As investors, we are used to seeing the Sensex fluctuate every minute. And to make investing more profitable and not a game of mere chance we need a solution. A solution which could help us ascertain whether the market is over-reacting or under-reacting, whether it is grossly depressed or irrationally exuberant. This is exactly what Sensex@MRP is!

Considering that the Sensex stocks are the top traded stocks of the country, we can expect them to be traded at their MRPs. Thus Sensex@MRP gives an indication of whether the Sensex is fairly valued or whether irrationality is driving the markets. Most of you must have gone through our earlier reports about Sensex@MRP which explained to you how the concept works and can help individual investors. So, with the September 2010 quarter results out for the Sensex companies, where does the Sensex@MRP stand?

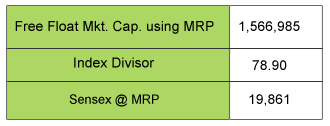

The free float market capitalization at the MRP of the individual stocks as computed by us at MoneyWorks4me.com and using share data as on 22nd November 2010 is Rs. 1,566,985.02 Cr. Using the index divisor 78.90 (as on 22nd November 2010) the Sensex@MRP comes out to 19,861.

So, currently, the Sensex which is close to 19,300 (as of 25th November) has dropped 3% or 500 points below the Sensex@MRP.

This means that the Sensex@MRP has gone up by close to 3% as compared to the Sensex@MRP for the June 2010 quarter which stood at 19,295. This when the Sensex has been pretty volatile climbing to 21,000 during Diwali and then dropping by close to 1700 points over the last few days. So, while the Sensex keeps on moving up and down, the Sensex@MRP has slowly but steadily moved up over the last year or so thanks to a steady growth in earnings. So, how has the earnings performance of the Sensex companies over the September quarter been?

A closer look at earnings

With the preceding quarters witnessing high growth, the earnings expectations for the Sensex companies were again high for this quarter. For the September 2010 quarter majority of the brokerage houses were expecting earnings growth to be 20%(Y-o-Y). However, analysis of the Sensex companies reveals that while the performance has been decent it has failed to live upto the market expectations. The average earnings growth rate for the Sensex companies stood at close to 15%. Among the 30 companies, 19 companies recorded a Y-o-Y growth in earnings whereas the rest 11 recorded a drop.

Analysis of the half yearly performance of the Sensex companies reveals that the leaders from the Sensex pack have been Jindal Steel, BHEL, Tata Steel, IT major TCs and Mahindra and Mahindra. The quarter saw good performance by companies belonging to the steel & steel products, auto and engineering sectors. Strong demand and higher prices aided steel products manufacturers to post healthy numbers. Jindal Steel reported impressive results backed by higher productivity in the steel business and better price realisations. Tata Steel also surprised the market with its performance aided by higher sales, lower staff costs and higher non-operating income. BHEL continued its excellent performance seen over the last few quarters and also reported good order inflow.

Analysis of the half yearly performance of the Sensex companies reveals that the leaders from the Sensex pack have been Jindal Steel, BHEL, Tata Steel, IT major TCs and Mahindra and Mahindra. The quarter saw good performance by companies belonging to the steel & steel products, auto and engineering sectors. Strong demand and higher prices aided steel products manufacturers to post healthy numbers. Jindal Steel reported impressive results backed by higher productivity in the steel business and better price realisations. Tata Steel also surprised the market with its performance aided by higher sales, lower staff costs and higher non-operating income. BHEL continued its excellent performance seen over the last few quarters and also reported good order inflow.

As expected the companies which lagged behind in growth included Telecom majors, Reliance Communications and Bharti Airtel. Cement and infrastructure companies also continued their woes suffering a drop in financial performance. Rising raw material prices seem to be hurting cement companies badly. Companies like ACC and Reliance Infra recorded a disappointing performance. Currently 16 companies out of the Sensex 30 companies are quoting above their MRP. The rest are quoting below the MRP, however just like last quarter, the margin of safety is not much.

So, what should we as investors do?

Sensex has been close to its fair value over the last 2 quarters. At the current levels of 19,400, Sensex is just 2.29% below the Sensex@MRP. This after a heavy FII inflow led to the Sensex reaching 21,000 and crossing the Sensex@MRP. But the rally could not be sustained and what we have seen is a drop of close to 1700 points fueled by profit booking, global cues and events like the housing scam. With speculations that the realty and infrastructure sector could be suffer due to the scam, the sector stocks could probably see a further drop.

While the Sensex continues to hover close to the Sensex@MRP, the next few weeks could see a lot of action due to the over dominance of buying and selling by institutional players – domestic institutions are heavy on buying whereas FIIs seem to be keen on withdrawing. The retail presence has been minimal till now. If indeed FIIs continue to withdraw the chances of a further correction does exist. Hence, investors can get the opportunity to enter fundamentally strong stocks at attractive prices. However, what will be tested is the determination and courage needed to be greedy when others are fearful. The best thing to do now would be:

In case of a further correction, keep a close watch on your stocks and be on the look out to buy if the opportunity presents.

And most importantly log on to MoneyWorks4me.com to find the answer to the million dollar question : What is the MRP of your stock?

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

Based on MoneyWorks4Me’s own principles, one must invest in stocks when there is a safety margin of 50%, correct?

On that same logic, one must even enter the markets when the Sensex is at least 50% of the MRP. Is that not so?

Yes. Value Investing principles advice you to buy with a safety margin of 50%. As you said using the same logic one could feel that the best time to enter the market is when the Sensex is at a 50% discount to its MRP. Though ideal, such an opportunity is not always available. This opportunity presented itself after the tech bubble burst in 2000-01 and during the recent market crash in 2009.

But, even if the Sensex is close to the MRP, you can have your stocks at a discount to the MRP. Remember, the Sensex is composed of just 30 stocks. What the Sensex@MRP gives you is the fair value of Sensex. If Sensex is considerably above the MRP (like it was in 2008), it means that the market is overvalued and any bad news or event could trigger a correction which will most likely affect not only the 30 composite stocks but the other stocks as well. Similarly, if Sensex is considerably below its MRP (like it was in 2000 or 2009), it indicates considerably buying opportunities. Thus, it gives you a yardstick to compare the general mood in the market, whether overly optimistic or pessimistic. So, be sure to check the MRP of the individual stocks as well.

Hope that answers your query.

VERY NICE & LOGICAL ANALYSIS THAT DEFINITELY HELPS US A LOT IN MANY WAYS;…building confidence in oneself, increasing urge to learn & read the situation in methodical manner & etc etc…

THANKS A LOT.

Thanks a lot for the appreciation. Do keep reading and posting your feedback.

what is d discount price of Reliance ?

Please log on to http://www.Moneyworks4me.com to find the MRP and Discount Price of Reliance and the other Sensex companies as well.