Investing is a challenging and rewarding activity that can bring great wealth and satisfaction to those who master it. However, not everyone who tries to invest succeeds. In fact, most investors fail to achieve their financial goals and end up losing money in the process. Why is that? What separates the successful investors from the unsuccessful ones? In this blog post, we will explore the three most important reasons why some investors succeed while most fail, and how you can avoid the pitfalls and improve your chances of success.

1. Successful investors have a long-term perspective and patience

The hallmark of successful investors is that they invest for the long term and have the patience to let their investments grow over time. How do they manage to have and sustain a long-term perspective? The simple answer is that they invest to achieve their big financial goals which are usually well into their future. They measure their investing success in term of whether they will achieve these goals despite any problems along the way.

Having this perspective, that investing is a marathon, not a sprint governs their way of investing, and how they make investing decisions. They realize that markets go through ups and downs, but they do not let them affect their confidence or conviction in their plan. They also know that compounding is the most powerful force in investing and that it takes time for it to work its magic. This makes them patient investors

Patience means that you do not expect instant results or gratification from your investments. It also means that you do not react hastily or irrationally to market events or news. You wait for your investments to mature and compound over time, rather than trying to time the market or jump in and out of positions frequently.

Unsuccessful investors have a short-term perspective and impatience. They focus on returns, on the daily or weekly movements of the market, and let them dictate their decisions. They expect quick returns or miracles from their investments and get frustrated or disappointed when they do not materialize. They also try to time the market or trade frequently, incurring unnecessary costs and taxes, eroding their returns, and exposing themselves to making mistakes.

2. Successful investors have a clear process and stick to it

One of the most important factors that determine your investing success is having a clear investing process and following it consistently. An investing process is a decision-making process. It involves answering questions like how to build your portfolio, select stocks that are worth investing in, at what price, and when do you sell. A process-driven decision-making helps you avoid emotional decisions, distractions, and temptations that can derail your progress.

But how do they ensure they implement this process consistently? They do so by organizing their data, information, tools, etc. into a ‘System’ and then develop mastery over using it.

Unsuccessful investors, on the other hand, invest randomly, and impulsively based on gut-feel, tips, hearsay, or hype. They chase after short-term gains or losses without considering the long-term implications. They do not have a clear decision-making process and hence in the heat of the moment are easily swayed by their emotions, biases, or external influences.

3. Successful investors have a diversified portfolio

Another key factor that contributes to your investing success is having a diversified portfolio. A diversified portfolio means that you spread your money across different asset classes, sectors, regions, and strategies. This reduces your exposure to any single source of risk or return and helps you capture the benefits of various market segments. In contrast, a concentrated portfolio is heavily allocated to a few assets, stocks, sectors, etc. While it can potentially deliver very high returns if you get it right, the risks are very high and so is the volatility of the portfolio.

Diversification is crucial for success given that you do not have the expertise, time and temperament to handle losses that come with a concentrated portfolio. It may deliver lower returns in some periods compared to a concentrated portfolio but it will steadily compound and ensure you achieve your financial goals. And this is what matters.

Successful investors diversify their portfolios and do not put all their eggs in one basket or chase after the hottest or best-performing assets.

Conclusion

Investing is not easy, but it is not impossible either. By following some of the principles and practices of successful investors, you can improve your chances of achieving your financial goals and avoiding the mistakes that most investors make. Remember, the key is to have clear long-term financial goals that you want to achieve through your investing, a well-defined decision-making process, and a system that enables you to implement this process and build a diversified portfolio.

We have over 15 Years, developed a better way to invest. A way that is based on proven principles, rigorous research, and consistent performance. A way that can help you achieve your financial goals with less risk and more confidence. A way that is called MoneyWorks4me Core Superstars.

MoneyWorks4me Core Superstars will help you straightway make a strong portfolio of 15-20 high-quality stocks that have strong competitive advantages, sustainable growth prospects, robust financials, and attractive valuations. These are the stocks that can deliver superior returns over the long term, regardless of market conditions. These are the stocks that can make you a successful investor.

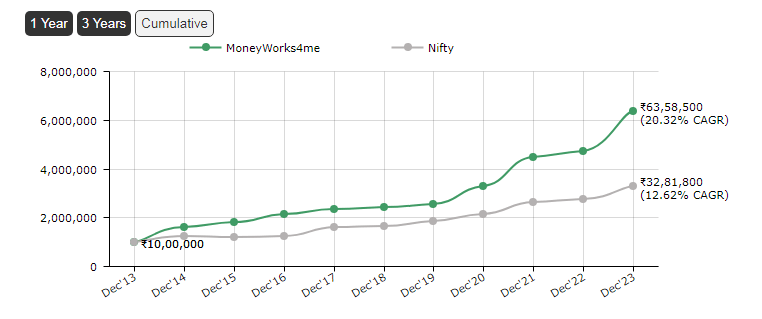

But don't take our word for it. MoneyWorks4me Core Superstars has outperformed the benchmark index by a wide margin since its inception in 2013. See how it has generated an annualized return of 19%, compared to 12% for the Nifty 50. See how it has beaten the market in both bull and bear phases, with lower volatility and drawdowns.

Don't miss this opportunity to join the elite club of successful investors who have benefited from MoneyWorks4me Core Superstars. Click on the link below and start your Investment Journey today.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: