When you started earning, the first thing you would have been told especially by people who care about you is that save some money for your future goals. Initially, when the savings were small you just left them in your saving accounts and then moved them into a couple of Fixed deposits and government bonds. But you know that these investments do not grow in value after inflation. And the amount you need to save to meet your goals would require cutting down sharply on your current spending which isn’t practical for everyone. All of us need to earn returns higher than inflation to increase our corpus faster and reach our financial goal with a manageable level of savings.

To make this happen, you rightly conclude the need to invest in Equity markets. The first thing you try is to do it on your own by buying a couple of good-quality stocks or funds based on your reading and browsing on a lazy weekend. Else you would have asked a friend or relative and then check on their suggestions. This, in our opinion, is highly inadequate.

Why do you need an investment advisor?

Research indicates that returns earned by investors are much lower than equity returns. Many expert Fund Managers and Research Advisories may have a stellar track record since inception but their investors haven’t earned equally good returns. Why? Because retail Investors often join the party late and leave it early. They usually buy high, after the recent good performance of equity and sell low, usually after a drop in the market. Or if they did buy at low prices they sell far too early booking small gains. Retail investors are less diversified, usually more small-cap, and own recent performing stocks that may have run their course. This unproductive behavior leads to poor returns, or worse, loss of capital. One bad decision, a one-off unwise bet can derail your financial planning. Poorly managing the savings that you and your family rely on can cost you your goals.

So it is important to have a partner, an advisor to guide you and work for you.

Think of it this way, you often need help in areas that are important but you don’t have adequate knowledge, skills, resources, and time to manage it well, and more so if you don’t see yourself fully equipped to handle this any time soon. Just like you need expert advice from a doctor, lawyer, accountant, you need advice for investing your hard-earned money.

How do you select an Investment Advisor?

Once you are convinced you to need an advisor, you have two challenges. One, can you trust the answer? Every Advisor/Fund Manager posed with this question runs the risk of trying to appear better than what they really are. The methods they chose depend on their values and something they are comfortable with. How do you know if this is suitable for you? Second, how do you assess the answers you get? People tend to evaluate based on past returns, and that is wrong and inadequate for many reasons.

Everyone wants to work with someone who is, competent and trustworthy. But how does one ensure this? Here are some of the challenges:-

- How do we assess someone’s competence in an area where we don’t have sufficient knowledge?

- How do we assess competence when there is a huge time delay before results are clearly visible and so many things change in between?

- If something goes wrong, how do we know whether it is due to incompetence or dishonesty or both or neither?

Who are SEBI Registered Investment Advisors, RIA?

Despite the challenges in finding a competent and trustworthy advisor, we need to find and work with one. Every profession has a regulatory body whose goal is to ensure that competent and trustworthy service is rendered in their profession. Even though they cannot guarantee this will happen every time it seeks to maintain certain standards and hold professionals accountable. Towards this, regulators issue certificates based on competence, usually a certain level of education and sometimes experience and lays down a ‘code of conduct and enforces it as best as possible.

When it comes to the Investment Advisory service, The Securities and Exchange Board of India (SEBI) is the regulator. It issues licenses to run a brokerage firm, a mutual fund, or an advisory. Prior to issuing a license, it lays out criteria for conducting the particular business.

For Investment advisory, SEBI expects the advisor to clear Investment Advisor exams and be qualified with a post-graduate degree in Finance or allied faculty.

SEBI also lays down some important regulations on how RIAs should conduct their advisory business which is mostly to protect investors and then it ensures these are followed by regulating that audits are conducted and also widely communicating these in the public domain.

There is no dearth of charlatans who take investors for a ride with the ‘promise’ of very high returns. If investor’s expectation runs high on returns which are very different than the historical average, they may meet bad fate at the end. The reality is, past performance has no guarantee, and future returns can’t be substantially different versus average.

SEBI through RIAs ensures that investors can expect ethical, competent advice from their advisors.

MoneyWorks4me, through its parent company “The Alchemists Ark Pvt Ltd.” is a SEBI registered Investment Advisor (Registration No. INA000013323).

Why use SEBI Registered Investment Advisors?

Here are some practices that SEBI Registered Investment Advisors (RIA) are required to follow that is very important for you

License to advice

Only SEBI registered investment advisors are allowed to advise. There are clear requirements of educational qualifications and IA certification to qualify as an RIA.

On the other hand, the distributors who are employed to dispense investment products might not be competent and are not allowed to provide investment advice.

Fee-only advice ensures RIAs work for investors’ success

RIAs can charge only a fee directly to investors and cannot earn any revenues eg. brokerage, distributor commissions, etc arising out of the investors’ actions. This ensures RIAs have no conflict of interest and work only for the investor. This fee-only model also drives RIAs to ensure clients’ success through quality advice and service

Distributors don’t charge investors any fees because they earn commissions from the sale of investment products sold through them. This creates a clear conflict of interest. There is no way an investor knows exactly what revenues and benefits are earned by Distributors. They may be sold products that earn the highest commissions for a distributor. Similarly, when a stockbroker doubles up as an advisor you run the risk of getting advice that leads to buying and selling very frequently simply because they stand to gain from it. That’s why SEBI does not allow Distributors and Brokers to act as advisors.

How much to pay for investment advice?

Maximum Fees are capped by SEBI

SEBI has set a cap on advisory fees at 2.5% p.a. MoneyWorks4me charges substantially lower fees versus the regulatory cap and its competitors. With help of a digital website and a single office, we can dispense quality research and advice at a low cost for benefit of investors.

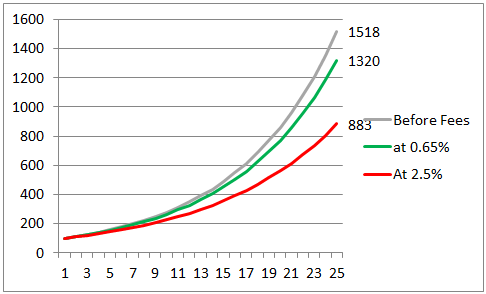

MoneyWorks4me average customer pays approx. 0.65% fees as implied by their portfolio value and fees he pays us. With the relatively lower fees charged by us, Investors get to retain most of their pre-fees returns even over the long run as compared to other high-cost advisors as seen from the below representation.

With MoneyWorks4me investors get to retain almost 90% of pre-fees returns as opposed to less than 60% with high-cost advisors. In the above graph, at 12% CAGR returns over 25years, every rupee invested with MoneyWorks4me can turn into 13x in 25 years versus 9x with a high-cost advisor.

Following guidelines leads to good practices

When RIAs are required to follow regulations and clients can complain to SEBI in case of poor behaviors/experience you can expect overall better quality advice and service than others. For example, IA will seek to understand your investment needs and risk-taking ability and advises products most suitable to you.

However, you still need to understand and agree with the investment process; know the why of the recommendations and for that, you need an RIA who is transparent and willing to share his knowledge and insights and be available for discussions. This is what ultimately convinces investors of the competence and trustworthiness of the advisor.

To summarize, professional advice is a must as investing is too important to fail. A fee-only registered investment advisor is a win-win solution for investors and advisors. You wouldn’t want to risk your financial goals by working with someone whose interests are not aligned with your success.

What we really do as an Investment Advisor?

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: