Vedant Fashions Limited IPO Details:

IPO Date: 4th Feb 2022 – 8th Feb 2022

Total Shares for subscription: ~3.6 Crore

IPO Size: ~Rs. 3,149 Cr

Lot Size: 17 shares and in multiples thereof

Price Band: Rs. 824-866/ share

Market Capitalization: ~21,000 Cr

Recommendation: AVOID; (Avoid for now, track for the future)

Purpose of Vedant Fashions Limited IPO

The objectives of the Offer are to

- Achieve the benefits of listing on the Stock Exchanges; and

- Carry out the Offer for Sale of up to 3.6 Cr Equity Shares by the selling shareholders.

About the Vedant Fashions Limited

Vedant Fashions Limited (“VFL”) is one of the largest companies in India in the men’s Indian wedding and celebration wear segment and owns the brands Manyavar, Mohey, Mebaz, Twamev, and Manthan.

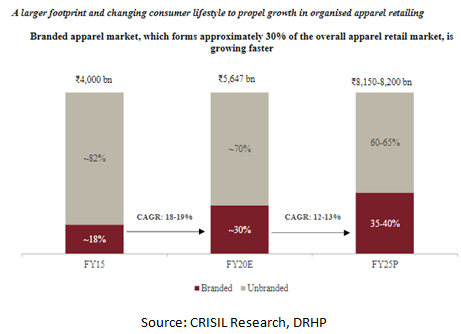

The apparel market in India is largely unbranded and branded apparels have a huge potential for growth. The wedding and celebration wear segment was estimated to be about Rs. 1 lac crores in FY 20 (normal year estimates) of which branded was about Rs. 15,000-20,000 Cr. VFL operates in the mid-market to a premium segment where it has a pan-India presence and is a most recognized national brand. With sales of about ~1,000 Cr, its market share is currently small. It, therefore, has a long runaway, making it attractive.

How Vedant Fashions Ltd reaches its Customers?

The company operates a franchisee model with ~85-90% of its revenue coming from franchisee-owned Exclusive Brand Outlets (EBOs). With each franchisee, the company typically enters into one of two possible types of arrangements, where: either (i) the franchisee is responsible for all of the store-related costs; or (ii) the company is responsible for the rental expenses of the EBO, but not other store-related costs.

Presence

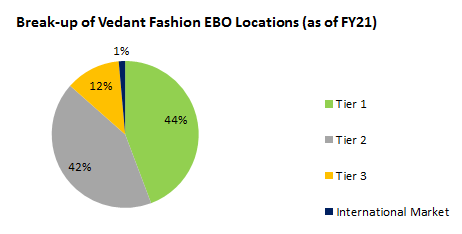

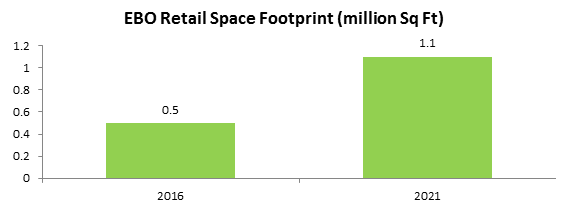

As of September 30, 2021, VFL had a retail footprint of 1.2 MSF (million square feet) in 535 EBOs (including 58 shop-in-shops) spanning 212 cities and towns in India, and 11 EBOs overseas in the United States, Canada, and the UAE.

Impact of Covid-19

Covid-19 has hampered the growth trajectory of the apparel wear and ethnic wear markets. The scale of wedding functions has reduced due to the pandemic-led restrictions on public gathering, which led to a steep decline of approximately 45% to 47% in the overall Indian wedding and celebration category. Mid-segment is mostly dominated by local brands that have smaller balance sheets versus their Pan-India players.

Financials of Vedant Fashions Limited:

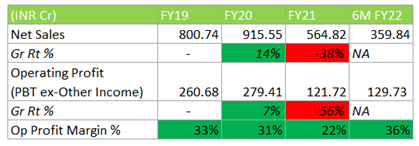

The revenue of the company has grown at a CAGR of 16% from FY16 to FY20 (pre-pandemic).

Sale from Manyavar stores is the dominant portion of the business and contributes 80% of the overall revenue.

Future Prospects

- VFL intends to expand their international presence in markets with a large Indian diaspora, strong-rooted Indian traditions, and high spending power such as the United States, Canada, United Kingdom, the Middle East, South East Asia, and Australia.

Aim to double their national footprint over the next few years.

- Scaling up its smaller emerging brands through increased up-selling and cross-selling initiatives, once customers walk-in. Thanks to the pull of its flagship Manyavar brand.

- Company’s marketing initiatives to garner a higher share of the Indian wedding and celebration wear market.

- Acquisitions of ‘Mebaz’ in FY18, a one-stop heritage brand catering to the entire family and sold through its omni-channel network. If successful, it can lead to significant growth.

Management of Vedant Fashions Limited:

Ravi Modi is the Promoter, Chairman, and Managing Director of the company. He has more than two decades of experience in the garment industry. He oversees the design and marketing functions of the company.

Shilpi Modi is the Promoter and Whole-time Director of the company. She has more than two decades of experience in the garment industry. She handles the digital strategy and product lifecycle of the company.

Rahul Murarka is the Chief Financial Officer of the company. He joined the company on December 16, 2013. He has over 16 years of experience in finance, accounting, audits, taxation, and regulatory compliances.

Positives:

- Brand and Market leader in the Indian wedding and celebration wear market with a diverse portfolio of brands catering to the aspirations of the entire family

- Good reach through 535 EBOs in 212 cities/towns.

- A large and growing market

Risks:

- Pandemic led business uncertainties can impact business in the near term

- Ability to retain existing franchisees and attract new franchisees. Any harm to the brand image may lead to the reduced bargaining power of the company in terms acceptable to franchisees.

- Change in preference to western style

- Stronger local brands and players

- Pressure on margins due to heavy marketing spends

Valuation

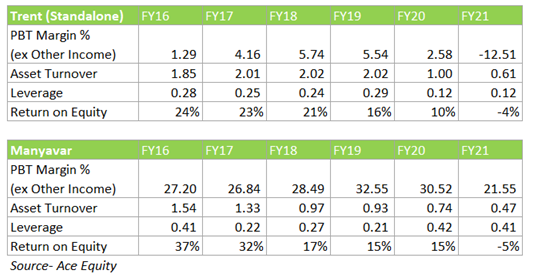

At IPO price of Rs. 866 per share, the company trades at a 1 year forward P/E multiple of ~76x (based on a growth rate of 20% on normalised earnings). The company earns good ROE and has been able to consistently generate margins above 25% and 30% off late.

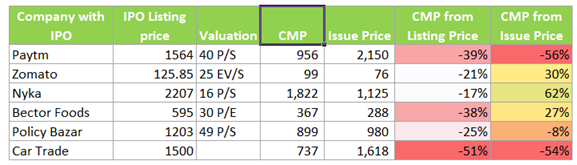

Based on our valuation of businesses growing at a higher rate of 25% and earning above-average ROE of 25%, we believe ~30x is the fair multiple. Looking at the current valuation, we think it is stretched and is factoring in very high growth. The valuation of the company is close to its listed peer Trent Ltd.

MoneyWorks4me Opinion

How is the business model? Good, Great, or Gruesome?

Great! In a retail business, till the time new store addition is significant % of overall stores, profits of the older/mature stores get masked by losses of newer stores. Hence, the full profitability can be attained when the company reaches the optimum level of stores and all the stores are profitable.

The good part is that the company operates in a growing segment plus it has a scope to grow at a higher rate by gaining market share. Considering the current revenue of the company as compared to the market size, it has a long runway ahead. If it can grow with better inventory replenishment and improve its asset turnover, it can incrementally add to better ROE going forward.

We like the business model and the company however; we find it overly priced. Also in the current market where the interest rates are expected to rise, the listing gains of overly priced IPOs can be challenging. We would be reluctant to buy this business at such a high price and for the performance to recover from Covid-19 restrictions and valuation to fall in our comfort zone. In the recent market correction, we have seen most of the high-growth IPOs shedding away their listing gains. Hence, we recommend having a cautious stance in highly-priced IPOs.

However, if you are a high risk-taking individual, this IPO can be looked at as a high-risk investment and you could make a small investment.

Considering the sound business model, industry tailwinds, high cash conversion, we find this as a “good business at an expensive price”. Considering the aggressive valuation and volatile markets and likely increase in interest rates, we recommend AVOID.

Note: We do not recommend buying just because the IPO market is hot. We do not earn any commission or fee for promoting IPOs so expect an honest review from us on a business model and valuation.

| IPO Activity | Date |

| IPO Open Date | Feb 04, 2022 |

| IPO Close Date | Feb 08, 2022 |

| Basis of Allotment Date | Feb 11, 2022 |

| Refunds Initiation | Feb 14, 2022 |

| A credit of Shares to Demat Account | Feb 15, 2022 |

| IPO Listing Date | Feb 16, 2022 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 17 | ₹ 14,722 |

| Maximum | 13 | 221 | ₹ 191,386 |

| Date | QIB | NII | Retail | Total |

| Feb 4, 2022 | 0.06x | 0.06x | 0.22x | 0.14x |

| Feb 7, 2022 | 0.11x | 0.09x | 0.31x | 0.21x |

| Feb 8, 2022 | 7.49x | 1.07x | 0.39x | 2.57x |

When will the Vedant Fashions Ltd IPO open?

Vedant Fashions Ltd IPO will open for subscription on Friday, 04th Feb 2022, and closes on Tuesday, 08th Feb 2022.

What is the price band of Vedant Fashions Ltd IPO?

The price band for Vedant Fashions Ltd IPO is Rs. 824-866/share.

What is the lot size for Vedant Fashions Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 17 shares, up to a maximum of 13 lots i.e. Rs. 1,91,386/-.

What is the issue size of Vedant Fashions Ltd IPO?

The total issue size is ~ Rs. 3,149 Cr.

What is the quota reserved for retail investors in Vedant Fashions Ltd IPO?

The quota for retail investors in Vedant Fashions Ltd IPO is fixed at 35% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on February 11th and refunds will be initiated by February 14th. Shares allotment will be credited in Demat accounts by February 15th.

What is the listing date of Vedant Fashions Ltd IPO?

The tentative listing date of Vedant Fashions Ltd IPO is Wednesday, February 16th.

Where could we check the Vedant Fashions Ltd IPO allotment?

One can check the subscription status on KFintech Pvt Ltd.

What does Vedant Fashions Ltd do?

Vedant Fashions Ltd is one of the largest company in India in the men’s Indian wedding and celebration wear segment and owns the brands Manyavar, Mohey, Mebaz, Twamev, and Manthan.

Who are the peers of Vedant Fashions Ltd?

Listed company peers for Vedant Fashions Ltd are Trent Ltd, Shoppers Stop, Aditya Birla Fashion & Retail.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks and Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, ICICI Bank.

Click here, for the Recent IPO complete list and IPO Historic data 2021.

Make Informed Stock Investing DeciZen

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463