Whenever a company makes a fundamental shift in its business model, it does so because of the potential for much higher earnings growth. The tricky part is that rarely is this value captured and realised immediately, and only over long term can one say how well did the strategy really develop. But the very fact that a company is creating a growth opportunity should tickle the palm of a long term investor especially if the cost of this strategy is minimal.

One of the best deals that created value for shareholders is the merger between BHP and Billiton. Over the last decade BHP Billiton’s market value has increased by 431% compared to Rio Tinto’s 151%.

Sterlite’s merger with Sesa goa has the potential to be equally value accretive plan and like BHP-Billiton, the benefits of this plan are more likely to be realised only over long term. The primary reason for undertaking such a restructuring of group business is for consolidation and simplification of Vedanta group’s corporate structure. Equally importantly the plan will also lead to diversification in commodity basket from which Sesa and Sterlite will make money, reducing volatility in earnings, leading to lower cost of capital and much more efficient capital structure.

Mineral and Mining Business Strategies:

Typically companies in metal and mining industry follow two strategies.

The traditional strategy since the time Metal companies first started mining ores has always been to develop capabilities and capacities in 2-3 metals. The company would concentrate on developing cost efficiencies in their business, capabilities in identifying assets that would significantly increase their reserves size. As a result of this strategy, the company would have huge mineral reserves; for some of the global players this can last upto hundred years. Major companies that follow this strategy even today are Vale (Brazil), Rio-Tinto (Australia), Potash Corp (Canada) and Coal India (India).

The one risk that these companies have is exposure to only a few minerals rather than a basket of minerals. As a result if there is a demand slump in any one of these minerals, it is not unnatural to see these miners bleed red. A direct consequence of this risk is that these companies tend to have higher cost of capital, low debt and thus have suboptimal capital structure giving them a low valuation.

And the other strategy is what happened in 2001 when BHP merged itself with Billiton to create a global mining giant; the new company now had exposure to all the major metals. This came at the cost of lower reserves in some of these minerals. But, as BHP Billiton saw it, mining reserves are like inventories and instead of spending its precious capital on creating reserves in just one or two metals it can intelligently allocate capital and build its reserves across different metals. This was the major driver behind BHP Billiton’s quest for acquiring Potash Corp (Potash has reserves of about 400 Years).

Rationale for Merger between Sesa Goa and Sterlite:

It is in this light that Sterlite merger with Sesa Goa should be seen. Sesa-Sterlite seeks to accomplish the same goals through its merger strategy. As of today, a merger between Sesa & Sterlite will allow the combined entity to have exposure to Iron Ore, Oil and Gas, Zinc, Lead, Silver, Aluminium, Copper and Power. This would help the company achieve a portfolio of commodities, lower cost of capital and fund its growth using more optimal mix of debt and equity.

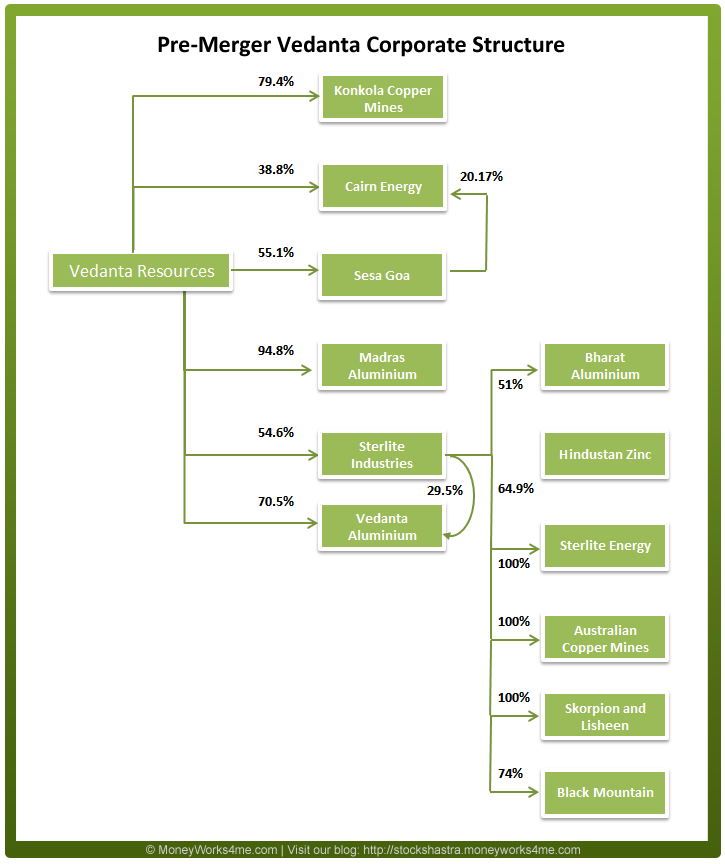

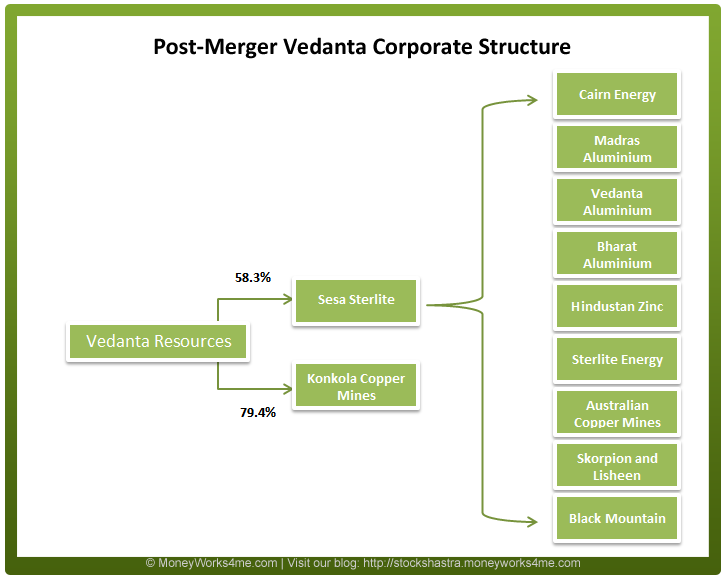

The second important goal that management has sought to achieve through this merger is simplification of its corporate structure; remove cross holdings among group companies and create a single operating company through which all the group’s operations are done.

While the group’s proposed structure is much more simplified than what it is today, it still is a work half done. Government continues to hold major stakes in Hindustan Zinc and Balco. A year or two from now it would not be surprising if the company seeks to buy out Government stake entirely and merge these companies in to the new entity Sesa-Sterlite. Given the groups high debt post-merger this was not feasible as of today.

The third major aspect that will be achieved through this merger is efficient use of cash reserves held by the group in various companies. To understand this we have to go back to the reason for creation of such a complex group structure to start with. The group broadly has some very cash rich and cash cow companies (Sesa Goa, Hindustan Zinc, Sterlite) and other companies that are at the start of their project execution cycle and hence need funds to execute their projects (Vedanta Aluminium, Zinc International). The group was forced to transfer this funds by way of creation of numerous cross holding structures as a result of which the group invariably earned the reputation for shady corporate governance as it transferred value from one group of shareholders to other. But now with a single operating company it can effectively deploy this cash without creation of any complex cross holding structures.

Negatives for this deal:

The merged entity would have Net Debt of Rs.36,936Cr. and Debt of Rs.66,717Cr. This is a huge debt and going forward the company will have to bring its leverage ratio down. The company has a Net Debt/EBITDA ratio of 1.5 times and Interest Coverage ratio of 25.6 times, meaning the company is comfortably positioned to service its debts as things stand today. But any significant price correction in commodities can significantly hamper its Debt servicing capacity. This remains a significant unavoidable risk. It helps that the company has a Cash and Marketable Securities of Rs.29,781Cr.

Valuations of the deal:

The deal overall is very positive for Vedanta Resources shareholders. The merger simplifies groups operating structure keeping only Konkola Copper mines outside of Sesa-Sterlite operating company. At 3 shares of Sesa Goa for every 5 shares of Sterlite the deal as of Feb 27th is slightly positive for Sterlite shareholders over Sesa Goa. As of Feb 27th a Sterlite shareholder can buy in to the new company at a discount of 6% compared to shareholders of Sesa Goa. There have been some concerns over the valuation of MALCO and VAL. But in our opinion these valuations have been done at fair value. While Vedanta Aluminium (VAL) comes with an enterprise value of Rs 21,000 Cr, given the strong growth possibilities expected from VAL the enterprise valuation seems fair. MALCO has been valued at Rs 1790 Cr. because of its ownership of 3.1% in Sterlite (about Rs. 1200Cr.), its cash reserves of Rs 238 Cr and its history of generating operating cash flow of Rs.80-100 Cr each year.

Sesa-Sterlite going forward:

The group entities have been developing new projects that would effectively double group’s revenues by 2014-15, significantly most of the capital expenditure needed for these projects has already been done. As a result the group is well placed for using its resource assets located at close proximity to major market and benefit from the commodity story of next decade. In this decade it is expected that increased consumption of commodities in India will drive commodity prices higher. We are already seeing the first signs of this in Coal, where it is expected that in 2012-13 India would be importing more Coal than China.

In totality, Sesa-Sterlite together are stronger, capable than as two separate companies.

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

The two biggest companies of industrial mining

Sesa Goa and Sterlite have decided to merge and amalgmate.this will be the best deal for all the mining industries.

Yes, both BALCO and HZL would be prime candidates for Sesa Sterlite to buy out stakes from Government. Given the cash generating capacity of HZL we believe though it is the most likely candidate. Though the management has given Rs16000cr offer to government for government stakes in both the companies, we are waiting for a confirmation from government. Most likely budget would be a good basis to make our assumption in to how the government would react. But yes as you are righlty alluding to BALCO and HZL would be next to be merged in to Sesa Sterlite/ Sterlite.

Thanks