If you ever asked “when is a good time to invest in a specific fund”, you are likely to get one of two following answers and some very dirty looks:

“Yesterday”. Meaning you were stupid enough not to have invested in MF earlier and now you are asking an even more stupid question.

“You will never know, so do an SIP and keep investing and don’t bother what the market is doing.”

But you may have lumpsum money to invest or have been doing SIP for long and the corpus is quite large. What do you do? If you have done your asset allocation right, when the market move up and you rebalance you are confronted with the question of what to sell and at the other extreme, what to buy. So it’s a perfectly valid question deserving an answer. May not be the accurate answer, a good-enough one atleast.

Why is knowing the right time to enter a fund important?

This question is not about what is the right time to enter or exit the market, to warrant patronizing answers. It’s about a specific fund. Every good fund manager follows a process. To earn better than market returns, a fund manager constructs a portfolio different than the market following a process or betting on some factor. This portfolio return will not move lockstep with the market return. It will lag or lead the market from time to time. Every outperformance will be followed underperformance and vice versa. Yes there is no process that works all the time. So we need to answer “What is the right time to enter a process?”

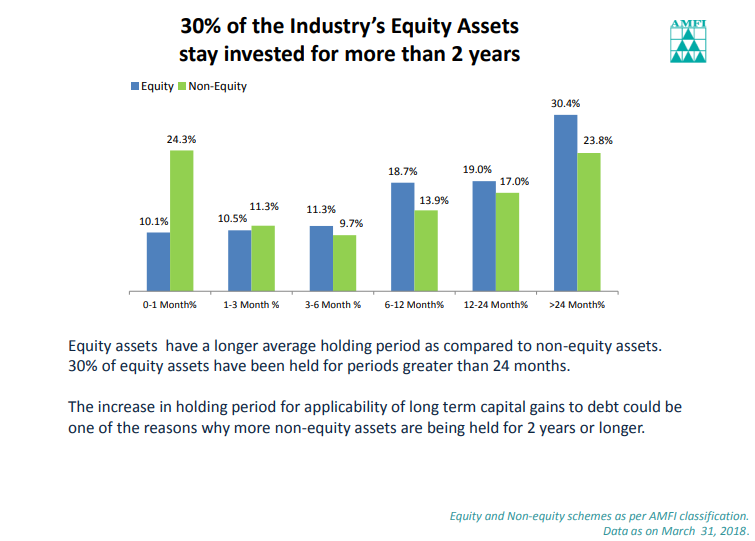

And also it corollary “what is the not the right time to enter a process?” This is very important and perhaps the answer to why >70% investors bail out from an equity mutual fund within 24 months of investment? Despite knowing that investing in equity mutual funds comes with an obvious caveat that you have to stay invested for long term.

The primary reason in our opinion is attributable to immediate underperformance of a mutual fund after purchase. Industry wide practice has been to invest in funds using past performance and selecting the most recent top performer.

Since these particular fund have already performed well, and that means the prices of the stocks they own have risen handsomely. Further increase may not be that stellar, so its underperformance starts which probably last for 12-24 months. This leads to disappoint for an investor and he bails out just before fund’s outperformance kicks in. Using historical data, we identified that latest performing fund gets maximum inflows. And so the numbers bailing out could be large.

Research Affiliates has highlighted in its white paper, “Investors often choose these strategies…based on recent performance…If the performance is due to the strategy becoming more and more expensive relative to the market, watch out!”

An estimate of the future upside helps stay invested and hence success

To avoid this disappointment cause by mistimed entry and exit and in contrast staying invested for longer term in a mutual fund, we recommend funds that are likely to perform in future rather than top past performance. While forecasting future performance is difficult, we do not aim to precisely time it nor are we trying to accurately forecast the future performance. The objective is to save ourselves with a likely disappointing performance triggering our exiting and not maximizing returns by picking the best performing fund. This would promote productive behaviour amongst investors and give them a better mutual fund investing experience. And since we recommend only ‘andar-se-strong’ funds, the performance over 3 years is likely to be reasonably good.

How do we estimate the future upside and how it helps improve returns?

To start with, we focus on Mutual Funds who typically follow buy and hold process as they are likely to have more predictability and higher chance to beat the market as opposed to high turnover funds.

With our expertise and experience to value individual stocks, we compute upside potential for all the stocks held by mutual funds largely. Since mutual fund portfolios are published every month, we estimate their upside from current market prices. This way we have upside potential for every equity mutual fund from today.

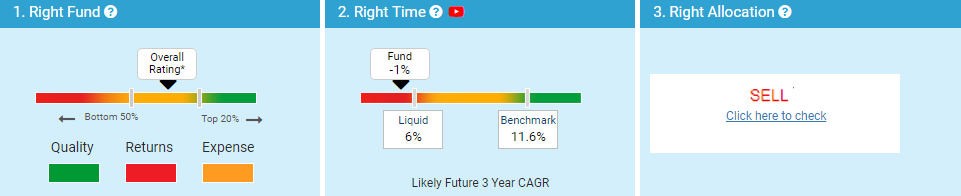

Fund A

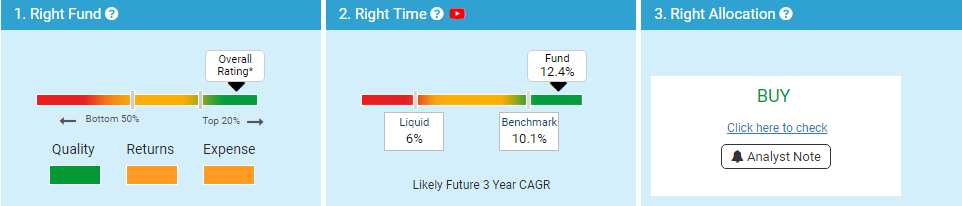

Fund B

A fund holding stocks with relatively low upside potential must be avoided, that’s it! Does it also give us precise answer for which fund would outperform next? Not necessarily! We are not interested in it either. Mutual Fund performance chasing is a futile strategy and no one can do it repeatedly. But as far as we earn our expected absolute rate of return from a fund to meet our financial goals, we must be content with it.

In the above example, investing in Fund B will be more profitable than Fund A which may be a top performing fund at that time (eg. small cap funds at the height of their performance had a very low future upside potential). Fund B may not necessarily earn 12.4% CAGR over next 5 years, but it can definitely earn more return from Fund A which shows upside potential of -1% over next 5 years. Also people holding Fund A would benefit by reducing their holding especially if it is large.

This upside potential tool definitely would improve investor returns and keep him invested in the market longer than average investor. It will improve his absolute returns as he would avoid potential underperforming funds and also not sell a fund early.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: