Acknowledging what you don’t know is the dawning of wisdom- Charles T. Munger

True indeed! I came to know much more about the super investor, Charles Thomas Munger, aka Charlie Munger, Vice-Chairman of Berkshire Hathaway over a discussion, which happened impromptu over a lunch meet with my fellow and senior analysts.

In The Buffett Menu, we told you about the essential ingredients of the specials in Warren Buffett’s investment menu, basically his investment style.

Now, it’s time to introduce you to the lollapalooza effect! As intriguing as it may sound, the concept behind ‘the lollapalooza effect’ holds much importance for the intelligent investor. A concept propounded by Charlie himself.

Let me jog my memory, and reiterate the discussion for you.

About Charles Thomas Munger…

All of us knew about Charlie Munger being a very successful investor, even before joining Warren Buffett in Berkshire Hathaway as the Vice-Chairman.

- He ran an investment partnership of his own from 1962 to 1975 where he generated CAGR of 19.8% during the period (vs. a 5.0% annual return for the Dow).

- He was the Chairman of Wesco Financial Corporation from 1984 through 2011, &

- He had also demonstrated his investing genius while managing the portfolio of ‘The Daily Journal’ Company, and growing it at a CAGR of 33.3% in 10 years.

What we also wanted to know more about was his investing style….

Charlie’s Investing Style…

Quite in parallel to Warren Buffett’s investing style, Charlie is also focussed on investing in undervalued businesses with an economic moat. Hence, the basic criteria for shortlisting a great business are the same.

He too believes in analysing value apart from price, leaving an appropriate margin of safety, ensuring proper compensation for the risk, and being wary of inflation and interest rate exposures.

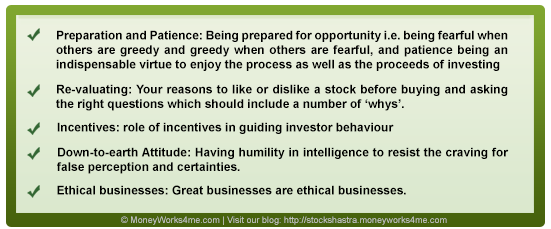

However, while Warren Buffett also follows some of these, Charlie particularly emphasises on using ‘P-R-I-D-E’:

Importance of developing mental models…

A very interesting distillation of Munger’s approach can be found in “Poor Charlie’s Almanack”. It introduces the concept of ‘Elementary Worldly Wisdom’ in relation to business & finance. It talks about developing a set of mental models as a framework to help solve critical business problems like being good at stock-picking.

According to him, isolated facts get you nowhere. They need to come together on a framework of theory, to become usable. In the words of Emile Auguste Chartier: ‘Nothing is more dangerous than an idea, when it’s the only one you have’.

However, there are certain rules that apply here:

Rule # 1: Have multiple models – because if you have just one or two, you’ll tend to force reality to fit into it. (To a man with a hammer, everything looks like a nail!)

Rule # 2: Have models across a fair array of disciplines – the most reliable models come from mathematics, biology and psychology.

The Lollapalooza Effect…

His speech on the ‘Psychology of Human Misjudgement’ is a treasure trove for behavioural finance enthusiasts. It identifies the following as drivers of human behaviour:

- biases and incentive-effects , &

- social proof i.e. the tendency to do what everybody else is doing.

In the speech, Charlie Munger highlights 24 standard causes that lead to human misjudgement. Out of the many concepts he touches upon in his speech, ‘the lollapalooza effect’ deserves a special mention. Munger himself considers it as one of the most important concepts.

The lollapalooza effect is what happens when you have more than one bias/incentive acting at the same time. It means the confluence of several themes heading in the same direction to produce a given result which can either be positive or negative. And, as it becomes hugely powerful, it also becomes a major driver of human misjudgement.

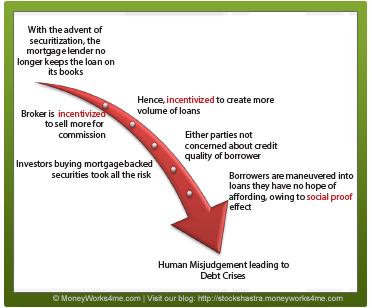

The most relevant example of the lollapalooza effect is the mortgage market:

Tupperware parties and open outcry auctions also demonstrate the same effect. Both are designed to manipulate people into certain behaviour. In the Tupperware party, the host/hostess gave the party, so the tendency is to reciprocate; other person’s decision to buy satisfies the desire to get social proof. In the open-outcry you’ve got social proof, the other guy is bidding, you get reciprocation tendency, you get deprival super-reaction syndrome, the thing is going away…hence, the desire to get it even more.

Munger vs. Buffett…

Though both, Charlie Munger & Warren Buffett hold parallel views on value-investing; there have been instances, where Charlie managed to convince Warren to take an alternative view!

- His approach towards blue-chip holdings.

Adhering to his stance ‘Income first, capital gains later’, Munger takes an alternate approach when it comes to blue-chip holdings. For him, stocks that generate strong business performance on a consistent basis are worth holding indefinitely, as opposed to just an undervalued one. It was Charlie who introduced Warren to the notion that some businesses are so fantastic at increasing intrinsic value with consistency that they are worth holding on to even during periods when the stock price seems to get a little ahead of the business fundamentals. In short, excellent businesses do a fantastic job of raising intrinsic value each year.

- Warren Buffett investing in the Chinese electric car maker BYD.

This serves as an exception to the rule that Berkshire avoids technology companies, being companies, whose businesses he didn’t understand quite well. However, Munger convinced Buffett to invest in BYD, by its numbers. What BYD had already done was ridiculously difficult to do, and they had done it anyway making it a very remarkable company, and Warren could see that from the numbers. Moreover, Charlie believed that the founder, chairman and CEO of the company Wang ChuanFu had the right character worth investing in, “a combination of Thomas Edison and Jack Welch – something like Edison in solving technical problems, and something like Welch in getting done what he needs to do“.

The return on my investment…

Though I was aware of Charlie Munger’s investment style with respect to stock selection, my time investment that day at the discussion gave me return in the form of new insights into his beliefs and concepts: the importance of putting facts together and developing a framework of mental models while solving critical business problems, the role played by the incentive effect and social proof in human misjudgment, and of course, the lollapalooza effect.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

wow