Dining is no more limited to restaurants; food delivery has gained an equal mindshare in the lives of millennials. People of all ages, from 10-year-olds to those in their 70s, have been users of online food delivery services in India. The growth of this industry is accelerated by changing food habits, work related migration, and more people coming in the workforce. Zomato & Swiggy are now well-known names in most Indian households. In the early years, there was a lot of cash burnt and many companies merged, were bought, or went bankrupt. But now, things have settled, and there are two big companies dominating the market, making it a duopoly.

How Zomato shaped up over the years:

The journey began in 2008 when the company started with the restaurant listings business. This initial venture paved the way for the entry into the food delivery marketplace in 2015. In 2017, the company made a significant move by acquiring Runnr, strategically shifting from a third-party food delivery service to a comprehensive first-party full-stack food delivery business.

As the food delivery business continued to expand, and with access to an extensive network of restaurants, the company further diversified in 2018 by acquiring Hyperpure. This decision was a natural progression, enabling the development of B2B sourcing capabilities through Hyperpure and enhancing last-mile delivery efficiency through the food delivery arm. These strategic steps provided the foundation for entering the realm of quick commerce which made it acquire Blinkit.

Their acquisition history suggests that they have been conscious about the acquisition and ventured into businesses that are adjacent to their core food delivery business and there will be synergies which can be gained from the customer acquisition as well as cost reductions in the operational side.

Today, as the company focuses on scaling its dining-out business, it has identified another promising opportunity in the form of Zomato Live – an events and ticketing business that complements its dining-out operations.

Business segments:

Zomato has evolved itself into a company which provides a holistic approach in the Food business. Its verticals can be described as,

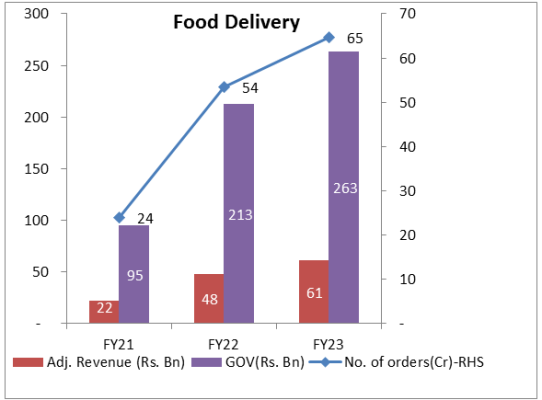

A. Food delivery

Zomato operates a technology platform that provides customers with a convenient, on-demand solution to search and discover restaurants, order food, and have it delivered reliably and quickly. Orders placed on our platform are fulfilled by a last-mile delivery fleet comprising of independent delivery partners who on-board themselves on the platform.

In FY23, 647 million orders were delivered to 58 million annual transacting customers on the Zomato platform.

Zomato Gold:

The Company launched a new membership program in January 2023 with a host of benefits including free delivery on orders meeting certain criteria, on-time guarantee, priority access to more restaurants during peak hours, and exclusive offers from a number of restaurants on both delivery and dining-out.

Zomato has also made Intercity Legends offering exclusively available to Gold members. Customers can become Zomato Gold members by paying a membership fee (~449 Rs per quarter). As at the end of FY23, Zomato Gold had 1.8 million active members. Growing adoption of the Gold program drives a higher frequency of ordering and now contributes to 30%+ of GOV (Gross Order Value) in the food delivery business.

New Initiatives in Zomato

- Intercity legends – Intercity Legends lets customers order iconic dishes of legendary restaurants across the country and have them delivered to their doorstep. How this works: Food is freshly prepared by the restaurant which is packed in reusable & tamper-proof containers and then transported to its destination. State-of-the-art mobile refrigeration technology preserves the food without the need to freeze it or add any kind of preservative. Currently available across 5 cities in India with ~150 restaurant partners onboarded.

- Zomato Everyday– This is a new initiative that aims to bring the taste of home-cooked meals to customers, offering fresh home-style dishes crafted by real home-chefs at affordable prices. Zomato Everyday aims to provide customers with the experience of wholesome meals that are not only affordable but also convenient to order, with a focus on quality ingredients and the care of home-chefs. It’s a way for people to have a taste of home even when they are away from their families. This service is currently operational only in Gurugram.

B. B2B supplies (Hyperpure)

Hyperpure is a B2B supplies service tailored for restaurants in India. It sources fresh, high-quality ingredients directly from farmers, mills, producers, and processors, streamlining the supply chains for its restaurant partners. This approach not only enhances the efficiency and predictability of the supply process but also elevates the overall food quality served by these restaurants.

Hyperpure acts as a one-stop solution, addressing multiple challenges faced by restaurants such as quality ingredients, reliable delivery, cost management, sustainable sourcing, and reduced wastage.

C. Quick commerce (Blinkit):

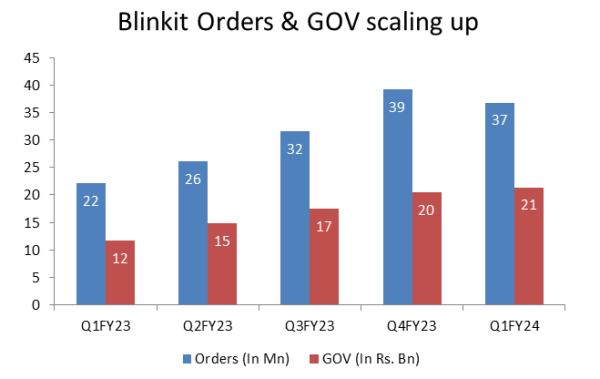

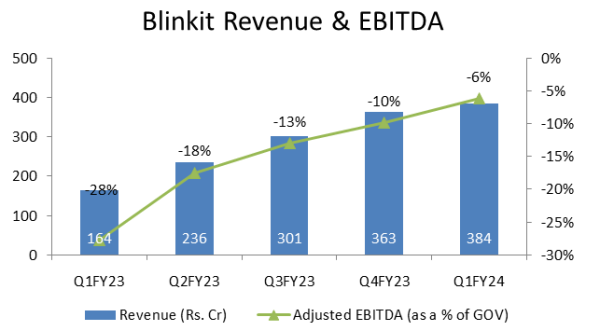

Blinkit is a quick commerce marketplace delivering groceries and essentials to customers within minutes. Zomato completed its acquisition of Blinkit (formerly Grofers) in August 2022 and since then Blinkit operates as a wholly-owned subsidiary of Zomato Limited. Blinkit hosts thousands of SKUs across a variety of product categories, in a network of warehouses and distributed dark stores. Customers can view and order these products on the Blinkit marketplace app. Blinkit also facilitates last-mile delivery of products to customers from dark stores. These dark stores are located close to the customer, within a radius of 2-3 kms which allows for quick delivery. For Blinkit, margin levers for break-even over the next few quarters include wallet share gains and strong operating leverage.

Key metrics:

Scale up of Hyperpure & Blinkit:

Revenue and orders in Blinkit are scaling up really fast as can be seen in the quarterly numbers below:

Path to Profitability:

Earlier this year, Zomato’s management had said it expects to turn EBITDA positive by Q4 FY24 and is eyeing net profitability by Q2 FY25. In a surprising turn of events, the company reported a net profit of Rs. 2 crores in Q1FY24 itself (aided by deferred tax adjustment). This was against the previous year’s loss of Rs. 186 crores. This significant milestone reflected a positive shift in its business model and strategy. This achievement has garnered attention and improved the outlook on the sustainability of this business.

Going forward, we will be seeing the Food delivery business increase its profitability and other businesses grow along with margin improvements. This shall be on account of cost reduction initiatives which were majorly due to a reduction in fixed operating costs like salaries and synergy benefits as the new businesses use core business resources. This provides the company with a potent combination to grow & maintain profitability.

Concerns:

- ESOP Costs: The company rewards its employees with ESOPs. Further issues of significant ESOPS shall impact value creation for minority shareholders.

- Capital allocation: The company currently has Rs. 11,000 Cr of cash & equivalents for maintaining its cash burn in newer businesses and acquisitions. Misallocation of the same in uncorrelated businesses and cash burn being higher than expected to establish a base for Blinkit & Hyperpure shall pose a threat for shareholder value creation.

Management Guidance on Growth:

Management expects to continue to see 60%+ YoY GOV growth in Blinkit business while continuing to improve unit economics as the business is still very nascent, with only ~4 million monthly transacting customers and a limited geographical footprint, especially given the massive size of the opportunity. Based on recent volumes, they are expecting a QoQ GOV growth of 20%+ in Q2FY24. Management believes that the Food Delivery business could get to 4-5% Adjusted EBITDA margin (as a % of GOV) in a few quarters from now.

To Summarise:

Zomato should not be evaluated as a standalone entity but should be evaluated on how it is able to efficiently grow its existing business along with developing new areas of growth by increasing its total addressable market. As the company continues its growth trajectory, it shall identify and seize new opportunities where they have the potential to excel. The history of management suggests they have a flexible approach to business expansion, rather than a rigid mindset about what types of businesses they should or should not pursue. What is important in this endeavor is that they remain prudent in capital allocation along this path of continued growth and innovation.

Best Stocks From:

Undervalued Nifty 50 Nifty 500 – Quality with Price Strength Screener Alpha Cases 5 Stars Rated Stocks from Nifty 500 Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | About | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory