TVS Supply Chain Solutions Limited IPO Details:

Estimated Market Cap: ~8,555 Cr

IPO Date: 10th August to 14th August

Total shares: ~4.4 Cr

Price band: Rs. 187- Rs. 197 per share

IPO Issue Size: ~ Rs. 880 Cr

Lot Size: 76 shares and multiples thereof

Purpose of Issue: Fresh Issue and Offer for Sale

About TVS Supply Chain Solutions Limited:

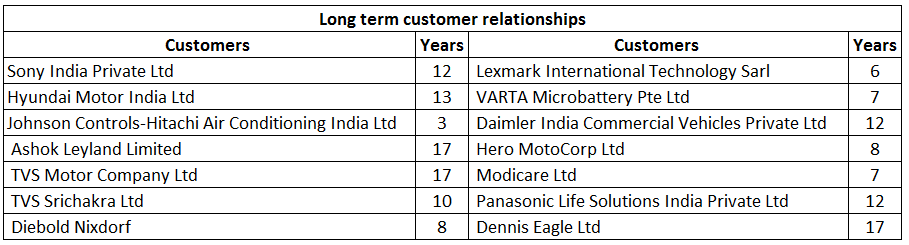

TVS Supply Chain Solutions (TSCS) is an Indian multinational, part of TVS Mobility Group, providing integrated supply chain solutions (ISCS). With over 16 years of experience, it has secured ~7% of the organized supply chain solutions market share (in terms of revenue during FY22). Catering to 70+ Fortune global customers, it has long standing relationships with Ashok Leyland, TVS Motors, Sony India, Panasonic Life Solutions and Johnson Controls-Hitachi Air Conditioning.

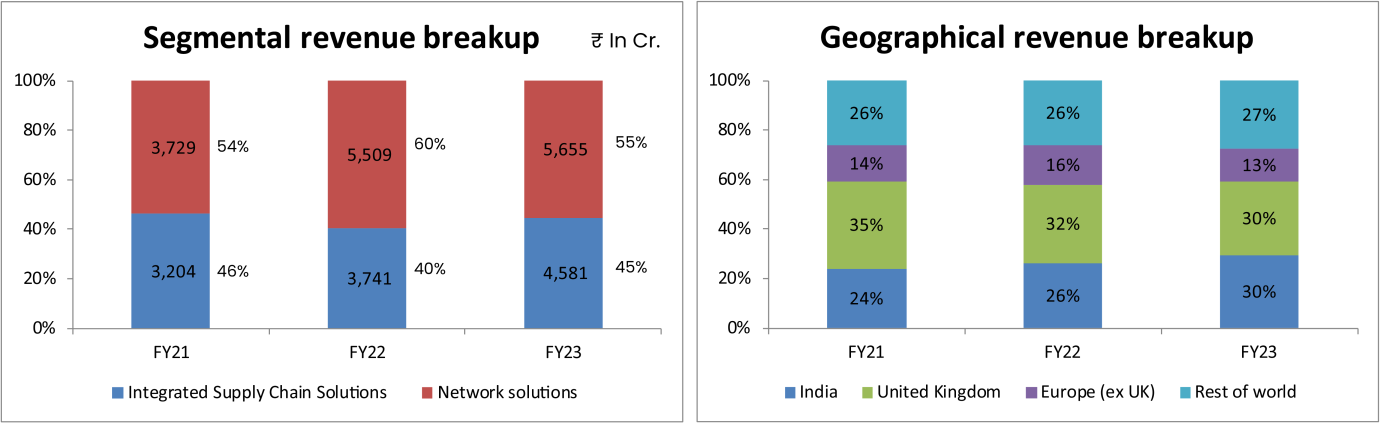

The company offers solutions covering the entire value chain from sourcing to consumption and can be categorized into two segments:

(a) Integrated Supply Chain Solutions (ISCS) include:

- Sourcing and procurement

- Integrated transportation

- Logistics operation centers

- In-plant logistics operations

- Finished goods management

- Aftermarket fulfillment

- Supply chain consulting

The nature of business is driven by outsourcing contracts that define the scope, service levels, and pricing. These typically are multi-year contracts with select contracts ranging up to 13 years. Contribution from this segment stands at ~45% of FY23 revenues and the EBITDA margin profile is better than the NS segment (9% in FY23).

Integrated Supply Chain Solutions Business Model

(b) Network Solutions (NS) includes:

- Global forwarding solutions (GFS): End-to-end freight forwarding and distribution via air, ocean, and land. Driven by engagements that are a mix of both long-term contracts and short-term contracts.

- Warehousing and port storage with value-added services.

- Time-critical final mile solutions (TCFMS): Closed-loop logistics support including spares logistics, break-fix services, refurbishment, engineering support, courier and consignment management. Contracts are a mix of single-year and multi-year engagements.

Contribution from this segment stands at ~55% of FY23 revenues while the EBITDA margin profile stands at ~5% in FY23.

Network Solutions Business Model

Total revenue has ramped up (21% CAGR over FY21-23) aided by domestic expansion

Pan India presence

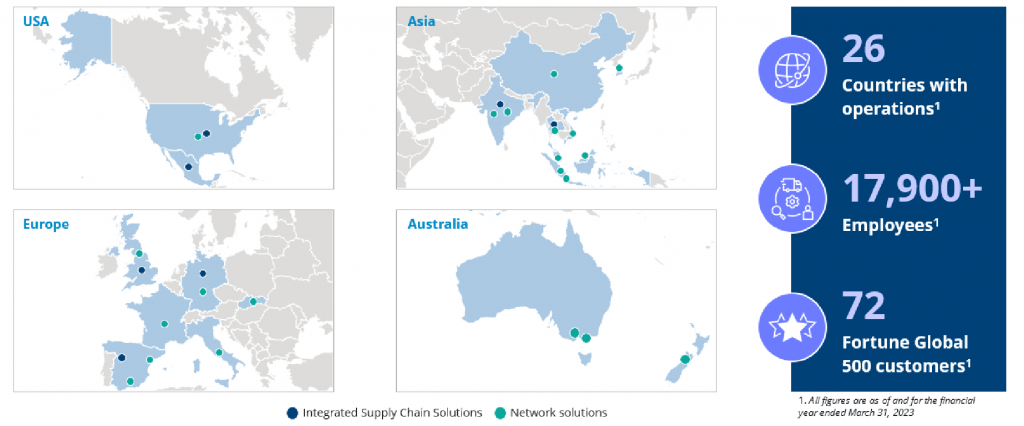

Global Operations

TSCS is well placed to capitalize on huge opportunity size -

In FY22, the domestic outsourced supply chain solutions market (excluding e-commerce) was valued at ~US$7.7 billion, which is estimated to grow to a market size of ~US$21 billion by FY27 (CAGR of ~22%). The global third-party logistics market achieved a value of US$1.4 trillion in 2021. Expected to be US$1.7 trillion by 2026 (8% CAGR from 2020 to 2026). The company's primary global market regions outside of India encompass the United Kingdom, Europe, Asia-Pacific, and North America.

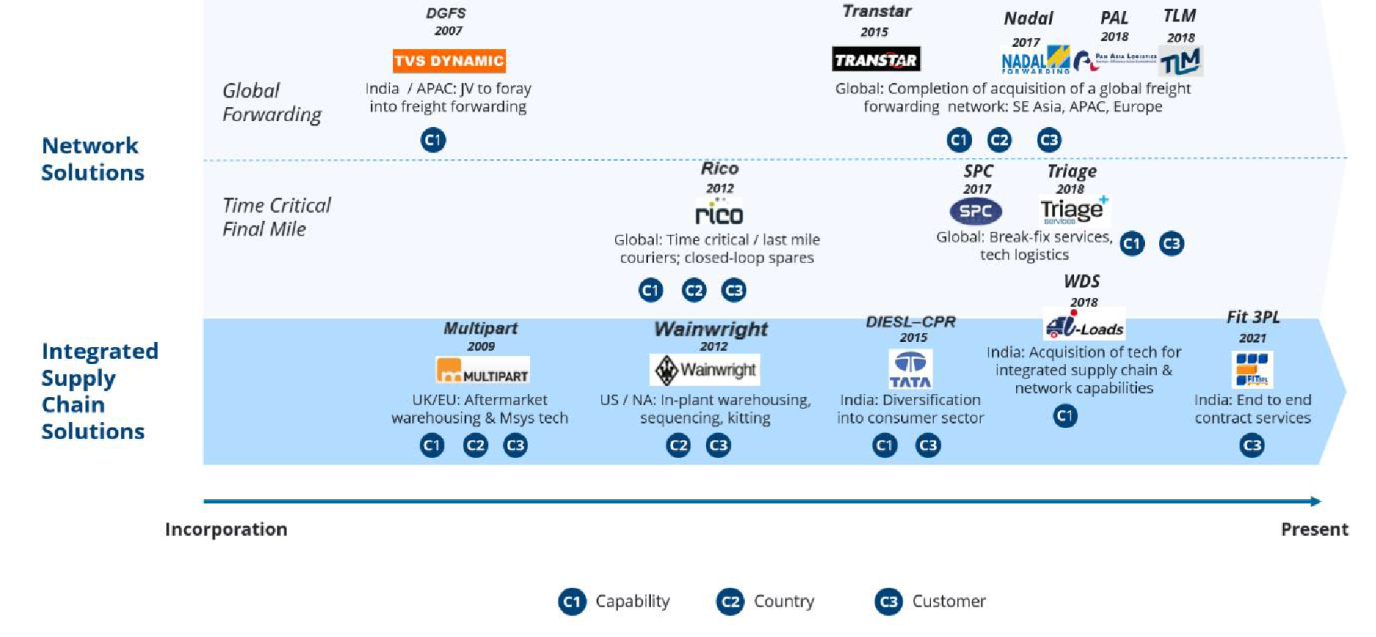

The company's growth strategy is underpinned by the 'C3 Framework', pivotal in achieving overall expansion. This strategy entails:

- Introducing new capabilities to current clients.

- Venturing into fresh geographical markets with existing clients.

- Offering current capabilities to new clientele.

- Deploying capabilities from developed markets to emerging ones, such as India and other parts of the Asia-Pacific region.

Positives

- Asset-light Operations- The company manages warehouses and vehicles through lease agreements with network partners. Despite lacking asset ownership, the company retains control over capacity, fleet, scheduling, routing, storage, and delivery of goods. This control empowers the company to maintain operational quality, boost performance and provide flexible, scalable solutions to meet customer demands.

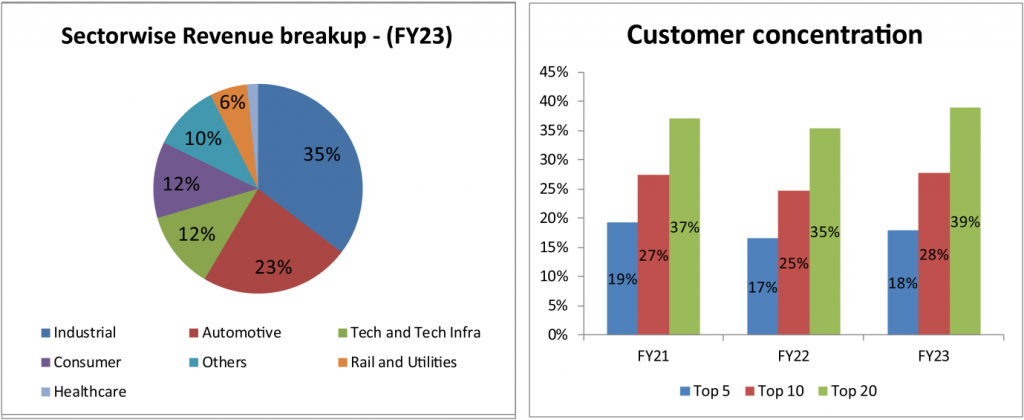

- Diversified sector exposure - The company derives its business from a diversified set of sectors which protects it from any foreseeable substantial downside from any of their customers in those industries. This decreases the chance of a major revenue slowdown that could affect the business adversely. Its customers span across industries such as Automotive, Industrial, Consumer, Tech, and Tech Infra. It has built long-term relationships over the years that can provide visibility to its revenues.

- Technology differentiation - In the face of increasing technological advancements within the logistics and supply chain domain, the company adopts a 'technology-first' approach to its supply chain solutions. The primary focus lies in delivering inventive and adaptable technology solutions with the aim of streamlining customers' supply chains.

Their technological strengths encompass two main components:

- Software Suite: This suite incorporates a blend of proprietary in-house technology solutions like i-Loads, Visibility, Msys, TRACE, Courier Alliance, LCL Consolidated, and e-Connect. Additionally, it incorporates external third-party technologies like CargoWise.

- Technology Infrastructure: Their technology framework is fortified by essential elements such as the smart center control tower, development centers, and dedicated 'Centers of Excellence'.

Strong acquisition history - TVS supply chain solutions boasts a successful track record of inorganic growth through strategic acquisitions to strengthen their capabilities and broaden customer reach. It has acquired more than 20 companies over the past 16 years across Europe, the United Kingdom, the United States, and Asia Pacific (including India).

Notable acquisitions such as Rico Logistics Ltd (UK), Multipart Holding Ltd, Wainwright Industries Inc., and several others have enriched the company's portfolio with diverse capabilities including production support logistics, time-critical final mile services, and integrated supply chain solutions. Moreover, the company's technological ability has been hoisted through acquisitions like I-Loads and Msys, further cementing its leadership in the industry.

Acquisition history with C3 framework

Concerns:

- Foreign currency risk: The company faces foreign currency risk due to non-Indian Rupee loans, trade receivables, trade payables, and export revenue exposure. In FY21/22/23, revenue from the rest of the world segment contributed 76.87%, 73.66%, and 70.43% of the total revenue. In FY21/22/23, foreign currency loans were Rs. 1,282 Crores, Rs. 1405 Crores, and Rs. 1229 Crores, respectively, accounting for 82.83%, 79.64%, and 61.77% of their total consolidated borrowings. While the company has a hedging policy in place, it doesn’t fully mitigate the risk.

- Related party transactions: The Company engages in various transactions with related parties as a part of regular business operations. These transactions primarily involve revenue from logistic services and certain operational expenses like rent. The percentages of related party transactions to the company’s consolidated revenue during FY21/22/23 were 5.19%, 5.22%, and 2.10%, respectively.

Competitors

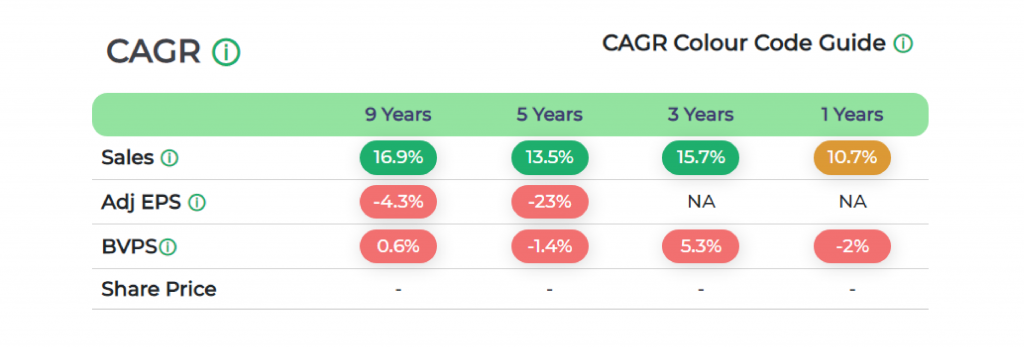

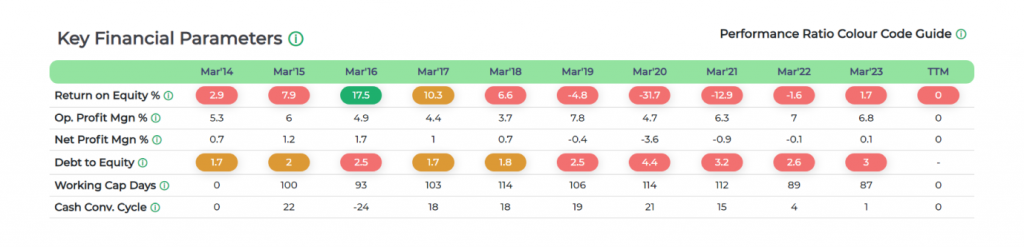

Performance

Management

R Dinesh is the Executive Vice Chairman, a commerce graduate, and an associate member of the Institute of Chartered Accountants of India and the Institute of Cost & Works Accountants of India. He is the director at Ki Mobility Solutions that operates myTVS brand. He is the president of CII National Council, chairman of the CII National Committee on Logistics, and chairs CII Institute of Logistics Advisory Council.

Ravi Viswanathan is the Managing Director. He holds a bachelor’s degree in electronics and communications engineering from the University of Madras with over 30 years of experience in the technology industry. Prior to joining, he has been associated with the TATA group for over 29 years holding various positions. He was formerly the president of the Madras Management Association, a member of the board of governors of the NIT, Tiruchirapalli, and has been part of the Executive Council of NASSCOM.

Kameswaran Sukumar is CEO of domestic operations. He holds a bachelor’s degree in technology on metallurgical engineering from IIT, Madras, and a PGDM from IIM, Ahmedabad. He has 27 years of experience in strategy development and operations. Prior to joining TSCS, he has worked with Maruti Udyog, Airtel as head - market planning, Tata Teleservices as senior VP, the consumer market business unit, AFL Private as CEO - express division which was acquired by FedEx Express.

Jonathan Croyden is the CEO of Rico group (subsidiary- UK operations). He joined the company as the head of technical services - Europe. He holds a national certificate of engineering from Windsor and Maidenhead College. He has several years of experience in technology products and services industry. He has worked with Siemens Nixdorf Information Systems Ltd as a repair engineer, Seimens Business Services Ltd as a customer engagement manager, Fujitsu- Siemens Computers IT Product Services as the head of the remote services group, and Fujitsu Services as operations director.

Ravi Prakash Bhagavathula is the Global CFO and holds a bachelor’s degree in mechanical engineering from Andhra University and an MBA from the University of Delhi. He has over 26 years of experience in finance and strategy. Prior to joining, he worked with Pfizer Ltd as finance director, the Coca-Cola group in various capacities, Procter & Gamble India as assistant manager, and Steel Authority of India as junior manager.

Opinion :

TVS supply chain solutions has an asset-light business model with a diversified customer base and seamless technology offering. We are cautious due to (a) low return ratios, (b) the company turned back profitable last year, (c) headwinds in foreign markets (70%+ of revenues), and (d) multiple levels of execution efficiency requirement. While we maintain optimism about developments in the logistics sector due to the formalization of the sector and outsourcing opportunities, currently, listed peers provide a more favorable risk-reward proposition.

Recommendation: Avoid, due to expensive valuations as listed peers are available at better risk-reward.

Note: We do not recommend buying just because the IPO market is hot. We do not earn any commission or fee for promoting IPOs so expect an honest review from us on a business model and valuation.

TVS Supply Chain Solutions Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | August 10, 2023 |

| IPO Close Date | August 14, 2023 |

| Basis of Allotment Date | August 18, 2023 |

| Refunds Initiation | August 21, 2023 |

| A credit of Shares to Demat Account | August 22, 2023 |

| IPO Listing Date | August 23, 2023 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 76 | Rs. 14,972 |

| Maximum | 13 | 988 | Rs. 194,636 |

TVS Supply Chain Solutions Limited IPO FAQs:

When will the TVS Supply Chain Solutions Ltd IPO open?

TVS Supply Chain Solutions Ltd IPO will open for subscription on Thursday, 10th August 2023, and closes on Monday 14th August 2023.

What is the price band of TVS Supply Chain Solutions Ltd IPO?

The price band for TVS Supply Chain Solutions IPO is Rs. 187-197/share.

What is the lot size for the TVS Supply Chain Solutions Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 76 shares, up to a maximum of 13 lots i.e. Rs. 1,94,636/-.

What is the issue size of TVS Supply Chain Solutions Ltd IPO?

The total issue size is ~ Rs. 880 Cr.

When will the basis of allotment be out?

Allotment will be finalized on August 18th and refunds will be initiated by August 21st. Shares allotment will be credited in Demat accounts by August 17th.

What is the listing date of TVS Supply Chain Solutions Ltd’s IPO?

The tentative listing date of TVS Supply Chain Solutions IPO is August 23th 2023.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: