Stove Kraft Limited IPO Details:

IPO Date: Jan 25 to Jan 28, 2021

Total Shares for subscription: ~1 Cr

IPO Size: ~Rs. 411 Cr

Lot Size: 38 shares

Price Band: Rs. 384-385/share

Market Cap: ~Rs. 1250 Cr

Recommendation: Avoid

Purpose of Stove Kraft IPO

- Fresh Issue (Rs 95 Cr) to be utilized for corporate purposes

- Offer for Sale (Rs. 300 Cr) to be received by outgoing Shareholders

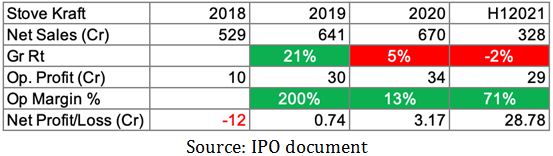

Incorporated on June 28, 1999, Stove Kraft is Rs. 700 Cr, kitchen solutions and an emerging home solutions brand.

Stove Kraft is engaged in the manufacture and retail of a wide and diverse suite of kitchen solutions under the Pigeon and Gilma brands and proposes to commence manufacturing of kitchen solutions under the BLACK + DECKER brand, covering the entire range of value, semi-premium, and premium kitchen solutions, respectively.

The kitchen solutions comprise cookware and cooking appliances across their brands, and the home solutions comprise various household utilities, including consumer lighting.

Pigeon branded products were amongst the leading brands in the market for certain products such as free-standing hobs, cooktops, non-stick cookware, LPG gas stoves, and induction cooktops. The Gilma portfolio comprises chimneys, hobs, and cooktops across price ranges and designs.

Stove Kraft has 2 manufacturing facilities, one each in Bengaluru, Karnataka, and Baddi, Himachal Pradesh. As of September 30, 2020, they manufacture 79.75% of their Pigeon and Gilma branded products (in terms of the number of units) at their well-equipped and backward integrated manufacturing facilities.

Stove Kraft has a separate distribution network for each of their Pigeon, Gilma, and BLACK + DECKER brands. Further, there is a separate distribution network for the Pigeon LED products. They have 651 distributors in more than 27 states of India and 5 union territories of India and 12 distributors for their products that are exported as of September 30, 2020.

Strengths

- Widespread, well-connected distribution network with a presence across multiple retail channels

- Focus on quality and innovation

- Strong manufacturing capability with efficient backward integration

Future prospects

- Expand geographically

- Scale-up branding, promotional and digital activities

- Invest in new plants and automation in existing manufacturing facilities

- Grow LED consumer lighting business

Weakness

- The small size might become a hindrance to growth in a competitive market

- Peers have a better product range, higher brand awareness, and a strong distribution channel.

How is the business model? Good, Great, or Gruesome?

Good Business Model. Upon achieving scale, the business can generate a superior return on Equity (ROE). Low asset intensity and pricing power over consumers are sources of superior ROE. However, Stove Kraft is still some time away from becoming a good business.

Valuation

With sales of Rs. ~650 Cr, Stove Kraft is demanding Enterprise value /Sales of more than 2x. Enterprise Value = Market Cap (1250 Cr) + Debt (300 Cr) – Cash from IPO (100 Cr)

With the limited scale and low ROE, we recommend AVOID.

| IPO Activity | Date |

| IPO Open Date | 25th Jan 2021 |

| IPO Close Date | 28th Jan 2021 |

| Basis of Allotment Finalisation Date | 02nd Feb 2021 |

| Refunds Initiation | 03rd Feb 2021 |

| A credit of Shares to Demat Account | 4th Feb 2021 |

| IPO Listing Date | 5th Feb 2021 |

| Date | QIB | NII | Retail | Total |

| Jan 25, 2021, 05:00 | 0.00x | 0.05x | 5.37x | 0.99x |

| Jan 27, 2021, 05:00 | 0.08x | 1.85x | 13.08x | 2.93x |

| Jan 28, 2021, 05:00 | 8.02x | 37.72x | 26.04x | 18.03x |

What is Stove Kraft Limited IPO?

Stove Kraft Limited IPO is an IPO of 1 Cr equity shares with a face value of ₹10 aggregating up to ~₹411 Cr. The issue is priced at a price band between ₹384 to ₹385 per share.

KFintech Private Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

When Stove Kraft Limited IPO will open?

The IPO opens on Jan 25, 2021, and closes on Jan 28, 2021, between 10.00 AM to 5.00 PM.

What is the lot size of Stove Kraft Limited IPO?

The lot size is in the multiple of 38 with a minimum order quantity of 38 Shares.

How to apply for Stove Kraft Limited IPO?

You can apply for Stove Kraft Limited IPO online using either UPI or ASBA as a payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don’t offer banking services like Zerodha.

When is the Stove Kraft Limited allotment?

The finalization of the Basis of Allotment for Stove Kraft Limited IPO will be done on 02nd Feb 2021 and the allotted shares will be credited to your Demat account by 4th Feb 2021.

When is the Stove Kraft Limited listing date?

The Stove Kraft Limited IPO listing date is not yet announced. The tentative date of the Stove Kraft Limited IPO listing is 5th Feb 2020.

Is it worth investing in Stove Kraft Limited IPO?

Stove Kraft Limited is not a proven business model yet. We would avoid investing in IPO.

What if I do not get the allotment?

We recommend investing in other consumer durables names like Crompton Greaves Con, Bajaj Electricals, TTK Prestige, Hawkins, etc at the right price. Subscribe to MoneyWorks4me for Right Stock and Right Price.

Know more: Indian IPO Historic Data 2021

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call: 020 6725 8333 | WhatsApp 8055769463