If you started as a DIY investor, using free and paid content and research to build your portfolio, you may have been successful so far. However, as your portfolio grows and your life becomes busier, it's important to recognize that what got you here, will not take you there. Getting more expensive research and tools is not going to take you to your larger long-term goals because the bigger constraint to your success at investing is your investing behaviour. But then what are the alternatives?

Some move a chunk of your portfolio to a PMS, or increase allocation to mutual funds; essentially an expert-driven, Do-it-for-me, DIFM way of investing. But then you know that you have given up exerting any control on how your money is invested. And you are paying hefty fees to become that, with no commitment from the service provider to enable you to reach your goals or to do anything specific for you.

If you are offered performance-linked fees and some do, even a large part of the total fees, it’s not wise to accept it because it incentives them to take higher risks to achieve higher returns. And the risks are all to your account but you share the profits if they happen. Does not sit well with me.

But the fact is nobody puts all their equity allocation through this route and hence you will still need to manage the rest of the money. If you don’t then you lose touch with investing and as they say get deskilled.

Or some move a portion of their corpus to fancier asset classes which anyway you cannot do it yourself like crypto, AIF, Options Trading etc. All of them are high risk. And if you think you can succeed at this by listening to some youtube course, then you are a big fan of the School of Hard Knocks.

Then how should your way of investing evolve?

Think about what happens in any sport. You get interested in a sport and start playing it when you can, and as you get better at it, play more often and against better opponents. You get better at the game. You get some tips on how to improve and at some point of time, you go to a ‘class’ or a ‘trainer’ who teaches a group of students like you. You get even better. But what next? This is the stage where almost all DIY investors reach eventually. Maybe you already have.

I can’t see an option like PMS or more MF in sports because it means giving up the sport, not getting better at it. And moving to other asset classes is like trying your hand at a different sport. That’s a different ball game in many ways and a waste.

Now, think of the prize at the end of all this investing. It’s not just more money but what it can do for you and the biggest prize is your achieving Financial Freedom. That’s when your investments are large enough to fund your needs and your dreams. Yes, you don’t have to work for it and you can choose what work you want to do. Now, if that’s what you want and it’s very much possible, what are you willing to do for it? Are you willing to up your game, and achieve greater skill even mastery over your investing? Yes? Then read on.

How do people in sports, music, or dance achieve a higher level of mastery? They get accepted by a Coach who works with them and guides them to mastery. He or she invariably ghas to push them to give up habits that they have learnt along the way that worked in the past but are now unproductive. Coaches pay personal attention to each ‘student’, respecting what they have achieved and working together to reach the next level. A lot of it is about enabling the student to think differently before they can do it differently.

In Investing, it cannot be any different. Investing is all about making informed decisions and acting on them. It is about a better process and about better managing of your ‘self’ when investing – your fears, greed, hopes, habits, etc.

Mastering anything is initially more effort but what is achieved is valuable for a lifetime. And the beauty is that you get better and better at it. In investing this results in improving returns with time. Also, there is much more joy, confidence, and peace on the path to mastery and investing successfully which many will tell you is priceless.

The essence of this relationship between Coach and Investor is working together, collaborating to build and manage your portfolio together as partners. Why is this not very common in investing? Because it takes a very different mindset and commitment to be a Coach. And it needs to set up a ‘System’ to make it possible, productive for both, and effective.

That’s what Omega our Portfolio Advisory Solution is all about. Omega is a Do-it-With-Me, DIWM solution where we partner with you to invest successfully in stocks and mutual funds and reach your goals.

Omega evolved seven to eight years after Superstars - our Research-guided investing solution. It was an answer to what DIY investors, even the most committed and veteran ones told us they needed having used Superstars for a few years. How well does it work in reality? Let's find out.

The Journey of Two Omega Clients!

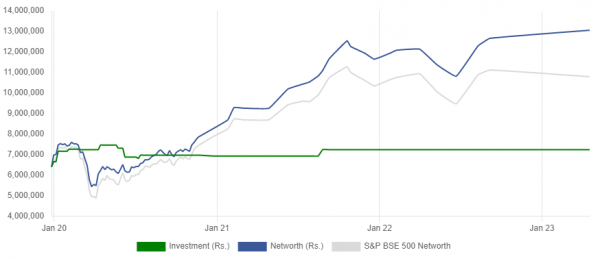

The investor, an established IT professional from IIT Bombay worked with Microsoft and other MNCs, started with an initial investment of approximately 70 Lakhs in mid-2019. We chose this example as it started Pre-covid and the journey tells us how it fared through the steep correction all the way to March 2023. As we write this note, the portfolio XIRR since June 2019 is 20.39%, outperforming the S&P BSE 500's 11.25% return over the same four-year period. And this includes exposure to cash at opportune times and some gold.

The Omega-managed portfolio corrected less than the benchmark index and also recovered faster from the steep correction …...

Disclaimer: Past performance is not an indication of future performance

Another client journey is a portfolio, which started in Dec 2020 with a value of 50 Lakhs. When the journey started the V-shaped recovery post-March 20 was already over. The investor's confidence and conviction grew over time, leading to gradual additions of fresh funds taking the total invested amount to 2cr by Jan 2022.

With appropriate exposures to cash and gold at opportune times, the Portfolio XIRR since Dec 2020 is 24.79%, outpacing the S&P BSE 500's 12.77% return over the same 2.25-year period.

Disclaimer: Past performance is not an indication of future performance

These are not some one-off cases. We have over 225 customers under our portfolio advisory collectively managing over 175 cores with journeys and experiences like the one's mentioned here.

What are the 3 Most important traits in all our Omega success stories?

- High Conviction to deploy significant corpus in a framework proven to work effectively in all market conditions without worrying about daily noise and market movements.

- Effective collaboration with the investment advisor and counsellor on portfolio strategy, asset allocation and financial planning.

- Confident and seamless Execution without trying to time the perfect entry and exits.

Whether you're a seasoned investor or relatively new to the world of investing, Omega will help you navigate the ups and downs of the market and achieve success like our other satisfied clients.

Here are just a few of the benefits you'll receive with our Omega Portfolio Advisory plan that overcome the behaviour challenges faced by a pure DIY investor over multiple market cycles:

- Personalized portfolio recommendations tailored to your specific goals and risk tolerance.

- Access to investment advisors who can answer your questions and provide guidance.

- Alerts and notifications to help you take the required actions. These are not very frequent once your portfolio is aligned.

- Regular and timely review discussions on portfolio and financial planning.

- And much more!

Omega is the perfect next step for investors who want to take their investing and portfolio to the next level.

Talk to us and we will find a way to make this transition easier for you.

If you have an investment portfolio of 25 Lakhs and above and wish to upgrade your subscription, simply express your interest for a discussion below to receive a call from our Investment Advisory Team.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: