Shall economic activity change your investment decisions?

Indian financial markets are in doldrums and a complete mess. There seems to be no future for the Indian economy. ATLEAST as per what the news media has to say. Let us get to the line of events that have happened in 2018 & 2019, that has led to ripples on financial system and markets.

2018

- IL&FS Scam: IL&FS, an AAA-rated investment NBFCs defaulted on its loan. The reason for the default was the poor governance and business practices observed by these firms. This led to a loss in confidence in other NBFCs or banks irrespective of their credit rating or financial position enjoyed. Bankers/lenders became cautious and tightened their fist. This led to a collapse of financing to select small cap companies.

- Many episodes of fraud came to daylight due to illiquidity. Then came governance slippage in Sun Pharmaceuticals vide whistleblower report. This shook the confidence of investors as it was a large cap company widely held by investors.

- 2018 ended with IT, Pharma and FMCG reaching 52 week highs backed by good growth in Sales and profits.

2019

- The year started with huge selling pressure in companies that had their promoter shares pledged for loans. Lenders started selling off shares marked against loans to build up liquidity.

- Then there was a new chapter in Yes Bank (supposedly known as next HDFC Bank) reporting jump in NPA numbers and many of it from not so good quality borrowers. And the bad loans kept rising as every big corporate (RCom, Cox & Kings) defaulted on their interest payments. This House of cards tumbled at once given the unconventional loan structure.

- Fall in liquidity across the board made lenders cautious against even auto dealers and second rung NBFCs which led to auto sector slowdown and consumption slowdown.

- Despite all these news, there are around 50 stocks that are making new highs. Their growth has not been hampered as badly as others.

Business performance over Economy

The point worth noting here is- it’s not about the economy but about the individual businesses. When there is slowdown or recession, some businesses will go down because of various reasons like an unviable business model, poor corporate governance and slow economy, above mentioned names are few of the examples. On the other hand, there are few businesses that will be reporting good growth rates, like what's happening in Chemical, FMCG and consumer durables stocks because their business may not be very much correlated to economy. So on an average, even if the economy is not doing good, there could be a vast divergence in individual business performance. This can lead to non-correlated stock performance as well. Hence we can conclude that even if there is a slowdown, we can find enough money making opportunities.

