There comes a time in everybody’s life when we sit our children down and tell them about the good old days of our childhood. One of the things that is routinely mentioned in these ‘walk-down-memory-lane conversations’ is how things were so much cheaper in our childhood. In fact even if you compare prices just 10 years back, you can see the stark difference in the prices of some essential day-to-day commodities. Prices of almost all the things have gone up considerably over the last 10 years. (See table)

So, while in the year 2000 a 100 rupee note would have fetched your bike close to 4 litres of Petrol, today it fetches barely 2 litres of petrol. Now, a litre of petrol gives the same value to your bike as it did in 2000, but you are paying more than double for the same quantity and quality after 10 years.

Over the period of 10 years, the value of Rs. 100 has more than halved. And all this due to the demon that is Inflation!

So, what exactly is inflation?

Economists define inflation as a rise in the general level of prices of goods and services in an economy over a period of time. For a layman it means a rise in prices of commodities of daily use and subsistence (food, clothing and shelter).

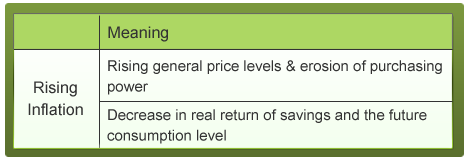

However, when the general price level rises, each unit of currency buys fewer goods and services just like in the case of ours Rs.100 buying just 2 litres of petrol in 2010. Thus, inflation reflects erosion in the purchasing power of money.

Also, during the periods of high inflation, the real return on fixed income securities like bonds and fixed deposits decreases. (Real return = Rate of return from investments – Inflation rate). So, a bond which pays say 7.5% interest rate actually gives a real return of just 1% if the inflation is 6.5%. If the inflation increases further, the real return falls more. Now, you save your money so that you can use it at some future date. If the return on your savings goes down then you would be left with less cash to spend in future. For businesses, inflation leads to higher cost of production which affects the profit margins to a certain extent.

What causes inflation?

Inflation can be attributed to one of the following reasons:

• Inflation via higher demand – It is the case of more money chasing few goods. This means that the demand for the goods is high which leads to higher prices of these goods. E.g. Real estate prices which have gone up due to the high demand over the years. The high demand is usually caused due to an increase in consumer & government spending. In a developing country like India, inflation via higher demand is usually a favorable situation for the economy because it is instrumental in continuing the growth process; also it can be better managed by the policy makers.

• Inflation via lower Supply– Every now and then we hear that poor monsoons have lead to lower harvests of food grains, pulses, vegetables etc. Thus lower supply in the economy leads to higher prices. Even if the demand is the same the prices may continue to rise due to lower supply. This form of inflation is particularly detrimental for a growing economy like India and it is relatively difficult to manage.

How do our policy makers respond to High Inflation rates?

The Government and the central bank of the country – RBI – is very wary about the inflation rate and is ready to jump in whenever it starts getting out of control. The tool with which they control inflation is by controlling the interest rates in the economy. Take for example the inflation seen in our country over the last year. The graph below shows the inflation rates since March 2009. ( click on the image to enlarge it)

To control inflation the RBI tries to lower demand by taking out the excess money supply from the economy. It increases various rates which eventually makes borrowing money expensive. This leads to lesser borrowing by the people leading to lesser spending.

Even for business the cost of borrowing goes up which has an impact on their profit margins. They might even delayany investment activity (to be funded by borrowing) to a later period when the interest rates are lower to reduce their investment costs.

As you can see from the table, over the past year RBI has increased the repo rate (rate at which banks borrow money from the RBI), reverse repo rate (rate at which RBI borrows money from the banks), CRR and SLR. This led to an increase in the Prime Lending Rate (PLR) and hence the general interest rate in the economy.

So, if high Inflation is not good, is Zero Inflation the solution?

Very low inflation rates are also not good especially for a growing economy like India because it can happen due to

a) Lower Demand and/or

b) Oversupply

Both these situations are detrimental to the growth process of the economy and hence not desirable.

While seeking for a wage hike from our bosses we usually quote high inflation rates as one of the reason’s. But when there is dip in inflation rates we don’t go running for wage cuts!! Generally, it is not so easy to reduce the wage rates in an economy. So, the company usually resorts to reduction in workforce. On a macro level, it leads to higher unemployment in the economy. At this point, the RBI takes action by lowering interest rate to boost domestic investment but this also leads to lower net inflows. Thus zero or very low inflation is not conducive for the growth process.

The preferred solution therefore is a middle path, i.e. moderate inflation rate (usually 4%-6% for a developing economy like India). Moderate inflation is necessary to act as a lubricant for the wheels of economy. It signifies healthy demand in the economy and also avoids RBI intervention which affects consumer and investment spending.

How does inflation affect the stock market?

Generally stock markets and inflation are believed to be inversely related. Let’s see how.

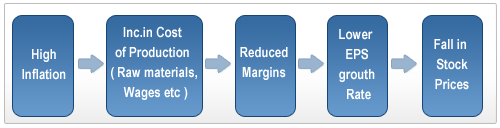

For businesses higher inflation means that raw materials become expensive which leads to higher costs of production. The companies usually pass on a fraction of the price rise to its final consumers; however invariably they have to absorb a fraction themselves. Thus, it adversely affects the earnings of the companies. Lower earnings by companies can make them less attractive for investors and hence the stock price may fall.

Also, during a high inflation period investors are looking for better rate of return on their investments in order to maintain or improve the purchasing power of their income. The investors will find better returns only when the P/E ratios are relatively lower. Thus in high inflationary periods the P/E ratio should be ideally lower and similarly at lower inflation rates P/E ratios would be higher.

But is this always the case?

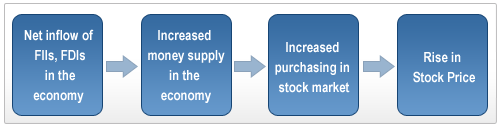

We have seen the crash of 2008-09 and also the recovery thereafter. Stock prices have risen considerably even while inflation was high and rising. How did this happen?

The reason for this was the Net inflows brought by the FIIs and the FDIs.

Thus, in a growing economy like India, even at double digit inflation rates investors might find it worthwhile investing in the stock market. So, while investing in stock market, an investor must always look towards the trend of macro-economic indicator like inflation which affects the whole economy and hence the stock market

How can you guard yourself from Inflation?

The best way to guard yourself from inflation is to ensure that your real rate of return i.e. rate of return adjusted for the inflation rate is sufficiently high. For this:

Check the real return that you are getting on your investments like fixed deposits

If you are getting 8% interest on your deposits but the inflation is 6% then your real returns are only 2% which is very low.

In this case, you can think about alternative investments which could provide better real returns. For e.g. Real estate, Gold, Stocks etc. Learn more about the various investment options here – Scratch to pro: Where can I invest?

Amongst all the options, stocks are one of the best ways to protect yourself against inflation. Historically, stocks have given a rate of return close to 15-18% over the long term thus giving a sufficiently high real rate of return.

So, in order to guard yourself against inflation invest in fundamentally strong companies which have good growth prospects and which are available at attractive prices.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

Awesome article.. thanks a lot StockShastra team.

Thank you for your appreciation

RBI almost all time increases Repo as well rev repo in same proportion so think impact must be negligible ! Consumer Spending from day to day point of view remain same e.g: it may increase or decrease due to population in family member but But Gov. spendings remain always high ! why so?

Thanks for your comments. Well repo and reverse repo might increase in the same proportion but they are not like two forces acting against each other. As you know when repo rate (rate at which the banks borrow money from RBI) increases, the commercial bank increases the interest rate which it charges from its borrowers. Thus this would lead to reduced borrowings overall, thus reducing the money supply in the economy. On the other hand, when reverse repo (rate at which borrows money from banks) increases, the commercial banks park more money with RBI as they would be getting a safe and higher return and also the banks are to lend compulsorily to RBI at the rate determined by it. Thus this would also reduce the money supply in the economy.

Regarding consumer spending, what you are stating is that spending increasing due to rise in population, now that is basically higher demand fuelling the inflation. Government spending is more governed by the development activities in the country rather than the inflation. With the economy growing at 8%, the government has to continue investing more on infrastructure like roads, railways, security etc.

1. How can a common person find the REAL rate of inflation?

2. What is the average rate of inflation in India over the past 30-40 years?

3. If a person today was to consider how inflation will affect his retirement 30 years from now, what rate of inflation should he/she take?

To answer your first query, you are probably looking for a formula for real return. Real Return = Return on investment- Inflation rate (if you are getting 7.5% on your Fixed deposits and inflation is 8.9%, then your real return is – 1.4%).

For the period 1970-2010, the average inflation rate in India for this period is 7.85%. You can take an average inflation rate of 6-7% if you have to consider for your retirement 30 years from now.

Thanks for your reply. Why do you take the future inflation as 6-7 when the past has shown almost 8? Are you more optimistic about the future than the past despite the way inflation is soaring alongside growth these days?

Basic told in a simple and easily understandable way. I expect more such articles from SS.

shivaraj e

Thank you. Do keep reading stock shastra and post your feedback/comments.Thank you. We strive to explain the concepts in a way which would be easily understandable and add value to the investors.

Its a wonderful article.

Thank you .and please provide us more such article.

kamya

Wonderful article…!!

mind blowing