Real Estate has always been thought of as a reliable & safe investment, where one invests in that second home or piece of land with the motive to earn rental income or capital appreciation. But the most rental yield on these are in the lower single digit (~3%) and capital appreciation is not quite high considering the risk, liquidity, and charges we pay. All these issues from paying government charges to the time required to sell at our desired price make investing in real estate cumbersome. Add to this high ticket size for owning real estate. To cater to this issue REITs & InvITs have been structured from the Individual investor’s perspective, giving access to own real estate at lower ticket sizes in various forms.

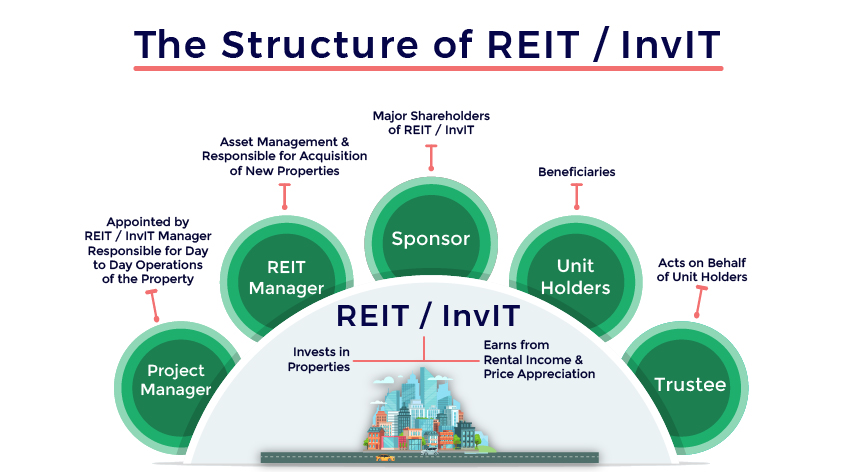

Real Estate Investment Trust (REIT)/ Infrastructure Investment Trust (InvIT) is a tax-efficient entity that owns a portfolio of income-generating real estate/infrastructure assets. These trusts, like mutual funds, issue units against assets held. Trust is created by a sponsor, who transfers ownership of assets. These assets can be held through a Special Purpose Vehicle (SPVs), where REIT/InvITs hold shares, interest-bearing loans, or debt instruments.

REIT/InvIT follow a business model where they lease space, collect rents on the properties/assets, and then distribute that income as dividends to shareholders. REITs invest in commercial real estate, while InvITs invest in infrastructure projects like roads, power plants, transmission lines, etc.

To be qualified as REIT/InvIT as per SEBI regulations trust needs to meet the following criteria –

- 90% of the income (rental less maintenance expenses) must be distributed to the investors in the form of dividends.

- 80% of their assets to be completed & income generating. Not more than 20% can be invested in under-construction properties or debt instruments of a real estate company or shares of listed companies deriving an operating income of less than 75% (~80% for InvIT) from real estate activities/government securities/money market instruments.

- The company must have assets of at least 500 Cr.

- Net Asset Value (NAV) must be updated twice in every financial year.

Why do REITs/InvITs make sense?

- Lower unit size allows an investor to invest in real estate without having massive budgets.

- Trust’s investment size makes investors gain access to premium high-ticket real estate/infrastructure assets by purchasing units.

- Being listed on the exchange, REIT/InvIT units are a lot more liquid than physical ownership.

What to look for in REIT?

REIT catering commercial real estate assets make it essential to look at the average lease term, occupancy rates, location of assets, and how diversified these assets are. The length of lease expiry helps us understand the time left till the property will be vacant. While good diversification of properties across geographies helps reduce volatility associated with price and rentals.

Some listed REITs are Brookfield REIT, Embassy Park REIT, and Mindspace REIT having commercial real estate assets across tier 1 and metropolitan cities in the country.

What to look for in InvIT?

InvIT owns infrastructure assets like highways, power transmission lines, pipelines, etc. which generate tolls, and transmission income. We need to consider assets income generating life (time left till the asset becomes obsolete), costs & maintenance associated, and utility of these assets (revenue might be different than expected) to understand the value of these assets.

Some listed InvITs are Powergrid InvIT (power transmission), India Grid InvIT (power transmission), and IRB InvIT (highways).

Taxing on these investments?

Any amount distributed by InvIT/REIT like interest, dividend, or rental income to share/unit holders is taxed on a personal tax slab. Trust deducts TDS on the such amount distributed.

Capital Gains taxes are charged similarly to debt investments (15% for short term, less than 36 months, and 10% for long term) to the unit holder.

Apart from these trusts, various others like DLF (commercial properties), Blackstone (retail complexes/malls), and several InvITs will emerge in the country. Owning a part of these trusts gives investors a way to include real estate exposure, as well as an income stream in their portfolio.

Best Stocks From:

Nifty 50 Nifty Next 50 Nifty 100 Nifty 200 Nifty 500 Nifty Financial Services SmallCap 250 MidCap 100

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463