Divergence in stock price and fundamentals

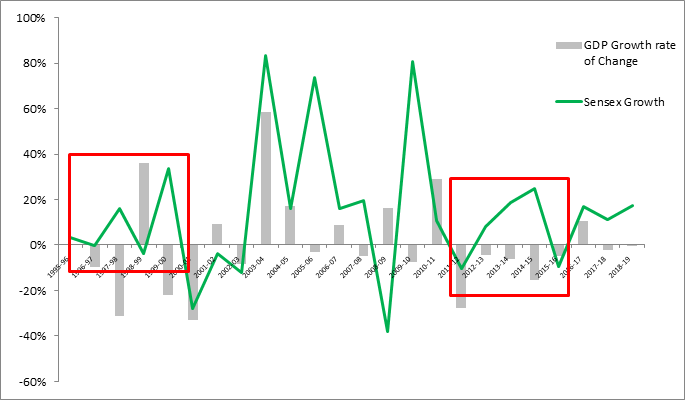

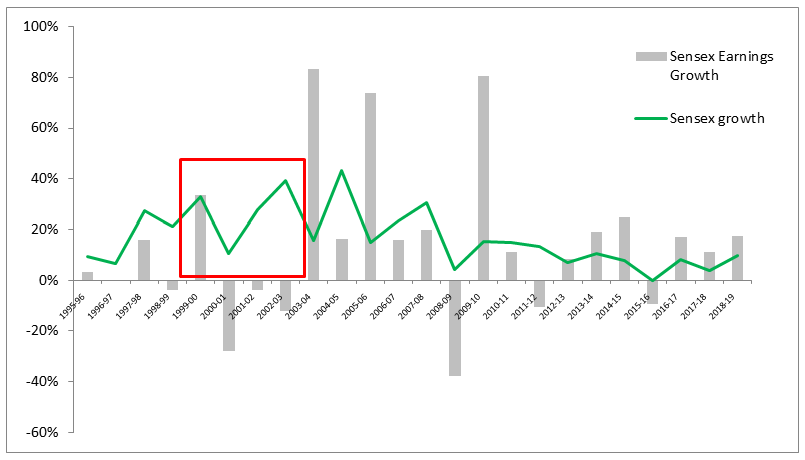

Besides, history suggests that there is no exact overlap of performance every year between aggregate stock prices and nominal GDP growth even if in long term they grow at similar pace. Look at Figure 1 below. Likewise, stock prices and earnings growth do not move exactly in line because slow growth can often be already factored in by drop in stock price or market may have rallied before earnings growth came in. One of the reasons for this divergent movement is because in short term markets are also driven by sentiments and fund flows versus just fundamentals.

As highlighted above, the year 1996-97 lodged a negative change in the nominal growth rate of GDP. Still, the market rallied up to 16%. Similarly, from 2014 to 2016, there was no positive change in nominal GDP growth rate, still the market rallied more than 12% CAGR.

Coming to earning growth, from the year 2000-01 to 2003-04, the earnings growth of Sensex has been negative. Yet, the market rallied throughout those years. This shows that there is always lead or lag in stock price versus earning growth.

Such divergent movements in stocks suggest that the relation of equity returns with slow growth is unpredictable and hence cannot be timed. Even if one manages to get out on time before slowdown hits, he can't get in on time as markets rally may precede growth missing out on those returns forever.

Time in the market is more important than timing the market

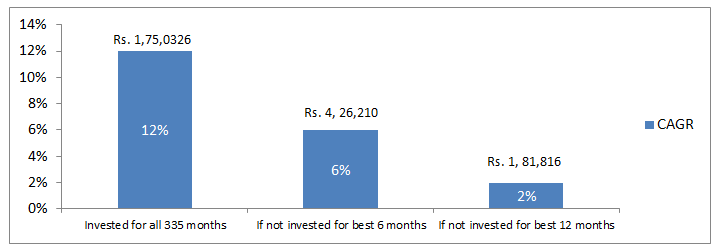

We studied the historical monthly Sensex returns from January 1992 to November 2019. We found that if you invested in Sensex, you would have earned 12% CAGR in these ~28 years. However, there were around 6-12 best months that contributed to large part of this return. Assuming you put Rs. 1 lakh at the start of 1992 what would be your return in each of the cases :-

As per the above figures, if you stayed invested between 1992 to 2019, you would have earned 12% return over ~28 years. However, if you missed the best 6 months of those 335 months, your return would have halved at 6% CAGR. And if you missed the best 12 months, your return would have been only 2% CAGR which is quite dismal. Basically, market returns come through in less than 4% of the occassions, rest of the time markets returns are flat/range bound.

Now, the best months are randomly scattered over those 28 years and will be known only in hindsight. We dig through lot of research and academic papers but couldn't find any formula or pattern to determine what factors led to good performance in those months. Hence, the only way to make the good returns is to stay invested in the markets whenever you get an opportunity and not try to time the markets.

In a nutshell, despite the slowdown or the noise created around negatives of recession, it is important not to tinker with your equity portfolios. One has to stay invested in the markets to make good returns over the long run, this way one wouldn't miss those best 12 months.

Let us look at it from another perspective. Equity as a whole consists of less than 10-25% of your total assets including real estate, gold, and fixed income. Equity is a risky asset, i.e. it moves up and down randomly; hence it is given smaller allocation. So you have already taken care of the risk in exchange for good rewards from equity. By simply trying to time the market – entering and exiting in fear of up and down movement - you are getting scared of the same risk you have accounted for by limiting equity at just 10-20% of your assets in equity. By not staying invested, you may miss out on the rewards of equity.

This reminds me of a quote- "There seems to be some perverse human characteristic that likes to make easy things difficult." - Warren Buffett

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: