NTPC Green Energy IPO Details

Estimated Post-listing Market Cap: Rs. 91,000 Crores

IPO Date: 19th to 22nd November, 2024

Fresh Issue: ~ Rs. 10,000 Crores

Price Band: Rs. 102 – Rs. 108 per share

Lot Size: 138 shares and multiples thereof

Purpose of Issue: Fresh Issue

Industry Overview

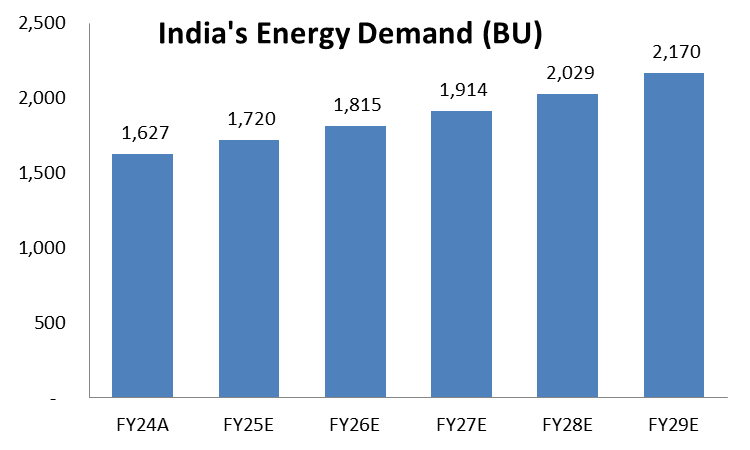

India's energy demand reached 1,627 Billion units (BU) in FY24 and is projected to grow at a CAGR of approximately 5.5% between FY24 and FY29, reaching 2,170 BU. This growth is anticipated to be fueled by infrastructure-related capital expenditure, robust economic growth, and the expansion of the power sector through enhanced transmission and distribution (T&D) networks. Additionally, significant government reforms aimed at improving the power sector's overall health—particularly the financial condition of state distribution utilities—are expected to enhance power supply quality, thereby boosting demand.

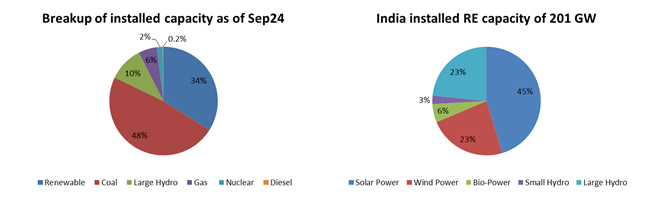

As of September 2024, India’s total installed power generation capacity stood at around 453 gigawatt (GW), with approximately 109 GW added between FY18 and FY25. The total capacity has grown at a compound annual growth rate (CAGR) of about 5% during this period. Renewable energy (RE), including large hydroelectric projects, has been the primary focus of new capacity additions. By September 2024, RE installations had reached approximately 201 GW, up from 114 GW in March 2018, solar representing 45% of the total installed capacity. Solar power has been a major contributor to this growth, with capacity surging to around 91 GW from 22 GW during the same timeframe.

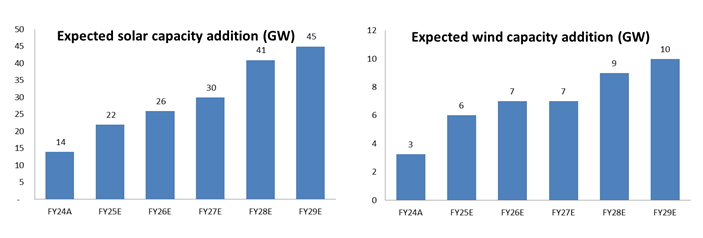

India’s solar energy sector has seen rapid expansion, supported by strong government policies and an aggressive approach to project tendering. Key drivers include advancements in technology, access to affordable financing, government subsidies (particularly for rooftop solar), and the increasing focus on "go green" initiatives. The sector is expected to add around 174 GW of new capacity between FY25 and FY29, supported by various government schemes and the rising corporate emphasis on ESG goals.

Similarly, the wind energy sector in India is poised for significant growth, with an expected addition of approximately 40 GW of capacity during FY25–FY29. This expansion will be driven by a strong project pipeline under existing and new schemes, advancements in wind technology, the push for green hydrogen, renewable generation obligations, and the adoption of hybrid resource models.

Company Overview

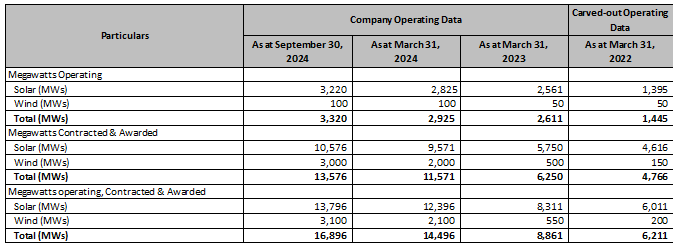

NTPC Green Energy Limited (NGEL), a wholly owned subsidiary of NTPC Limited, is the largest public sector enterprise in the renewable energy sector (excluding hydro) as of September 30, 2024, based on operating capacity and power generation during FY24. The company’s renewable energy portfolio includes both solar and wind assets, with operations spread across multiple locations in more than six states, reducing the impact of location-specific generation variability.

As of 6 months ending September, 2024, NGEL had an operational capacity of 3,220 MW in solar projects and 100 MW in wind projects across six states. Additionally, the company had secured contracts and awards for 13,576 MW of projects and had 9,175 MW of capacity in the development pipeline as of September 30, 2024.

Financial Performance

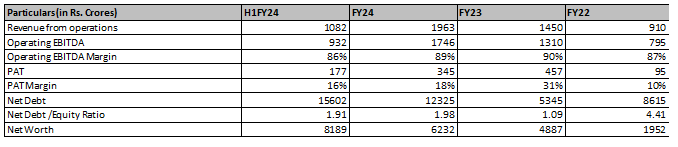

- The company's revenue from operations has grown at a CAGR of approximately 47%, while its operating EBITDA has grown at a CAGR of approximately 48%.

- The company's PAT margin has declined from 31% in FY23 to 18% in FY24. The decline in the PAT margin is attributed to rising interest costs due to the company taking on debt this fiscal year, as well as an increase in depreciation and amortization expenses.

- The company's net debt-to-equity ratio has increased from 1.09 times in FY23 to 1.98 times in FY24.

Strengths

- Strong Parentage and Support: NGEL, a subsidiary of NTPC Limited, leverages its parent’s extensive expertise, financial strength, and focus on renewable energy expansion. NTPC’s target to achieve 60 GW of renewable capacity by 2032 provides NGEL with a solid foundation for growth.

- Diverse and Growing Portfolio: NGEL manages a 26,071 MW renewable energy portfolio, including operational, contracted, and pipeline projects, spread across multiple states. Long-term power purchase agreements (PPAs) and partnerships with public and private entities enhance its stability and reduce location-specific risks.

- Proven Execution Capability: With extensive land assets and NTPC’s economies of scale, NGEL ensures efficient project development and cost management through strategic procurement and experienced in-house teams.

- Strong Financials: NGEL’s revenue and EBITDA have grown significantly, with revenues rising at a 46.82% CAGR from FY22 to FY24. Improved financial leverage and access to low-cost capital further strengthen its position.

Risks

- Off-Taker Risk: The company relies heavily on a limited pool of government-controlled utility companies for the sale of its power. As of September 2024, it had 17 off-takers across 41 solar and 11 wind projects, with its top nine off-takers contributing 98.5%, 97.6%, and 98.0% of revenue in FY23, FY24, and 1H FY25, respectively. Any loss of these key customers or deterioration in their financial stability could significantly impact the company’s operations and financial health.

- Raw Material Risk: The company depends on the availability and cost of solar modules, solar cells, wind turbines, and other essential components. These are sourced from domestic and international manufacturers without long-term supply contracts, exposing the company to risks of supply disruptions and price volatility, which could adversely affect its operations and financial performance.

- Execution Risk: The Company’s growth depends on the timely and successful execution of its contracted and awarded projects. Delays, cost overruns, or execution failures could negatively affect its business and financial results.

- Geographic Risk: With 62.2% of its operational renewable capacity concentrated in Rajasthan the company is vulnerable to disruptions caused by regional social, economic, political, or natural events. Such disruptions could have a significant adverse effect on its operations and financial condition.

Management

Gurdeep Singh is the Chairman and Managing Director of the Company. He has also been the Chairman and Managing Director of NTPC Limited since 2016. He has an experience of more than 18 years as a director in different companies associated with the power sector. He is responsible for the efficient functioning of the corporation and achieving its objectives and performance parameters.

Jaikumar Srinivasan is the Director (Finance) of the Company. He is also the Director (Finance) of NTPC Limited. He is an associate member of the Institute of Cost and Work Accountants of India and holds a bachelor’s degree in commerce from Nagpur University. As the Director (Finance), he is responsible for developing and implementing sound financial policies, control and practices in the organization commensurate with the corporate objectives and goals.

Shanmugha Sundaram Kothandapani is the Director (Projects) of the Company. He is also the Director (Projects) of NTPC Limited. He holds a bachelor’s degree in engineering from Bharathiar University and post graduate diploma in business management from Management Development Institute, Gurgaon, India. He has been associated with NTPC Limited since 1988. As the Director (Projects), he is responsible for ensuring timely construction, erection, commissioning and completion of all projects as per the desired quality and cost framework through an effective project management system.

Utilisation of Funds

The fresh issue of Rs. 10,000 crores would be used in the following manner:

- Rs. 7,500 crores will be utilized for investment in the wholly-owned subsidiary, NTPC Renewable Energy Limited, for the purpose of repayment of debt.

- 2,500 crores will be used for general corporate purposes.

MoneyWorks4Me Opinion

Investors should approach the NTPC Green Energy Limited (NGEL) IPO with caution. While the company benefits from strong parentage, a growing renewable portfolio, and robust financial growth, the risks associated with its business model are significant. These include a heavy reliance on a concentrated pool of off-takers, exposure to raw material price volatility, execution challenges, and geographic concentration risks.

Moreover, the IPO is priced aggressively and does not adequately reflect these operational and financial risks, potentially leading to overvaluation. Post IPO, the Price to Book Value would be 5.2, which is on the high end of the valuation spectrum for utility assets. The sector is young and is in favor, with attractive growth rates, however execution remains to be seen. The pricing does not leave room for upside, especially given the industry’s competitive dynamics and the company’s reliance on government policies and utility relationships.

NTPC Green Energy Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | November 19, 2024 |

| IPO Close Date | November 22, 2024 |

| Basis of Allotment Date | November 25, 2024 |

| Refunds Initiation | November 26, 2024 |

| A credit of Shares to Demat Account | November 26, 2024 |

| IPO Listing Date | November 27, 2024 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 138 | Rs. 14,904 |

| Maximum | 13 | 1794 | Rs. 193,752 |

NTPC Green Energy Limited IPO FAQs:

When will the NTPC Green Energy Ltd IPO open?

NTPC Green Energy IPO will open for subscription on Tuesday, November 19, 2024 and closes on Friday, November 22, 2024.

What is the price band of NTPC Green Energy Ltd IPO?

The price band for NTPC Green Energy Ltd IPO is Rs. 102-108/share.

What is the lot size for the NTPC Green Energy Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 138 shares, up to a maximum of 13 lots i.e. Rs. 1,93,752/-.

What is the issue size of the NTPC Green Energy Ltd IPO?

The total issue size is ~ Rs. 10,000 Cr.

When will the basis of allotment be out?

Allotment will be finalized on November 25th and refunds will be initiated by November 26th. Shares allotment will be credited in Demat accounts by November 26th.

What is the listing date of NTPC Green Energy Ltd.'s IPO?

The tentative listing date of the NTPC Green Energy IPO is November 27th, 2024.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: