Sterlite Industries Ltd. – Can it deliver the promised high growth?

Sterlite Industries Ltd.: Company Highlights

Sterlite Industries Ltd. – India’s largest non-ferrous metals and mining company

Market View of Sterlite Industries Ltd. (as of 19/04/2012)

Latest Stock Price: Rs. 110.05

Latest Market Cap: Rs. 36994.43

52 Week High Stock Price: Rs. 189.50

52 Week Low Stock Price: Rs. 86.10

Latest P/E: 6.76

Latest P/BV: 0.78

Tell me more about Sterlite Industries Ltd.…

Sterlite Industries Ltd is part of UK listed Vedanta group. Sterlite is engaged in business of Copper, Zinc, Lead, Aluminium, Silver and Power. Its principal operating companies comprise:

- Hindustan Zinc Limited (HZL) for its fully-integrated zinc and lead operations

- Sterlite Copper – Tuticorin & Silvassa and Copper Mines of Tasmania Pty Limited (CMT) for its copper operations in India/Australia

- Bharat Aluminium Company (BALCO), for its aluminium and alumina operations and

- Sterlite Energy Limited (SEL) for its commercial power generation business.

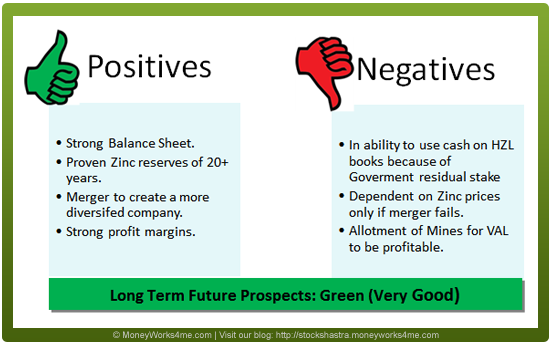

On 25th Feburary,2012 Vedanta announced a restructuring of the group – as a part of the new structure, Sterlite would be merged with Sesa Goa (India’s largest producer of iron-ore) to form Sesa-Sterlite a diversified metal-mining-Oil & Gas company. This merger would create a highly diversified commodity giant with interests in Iron, Zinc, Lead, Aluminium, Silver, Crude Oil, Copper and Power.

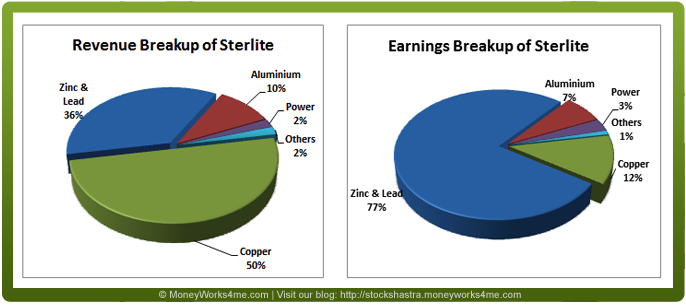

In 2011, Sterlite earned about 36% of its revenues from Zinc and Lead and 50% of its revenues from Copper. However, a major chunk of the profits consistently comes from the zinc division – 77% in the last year. Sterlite operates its zinc business through Zinc International and Hindustan Zinc Ltd. Sterlite has 69% ownership in Hindustan Zinc and government has residual stake of 29.54%.

How has the financial performance of Sterlite Industries Ltd. been? Here’s the review….

Sale Growth and Profit Growth have come in large lumps: Both, Sterlite’s top line and bottom line have grown in lumps with large growth seen in some years and lower growth in other years. This has been as a result of the various projects that have been executed by the company. In short, Sterlite’s management has focussed over the last decade in creating a strong copper and zinc commodity company. This growth bias has resulted in topline and bottom line growing 13 times and 22 times respectively over last decade.

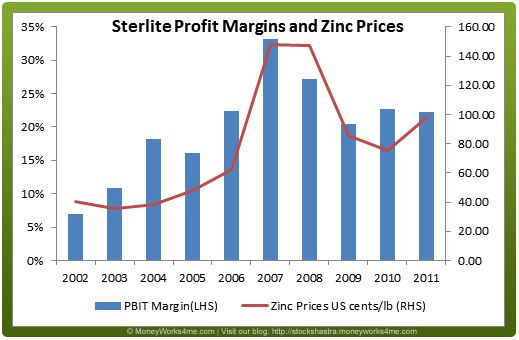

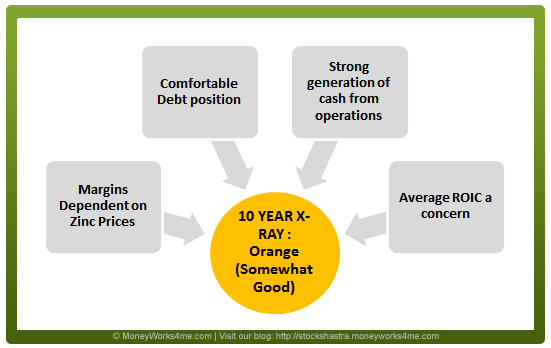

Zinc business has contributed in strong profit margins and cash flows: In 2002, Sterlite had Net Profit Margins (NPM) of just 6% and Operating Profit Margins (OPM) of 17%.This has today grown to a high of 23% and 25% respectively by end of 2011. This superlative performance has come from increased capacity creation in the high-margin fully-integrated Zinc business through Hindustan Zinc as well as Zinc International in recent years. During this decade Zinc prices have also increased by 2.5 times which has resulted in strong profit margins for the company. However, profit margins also fell after Zinc prices corrected by 33% from their 2007 peak. Sterlite’s performance therefore is heavily skewed towards price performance of Zinc.

Large cash locked in with HZL, hence lower ROIC: The Company has about Rs.21,000 Cr. of cash and marketable securities on its books, which net of debt on its books is equal to about Rs. 11000 Cr. or about 30% of its current market capitalization. But most of this cash is locked in Hindustan Zinc in which Sterlite has 69% stake and Government of India has 29.54% stake. As a result Sterlite has been unable to use its cash to fund profitable projects and create much higher ROIC.

Looking at all this, we can say that Sterlite’s 10 YEAR X-RAY is Orange (‘Some What Good’).

What can we expect in the future? Here is the fundamental analysis of Sterlite Industries Ltd…

In the short-term:

Zinc prices to remain firm as China sees calibrated slowdown: China is the world’s largest consumer of Zinc and consumes about 43% of the world’s zinc output. A steep slowdown in the Chinese economy will hurt zinc prices in the international markets; this in turn would have a negative impact on Sterlite’s performance. The Chinese leadership has been trying over last the few quarters to recalibrate Chinese economy towards a more domestic consumption-oriented economy from the current export-led economy. A part of this recalibration is also a realisation that, given the size of Chinese economy it needs to grow over next decade at much lower rates of growth than the near double digit growth that it had enjoyed over last decade. While a lower rate of growth (7.5%-9%) of the Chinese economy would itself not dampen Zinc prices, a steep fall in GDP growth rate (<7%) would affect Zinc Prices. The Chinese economy in Q1 2012 grew at a modest 8.1% much higher than government estimate of 7.5%

Merger and Restructuring: Sterlite Industries is going through a major restructuring of its business. It has been merged with Sesa Goa (India’s largest producer of iron-ore) to create a diversified commodity player. While the merger would help create value for shareholders over long-term, it would involve a lot of the management’s time and effort and eventually divert focus from core business activity for the next one year.

Going forward, purchase of Government’s residual stake in cash rich Hindustan Zinc and BALCO remains extremely crucial in consolidating the group structure.

Silver output to add to bottom line: Sterlite continues to expand its silver refining capacity from its Zinc-Lead-Silver ore at Sindesar Khurd. The Sindesar Khurd mine is rich in silver and growth in silver output from this mine would add to the bottom line. Silver output from Sindesar Khurd for the full year was up by 35% at 242 tonnes.

Increased infrastructure spending by both State and Central government would lead to higher construction activity. Higher construction activity would create further incremental demand for zinc helping zinc prices stay firm.

Hence, looking at all the above factors we can say that the short-term future prospects of Sterlite Industries can be expected to be Green (Very Good).

In the long-term:

Unlocking Cash in Hindustan Zinc Ltd: In January 2012, the management of Sterlite made a formal offer to the Government to purchase the residual stake of the Government in Hindustan Zinc and BALCO. This would allow Sterlite to use cash on the books of Hindustan Zinc to acquire assets across the world in various commodities. This unlocking of cash is expected to increase the ROIC of the company as it gets deployed in profitable projects.

Zinc prices expected to stay firm: High spending on infrastructure in Emerging Markets including China, India and Brazil is expected to keep demand for Zinc strong. It is expected that India itself would spend about US $1 trillion to develop basic infrastructure like Ports, Power Plants, Highway, and Airports. This would increase the intensity of steel used in the economy. Increased steel intensity (demand) as a result of infrastructure spends is accompanied by higher demand for Zinc.

India to become third largest Automobile market, and South America to be fourth largest: Over the next decade India and South America would see near double digit growth in consumption of automobiles. Most automobile cars use lead-based battery. Use of lead in batteries accounts for about 75% of lead usage, we believe this is expected to continue and along with growth in demand from South America and India would keep lead prices high.

Merger between Sesa Goa and Sterlite to create a large diversified commodity player: A merger between Sesa & Sterlite will allow the combined entity to have exposure to Iron Ore, Oil and Gas, Zinc, Lead, Silver, Aluminium, Copper and Power. This would help the company achieve a portfolio of commodities, lower cost of capital and fund its growth using more optimal mix of debt and equity. To put it in perspective, Sterlite’s earnings are heavily skewed towards price performance of Zinc, While Sesa Goa earnings are more dependent on Iron Ore prices. But the combined entity would be less dependent on one such commodity and would be dependent on a basket of commodities. As a result earnings are expected to be more stable and less volatile for the merged entity than for both Sterlite and Sesa Goa as separate companies.

The second important goal that management has sought to achieve through this merger is simplification of its corporate structure; remove cross holdings among group companies and create a single operating company through which all the group’s operations are done.

The third major aspect that will be achieved through this merger is efficient use of cash reserves held by the group in various companies. The group is very cash rich. it broadly has some cash cow companies (Sesa Goa, Hindustan Zinc, Sterlite) and other companies that are at the start of their project execution cycle and hence need funds to execute their projects (Vedanta Aluminium, Zinc International). The group was forced to transfer these funds by way of creation of numerous cross holding structures as a result of which the group invariably earned the reputation for shady corporate governance as it transferred value from one group of shareholders to other. But now with a single operating company it can effectively deploy this cash without creation of any complex cross holding structures.

To read a detailed analysis on our view on the Sterlite-Sesa Goa merger click here.

Concerns:

Higher break-even cost and losses in VAL project: The merger would also lead to Sterlite becoming majority owner of Vedanta Aluminium. VAL is the first green field project of the company. VAL project was designed to be among the most cost-efficient producers of Aluminium. This project involved building an alumina refinery and mining coal and bauxite in Lanjigarh, Orissa. The company planned to mine bauxite from Niyamgiri hills, which has one of the largest deposits of Bauxite in the country. But now this project has been bogged by controversies and as a result now the company has to purchase bauxite from a third party instead of Niyamgiri hills. As a result, this has led to a higher break-even cost and losses in the VAL project.

Merger of Sesa Goa and Sterlite is important to realise long term value for shareholders: There were some concerns raised by institutional shareholders regarding valuation of VAL as well as transfer of Vedanta’s debt raised for financing its Cairn India acquisition in to the books of the Sesa-Sterlite. But Vedanta also transferred its stake in Cairn India to Sesa-Sterlite . These concerns of some large shareholders would have to be met for the merger to sail through. Their last major exercise in restructuring failed to go through in the final phases. However, it’s critical for the long term story of the Sesa-Sterlite for this merger to go through.

Considering all these points, we can say that the long-term future prospects of Sterlite are Green (Very Good).

So, is it an investment-worthy company?

The company’s Zinc business continues to deliver huge profits. Further, the merger with Sesa Goa will lead to a diversified commodity conglomerate, with access to the group’s huge cash reserves and will help helping to lower the cost of capital. Also, the increasing commodity prices ares is a huge plus for the company. All these will help the company clock a robust future growth.

Yes, Sterlite Industries Ltd. is an investment worthy company, but only at the right price. Being a large cap stock (Market cap of ~ Rs. 36994.43 Crs.), it can be considered to be a low risk stock as compared to mid and small cap stocks. However, the cyclicality of the commodity business, concerns regarding slowdown in demand from China and the huge debt makes it imperative that you buy the company at a relatively higher discount to its fair value.

Currently, its stock price is at Rs. 110 (as on 19th April 2012). But, does this price offer an attractive discount to its right value (MRP) or is it over-priced? It is always best to invest at an attractive discount to its MRP, to get maximum returns at minimum risk.

To find out the Right Price and know if it is the Right timing to invest in this stock, log on to MoneyWorks4me.com.