Usually, the world of stock buyers is made up of two kinds of people – those who buy to hold i.e. investors and those who buy to sell i.e. traders. Since our goal is to help our readers build wealth over the long-term, the differences between these two approaches are worth considering.

How Traders play the game?

Traders buy/sell stocks with a very immediate short-term goal – to make a quick profit. To do this, traders can select stocks in a couple of ways. The stocks can be bought based on the expectation of some news/event. For e.g. an oil stock bought in the morning and sold in few hours against the backdrop of an announcement of rising petrol prices will generate profit for the traders, who usually know exactly what price they will sell at. Alternatively, traders select stocks on the basis of technical analysis, which involves market data analysis such as historical price movements, trading volumes and much more. For this they use statistical tools and charting software to predict short-term stock price movements. Thus, the goal is to make quick profits on price differences. They usually have an exit expectation which might be in the form of price target or in terms of how long the position will be held. Traders often sell shares i.e. short-sell in anticipation of price decreases, thus seeking to profit from price fall and often transact with borrowed money to fund trades.

So, how do Investors see the market!

Investors buy stocks with the intention of holding them for the long term. They select stocks based on fundamental analysis, which involves analysis of a company’s financial statements to identify its strengths and weaknesses, company’s markets, competitors and products. Investors develop a thorough understanding of the business, value and its long-term potential. Investors often look for companies that are “undervalued”, implying they are intrinsically worth more than their share price suggests. Investors usually go for these companies because in the long run their share prices are most likely expected to rise. The goal of an investor is to own stocks which are very likely to deliver price growth and decent dividends over the long-term. Some investors often reinvest their dividends in the stocks they own, as they believe that the companies they’ve bought are worth more. Investors seldom have a firm idea about what price they would sell their shares for. Usually, serious investors plan to hold on to their shares indefinitely.

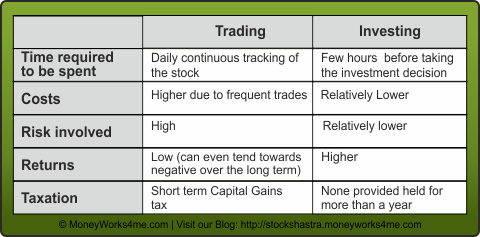

And now the comparison!!

If you compare both the strategies, trading is a lot more risky and usually more expensive, because every time you buy or sell stocks, you pay certain fees/commissions, which add up to the cost. It thus, lowers the total returns. Trading is thus, subject to higher transaction cost and commissions. To be successful at trading, it becomes essential to time the market which is easier said than done. Markets are very volatile and tend to go up and down quickly without any fore-warnings, which can make traders lose much more money than they have, especially if they have borrowed the money to fund the trades. Based on numerous studies of individual investors, mutual funds, and active managers, over 90% of active traders have underperformed the market i.e. generated returns less than market returns. Investors, who carefully research companies and are willing to hold on to the investments for a couple of years have shown better performance in the long run.

Both trading and investing have their own risk and rewards. While you might make more returns in some trades remember there are equal chances that you may end up losing your invested capital too! Also, the time commitment required in trading in very high. Thus, for retail investors, investing for the long term may prove to be the best strategy.

However, some might argue that following both strategies might be a good way. But think about this for a minute – A stock investment that goes up immediately tends to turn into a trade, while a trade that goes down immediately tends to turn into an investment!

So, what do you think will work for you the best – day to day trading in stocks or investing for the long term? Post your comments to let us know!

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

Definitely investing works out to be a better option since trading most often turns out to be a zero sum game

@37c332a01e364037add8f177a9bc53e1:disqus Investing definitely works out to be a better

option. In fact great investors like Warren Buffett and Rakesh

Jhunjhunwala have made great returns from safe investing rather

than trading.

Without a proper study of the trading strategy with technical skills and strict stop loss mechanism in place,one should not indulge in stock trading.Never borrow or leverage and trade.

@facebook-100000502520519:disqus Its good to hear about your understanding of

pitfalls to be avoided while doing trading. Stock trading, even

with sound trading strategy and proficiency in technical skills is

a tough task to master. The risks increase manifold when trading

is done with borrowed funds.

investing in long term is safe and its 100% safe in money & time

@ Saby, Thanks for your comment. Investing is definitely

safe and preferred over trading. Choosing the right stock at right

price makes investing much more fruitful. To get more insight

about investing, please visit our website http://www.moneyworks4me.com

investment is better way than trading..

Hey that’a good article and thanks for writing up !

Want to play safe and wan to get good returns more than saving acc and beat inflation investing works,,,

Want to make your hands dirty and play game with adrenaline rush, then u should look at trading with pre-determined error bearing capability.

Trading vs Investing… well, I like to use both, depending on worlds Market. Investing, in dividend is smart, because even if you hold during years, at least you have some cash flow. But Trading it’s also necessary, especially in “bear market” , or in “distribution market”,

Personally I like to use both, and when I’m looking for “investing strategies”, I use technical analyse and my trading skills.

But, I disagree by saying investing give better ROI than trading.. In fact, you can make about 25 easy ROI in a year with trading, whit low risk as 1% of your capital, if done properly. Against Stocks /Dividend that give you about 3-5% ROI.

At another way, for the time, it took me, till I become a positive trader in the market, …it cost me a lot of money in education (mistake/course/Testing stuff etc).

On investing side, I does require some trading skills how ever. If stocks, going down, (and you can see this in technical analyse).It will be smart to use “hedge” against your position, to protect it.

I can go on and on…but I will stop here.

For conclusion, I think if you would like to make money in trading, you need to use appropriate skills in appropriate market time. Or something, use both. Today market are affected same way, by all world good and bad news. And you need to adapt your self very fast and use the right skills at the right time.