Tata Steel Ltd. – Set for a high future growth!

Tata Steel Ltd.: Company Highlights

Tata Steel Ltd. – The largest Steel producing company in India (by revenues)

Market View of Tata Steel Ltd. (as of 20/01/2012)

Latest Stock Price: Rs. 436.60

Latest Market Cap: Rs. 41745.01

52 Week High Stock Price: Rs. 662.80

52 Week Low Stock Price: Rs. 332.35

Latest P/E: 3.89

Latest P/BV: 1.02

Tell me more about Tata Steel Ltd.…

Tata Steel Ltd. is India’s largest integrated steel player in the private sector and the world’s seventh largest steel producer with an annual crude steel capacity of around 30 million tonnes per annum (mtpa). It manufactures hot and cold rolled coils and sheets, galvanized sheets, tubes, wire rods, construction rebars, rings and bearings. Apart from India, the company operates through its major subsidiaries on a consolidated basis – Europe (Corus) and South-East Asia (NatSteel & Thailand). In India the company has manufacturing facilities at Jharkhand, Chhattisgarh, Orissa, West Bengal and Tamil Nadu. It has operations in 26 countries and commercial presence in over 50 countries with over 81,000 employees.

How has the financial performance of Tata Steel Ltd. been? Here’s the review…

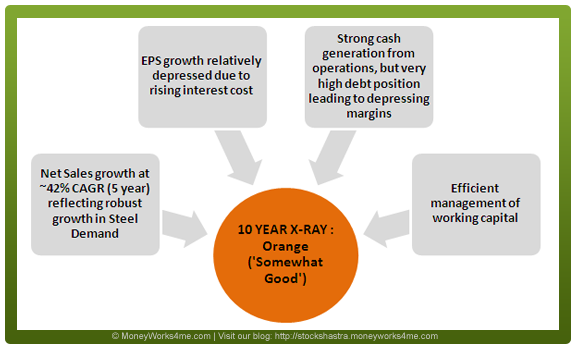

On Standalone basis: Tata Steel India has performed robustly in all its parameters in the last 10 years. Its Net Sales have grown by 18% CAGR showing consistent demand. Also, a strong re-investment into the business along with an improvement in margins has helped the company grow its Earnings per Share (EPS) by more than 30% over the years. However on the ROE & ROIC front it has shown a weakening performance with a declining trend. The fall in ROE is mainly due to the substantial increase in interest costs. Similarly from a high of 41% in FY05, ROIC has come down to around 10% in FY2011. This fall in ROIC can also be attributed to the continuous increase of debt on books. The company’s debt has increased from Rs. 9600 Cr. in 2007 to Rs. 28000 Cr. currently. This has led to a rise in Debt-to Net Profit ratio (5) and Debt-to-Equity ratio (0.66).

On consolidated basis, Tata Steel has shown a massive jump in net sales since FY 2008 after the acquisition of Corus. This acquisition took Tata Steel’s revenues from Rs. 25117 Cr. (FY07) to Rs. 1,31,498 Cr. (FY08). Its profits too increased from Rs. 4,174 Cr. to Rs. 7,359 Cr. in the same period. Further in FY09 the company registered a good sales growth of 12% and a profit growth of 3.5%. But, in FY10 the company’s sales fell and it registered losses of Rs. 2009 Cr. as a result of the slowdown in the European markets and lower production from Corus. In FY11, the company has been able to register a good sales growth of 16%, and thus clocking a profit of Rs. 8,856 Cr. The company’s debt on a consolidated basis is very high at Rs. 60,000 Cr. which includes a major chunk of Corus’ debt burden.

Margins: Historically, Tata Steel has maintained best profit margins amongst integrated steel players. On standalone basis, Tata Steel has shown impressive improvements in its profit margin ratios over the last 10 years. From FY2005 the company has maintained an operating profit margin in the range of 38-40% and Net Margin around 20%. But, on consolidated level, margins are much lower mainly due to heavy debt burdens and slowdown in its European operations and market. Though, considering the company’s planned debt restructuring/repayments; we can expect significant improvement in its NPM and operating margins.

Thus, while Tata Steel’s financial performance has been good mainly due to rising steel demand over the years, its balance sheet reflects a rising debt position causing lower net margin making it relatively a risky company as far as financial performance is considered. Considering this, we can say that Tata Steel’s 10 YEAR X-RAY is Orange (‘Somewhat Good’).

What can we expect in the future? Here is the fundamental analysis of Tata Steel Ltd.

In the short term

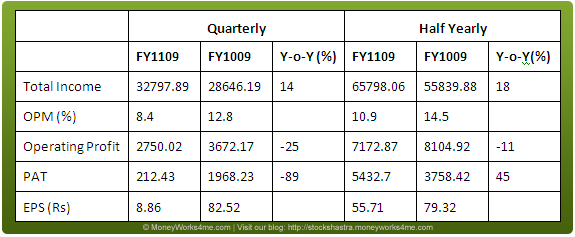

Quarterly results disappoint:

Coming Quarters:

In the long term

Lowest Cost Producer leads to higher margins:

Tata Steel is one of the lowest cost producers of steel, thanks to captive sources of iron ore and coal mines. It relies on external sources only to the extent of 40% for coking coal. Also, Tata Steel’s RM cost constitutes only 23-25% of total cost compared to other domestic players, like SAIL and JSW Steel, where RM cost forms about 50% of total cost. Tata Steel is looking for further acquisitions of strategic raw material mines globally. Besides, the company has also started Industrial Energy Limited, a 24:76 joint venture (JV) with Tata Power that ensures the expanded facilities will have a reliable, low-cost supply of power to its steel plants. At a time when the global iron ore and coal prices are racing ahead, the captive mines keep Tata Steel’s input costs low and facilitates higher margins.

Raw-material for European Operations:

To address the raw material shortages at its European plants, Tata Steel has acquired 35% stake in a coal project owned by Riversdale Mining. It also has 24% stake in Riversdale Mining. Tata Steel has also acquired 80% interest in a Canadian Iron ore project from New Millennium Capital Corporation (NMI) and 100% off-take rights of the project. The Canadian Ore project is likely to commence iron ore production by this fiscal.

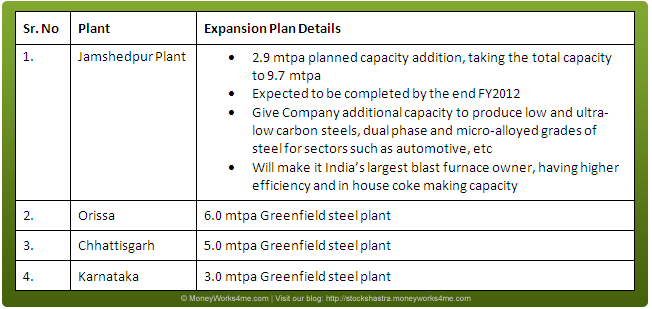

Massive Expansion Plans to meet future domestic demand:

In its bid to maintain its leadership position, Tata Steel is aggressively expanding its production capacity. Outlined below is its expansion plan:

Due to this higher capacity and increased efficiency, Tata Steel will have better footage in domestic steel market.

Europe to lead the future growth:

With the acquisition of Corus, Tata Steel became one of the largest steel players in the world. After having faced troubles in the last two years, Tata Steel Europe seems to be on a turnaround path. The company is expected to resume close to 90% of capacity utilization in this fiscal. Acquisition of strategically placed Corus has given Tata Steel a low-cost manufacturing set up in India with unrestricted access to the high-end European markets. Looking at its huge contribution and recent recovery, we can expect this subsidiary to be a future revenue and growth driver.

Long term steel demand to be intact:

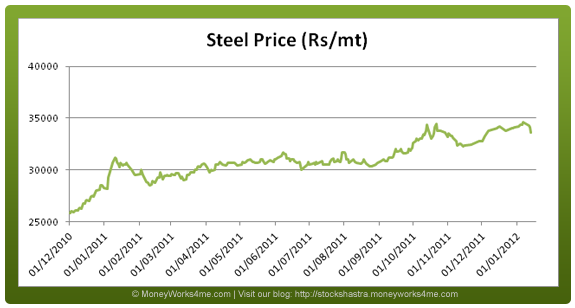

Steel is the basic foundation material for many construction activities, equipment, goods etc. The Steel sector has grown by more than 20% CAGR in Sales and Net Profit over the last 6 years. We can expect continued growth in steel demand in India, spurred by the increased need for steel based products (construction and infrastructure, automobiles, appliances, etc.) and estimated gross domestic product. The sector is poised for great growth in the future, especially considering economic recovery and is expected to grow with robust double digits in future. Tata Steel, being one of the largest and most successful players in this industry, is expected to take advantage of all the opportunities available in the industry.

So, after seeing the company’s positive points, is there anything you should be concerned about?

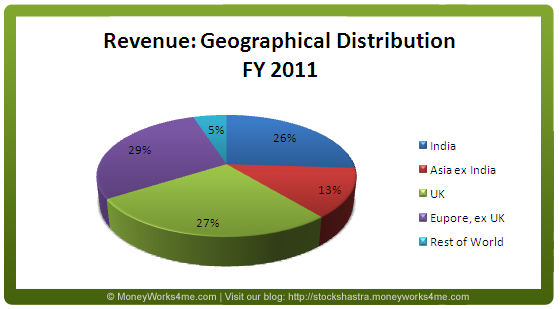

- Heavy dependence on European business: Tata Steel’ European business contributes around 60% of the company’s steel production and around 50% (46% in 2010) of its revenue. As Europe is the company’s largest market (56%), its business gets materially and adversely affected if economic conditions in Europe deteriorate. A slowdown in this geography has had major impact on the company in the past and could impact its performance in future as well.

- Third party sourcing for raw materials increases cost: The Company gets majority of its raw-material (iron ore & coking coal) requirements for its European operations from third parties that accounts for a major portion of its overall cost. In the time of rising raw material prices, the profitability of its European operations gets affected adversely because of this.

- High debt leading to lower margins: Tata Steel is sitting on more than Rs 60,000 Cr. of debt which has a very high service (interest) cost. Due to the continuous interest payments, the company is witnessing depressed margins.

- Foreign exchange fluctuations are also a major cause of concern for the company as it gets close to 75% of its revenue from overseas operations. Any adverse forex movement could impact the profitability.

- Cyclical nature of the steel industry: Overall, the steel industry is cyclical in nature and has a high sensitivity to economic factors like interest rates, inflation etc. Globally, Steel prices fluctuate based on these macroeconomic factors. The industry is also very sensitive to the trends & performance of its user industries like automotive, construction, capital goods.

Despite these concerns, Tata Steel is well-positioned to make the most of the opportunities in the Steel space. Hence, we can expect the long-term future of the company to be Green (Very Good).

So, is it an investment-worthy company?

Tata Steel Ltd., a Tata Group company, is India’s largest integrated steel player in the private sector and the world’s seventh largest steel producer with an annual crude steel capacity of around 30 million tonnes per annum (mtpa). With rapid expansion in capacities, economic recovery and expected rate cuts in domestic market, Tata Steel is poised to grow in coming years.

Currently, its stock price is at Rs. 430. So, let’s see what the technical chart of the company indicates? Click to view the chart

Tata Steel’ long term chart suggests a downward pressure on stock price. Tata Steel is trading in a major downward channel for last three years and stock’s attempt to break this channel has not been successful yet. The stock is also trading in other downward expanding channels for quite some time. Currently the stock is hovering around 61.8% Fibonacci level of its previous rally which could act as a strong support level. But again till the trending channels are broken, stock will remain in downtrend in medium-term.

Considering its fundamentals, Tata Steel Ltd. is an investment worthy company. Tata steel is considered to be a safe-bet as compared to mid and small cap stocks. However, the presence of high debt on its balance sheet makes it a relatively high risk company as compared to other large cap stocks. Thus, investors should invest in the company only at a deep discount to its right value (MRP).

So is price offer an attractive discount to its right value (MRP) or is it over-priced? It is always best to invest at an attractive discount to its MRP, to get maximum returns at minimum risk. Become a member of MoneyWorks4me.com to know its sensible buy- price and hence take the right action for this company.

Apart from buying at a discount to the MRP, investors can also look at the Technical chart of a company to support their buying and selling decisions based on fundamentals.

However, remember technical should only be used as a supporting tool to fundamentals. One should always take an investment decision based on how fairly is the company priced. So, make sure you check out the MRP of Tata Steel Ltd. at MoneyWorks4me.com

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

@8f6f14cdf42017b931718059e50b3bce:disqus

Here is our analysis regarding Tata Steel’s Pension

liability in its Europe Business:

Condition as of now: As pension fund

Assets are more than Pension liability the fund remains fully funded.

Concerns: The pension fund liability is more than the total net worth of

the company hence any slack in the performance of the funds’ performance would

have detrimental effect on the company’s valuation. And we remain extremely

concerned about it.

Management is addressing the

issue of the exposure the company has on its pension liability, for starters it

has already closed the Defined Benefit Pension scheme for new recruits and the

contribution rate for future service of existing members have been negotiated

with the fund trustees at lower rates. While management is addressing the

issue, the problem would be rectified only in long term and thus remains one of

the key concerns in TATA Steel that we continue to monitor closely.

Valuation adjustments: Pension

funds’ performance remains contingent on the quality of the asset the fund has

and the general economic climate in Europe. With the limited information that

company provides in its annual report it’s not possible to estimate future

performance of the fund. But as Pension is a critical concern for the company,

the concern has been addressed through margin of safety. Tata Steel has among

the highest Margins of Safety among Nifty 50 companies.

For a detailed report and Tata Steel’s MRP and DP please log in to our website http://www.moneyworks4me.com.

Sorry for the late reply.