Sai Life Sciences IPO Details:

Estimated Post-listing Market Cap: ~ Rs. 11,400 Crores

IPO Date: 11th to 13th December, 2024

Fresh Issue: ~ Rs. 950 Crores

Offer for Sale: ~ Rs. 2,092 Crores

IPO Issue Size: ~ Rs. 3,042 Crores

Price band: Rs. 522 – Rs. 549 per share

Lot Size: 27 shares and multiples thereof

About Sai Life Sciences

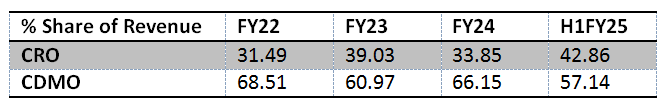

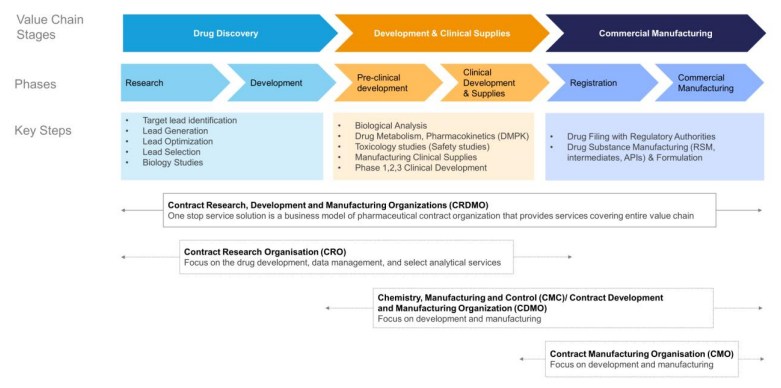

Sai Life Sciences Ltd. (SLSL) is a leading CRDMO (Contract research, development and manufacturing organization) catering to global pharmaceutical and biotech innovators. It provides end-to-end services across the drug lifecycle for small molecule new chemical entities (NCEs), integrating CRO capabilities in discovery with CMC/CDMO expertise in development and manufacturing. Between FY2022 and FY2024, SLSL emerged as one of the fastest-growing Indian CRDMOs in revenue and EBITDA growth. In FY2024 and H1 FY2025, the company supported over 280 and 230 pharmaceutical innovators, respectively, including 18 of the 25 largest pharmaceutical firms globally, while maintaining a strong presence in regulated markets like the US, UK, Europe, and Japan.

SLSL has a robust portfolio of services spanning drug discovery and development. Over the past five years, it supported 200+ discovery programs, resulting in five approved drugs and 40 IND (Investigational New Drug) filings. Its CDMO services cover clinical and commercial-scale API and intermediate manufacturing, with a portfolio of 50 commercial and late-phase products as of September 2024, including seven blockbusters. Strategic facilities in India, the US, and the UK combine cost-efficient production with proximity to innovation hubs. With globally accredited facilities and a team of 2,353 scientific professionals, SLSL is well-positioned to deliver flexible, high-quality solutions, meeting the evolving needs of its clients.

Industry Overview

Global Pharmaceutical Research & Development

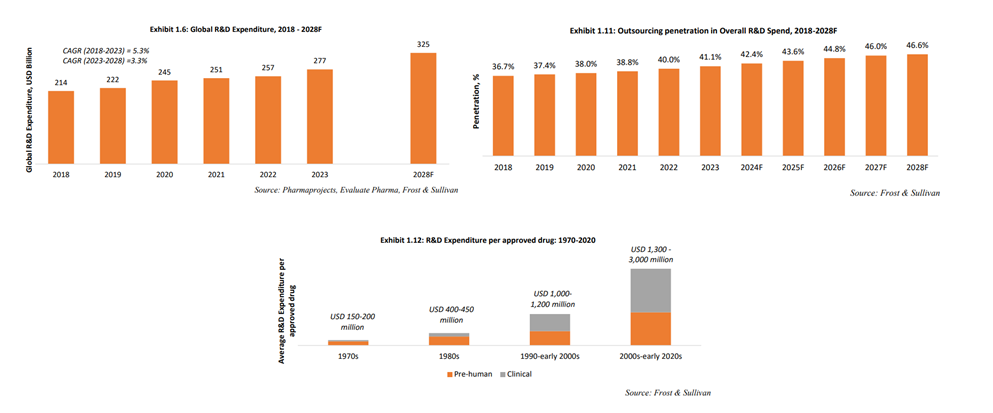

Global pharmaceutical R&D spending has grown from $213.8 billion in 2018 to $276.8 billion in 2023, with R&D outsourcing rising from 36.7% to 41.1% during the same period. By 2028, outsourcing penetration is projected to reach 46.6%, driven by escalating drug discovery costs, which now exceed USD 1 billion per drug—a tenfold increase since the 1970s. Longer drug development timelines, averaging 13.5 years compared to 6 years in the 1970s, and the growing complexity of drug technology and regulations further fuel this trend.

The low success rate of drug development amplifies the need for outsourcing. As of 2023, only 5.9% of drugs successfully advanced from Phase I trials to regulatory approval, a decline from 7.5% in 2010. This uncertainty makes pharmaceutical companies hesitant to invest in in-house manufacturing, preferring external partnerships to manage risks and costs associated with their drug pipelines.

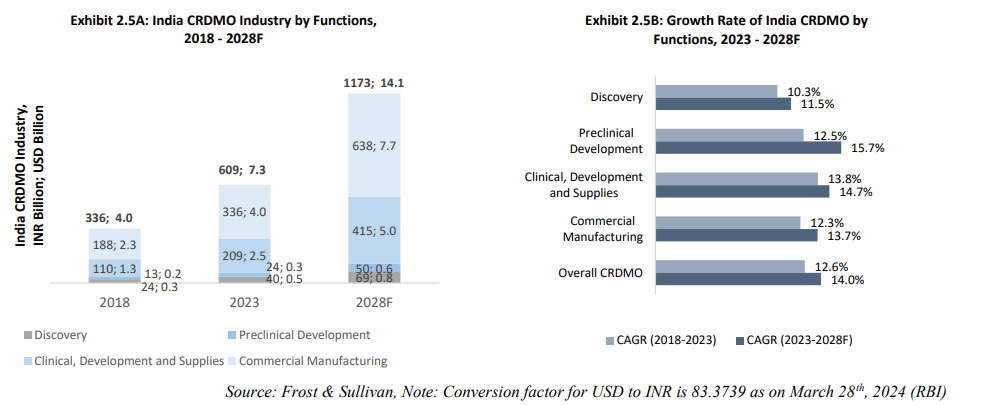

India's CRDMO industry has shown remarkable growth, expanding from USD 4.0 billion (INR 336 billion) in 2018 to USD 7.3 billion (INR 609 billion) in 2023, at a CAGR of 12.6%. It is projected to grow at a faster CAGR of 14.0%, reaching USD 14.1 billion (INR 1,173 billion) by 2028. Pre-clinical development is expected to lead this growth, with a CAGR of 15.7% during FY23-28F, driven by improved technical capabilities and increased R&D outsourcing by global pharmaceutical innovators.

India's CRDMO industry has outpaced its APAC counterparts in growth from 2018 to 2023 and is expected to continue this trend, boosting market share and attracting more global partnerships. The "China plus one" strategy, adopted by many pharmaceutical companies, further supports this demand shift to India, positioning the country as a key player in the global CRDMO landscape.

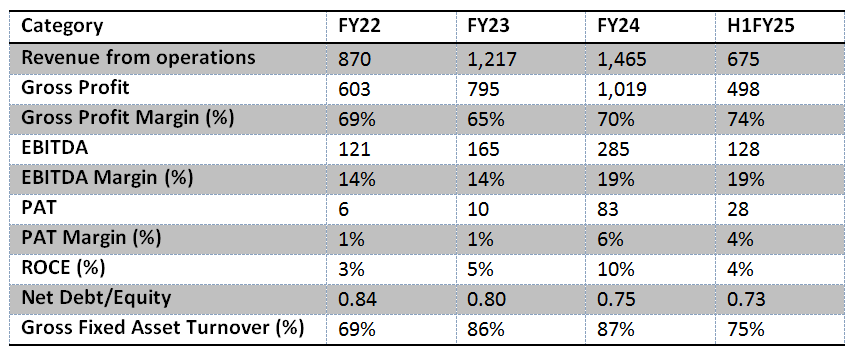

Financial Performance

The company’s financial performance reflects robust revenue growth coupled with the benefits of operating leverage. However, its Return on Capital Employed (ROCE) remains subdued, primarily due to a low gross fixed asset turnover of just 75%. Over the coming years, PAT margins are expected to improve, driven by the impact of operating leverage on EBITDA, and a decline in depreciation as a percentage of sales as fixed asset turnover increases. Additionally, a reduction in interest expenses, aided by the utilization of IPO proceeds, is likely to further enhance PAT margins.

Utilisation of Funds

The company plans to raise Rs. 950 crores through a fresh issue, with Rs. 720 crores allocated for debt repayment in FY25 and the remaining amount earmarked for general corporate purposes.

Positives

One-Stop Platform for Discovery, Development and Manufacturing: Sai Life Sciences Ltd. (SLSL) stands out as one of the largest integrated CRDMOs among listed Indian peers, providing a comprehensive "follow the molecule" platform for drug discovery, development, and manufacturing. This seamless integration across the drug development lifecycle enables SLSL to engage customers at various stages and retain them through successive phases, delivering advantages like faster transitions, cost savings, and innovative solutions. By serving as a one-stop partner, SLSL has become a trusted collaborator for global pharmaceutical companies.

SLSL's CDMO portfolio showcases its dual expertise in developing new processes and seamlessly scaling up technology transfers. As of September 30, 2024, the portfolio comprised 50 late-phase or commercial products, including 34 developed in-house and 16 through external transfers. The company’s CRO services further leverage synergies across biology, chemistry, and DMPK (Drug metabolism and pharmacokinetics), with over 75% of FY2024 chemistry revenues stemming from multi-service clients. This integrated and adaptable approach highlights SLSL’s ability to provide end-to-end, client-focused solutions across the drug development value chain.

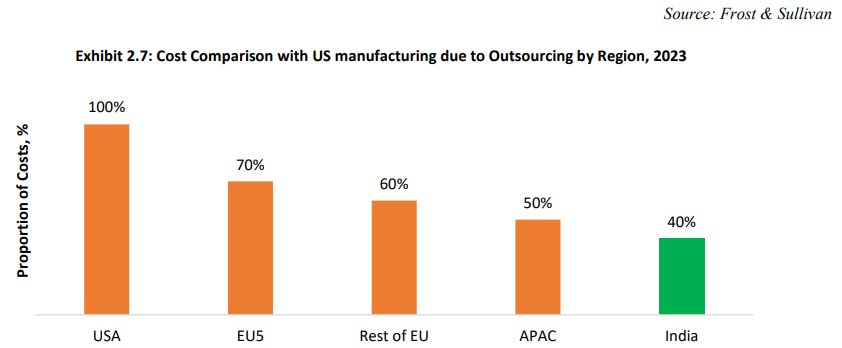

Cost Advantage and Infrastructure Availability: Indian CRDMOs are preferred partners globally due to significant cost advantages, particularly in labor costs, which are much lower than in Europe or the US. India, with a strong pharmaceutical legacy, hosts over 3,000 drug companies and 10,500 manufacturing units. It supplies 20% of the global pharmaceutical market, including 60% of vaccines and 40% of generics for the US. Additionally, Indian firms have extensive experience with regulators like the FDA and EMA and boast the highest number of US-FDA-approved plants outside the US.

Concerns

FDA & Client Audit Risk: Over the past three financial years, the Company has not experienced any contract terminations due to audit observations raised by customers. It maintains an independent quality assurance system to ensure manufactured products meet customer specifications. However, there is no guarantee of passing future audits or inspections to customers’ satisfaction. Any failure in this regard could damage the Company's reputation and lead to the termination of ongoing projects.

While this is a tail risk, its potential impact on the business is substantial. Global innovators operate under stringent timelines due to the high costs of drug development and the limited window to capitalize on profits before patent expiration. Non-compliance could result in prolonged production halts, causing significant opportunity costs and jeopardizing long-term business prospects.

Underutilisation of Capacity:

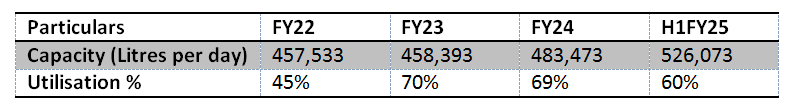

Under-utilization of manufacturing capacities may lead to excess production capacity and higher operational costs. The "follow the molecule" strategy is heavily reliant on the progression of molecules to advanced development phases. However, there is an inherent risk that the volume requirements for such molecules may fall short of the available capacity, potentially resulting in suboptimal utilization of resources and higher cost structures.

Management

Kanumuri Ranga Raju serves as the Chairman and Whole-time Director of the Board. He holds a Bachelor’s degree in Pharmacy from the University of Mysore, along with a Bachelor’s and Master’s degree in Science in Pharmacy from the Massachusetts College of Pharmacy, Boston. Previously, he was a director on the board of Chemrich Fine Chemicals Pvt Ltd. With over 25 years of experience in the pharmaceutical sector, he has been a key part of the company since January 25, 1999.

Krishnam Raju Kanumuri is the Managing Director and Chief Executive Officer of the Board. He earned an MBA from the University of Kansas and attended the 1995 summer program on financial markets at the London School of Economics and Political Science. Formerly, he served as a director at Laxmi Acqua Culture Pvt Ltd. With more than 13 years of experience in business management, he has been associated with the company since May 1, 2004.

MoneyWorks4Me Opinion

With a market capitalization of Rs. 11,400 crores, the company is trading at an FY24 P/E ratio of approximately 140. While the expectation of rapid earnings growth due to operating leverage is understood, it appears that this growth is already priced in, without accounting for the inherent uncertainties. The CDMO business is subject to significant uncertainty, and the information available to investors may not be sufficient to justify such high valuations.

In light of this, we believe that investors should be cautious and avoid subscribing to the stock at these levels.

Sai Life Sciences Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | December 11, 2024 |

| IPO Close Date | December 13, 2024 |

| Basis of Allotment Date | December 16, 2024 |

| Refunds Initiation | December 17, 2024 |

| A credit of Shares to Demat Account | December 17, 2024 |

| IPO Listing Date | December 18, 2024 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 27 | Rs. 14,823 |

| Maximum | 13 | 351 | Rs. 192,699 |

Sai Life Sciences Limited IPO FAQs:

When will the Sai Life Sciences Ltd IPO open?

Sai Life Sciences IPO will open for subscription on Wednesday, December 11, 2024 and closes on Friday, December 13, 2024.

What is the price band of Sai Life Sciences Ltd IPO?

The price band for Sai Life Sciences Ltd IPO is Rs. 522-549/share.

What is the lot size for the Sai Life Sciences Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 27 shares, up to a maximum of 13 lots i.e. Rs. 1,92,699/-.

What is the issue size of the Sai Life Sciences Ltd IPO?

The total issue size is ~ Rs. 3,042.62 Cr.

When will the basis of allotment be out?

Allotment will be finalized on December 16th and refunds will be initiated by December 17th. Shares allotment will be credited in Demat accounts by December 17th.

What is the listing date of Sai Life Sciences Ltd's IPO?

The tentative listing date of the Sai Life Sciences IPO is December 18th, 2024.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks.

With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: