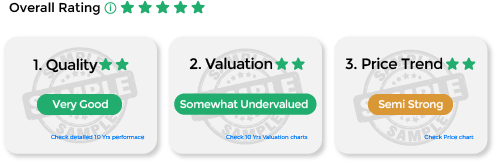

Stocks - Q : Quality | V : Valuation | PT : Price Trend

Funds - P : Performance | Q : Quality

Funds - P : Performance | Q : Quality

| Market Cap | ₹37,990 Cr. |

| P/E Ratio | 36.1 |

| TTM EPS | 8.1 |

| P/B Ratio | 4.26 |

| ROE | 6.84 |

| Debt to Equity | 0.26 |

| Face Value | 1 |

| BVPS | 68.6 |

| 3 Year Sales Growth | 9.91% |

| 1 Day | -0.73% |

| 1 Week | -11.70% |

| 1 Month | -9.90% |

| 3 Months | -22.70% |

| 6 Months | -13.60% |

| 1 Years | -7.80% |

| 3 Years | 0.00% |

| 5 Years | 0.00% |

| 10 Years | 0% |

Adani Wilmar is one of the few large FMCG food companies in India to offer most of the primary kitchen commodities for Indian consumers, including edible oil, wheat flour, rice, pulses and sugar. Commodities, such as edible oils, wheat flour, rice, pulses and sugar, account for approximately 66% of the spend on primary kitchen commodities in India. The company offers a range of staples such as wheat flour, rice, pulses and sugar. Its products are offered under a diverse range of brands across a broad price spectrum and cater to different customer groups. The company’s portfolio of products spans across three categories: (i) edible oil, (ii) packaged food and FMCG, and (iii) industry essentials. A significant majority of its sales pertain to branded products accounting for approximately 73% of its edible oil and food and FMCG sales volume for the financial year 2021 (excluding industry essentials which were offered on a non-branded basis).

The company operates an integrated manufacturing infrastructure to derive cost efficiency across its different business lines. Its integration includes the following means: (i) backward and forward integration. Most of its crushing units are fully integrated with refineries to refine crude oil it produces in-house. It further derive de-oiled cakes from crushing and use palm stearin derived from palm oil refining to manufacture oleochemical products, such as soap noodles, stearic acid and glycerin, and FMCG, such as soaps and handwash; (ii) integration of manufacturing capabilities of edible oils and packaged foods at the same locations. Such integrated manufacturing infrastructure has enabled it to share supply chain, storage facilities, distribution network and experienced manpower among different products and reduce the overall costs for processing and logistics.

Business area of the company

The company is one of the few large FMCG food companies in India to offer most of the essential kitchen commodities for Indian consumers, including edible oil, wheat flour, rice, pulses and sugar. Its products are offered under a diverse range of brands across a broad price spectrum and cater to different customer groups.

Awards, accreditations and recognitions

Major events and milestones

| Market Cap | ₹37,990 Cr. |

| P/E Ratio | 36.1 |

| TTM EPS | 8.1 |

| P/B Ratio | 4.26 |

| ROE | 6.84 |

| Debt to Equity | 0.26 |

| Face Value | 1 |

| BVPS | 68.6 |

| 3 Year Sales Growth | 9.91% |

| 1 Day | -0.73% |

| 1 Week | -11.70% |

| 1 Month | -9.90% |

| 3 Months | -22.70% |

| 6 Months | -13.60% |

| 1 Years | -7.80% |

| 3 Years | 0.00% |

| 5 Years | 0.00% |

| 10 Years | 0% |