At a very early stage, investors learn that SIP is the best way to invest in the Stock market. While it is true for regular income earners, this strategy is highly inefficient for an investor who already holds a large sum to be deployed into Equity. Data shows that Lumpsum beats the SIP strategy hands down and by a huge margin. If you still prefer the SIP strategy over Lumpsum, be prepared to miss 25% returns. Read on.

Table of Content:

- Is there any secret formula in investing?

- Let us actually witness what history tells us about Lumpsum versus SIP

- Why is that SIP lures investors more than Lumpsum?

- What do we suggest?

Is there any secret formula in investing?

The movie Kung Fu Panda is one of the most loved family entertainers. Panda Po, the Dragon Warrior, is stunned to learn that the Dragon Scroll, the most sought-after secret power, turns out to be blank. There was no secret for limitless power nor was there any secret ingredient in his father’s noodle soup.

Likewise, when investors start their journey in the Stock market, they are told that there is secret formula while investing in Equity. Systematic Investment Plan aka SIP is one such secret formula to be successful in funds/direct Stocks.

We disagree. SIP is not the most efficient way to invest.

SIP is good for those who earn regularly and invest as soon as the salary hits their bank accounts.

If an investor already holds a lumpsum amount, she must avoid investing through SIP. Let us explain why.

Equity is an asset that keeps trending higher. On three out of four occasions it has given a positive return.

Fig 1: Sensex Annual Return scale

Still, investors hesitate to get invested quickly. A typical fear is what if the market tanks tomorrow.

There is no denying that equity investing is a volatile asset. It will have frequent corrections and an occasional crash every few years. But the long-term trajectory is what matters when it comes to investing and it is definitely trending up.

This will be true till the economy keeps growing, we remain a democratic country that allows free markets. We don’t see any reason why Equity will not fulfill our expectation of beating inflation and growing in lines with GDP growth.

Let us actually witness what history tells us about Lumpsum versus SIP.

Say an investor decides to break her Lumpsum into 24-months SIP, a reasonable timeframe to spread out investment to average down our investments.

Instead of investing the entire 10,00,000 as Lumpsum, she decides to break it into 41,500 each and invested every month for 24-months.

We compute Lumpsum returns if it were invested at the start of the 24-month period and compare it with SIP return over those 24-months. We have taken the time period from Jan-85 to Mar-21.

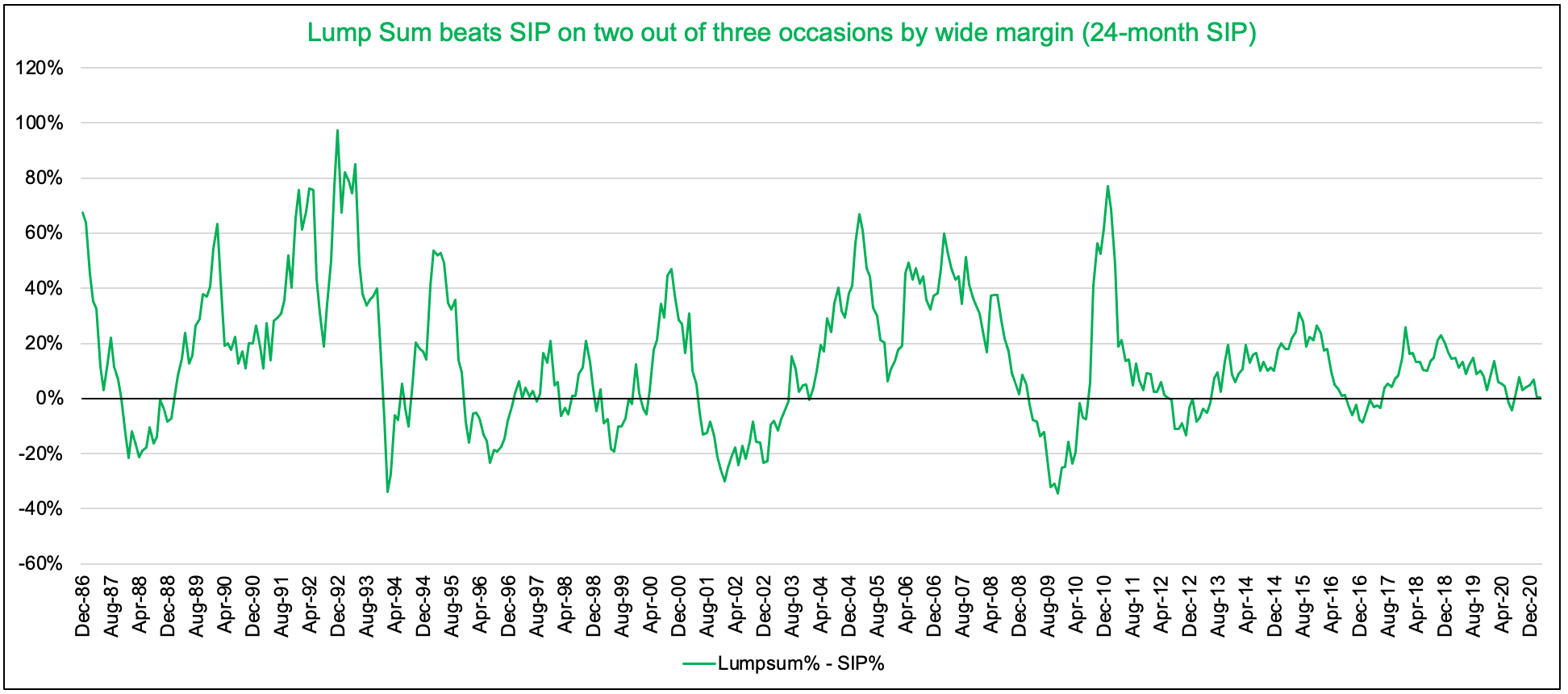

Fig 2: Lumpsum Return – SIP return in % in Sensex 30 index; Jan85-Dec86, Feb85-Jan-87, Mar85-Feb87, and so on…

The above graph shows the difference between Lumpsum and SIP return over every 24-month period for which one would have set up a SIP. What happens post that will be the same outcome for both the strategies as the entire savings is fully deployed.

Lumpsum has done better than SIP on 70% occasions and as high as 100% more returns versus the SIP route.

Elementary maths teaches us that if an asset’s price keeps rising regularly, one has to get on board sooner than later.

That is why we see that an investor would have fared better investing through Lumpsum versus SIP. There are only a few occasions when SIP would have done better than Lumpsum, but odds are highly in favor of Lumpsum.

Besides, Lumpsum beat SIP by a huge margin, ~25% on average, when it fared better than SIP.

Why is that SIP lures investors more than Lumpsum?

What explains this behavioral fallacy? It has to do with loss aversion. In 1979 psychologists Amos Tversky and Daniel Kahneman found out that investors feel the pain of a loss twice as strongly as they feel the enjoyment of making a profit.

Fear of immediate loss is so strong that it grips investors to act in a rational manner. This is despite knowing that Equity will have several such upheavals from time to time in the future too. Those periods are inevitable and inescapable.

So to avoid the emotional pain of seeing an immediate loss (on those 30% occasions when SIP beat Lumpsum), investors opt for suboptimal solutions like SIP with their large sum.

There are numerous studies and research papers that highlight that SIP is not the right strategy to invest in the long term. Read here, here, here

We quote one of the studies,

“There is a general misconception among many investment professionals that Dollar Cost Averaging (DCA) [SIP] is a superior investment strategy in terms of returns. Our research, in addition to several prior studies (see box on page 2), has shown that this is in fact not the case. If not, then why is DCA [SIP] still a popular investment strategy?

One explanation may be investors’ aversion to risk. DCA [SIP] strategies do result in lower volatility. This is a direct function of the assets staying in cash (little to no volatility) for a longer period of time. However, if the long-term asset allocation for an investor suggests a target equity level of ‘X percent, is it still appropriate to invest small portions of capital until the investor reaches the target equity allocation of ‘X? The answer, according to Thorley (5), is no. His research suggests that a buy-and-hold strategy (BH), which would hold the target risky asset allocation of ‘X percent from day 0, results in higher expected returns and lower risk compared to a DCA [SIP] strategy.”

Every month when investors decide to park their lumpsum amount through the SIP route, they lose 25% returns on average because they chose an inferior strategy to get invested in Equity. This is by no means a small return to forgo because we invest in Equity to earn good returns.

What do we suggest?

An investor must quickly invest into funds/stocks after she decides what portion of her portfolio goes into equity as per Asset Allocation. There is no benefit in waiting because the gains are too high to be missed just for the comfort of less volatile but low-yielding assets.

Whenever a customer joins us or adds to her portfolio, we start deploying their portfolio immediately. In past, we have managed to deploy the entire portfolio within 6 months unless stocks were steeply priced in which case the last 10-15% amount stayed in Liquid funds.

Few customers tell us that research and goal planning may take few weeks or a month. We understand this might be true if you have just started or just received a large sum from selling a property, inheritance, or a bonus. One may want to reassess the ultimate utility of this surplus and make minor tweaks to their asset allocation.

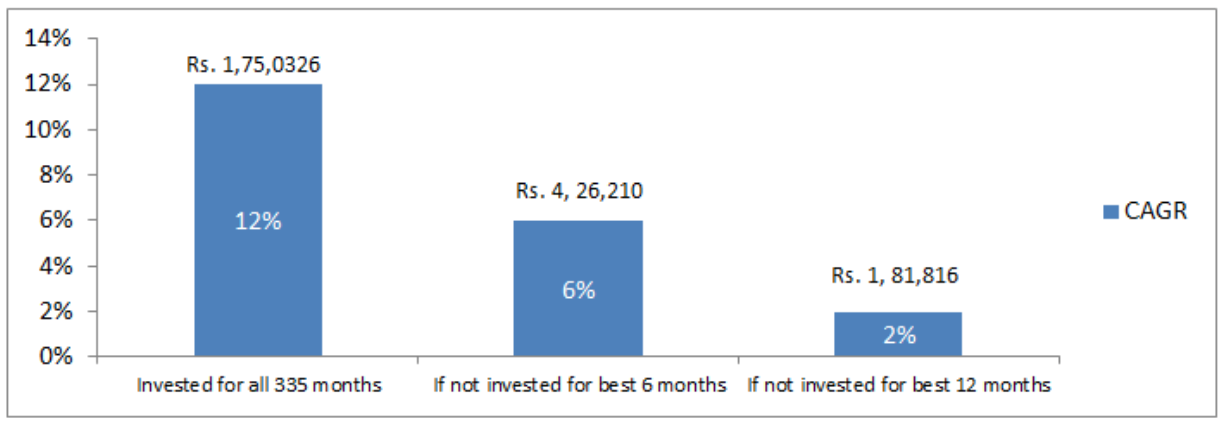

Take a few weeks but don’t delay it any further. Timing the market doesn’t work. Missing the best 6 months reduces your return down to 6% CAGR from 12% CAGR.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: