STFC Limited: Should you invest in this largest CV financier?

STFC Limited: Company Highlights

STFC Limited – Largest Asset Financing NBFC in India

Market View of STFC Limited Stock Price (25-08-2011)

Latest Stock Price: Rs. 592.60

Latest Market Cap: Rs. 13403.67 Cr. (Large Cap Stock)

52 Week High Stock Price: Rs. 899.90

52 Week Low Stock Price: Rs. 551

Latest P/E: 10.40

Latest P/BV: 2.57

Tell me more about STFC Limited….

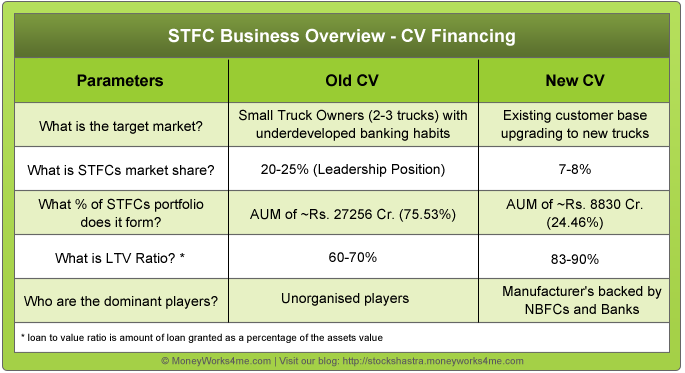

Shriram Transport Finance Company Ltd. is India’s largest asset based NBFC (Non-Banking Financial company). It is mainly focused on catering to the needs of the Small Truck Owner (STO) and financing pre-owned trucks. It also offers finance for construction equipment and other automotive segments like passenger commercial vehicles, multi-utility vehicles, three wheelers, tractors, etc. It also extends finance for tyres, engine replacement and working capital; and provides ancillary services such as freight bill discounting besides offering co-branded credit cards.

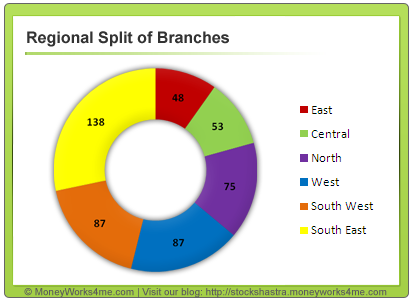

On an average, it finances 1,000 vehicles a day. As on March 31, 2011, the Company had 488 branches and tie up over 500 private financiers; and a very large client base of around 750000 across India.

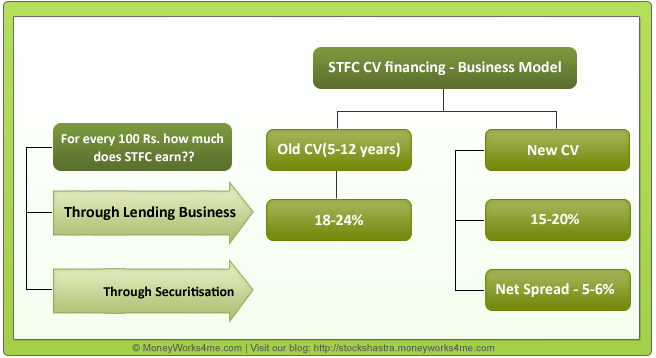

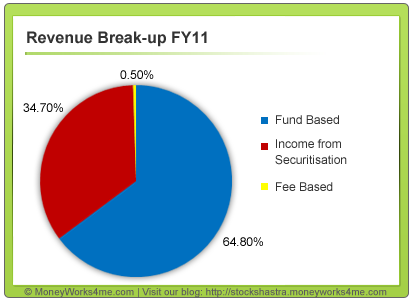

Income from Securitisation:

STFC receives significant revenue (about 30% in FY11) through securitisation of its portfolio. This helps it to boost its NIMs (Net Interest Margin), as cost of funds raised through securitization is 1-1.5% lower than the cost of borrowing from other sources.

What STFC does is that it takes a portion of its portfolio, securitizes it and sells it to banks who are more than willing to purchase it from STFC in order to meet their priority sector lending (PSL) targets.

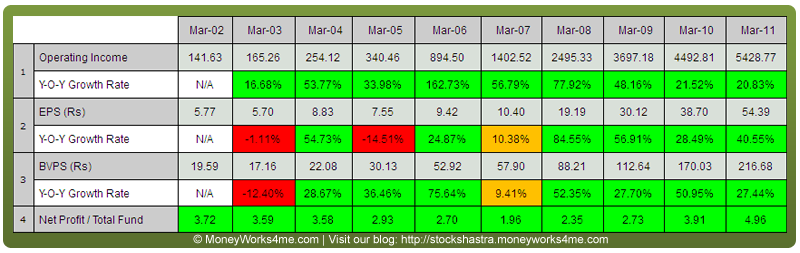

How has the Financial Performance of STFC Limited been? Here’s the review….

STFC Ltd. has shown an excellent financial performance in the past ten years. The operating income of STFC has grown consistently in the past ten years with a CAGR of approx. 31%. The EPS and BVPS have also shown significant CAGR growth of 28% and 30.60% over the last ten years.

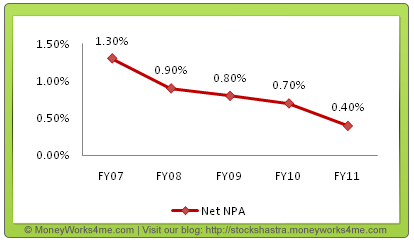

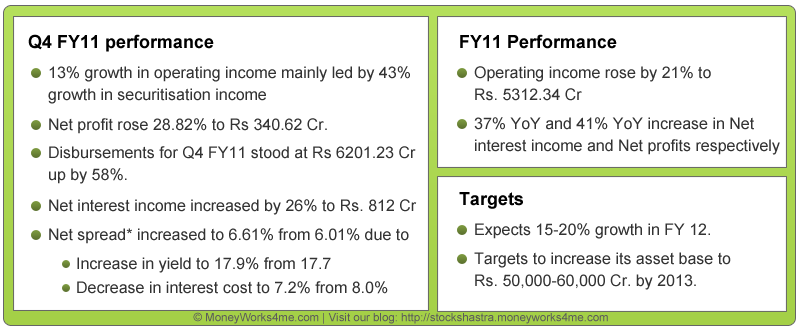

The company has maintained a high Net Profit to Total Fund ratio, above 2%, over the last 10 years. It indicates that the management of the Company is efficient in utilising its funds. The Capital Adequacy Ratio of the Company was 24.85% during FY11 against the stipulated 12% which shows that the Company can easily cover all the risks associated with it. The Net Non-Performing Assets has decreased from 0.71% in Q4 FY10 to 0.38% in Q4 FY11 (as seen in the graph below). It indicates a decrease in the default risk of the company. However, given the rising interest rate scenario, the NPA ratio could inch up marginally.

Considering all the above factors we can say that the 10 YEAR X-RAY of STFC Ltd. is Green (Very Good).

What can we expect in the future? Here is the fundamental analysis of STFC Limited….

In the Short Term

Rising interest rates, margins to be slightly affected

STFC has a diversified borrowing-mix and currently 80% of its borrowings are on a fixed-rate basis. This helps the company to maintain its margins in a rising interest rate scenario by making it less prone to the rising interest rates cycle. Also, average cost of funds declined over the years with increase in funds from Bank/ Institutions for a fixed tenure of 3 to 5 years. However, with key policy rates on a rise, the company may face some pressure in terms of interest costs as borrowing may get expensive. The management expects the NIMs to be in the range of 7.5-8% for the rest of the year.

Regulatory Concerns

RBI in its monetary report on 3rd May, 2011; came out with a rule that loans given by banks to the MFI (Micro-finance Institutions) and NBFC sector would not be classified under PSL from 1st April, 2011. This would have led to increase in the interest costs for STFC. However, on July 1, 2011, RBI clarified that assets securitised (portfolios sold to banks) by NBFCs will continue to be treated as priority sector loans. Thus STFC, which has been aggressively selling its portfolio to banks, which have to meet their PSL targets will not be affected very much.

RBI has set up a committee to go over the same and only post this would one get an update on whether its off-balance sheet portfolio will also be affected. NIMs will be further affected, if the committee recommendation is not favourable. However, the possibility of RBI completely removing PSL status to the securitised loans is low. But, growth in the securitized portfolio is expected to slow down given stricter due diligence by banks.

Lower growth expected in near future

The increase in fuel prices and inflation without a commensurate increase in freight rates could lead to margin pressure for truck operators, thus adversely impacting CV financing. This coupled with a slowdown in industrial production and rising interest rate scenario will further add to the woes of this segment. Customers don’t want to borrow at peak rates as the loans are fixed rate loans. This slowdown will affect both new and second hand trucks sales and, hence, the demand for loans.

STFC is targeting a 15-20 per cent growth in assets, however it may need to revisit the target if interest rates do not moderate, going ahead.

Looking at the above points, we expect the short-term future prospects of STFC to be Orange (‘Somewhat Good’).

In the Long-Term

Unique Business model

STFC possesses a very unique business model and is functioning in an environment where organized competition is low and entry barriers are high. It follows a relation-based business model (a personal understanding of the customers proposed business model) thereby substituting formal credit evaluation tools. This model helps the company to keep a close check on their credit profile, ensure ready business and take a client and truck-wise exposure limit. STFC has been able to develop strong competencies in the areas of loan origination, valuation of 2nd hand CVs and collections since it has been involved in this business for over three decades.

Efficient collection system to restrict credit losses below 2%

STFC mainly finances STOs (small truck operators) & FTUs (first time users) who have underdeveloped or no banking habits. Collection is always a challenge as these people are scattered in remote areas. To overcome this issue, STFC has made its field officers responsible for the loans they originate. It also has a well-defined incentive plan linked to loan default rates, thus helping to keep loan defaults at a minimum. This helps to keep an eye on the financial position of the customer and take adequate steps to reduce the credit losses to a minimum.

Increasing market share by expanding distribution network

STFC has developed a pan-India presence through its 488 branches and 68 strategic business units (SBUs). With an aim to increase market share in the pre-owned CV segment, STFC is further expanding its widespread geographical reach in the north and east. It is also building partnership with private financiers in the unorganised market to leverage their local knowledge to enhance market share. The company had already formed collaboration with more than 500 private financiers as of end March 2011. Moreover, it has introduced top-up products such as finance for tyres, working capital and engine replacement to increase its market share in the pre-owned CV segment.

Huge Opportunities being the only organised player

The CV financing market for pre-owned trucks (5-12 yrs) is estimated to be around Rs 36,000 Cr. Nonetheless it has been neglected by banks due the risky profile of the borrowers and mobility of the collateral (especially in the 2nd hand CV market). This 2nd hand truck market is hugely underpenetrated with the private financiers (unorganised players) having a 65-70% market share, who charge high interest rates. Also the legislative pressure on banning trucks beyond 15 years and stricter emission norms (Bharat III emission norms to be implemented in the entire country) are expected to further increase the opportunities in this industry.

Shiram Transport Finance being the only organised credit provider for second-hand trucks in the Country has a competitive edge in the industry.

Portfolio Diversification

Apart for CV financing, STFC has also ventured into new businesses like freight bill discounting (estimated market size for FY11-Rs 6000-7000 Cr.), passenger CV financing (estimated market size for FY11-Rs 20000 Cr.), tractor financing (estimated market size for FY11-Rs 20500 Cr.) and construction equipment financing (estimated market size for FY11-Rs 35000 Cr.). The freight bill discounting market has yields higher than those of CV financing. These ventures will further contribute to its sales and also help insure the company against cyclicality of the auto sector.

Subsidiaries to aid STFCs Growth

STFC has two subsidiaries Shriram Automall Ltd. and Shriram Equipment Finance Ltd.

Shriram Automall Ltd. is to set up Auto Malls in different parts of the country. It will renew and sell pre-owned commercial vehicles under the brand name ‘New Look’, receiving commission for the sale and providing advisory services). AutoMalls would be a one-stop shop for all CV owners needs with facilities like workshops etc. STFC intends to provide electronic advertising and trading infrastructure at these AutoMalls. The initiative would help STFC market its financial products and develop new customers AutoMalls. Shriram Automall opened its first AutoMall in February, 2011 and posted a net loss of Rs. 13.9 Cr. for the fiscal. It plans to gradually expand to 50-60 AutoMalls over 12-24 months.

Shriram Equipment Finance (SEFL) is focused exclusively on pre-owned and new construction equipment (CE) financing. The company finances commercial construction equipment such as forklifts, cranes, loaders, etc. It commenced operations in FY10 and had Assets under management of Rs.634 crores and a profit of Rs.1.1 crores, at the end of FY11.

Key Concerns

- Change in interest rates: Increasing rates of interest, to curb higher inflation are likely to have a negative effect on the margins and profitability of the company.

- Change in regulatory environment: Over the last few months, RBI has been paying greater attention to the NBFC sector with a number of new regulations. Any changes in RBI guidelines relating to securitization, which could impact cost of funds and in turn profitability for companies like STFC, can act detrimental to STFC’s growth.

- Default Risk: STFC’s target market (2nd hand CV owners) have a risky profile due to their limited banking habits, lack of credit history and difficulties in keeping track of the asset due to its mobile nature. This increases default risk of the company.

Considering all the above factors, we expect that the Long-term Future Prospects of Shiram Transport Finance Company Ltd will be Green (Very Good).

So, should you invest in this largest asset backed financing NBFC?

A unique business model and a niche in the 2nd hand CV financing business, along with huge opportunities in the industry, bode well for STFC’s future. However, the rising interest rates and the regulatory uncertainties are causes of concern.

Yes, STFC is an investment worthy company, but only at the right price. Being a large-cap stock (Market cap of ~ Rs. 13616 Cr.), STFC is considered to be a safe-bet as compared to mid and small cap stocks. However, the company’s business is highly risky given the concentration on vehicle lending, the cyclical nature of the business and the credit profile of the borrowers. Thus, only investors with some appetite for risk should invest in this company.

Currently, its stock price is at Rs. 608.60 (as on 18 Aug’ 2011). But, does this price offer an attractive discount to its right value (MRP) or is it over-priced? It is always best to invest at an attractive discount to its MRP, to get maximum returns at minimum risk. Become a member of MoneyWorks4me.com to know its sensible buy- price and hence take the right action for this company.

STFC receives significant revenue (about 30% in FY11) through securitisation of its portfolio. This helps it to boost its NIMs (Net Interest Margin), as cost of funds raised through securitization is 1-1.5% lower than the cost of borrowing from other sources.

What STFC does is that it takes a portion of its portfolio, securitizes it (similar to the guy in our story) and sells it to banks who are more than willing to purchase it from STFC in order to meet their priority sector lending (PSL) targets. However STFC does not provide for the full securitization income on the P&L at one go, but rather amortizes it over the time period of the securitized assets (the average loan period of securitized assets is 2.5-4 years). This conservative mode of recognizing income from securitization is a welcome measure.