Since the beginning, MoneyWorks4me investing strategy is buying good stocks when they are available at discount to their fair value (MRP). Usually we got the desired margin of safety when good companies faced temporary business problems and the market reacted disproportionately. The usual market swings also gave us opportunities to buy good stocks at attractive prices. And when the cycle turned the market rewarded us with great returns –and even in some cases it didn’t, the loss was modest given it was a good company that we bought cheap. We have done this across years and the outcome has come out just great.

We too would love to see strong companies in your portfolio in addition to current ones!

Even great companies trade at discount to fair value but this may happen only during deep market corrections-which are infrequent. More often we observed that whenever great companies come close to their MRP, other market participants start piling it up even on small correction making it very difficult to catch great companies at decent margin of safety. Also these companies tend to weather tougher situations much better than others thanks to their strong market share, pricing power and scale. But we have been watching these companies very closely as we want you to own them.

So how do plan to ensure we are able to invest in the best profitably?

We do by implementing this Warren Buffett’s advice in letter and spirit! – “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” We already have valuations that tell us the fair price- MRP. So we needed to figure out which companies would qualify for this and how do we tweak the tranche buying for them.

When we do not get the margin of safety through the buying price, we look for companies that are great compounders so that their value grows at a brisk pace and in reasonable time our buy price seems reasonable. We filter such companies using these 3 criterions

- Long run way as they operate in either an underpenetrated or a fast growing market

- Less cyclicality

- Strong pricing power or Moat.

A good quality company has a better bargaining power with customers or suppliers and distributors. It can charge high price to a customer or it can demand advance/credit period from distributors/suppliers. These advantages improve a company’s cash flows even if its volume growth is same as an average company.

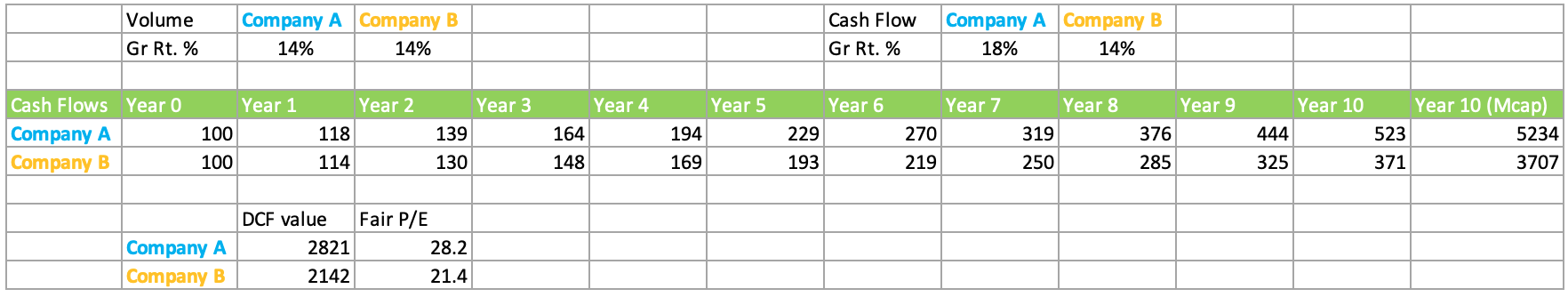

A good quality company can thus have higher growth in cash flows versus an average company which is why it can enjoy higher valuation of 30% to 100% depending on industry growth rate.

Illustration:

In the above illustration, Company A generates higher cash flows with same volume growth versus Company B. The valuation Company A deserves is 33% higher than Company B.

In the above illustration, Company A generates higher cash flows with same volume growth versus Company B. The valuation Company A deserves is 33% higher than Company B.

For such quality companies, we will be recommending the first tranche (~2.5% of your portfolio) for buying even at MRP-fair value while the next tranches will be at a reasonable discount from MRP. This would lead to you entering the stock at or very close to its MRP and essentially without a margin of safety (as we see it), but that okay for the first tranche. In case the prices fall we will buy more to reach our intended allocation. And if the prices rise, we would be happy that we have invested some of our money in a wonderful, growing company which will give very attractive returns.

This small but important change will help build a better diversified portfolio which will give higher returns under different market conditions.

We are adopting this policy primarily because we believe our subscribers are long term investors who will not get swayed by stock price correction and will hold their stocks for long term, 5+ years. Then this strategy will bear abundant fruit.

To summarize, you will now see recommendations for buying the first tranche for some company-stocks at or close to MRP. These companies are great compounder and the market tends to price them fully even during difficult times. Adding such companies will build a stronger well diversified portfolio.

We expect to see more opportunities to buy. Portfolios will have a mix of strong compounders at fair prices and strong companies who have a short term problem at very attractive discounts. Together it will build a well-diversified portfolio that will work under different market conditions. Our usual advice: Please always buy the recommended allocation only at the suggested price so that you have the money and the comfort to add more if prices fall and prevent over-exposure to any one company at the entry price.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463