MoneyWorks4me Transact

Understand then Invest

Enter the details in the table below and click Transact now to go to your broking account and execute the order

After the transaction your portfolio will get automatically update on our Portfolio Manager.

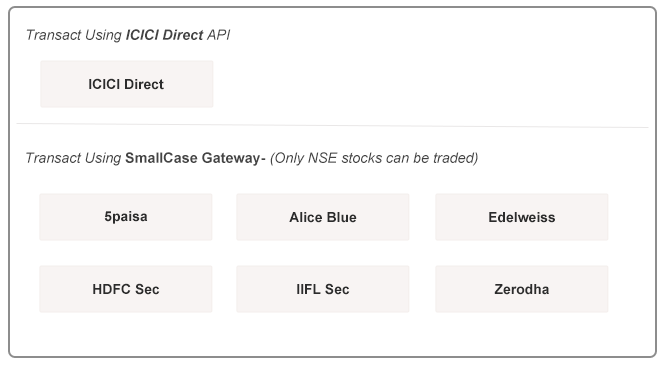

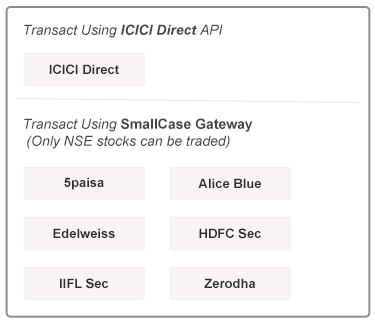

Thanks to smallcase gateway and ICICI Direct we are now able to provide you the facility to move to your broking account*, complete the transaction seamlessly and securely and then update your portfolio on MoneyWorks4me without any hassles to you.

Steps to transacting successfully

- Step 1: Create your order: Once you have decided what investment action you want to take click the Transact button. You will land on the Moneyworks4me Transact page. Fill in the details of what you wish to buy and/or sell and click Transact-now

- Step 2: Login to your broking account: Select your broker from those currently available. You will land on to the login page of your broker where you proceed as usual. You will first complete the login process using your user id and password just like you do currently.

- Step 3: Execute your order: After successful login you will see your order details which you had filled earlier. You can make changes if you wish and then proceed to execute. When the order has been executed you will get a message of successful completion on your screen. If not you will get the reason why it has failed eg inadequate funds. You will not be able to add funds to your ICICI Direct account through this API but will have to go through the regular route. Your Portfolio Manager on MoneyWorks4me will be updated automatically. Please check this before logging out from Moneyworks4me as a good practice.

- Going to the share bazaar without knowing what to buy and at what price is a recipe for disaster. Everybody is trying to sell you something and making it super convenient to buy it. Chances are you will come back with something you don’t need after paying a higher price than its real worth.

- Asking the middleman for investment advice is like asking a barber whether you need a haircut. Some like brokers and fintech players who offer regular mutual fund plans are middlemen you can identify because they earn fees from your transactions. But what about those who don’t, those who offer Direct plans. Their priority is getting very large number of users on their platform because their start-up valuations are dependent on that. And they cannot get these numbers without making investing look simple. Stocks and MF are therefore sold by most players as products that are bought at the click of a button.

- This product thinking has led stock data and MF Fact Sheet being presented as research and investment advice. What you see is like a label on a product. It has the ingredients, specifications, chemical composition, the statutory warning etc , but it doesn’t tell you whether its what you need to get well. Financial health like the health of your body is not possible by consuming some convenience foods. It requires eating healthy (buying the right assets), exercising (disciplined action) and the advice of your doctor (investment advisor).

In investing, research is the dog and execution the tail. Its natural for the dog to wag its tail but in investing its common to see the tail wagging the dog. That’s because research quality and effectiveness is difficult to asses whereas ease of execution is not. And well its easy to conclude that if there’s a tail there must be a dog!

At Moneyworks4me you can’t and don’t make this mistake of letting the tail wag the dog! You are there to take sensible investment decisions based on quality research and advice. And you get that transparently and with no conflict of interest. You have all that you need to understand what you are buying and what is a reasonable price to pay for it. You have the list before you go shopping. Transaction@moneyworks4me makes it convenient to act on your well thought through investment decisions.

Download APP

Download APP