The Fast-Moving Consumer Goods (FMCG) sector is brimming with optimism, thanks to an anticipated resurgence in rural demand. And why not? With a good harvest, increased government spending on infrastructure, and rising disposable incomes, the future looks bright. FMCG companies are gearing up to seize this opportunity, with major players planning to invest around Rs 17,200 crore in the near term.

But what exactly makes the FMCG sector so attractive, and what should you look out for when analyzing these companies? Let's dive in.

Understanding FMCG Product Categories

The FMCG sector is divided into three main categories:

- Home and Personal Care: This includes daily essentials like soaps, detergents, skin and hair care products, and oral care items. These products are crucial for maintaining hygiene and personal well-being.

- Healthcare: Think over-the-counter medications, nutritional supplements, and personal hygiene products. These items are essential for treating common ailments, boosting health, and maintaining hygiene.

- Food & Beverage: This category covers packaged foods, beverages, and staples. It caters to the need for convenient meals, drinks, and essential food items.

Why is FMCG So Attractive?

Now, let's talk about why this sector commands such high multiples. Using Porter's Five Forces framework, we can understand the dynamics at play:

- Threat of New Entrants: High barriers due to the significant investments needed for distribution networks and brand promotion. Strong brand loyalty and aggressive advertising by existing players also make it tough for new entrants. While new companies keep on entering, hardly any achieve the scale to become a challenger brand.

- Bargaining Power of Suppliers: Low, as large FMCG companies can dictate prices through local sourcing from a fragmented group of suppliers.

- Bargaining Power of Buyers: Medium, since there are many products and brands to choose from, it reduces brand loyalty.

- Threat of Substitutes: Low in non-discretionary goods, medium in discretionary goods.

- Rivalry Among Existing Competitors: Medium, depending on category penetration, industry is marked by high Ad spends and product innovations.

The FMCG Business Model

FMCG companies usually operate with asset-light business models, focusing on outsourcing manufacturing. This helps reduce capital expenditure and boost return ratios. By leveraging third-party manufacturers and focusing on branding, marketing, and distribution, these companies maintain high profitability and strong return on investment. Their strong cash flows and low earnings cyclicality, due to the essential nature of many products, are also noteworthy. These cash flows are often distributed to shareholders via dividends.

Key Factors to Analyze in FMCG Companies

When analyzing FMCG companies, consider the following factors:

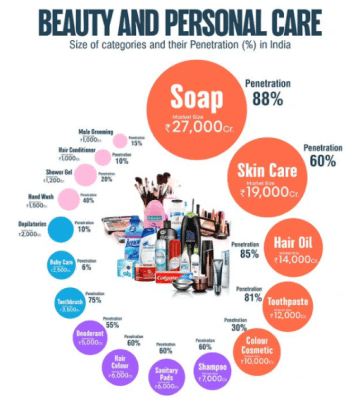

1. Category Penetration: Higher penetration rates indicate widespread acceptance and usage of products. For instance, soap has an 88% penetration rate with a market size of ?27,000 crore, while toothpaste follows with an 81% penetration and a market size of ?12,000 crore. Categories like skin care and hair oil, with penetration rates of 60% and 85% respectively, show room for growth despite substantial market sizes. Lower penetration categories like baby care (6%) and male grooming (15%) represent high growth potential.

Source: CLSA

2. Brand Salience: Strong brand recognition and loyalty drive consistent sales and allow for premium pricing. For example, Dabur and Marico leverage their brand strength to maintain market leadership and drive growth.

3. Volume and Value Growth: Tracking both volume (units sold) and value (revenue generated) growth provides insights into market share gains and pricing strategies. Companies focusing on premiumization, like Nestle, can achieve higher value growth even if volume growth is moderate.

4. Pricing Power: The ability to set and adjust prices in response to cost fluctuations is crucial. Companies like Hindustan Unilever and ITC can pass on cost increases to consumers without significantly affecting demand, demonstrating strong pricing power.

5. Distribution Networks: Effective distribution is vital for reaching consumers, especially in rural areas. Companies with extensive distribution networks, like Nestle and ITC, can capitalize on both urban and rural demand. Expanding direct distribution and leveraging e-commerce platforms are crucial strategies for increasing market penetration.

6. Innovation and Product Development: Continuous innovation helps companies stay relevant and capture market trends. For example, ITC's foray into health and wellness products reflects its strategy to diversify and innovate.

Conclusion

The Indian FMCG sector offers promising investment opportunities, characterized by a favorable demand outlook, strong business models, and supportive government policies. By focusing on key factors such as category penetration, pricing power, brand salience, and distribution efficiency, investors can identify companies well-positioned to capitalize on the sector's growth potential. With a balanced approach that considers both urban and rural dynamics, the FMCG sector in India is set to continue its trajectory of strong performance.

We've identified a large-cap and a small cap company in this category with a presence across various segments. To learn more, check out our recommendations!

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: