Ujjivan Small Finance Bank Ltd IPO Details:

Issue Open: Dec 02nd, 2019 – Dec 04th, 2019

Issue Type: Book Built Issue IPO

Issue Size: 208,333,333 shares (Upto ₹750.00 Cr)

Face Value: ₹10 Per Equity Share

Issue Price: ₹36 to ₹37 Per Equity Share

Market Lot: 400 Shares

Minimum Order Quantity: 400 Shares

Proceeds of the offer

Proceeds of the offer will be going towards augmenting the Bank’s Tier – 1 capital base to meet future capital requirements.

The listing is a part of the Small Finance Bank licensing mandate, where the bank has to be listed within three years from the date of commencement of operations.

About the Ujjivan Small Finance Bank

Ujjivan Financial Services, now a parent company, started as a microfinance institution in 2005, offering small finance to underserved & unserved segments in India.

Ujjivan Small Finance Bank Limited (USFB) got a banking license in 2017. The bank aims to work for the financial inclusion of the country.

UFSL offers small size loan products to economically poor women, individual loans to Micro and Small Enterprises (MSEs).

It follows the integrated lending approach where the company considers technology infrastructure and back-end support functioning before lending.

The areas of lending are:-

- Agriculture and allied loans,

- Affordable housing loans,

- Loans to micro banking customers,

- Personal loans,

- Group loans to Financial institutions,

- Vehicle loans,

- Micro and Small Enterprise loans

USFB has a presence across 24 states and union territories in India predominantly West Bengal, Tamilnadu, and Karnataka (50% of loan book). As on 30 June 2019, USFB had 47.2 lakh customers, 474 Banking Outlets, 387 ATMs, two 24/7 phone banking units (in Bengaluru and Pune) and 50 additionally operated Asset Centres.

Ujjivan Financial Services Financials

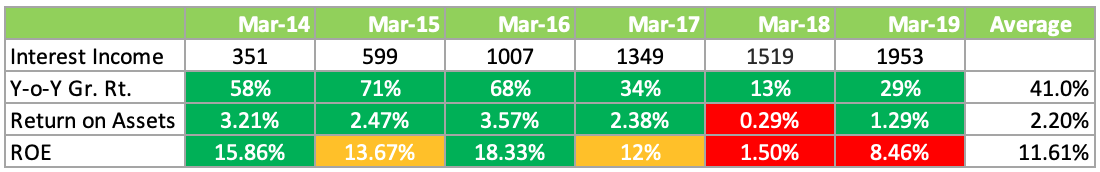

Since USFB has only 2 years of existence, we must see how the parent company performed before getting a banking license just to get a sense on execution.

Although growth rates are quite staggering, the profitability is very volatile. After getting a bank license, we may see some improvement in the CASA ratio but it appears that the ROE is not very high for the equivalent risk that comes with this business model.

Ujjivan Small Finance Bank IPO – MoneyWorks4me Opinion

As fundamental investors, we prefer to own firms that have an above-average long track record, exhibited the ability to earn superior ROE, consistent growth and scaling up.

Even if it means we may join the party late, the execution track record helps to achieve twin benefits; not only it significantly reduces our risk to lose money but also gives good upside potential.

Ujjivan Small Finance Bank still operates at a low scale (Rs. 13,000 Cr in AUM) and a relatively risky sector. USFB has large exposure (80%) to unsecured microfinance segment which makes it vulnerable especially when the income generation is at risk during an economic slowdown.

Microfinance has taken off in a big way as the proponents argue that small borrowers are relatively more honest and communities in which they belong to make sure they pay their loans or else face defamation in social circles.

However, if there is a big loss of income of the whole community from floods, drought, etc, a group of borrowers may approach local/state governments to get protection from Ujjivan’s recovery activity.

Risks are evident from past instances in microfinance loans like Bharat Financial Inclusion (erstwhile SKS Microfinance). This makes the Microfinance business model unviable.

This may reduce over time as Ujjivan diversifies into secured lending into affordable housing and SME lending.

We do not find any material difference in return expectations from smaller banks versus larger banks however, larger banks have the advantage of scale-up and raise money without diluting equity.

A few bad years for a small bank wipe out all benefits from high growth in previous years.

We recommend to AVOID Ujjivan Small Finance Bank. As an advisor, it is our duty to inform you what is right and refrain from risk-taking behavior in this market.

We will definitely recommend you select issues that are worth investing in. We are equally interested in making money as you are!

Those who are aggressive might want to invest only a small portion and keep monitoring growth rate, NPA levels and government pressure for loan waiver.

Have an exit strategy, if you find falling growth rate (Less than 15%), rising NPA (More than 2%) and noises against Ujjivan from government authorities.

Exit the stock under these conditions irrespective of gain/loss on your investment. For those who are already invested in Ujjivan Financial Services use this price rise in stock to exit (if long term investor) or move investment to the bank (if aggressive investor).

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463