Windlas Biotech Limited IPO Details:

IPO Date: August 4th to August 6th, 2021

Total Shares for subscription: ~87.3 Lakhs

IPO Size: ~ Rs. 402 Cr

Lot Size: 30 shares

Price Band: Rs. 448-460/ share

Market Capitalization: ~1,003 Cr

Recommendation: Avoid

About the Windlas Biotech Limited:

Incorporated in February 2001, Windlas Biotech Limited (“Windlas”) is amongst the top five players in the domestic pharmaceutical formulations contract development and manufacturing organization (“CDMO”) industry in India in terms of revenue.

Windlas provides a comprehensive range of CDMO services ranging from product discovery, product development, licensing, and commercial manufacturing of generic products. This includes complex generics, in compliance with current Good Manufacturing Practices (“GMP”) with a focus on improved safety, efficacy, and cost.

Windlas partners with many of their CDMO customers early in the drug development process, providing them the opportunity to continue to expand their relationship as molecules progress through the clinical phase and into commercial manufacturing.

The company was incorporated as ‘Windlas Biotech Limited’ in February 2001 in New Delhi. Ashok Kumar Windlass, Hitesh Windlass, Manoj Kumar Windlass, and the Promoter Trust are the Promoters of the company. Currently, the Promoters cumulatively hold 70.20% of the pre-Offer, issued, subscribed, and paid-up Equity Share capital of the company.

About the Windlas Biotech Limited Business:

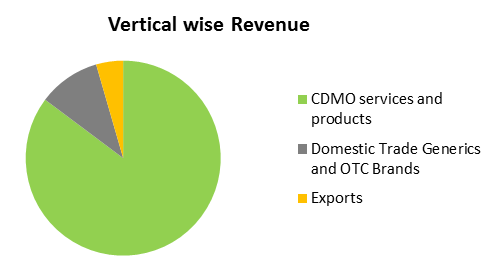

Windlas has 3 distinct strategic business verticals (“SBVs”): (i) CDMO Services and Products; (ii) Domestic Trade Generics and over-the-counter (“OTC”) Brands; and (iii) Exports.

Company’s Domestic Trade Generics and OTC Brands SBV consist of (i) trade generic products; and (ii) OTC brands. Windlas also sells its own branded products in the trade generics and OTC markets as well as exports generic products to several countries.

Windlas has developed relationships with various leading Indian pharmaceutical companies, including Pfizer Ltd, Sanofi India Ltd, Cadila Healthcare Ltd/ Zydus Healthcare Ltd, Emcure Pharmaceuticals Ltd, Eris Lifesciences Ltd, Intas Pharmaceuticals Ltd, and Systopic Laboratories Pvt Ltd. In Fiscal 2020, they provided CDMO services to 7 of the top 10 Indian formulations pharmaceutical companies.

Windlas currently owns and operates 4 manufacturing facilities located at Dehradun in Uttarakhand. As of March 2021, their manufacturing facilities had an aggregate installed operating capacity of 7,063.83 million tablets/ capsules, 54.46 million pouch/ sachet, and 61.08 million liquid bottles.

Management of Windlas Biotech Limited:

Ashok Kumar Windlass is the Whole-time Director of the company. He has over 20 years of experience in the manufacturing and pharmaceutical business in India. He is one of the Promoters and founders of the company. He plays a significant role in the administration, legal and engineering functions of the company.

Hitesh Windlass is the Promoter and Managing Director of the company. He has set up the company’s Domestic Trade Generics, OTC Brands, and Exports SBVs and plays a significant role in driving the technical operations, quality, R&D, manufacturing strategy, and financial strategy of the company. He was previously associated as a process engineer with Intel Corporation, USA.

Manoj Kumar Windlass is the Promoter and Joint Managing Director of the company. He has over 15 years of experience in product development, operations, procurement, and portfolio functions of the medicine business.

Komal Gupta is the CFO of the company. She has experience in the field of finance. Prior to joining the company, she has worked at Perfect Circle India Ltd, Anand Automotive Systems Ltd, and DSM Sinochem Pharmaceuticals India Pvt Ltd.

Shailesh Gokhale is the Chief Operating Officer of the company. He has experience in the field of the pharmaceutical Industry. Prior to joining the company, he has worked at Paras Pharmaceuticals Ltd, Cipla Ltd, Cadila Pharmaceuticals Ltd, Biocon Ltd, ACG Associated Capsules Pvt Ltd, Fresenius Kabi Oncology Ltd, and Pfizer Products India Pvt Ltd. He joined the company on January 15, 2020.

Financials Windlas Biotech Limited:

Windlas has just Rs. 400 Cr in sales volatile financial performance. It is yet to achieve scale to earn a consistent return on equity.

Positives:

- CDMO in India with a focus on the chronic therapeutic category

- Innovative portfolio of complex generic products

Risks:

- High Competition in the industry

- Low scale of operations will hinder its cost efficiency versus peers.

MoneyWorks4me Opinion:

How is the business model? Great, Good, or Gruesome?

Good. Manufacturing and outsourcing of pharmaceuticals in India, either formulations or contract research is a very profitable business model. A few of the reasons for bright future prospects are low cost of operations, limited regulations with respect to environmental and large addressable market like US and other developed markets where drugs go off-patent inviting competition from generics drugs.

However, Windlas’ size of operations is too small to take advantage of the growth in the sector. Companies that earn high returns on equity have large-scale operations which help them produce low-cost drugs or conduct large-scale contract research.

Global firms outsource contract research or development to Indian companies as cost scale helps them conduct end-to-end research with access to human resources at a cheaper cost. Being a small company in this segment, it may find it hard to attract talent and retain them.

We recommend Avoid; However, because of liquidity flows, the stock price may rise as money chases the low volume of shares in a small company like Windlas too.

We have invested in many pharma companies all through 2018-19-20 as they had bright prospects and offered a high margin of safety.

Some of the recommendations include the stocks of the best-performing pharmaceutical like Divis Labs, Syngene, Sequent Scientific, Cipla, Ipca Labs, Dr. Reddys, and Laurus Labs. Today, the prices are quite elevated and we remain cautious on many Pharma companies with few exceptions.

| IPO Activity | Date |

| IPO Open Date | Aug 4, 2021 |

| IPO Close Date | Aug 6, 2021 |

| Basis of Allotment Date | Aug 11, 2021 |

| Refunds Initiation | Aug 12, 2021 |

| A credit of Shares to Demat Account | Aug 13, 2021 |

| IPO Listing Date | Aug 17, 2021 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 30 | ₹ 13,800 |

| Maximum | 14 | 420 | ₹ 193,200 |

| Date | QIB | NII | Retail | Total |

| Aug 04, 2021 | 0.00x | 0.34x | 6.15x | 3.17x |

| Aug 05, 2021 | 0.04x | 1.12x | 13.52x | 7.06x |

| Aug 06, 2021 | 24.40x | 15.73x | 24.13x | 22.40x |

When will the Windlas Biotech Limited IPO open?

Windlas Biotech Limited IPO will open for subscription on Wednesday, August 4, and will close on Friday, August 6.

What is the price band of Windlas Biotech Limited IPO?

The price band for Windlas Biotech limited IPO is Rs. 448-460.

What is the lot size for Windlas Biotech Limited IPO?

Retail investors can subscribe to the IPO minimum lot size is 30 shares, up to a maximum of 14 lots i.e. Rs. 1,93,200.

What is the issue size of Windlas Biotech Limited IPO?

The total issue size is ~ Rs. 401.54 Cr.

What is the quota reserved for retail investors in Windlas Biotech Limited IPO?

The quota for retail investors in Windlas Biotech limited IPO is fixed at 35% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on August 11th and refunds will be initiated by August 12th. Shares allotment will be credited in Demat accounts by August 13th.

What is the listing date of Windlas Biotech Limited IPO?

The tentative listing of Windlas Biotech limited IPO is August 17th.

Where could we check the Windlas Biotech Limited IPO allotment?

One can check the subscription status on Link Intime India Private Ltd.

Who are the leading book managers to the issue?

DAM Capital Advisors Ltd (Formerly IDFC Securities Ltd), IIFL Holdings Limited, SBI Capital Markets Limited

What does Windlas Biotech limited do?

Windlas Biotech Ltd is one of the leading companies in the pharmaceutical formulations contract development and manufacturing organizations (CDMO) segment in India. It offers a range of CDMO services from product discovery to product development, licensing, and commercial manufacturing of generic products including complex generics.

It further sells its own branded products in the trade generics and OTC markets.

Who are the peers of Windlas Biotech limited?

The key players in the domestic formulations CDMO segment include Akums Drugs and Pharmaceuticals, Synokem

Pharmaceuticals, Theon Pharmaceuticals, Innova Captab, and Tirupati Medicare. Abbott Healthcare Ltd, Cipla Ltd, and Alkem Laboratories Ltd are some of the players operating in the Indian trade generics market.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me PRO solution which provides you with exhaustive research-backed recommendations on strong companies, mutual funds, and index funds. You get all this for a price which can be as low as Rs. 4,999. The MoneyWorks4me PRO provides a guide to building a strong portfolio for beginners to become PRO.

Click here, for the Recent IPO complete list and IPO Historic data 2021.

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463