Zomato IPO Details:

IPO Date: July 14th to July 16th, 2021

Total Shares for subscription: ~130 Cr

IPO Size: ~Rs. 9,375 Cr

Lot Size: 195 shares

Price Band: Rs. 72-76/ share

Market Capitalization: ~59,623 Cr

Recommendation: Subscribe for risk takers

Purpose of Zomato IPO

- Funding organic and inorganic growth initiatives

- Meet general corporate purposes

About the Zomato Limited

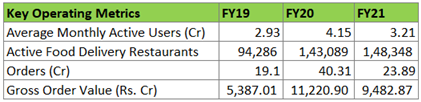

Zomato Limited (“Zomato”) was incorporated in Jan 2010 as “DC Foodiebay Online Services Pvt. Ltd. Today it is one of the leading Food Services platforms in India in terms of the value of food sold, as of March 2021. During FY21, 32.1 million average MAU visited their platform in India.

As of March 2021, they were present in 525 cities in India, with 389,932 Active Restaurant Listings. Their mobile application is the most downloaded food and drinks application in India in each of the last 3 fiscal years on the iOS App Store and Google Play combined.

Their technology platform connects customers, restaurant partners, and delivery partners, serving their multiple needs. Customers use their platform to search and discover restaurants, read and write customer-generated reviews and view and upload photos, order food delivery, book a table and make payments while dining out at restaurants.

On the other hand, they provide restaurant partners with industry-specific marketing tools which enable them to engage and acquire customers to grow their business while also providing a reliable and efficient last-mile delivery service. They also operate a one-stop procurement solution, Hyper pure, which supplies high-quality ingredients and kitchen products to restaurant partners. Zomato also provides its delivery partners with transparent and flexible earning opportunities.

Zomato has a footprint across 23 countries outside India as of March 2021. They have taken a conscious strategic call to focus only on the Indian market going forward. As of Mar 2021, they were present in 525 cities in India, with 389,932 Active Restaurant Listings. Their mobile application is the most downloaded food and drinks application in India in each of the last 3 fiscal years on the iOS App Store and Google Play combined.

Business of the Company:

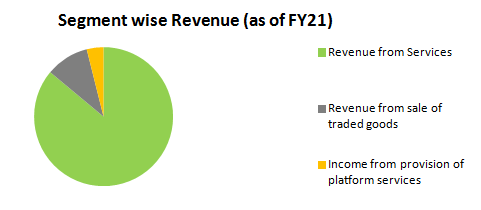

The company’s business is built around the core idea that over time, people in India are going out to eat at restaurants more than they cook at home. To capture value out of this shift in customer behavior, they have two core business-to-customer (B2C) offerings:

- Food delivery (it earns per delivery)

- Dining-out (Restaurants advertise on Zomato platform)

- In addition to their business-to-business (B2B) offering Hyper pure.

- Another important part of their business is Zomato Pro,

Their customer loyalty program encompasses both food delivery and dining out.

There are 3 key stakeholders in their food delivery business:

- Customers,

- Delivery Partners, and

- Restaurant Partners

Management of Zomato Ltd:

Deepinder Goyal is the Founder and the Managing Director and Chief Executive Officer of the company. Prior to founding Zomato, he worked with Bain and Company. He is an IIT Delhi alumnus Batch 2005.

Gunjan Patidar is co-founder of the company and currently the chief technology officer. He joined the company on January 19, 2010. He is an IIT Delhi alumnus Batch 2009.

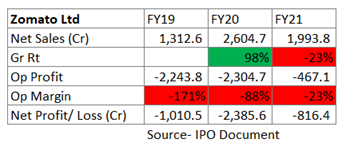

Financials of Zomato Ltd:

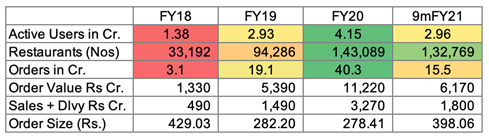

The company has grown its sales at a CAGR of 23% from FY19 to FY21.

Profitability must be viewed from unit economics and not net profits today. Imagine you are selling the best Ice-cream in your town and cater to 5 out of 100 population. You would earn Rs. 5. There are 95 potential people you can reach out to. Should you advertise and increase your market to say 20-30 people i.e. Rs. 20-30 profit at a later date or should you be happy with just Rs. 5 profit?

Zomato is profitable on every order it delivers 9mFY21 gross profit per order was Rs. 23. However, all this profit was spent to reach out to the target market and onboarding more customers through advertisement and other promotional offers.

MoneyWorks4me Opinion

How is the business model? Good, bad, or gruesome?

Good (Potential to become great if scale up with healthy profit per order). Food delivery business is a platform-based business where the platform spends on marketing and getting a large number of customers on board. Once customers get used to it, it monetizes by way of charging them directly or indirectly.

Scaling up: Platform-based businesses usually are “Winner takes all” type of businesses with network effect working for them. Just like everyone in our house installs Whatsapp as all our friends and relatives are on Whatsapp, all restaurants and customers use Zomato (or Swiggy) to order food online. Because all restaurants are available on Zomato, new customers folk to Zomato and vice versa.

We can see the rapid acceleration of active users and restaurants on the platform. We saw a similar trend in Flipkart when initially a lot of users were onboarded with steep discounts till we got used to online ordering. Today Amazon and Flipkart have limited discounts, but we are hooked.

Opportunity size: The food services industry i.e. restaurants/eating outside, today stands at Rs. 5 Lakh Cr. This is just 10% of total spends on Food in India (Rs. 50L Crore) versus 50% in China and the USA. The food services industry is rising rapidly as we become more used to eating out and ordering foods with rising disposable income, women working, and urbanization. However, the benefit of this tailwind is not captured by the restaurant business as it is a very competitive and tough business to crack. However, this trend in the Food industry growth will be captured by commercial real estate owners and platforms like Zomato/Swiggy.

Competition: With the large investment required to get more customers onboard, very few players are left in the Food delivery business, and predominantly Zomato and Swiggy. Rest are either small or they sold their companies to Zomato and Swiggy. This bodes well for rapid scalability without very high investments versus otherwise required when multiple players were available. We believe all tech/platform companies will try their hand and those who scale up faster will ultimately win the game and buy out smaller competitors. This has been happening across the board. There is less fear of competition in Food delivery but more on the ability to scale up with maintaining profitability to fund growth without new equity infusion.

Challenges: Unit economics (Profit per order) may not be very high versus western peers. Typically Indian order size is close to Rs. 300 versus 800-1300 in the west. Delivery costs are fixed irrespective of order size, so one may find a delivery charge of Rs. 30-50/order very high, almost 10-15% of the order value of Rs. 300. However, we have seen that consumer behavior can change to pay the delivery fees due to habitual or convenience reasons.

Where do we go from here?

Zomato and Swiggy will continue to scale up and capture more customers. Till that time, we can’t expect to see profitability. But it is important to track unit economics (profit per order), Gross profit per order, which will help us to conclude that spends on acquiring new customers is worth it for higher profits in the future. We believe if it manages to scale up order size (such that delivery fee is lower as % of order) and minimum number orders in any area (control delivery costs), it has potential to capture huge profits of the Industry which otherwise is captured by customers and commercial real estate and very few restaurants.

Strengths:

- Strong network effect

- Low investment is required after scaling up throwing up a lot of cash after it reaches scale.

Risks:

- Operating losses can lead to high cash burn and frequent equity dilution

- Unit economics (profit per order) are lower versus west.

- Cost of delivery is large component of food ticket size (10-15% vs < 10% abroad)

- Competition exists from players like Swiggy or standalone delivery but the intensity is low.

Valuation – High risk, high return?

Valuing Zomato or any internet platform is difficult when it has not scaled up fully as potential is huge and the seller wouldn’t want to part away from his stake for a low price. More so if it looks like the company might turn out to be a winner.

We would suggest looking at Zomato as optionality. There are a lot of things working in favor of Zomato –

- Industry tailwinds,

- lower competition,

- stickiness from habits, etc.

So if it really scales up with industry growth, it can become at least 5 times today’s size, in 10 years’ time. Since industry size is Rs. 5L Cr and Zomato orders value is just 3% of industry size, it has ample scope to grow. Since it is a platform business, it can trade at higher value versus actual industry as it doesn’t require any capital investment to grow after it has captured the potential market.

Because the company is not yet profitable, as well as it is valued quite high for a very optimistic future, it can’t be a core investment in any portfolio. It will remain a high-risk and high-return investment for a small portion of a portfolio. Such high-risk ventures are usually funded by private equity players that manage smaller, “riskier” portions of HNI or institutional investors’ portfolios; in that case, why should it be any different for a retail investor?

If you like the business model or willing to accept high risk, for ‘potential’ high return (high risk doesn’t guarantee high return), you can SUBSCRIBE in IPO, restricting it to 1% of 2% of your portfolio. You can add to it after listing also if it is available at a more or less similar valuation. (+10-20%)

For others, Subscribe for a listing gain investment and later deploy the funds to more predictable, profitable businesses. We understand that not everyone looks for the ‘best investment’ in the market but steady compounding.

Note: We do not recommend buy just because the IPO market is hot. We do not earn any commission or fee for promoting IPOs so expect an honest review from us on the business models and valuation.

| IPO Activity | Date |

| IPO Open Date | Jul 14, 2021 |

| IPO Close Date | Jul 16, 2021 |

| Basis of Allotment Date | Jul 22, 2021 |

| Refunds Initiation | Jul 23, 2021 |

| A credit of Shares to Demat Account | Jul 26, 2021 |

| IPO Listing Date | Jul 27, 2021 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 195 | ₹ 14,820 |

| Maximum | 13 | 2535 | ₹ 192,660 |

| Date | QIB | NII | Retail | Employee | Total |

| Jul 14, 2021 | 0.98x | 0.13x | 2.70x | 0.18x | 1.05x |

| Jul 15, 2021 | 7.07x | 0.45x | 4.73x | 0.36x | 4.80x |

| Jul 16, 2021 | 51.79x | 32.96x | 7.45x | 0.62x | 38.25x |

When will the Zomato Limited IPO open?

Zomato limited IPO will open for subscription on Wednesday, July 14, and will close on Friday, July 16.

What is the price band of Zomato Limited IPO?

The price band for Zomato limited IPO is Rs. 72-76.

What is the lot size for Zomato Limited IPO?

Retail investors can subscribe to the IPO minimum lot size is 195 shares, up to a maximum of 13 lots i.e. Rs. 1, 92,660.

What is the issue size of Zomato Limited IPO?

The total issue size is ~ Rs. 9,375 Cr.

What is the quota reserved for retail investors in Zomato Limited IPO?

The quota for retail investors in Zomato limited IPO is fixed at 10% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on July 22 and refunds will be credited by July 23. Shares allotment will be credited in Demat accounts by July 26.

What is the listing date of Zomato Limited IPO?

The tentative listing of Zomato limited IPO is July 27.

Where could we check the Zomato Limited IPO allotment?

One can check the subscription status on Link Intime India Private Limited.

Who are the leading book managers to the issue?

BoA Merrill Lynch, Citigroup Global Markets India Private Limited, Credit Suisse Securities (India) Private Limited, Kotak Mahindra Capital Company Limited, Morgan Stanley India Company Pvt Ltd.

What does Zomato limited do?

Zomato with its technology platform connects customers, restaurant partners, and delivery partners, serving their multiple needs. Customers use their platform to search and discover restaurants, read and write customer-generated reviews and view and upload photos, order food delivery, book a table and make payments while dining out at restaurants.

Who are the peers of Zomato limited?

There are no listed peers of Zomato. The unlisted one is Swiggy.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me PRO solution which provides you with exhaustive research-backed recommendations on strong companies, mutual funds, and index funds. You get all this for a price which can be as low as Rs. 1,999 (14% of IPO lot size). The MoneyWorks4me PRO provides a guide to building a strong portfolio for beginners to become PRO.

Click here, for the Recent IPO complete list and IPO Historic data 2021.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463