We all know that investing in the stock market is the only way to beat inflation. But while investing in stocks, investors are usually lost as to how to keep a track of the companies they want to invest in, once available at the right price and on how to manage the stocks they already own so as to gain high returns etc.

And this is where the Portfolio Managers from MoneyWorks4me.com come in. The main benefit it offers is that it helps you manage your portfolio effectively so as to gain the best out of your stock investments.

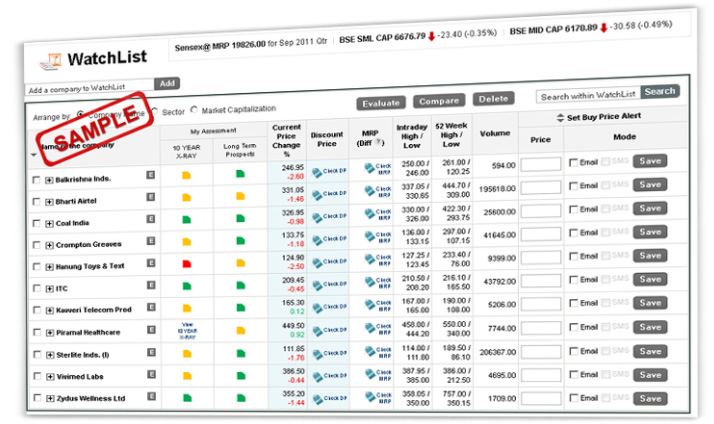

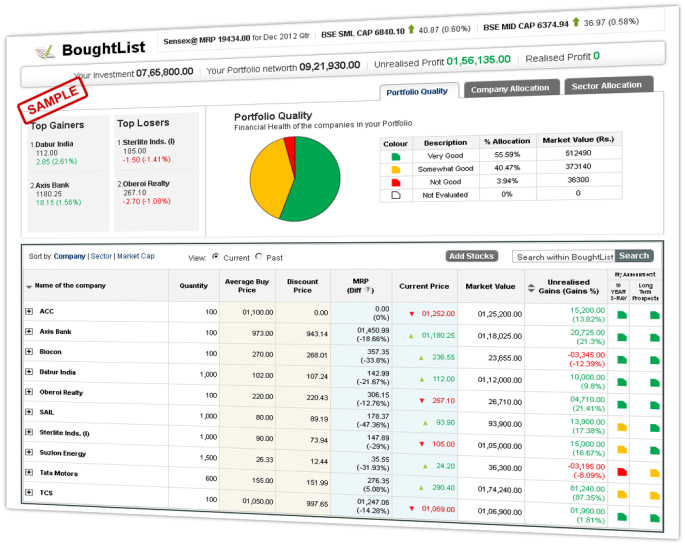

These portfolio management tools i.e. the WatchList and BoughtList managers allow you to keep a watch on your desired list of stocks so that you can make timely investment decisions. They are loaded with unique features which will help you to buy and sell the right stocks at the right time and at the right price.

How are the MoneyWorks4me portfolio tools different? What sets these stock portfolio managers apart?

MoneyWorks4me portfolio management tools have unique features which enable you to understand the fundamental strength of your stocks and the ideal prices below or above which these stocks should be bought or sold. Here's how these unique features will help you take the right decisions:

- Know the fundamental strength of your companies absolutely FREE with our 10 YEAR X-RAY. It colour codes every stock as Green, Orange or Red indicating whether the financial performance has been Great, Good or Risky.

- Assure yourself of the long term future prospects of companies i.e. whether the long term is great, good or risky in the form of colour codes.

- Know the right price to buy and sell a stock by looking at the MoneyWorks4me MRP and Discount price of stocks. Ideally, a stock should be purchased when its price is at or below the discount price and it should be sold when its price is at or above MRP. The MRP is the true (intrinsic) worth of a stock and application of a reasonable margin of safety gives the discount price which is an ideal buy price.

- Analyse the fundamental strength of your portfolio with our 'Portfolio Quality Diagram'. It is a snapshot of your portfolio showing the proportion of your portfolio in Green, Orange and Red (Great, Good and Risky) stocks.

Moreover, the MoneyWorks4me BoughtList has other features which will guide you so that your portfolio is well-diversified among market caps and not over-exposed to a particular sector or company.

All the above features will assure that you take timely investment decisions and manage your stock investments in the most effective manner.

WatchList Manager: To keep you updated about the best buying opportunities

While investing in stocks it is important that once you have selected a fundamentally sound company, you must buy it at an attractive price. Since you need to buy it an attractive discount, you can set your buy price triggers in the WatchList. This helps you identify attractive buying opportunities and you do not have to be glued to the stock market ticker 24*7 to check whether the stock price has reached your desired buy price.

This manager helps you manage your wish-list of stocks, so that you do not miss out any good buying opportunities.

BoughtList Manager: To help you Buy / Sell stocks at the right time & the right price

Once you have invested in certain stocks, you need to keep a close watch on them and manage them in the most effective way. The BoughtList manager with its unique features helps you do just the same. Boughtlist helps you set trigger prices for both buying and selling so that you can make timely buying and selling decisions and make money from the stock market. The main aim of the boughtList is to make sure that your portfolio is optimally diversified.

You will make money from the stock market only when you buy and sell stocks at the right time and at the right price and both the WatchList and BoughtList managers help you manage this effectively.

Now you can manage your Portfolio the most effective way absolutely FREE!