The prospect of a quick recovery appears unlikely, as household confidence remains low. Furthermore, the real estate crisis continues to instigate turmoil within the Chinese economy.

Eurostat’s preliminary GDP estimate indicated a modest 0.3% quarter-on-quarter growth for the Eurozone in Q2 2023. The unemployment rate remained at its historic low of 6.4% in August. However, the economic future remains uncertain, as the composite Purchasing Manager’s Index (PMI) for August dropped to 47, its lowest level since 2012 except the Covid period.

Overall, incoming economic data remained solid in the US. China’s difficulties could impact the global growth given the fact that it contributes almost a third to the global growth.

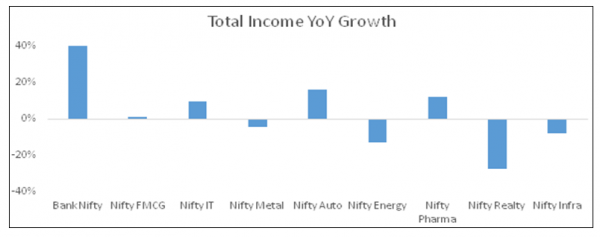

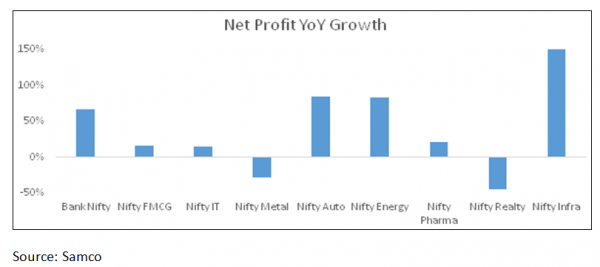

India Inc’s first-quarter earnings season for FY24 concluded in the last month. Due to high base effect in the June quarter of the previous year, the Nifty 50’s revenue in Q1FY24 increased by 5% compared to the previous year, marking its slowest growth in ten quarters. In contrast, profitability (Net Profit) experienced a notable surge, achieving its highest annual growth rate in six quarters. Companies have benefited from reduced input costs, leading to the expansion of their profit margins.

Automobile and ancillaries sector has shown double-digit growth in revenue and profits on the back of healthy demand and price hikes by automakers. On the other hand, the banking sector has witnessed interest rate peaks that have been acknowledged by the market and might not experience an improvement in their net interest margin. But banks will continue to benefit from these elevated interest rates, as rate cuts are not expected soon.

The Infrastructure sector has exhibited strong performance with an impressive year-on-year profit growth of 157%, primarily driven by the reduction in raw material costs. In contrast, the FMCG sector has faced challenges in revenue growth due to weak volume growth, more so in rural markets. The sector now looks to boost its performance by focusing more on volume growth.

The IT industry experienced year-on-year growth in net sales and operating profit. Nevertheless, it faced a decline in performance compared to the previous quarter, which can be attributed to delays and reductions in discretionary IT expenditures, amid weakness in select markets like the US and Europe. However, expectations are that these issues will be resolved by second half of FY24. Amidst this, select companies in the Midcap IT space are performing well due to presence in select geographies and exposure to certain segments (Intelligent automation, cloud, and platforms).

Pharma companies posted healthy result on growth in formulations and API (active pharma ingredient) segments. While the chemicals company’s volumes remained under pressure on excess supply from China, we remain watchful of opportunities in this space over the next few quarters.

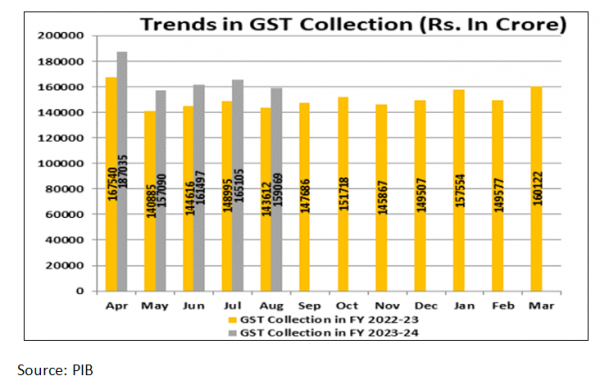

GST collection for August 2023 is Rs. 1,59,069 Crore, falling from Rs. 1,65,105 Crore last month. However, the collection in the month of August recorded an 11% Y-o-Y growth and crossed the 1.5 Lakh Crore mark for the ninth time since July 2017.

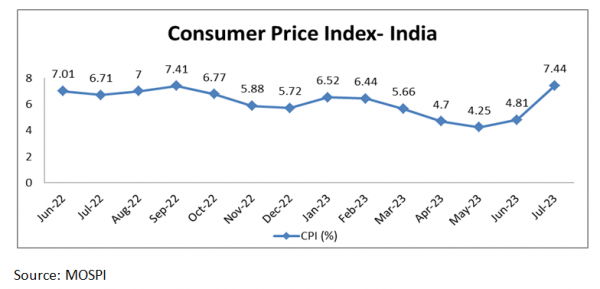

In the month of July, retail inflation (CPI) surged to a 15-month high of 7.44%, breaching the RBI’s upper tolerance band. This surge was primarily driven by the rise in food prices. RBI expects inflation to moderate from September citing a recent fall in food prices.

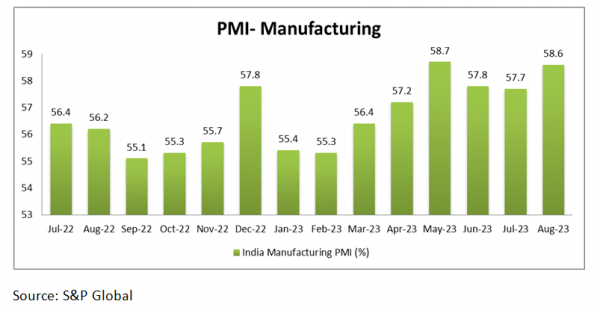

India’s purchasing managers’ index (PMI) for manufacturing for August, rose to a three-month high of 58.6 during the month on the back of an increase in orders and output. The PMI data is an indicator of the health of the economy. The higher the number, the better it is for the economy.

In August, Services PMI experienced a slight decline, dropping to 60.1 from 62.3 in last month. Nevertheless, the overall business conditions remained robust, despite the presence of heightened inflationary pressures. India’s August composite PMI, which is a combination of the manufacturing and services indices, declined to 60.9 in August from 61.9 in the previous month. PMI continues to be in an expansionary phase when observed over a longer period.

The country experienced a rainfall of around 162 mm during August; falling short by 36% compared to the anticipated 255 mm. August had been the driest and warmest month in the entire country, which clearly shows intensifying El Nino conditions. El Nino is generally associated with weakening monsoon winds and dry weather. The IMD forecasts’ that September’s rainfall is expected to be within the normal range of 91 to 109% of the long-term average.

Indian economy continues to be an Oasis in the Global Desert

India appears to be in a favourable position compared to the rest of the world, both in terms of cyclical and structural factors. Healthy growth in various domestic high-frequency indicators, such as GST collections, retail spending, consumer demand, credit growth, and PMI, indicate a significant level of economic activity.

Projections suggest that India is expected to be among the fastest-growing economies in 2023. Recent policy reforms, government-led capital expenditure focus, and stronger corporate balance sheets have potentially established a robust foundation for sustained growth over multiple quarters.

Nifty is trading marginally above long term averages

On a PE basis, Nifty is trading at 22.33, above its historical median of 20.62, showing a positive sentiment and bullishness in the market. On a PB basis, Nifty is trading around 4.46, above its historical median of 3.52, implying slightly premium valuations.

How are we looking at this?

The development of the shift of manufacturing from China to more domestic production supported by the government as well as the perception of companies to diversify their supply chains bodes well for the Indian Manufacturing sector. The government’s thrust on capex shall support growth in the infra sector with corollary growth benefits to Financials, construction materials, and allied industries.

With the US recession still a possibility, Germany already in recession, and the Eurozone experiencing high inflation worries, even though domestic demand is good, there is muted demand in exports due to a slowdown in advanced economies. This can be seen by the ramp-downs and project delays seen in the Indian IT space. Going ahead with recovery in exports the economy is expected to perform better than before.

What is MoneyWorks4me’s action plan for its subscribers?

We stay on course to look at individual securities with strong future outlooks and growth. While taking a portfolio view to diversify and make the most of the rising economy.

We have given a couple of BUY calls in the past few months. The market has rallied since then. Given the strong dynamics of the economy, we are excited to BUY existing opportunities or new ones in the near future. We are tracking more companies to add in our BUY zone; however, they are still ahead of our MRP.

The deleveraged balance sheets of Indian corporates, sub-par capacity addition in the past decade, and increasing utilisation levels give us confidence on the credit cycle. This combined with the underperformance of the financial sector in the last couple of years gives us confidence on the prospects of lenders (BFSI sector).

We believe that the current economy recovery is led by the credit growth cycle which remains definitive. Also, the Indian corporate sector is in the best position to gain pricing power and balance sheet strength. The majority of the sectors have seen consolidation. We are looking at sectors that will be early beneficiaries of these two themes.

Best Stocks From:

All Weather Alpha Case Screener Alpha Cases Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory