Dr. Agarwal's Healthcare Ltd IPO Details:

Estimated Post-listing Market Cap: ~ Rs. 2,000 Crores

IPO Date: 29th to 31st January, 2025

Fresh Issue: ~ Rs. 300.00 Crores

Offer for Sale: ~ Rs. 2,727.26 Crores

IPO Issue Size: ~ Rs. 3,027.26 Crores

Price band: Rs. 382 – Rs. 402 per share

Lot Size: 35 shares and multiples thereof

About Dr. Agarwal's Healthcare

Dr Agarwal Healthcare (DAHL) provides a comprehensive range of eye care services. Services include cataract, refractive, and other surgeries; consultations, diagnoses, and non-surgical treatments; as well as optical products, contact lenses, accessories, and eye care-related pharmaceutical products. The company held a market share of ~25% of the total eye care service chain market in India in FY24. In H1 FY25, Dr Agarwal had a total of 737 doctors serving patients across 209 facilities, making it the largest player in eye care service facilities in India. In FY24, the company served 21.3 lakh patients and performed 2,20,523 surgeries.

DAHL operates a "hub-and-spoke" model that enables high patient volumes, economies of scale, and efficient use of doctor resources across its network. This model also offers greater accessibility and choice to patients. Except for one facility, the company has leased all its facilities, allowing for scalable growth with minimal upfront investment. In H1 FY25, the company expanded to 209 facilities in India, up from 106 facilities in FY22.

The network includes:

- 28 hubs: These are Tertiary Facilities, including three Centers of Excellence (COEs) that provide specialized surgical services and training.

- 165 spokes: These include 53 Primary Facilities and 112 Secondary Facilities.

Facility Types:

- Primary Facilities: Non-surgical clinics that serve as patient touch points, providing basic diagnostics, consultations, and teleconsultations with ophthalmologists at other facilities. They are often located in suburban or rural areas and may include pharmacies and optical product counters.

- Secondary Facilities: Surgical centers offering cataract surgeries and clinical investigations, along with the services provided at Primary Facilities.

- Tertiary Facilities: Super-specialty surgical centers with advanced surgical capabilities for retinal, corneal, and refractive surgeries. These facilities include COEs that provide additional services like postgraduate training, clinical research, and centralized quality control.

The company also has a listed subsidiary, Dr. Agarwal’s Eye Hospitals (71.9% stake) and management commentary is to merge the two companies in 3 years via a share swap. Legacy hospitals, based mainly out of Tamil Nadu are in the listed subsidiary, and hospitals based in other states and international facilities are housed in the holding company.

Industry Overview:

India has the highest number of visually impaired people in the world with 1 in 5 people facing vision loss disorder. The Indian eye care market has exhibited an 11.5% CAGR from FY19 to FY24 to reach a value of Rs. 378 billion. This market is further poised to grow at the rate of 12-14% CAGR to reach a market size of around Rs. 550 – 650 billion in FY28. In FY24, eye care formed ~6% of the healthcare delivery market in India.

Surgical market

Surgical treatments are the major contributor to revenues for eye care hospitals with a contribution 80-85% to the revenues, with non-surgical treatments contributing the rest.

The eye care service chains in India contribute about 13-15% of the total eye care market in India. These are part of single-speciality and multi-specialty hospitals spread across various cities. The eye care industry is highly fragmented with a presence of only a few eye care service chains, thus there is a long runway for growth in the organised eye care service market in India

Cataract is the most common cause of blindness in India, accounting for 62.6% of blindness. Cataract surgery has the largest share of eye care surgery in India.

The Indian cataract surgery volume grew by 4-6% CAGR between FY19 and FY24. In future, such surgeries volume is expected to follow a similar growth rate reaching 1.7 - 1.9 crore surgeries in India in FY28, up from the existing 1.4 - 1.6 crore surgeries in FY24.

Growth Drivers for Cataract Surgeries:

- Aging Population

- Rise in Income Levels

- Government and non-government initiatives

- Rise in Diabetic patients

Other surgeries market

40%-50% of the Indian population suffers from refractive eye disorders. The majority of the people affected resolve the problem by using eye spectacles, although many people are now opting for permanent correction surgeries such as LASIK and these surgeries account for 8-10% of the total eye surgeries. Glaucoma contributes the remaining 3-5% of the total surgeries.

Optical market

The Indian optical industry, which covers products like spectacles and contact lenses to address refractive eye disorders, has been growing rapidly, driven by strong demand. Nearly half of the population experiences refractive issues, and with greater awareness and better access to optical products, the demand is no longer limited to urban areas but is also spreading into rural regions. The industry’s market size increased from Rs. 205 billion in FY19 to Rs. 356 billion in FY24, exhibiting a CAGR of 11.7% and is poised to grow at the rate of roughly 12-14% to reach a market size of Rs. 500-600 billion.

The Indian eye pharma market has exhibited a CAGR of 7-9% from FY19 to FY24, to reach Rs.33-38 billion in FY24 and is projected to grow at the same rate to reach a market size of Rs. 46-51 billion by FY28.

The awareness about eye health is increasing due to factors such as rising income, charitable eye hospitals and government initiatives promoting eye health, rise in literacy, etc. Also, there is growth coming from medical tourism, as the cost of cataract surgery in India is one of the lowest in the world.

Business Segments

The Company’s segmental mix includes the following-

Services:

(a) Surgeries:

- Cataract surgeries: The company provides various cataract surgical treatments at its facilities, such as small incision cataract surgery, phacoemulsification, robotic cataract surgery, and glued intraocular lens treatments.

- Refractive surgeries: offers refractive surgeries to correct the refractive error of the eye, reducing or eliminating dependence on glasses and contact lenses. Primary refractive treatments include LASIK surgeries, SMILE treatments and other treatments.

- Other surgeries: A range of other surgical treatments for eye ailments are also available, including surgical retinal treatments, corneal transplantation, pinhole pupilloplasty, oculoplasty, and surgeries for the treatment of glaucoma and pterygium.

(b) Consultations, diagnoses, and non-surgical treatments:

The Company provides doctor consultation services, diagnostic services for eye disorders, and non-surgical treatments, such as retinal laser therapy and dry eye treatment.

Products:

- Sale of opticals, contact lenses, and accessories: The Company offers a wide selection of glasses, lenses, contact lenses, and frames at its facilities.

- Sale of eye care-related pharmaceutical products: The Company sells eye care-related pharmaceutical products at its facilities, as prescribed by its doctors.

The company’s revenue from its mature facilities grew at ~30.8%, from FY22 to FY24 to reach Rs. 1018 cr. The company defines mature facilities as facilities operating for a period of at least 3 years.

Apart from the aforementioned segments, the company is also present in the African region, from where it derived ~13% of its revenue in FY24.

Purpose of Issue:

The issue comprises of a fresh issue of Rs. 300 cr and an OFS component of ~Rs. 2727 cr. The main selling shareholders are the Agarwal promoter group, and investors such as Temasek Holdings, through its affiliate Claymore Investments (Mauritius) and Arvon Investments and TPG Growth through its affiliate Hyperion Investments.

The proceeds from the Fresh Issue will be used to prepay debt and the remaining to be used for general corporate purposes and potential inorganic acquisitions.

Acquisition history:

The company drives growth through acquisition-led expansion, leveraging acquired facilities' brand equity to establish new "spoke" facilities. Its M&A strategy focuses on underpenetrated regions, targeting high-quality clinical establishments with strong brand equity. The company improves acquired businesses by implementing best practices, leveraging its network, and accessing cost-efficient resources.

The company acquired the above-mentioned facilities between FY22-H1FY25 for ~Rs. 1290 Cr and the value of acquired assets was ~Rs. 686 Cr.

Concerns:

- High competitive intensity among other eye care and hospital chains

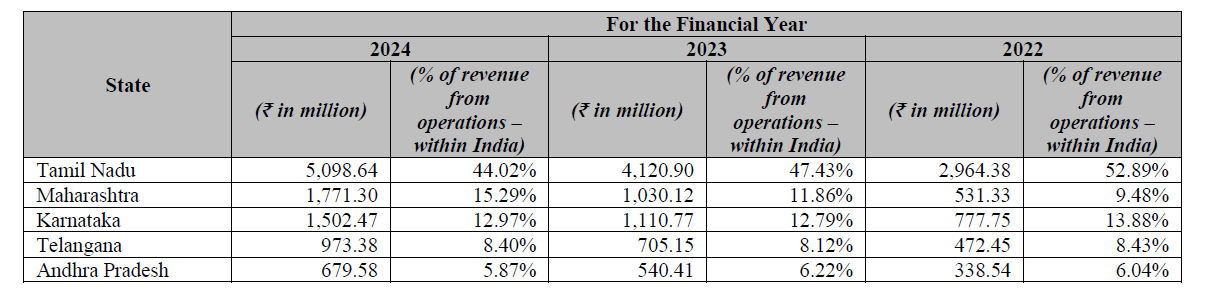

High geographical concentration - mainly in Southern states and the Maharashtra region

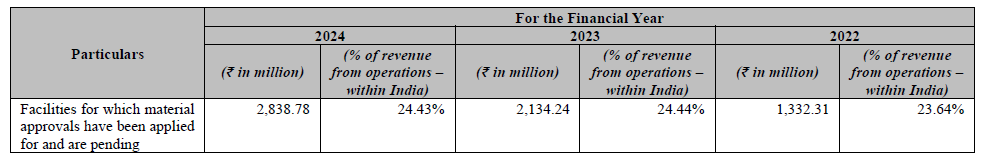

Delay in approvals - DAHL is required to obtain a number of approvals from government and regulatory authorities for operating its facilities, procuring and operating medical equipment and storage of drugs. The company has not yet applied for approvals from pollution control boards for some of its facilities in Tamil Nadu, Punjab and Haryana. Also, the company has applied for certain approvals pertaining to biomedical waste authorizations, air and pollution licenses, corneal transplant and clinical establishment licenses, which are yet to be received.

These licenses are delayed due to reasons such as pending structural modifications,shifting of premises. In the event of non-approval of these licenses/ approvals, the facilities will have to be shut down. The facilities which pertain to the pendency of these approvals contribute over 20% of the total revenue from India.

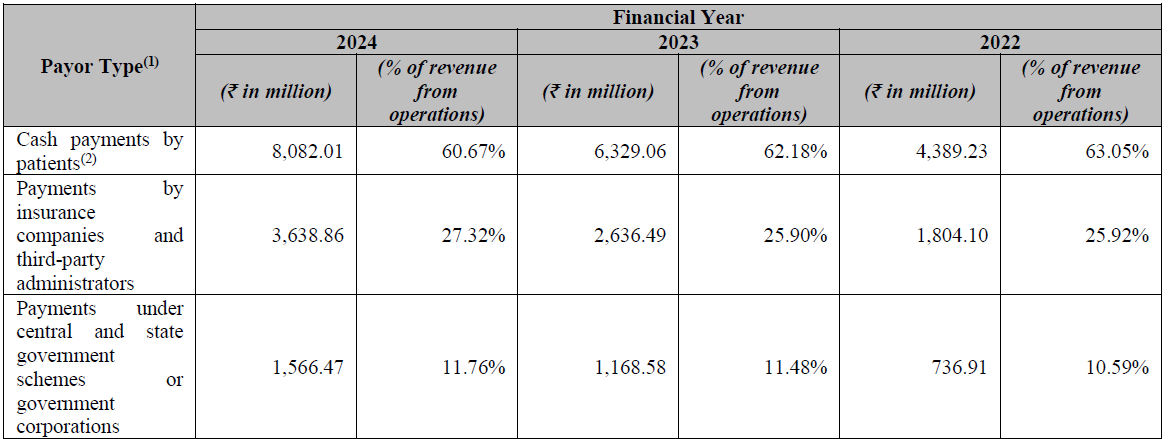

Extended working capital and allowance for expected credit loss- In addition to receiving direct payments from patients, the company receives payments through central and state government schemes, government corporations, insurance companies, and third-party administrators.

Recovery cycles for insurance claims range from 56 to 77 days, while for government corporations they vary between 168 to 217 days. Receivables unpaid for over two years are written off. Bad debts are recorded under Ind AS 109, considering historical trends and creditworthiness of payors.

Financials:

Management:

- Amar Agarwal: He is the Promoter Chairman and Non-Executive Director. He holds a master’s degree in surgery from Gujarat University. He has been a part of the Company since 2010. He also serves as a director on the boards of the Company’s subsidiaries.

- Adil Agarwal: He is part of the promoter group, Whole-Time Director, and the CEO. He completed his Master’s in Ophthalmology from Sri Ramachandra University, and MBA from Stanford University. He has been associated with the company since 2010 and has 12 years of experience in the healthcare industry.

- Anosh Agarwal: He is part of the promoter group, the Whole-Time Director, and the COO. He completed his Master’s in ophthalmology from Annamalai University, and MBA from Harvard Business School. He has been associated with the Company since 2010 and has 12 years of experience of the healthcare industry.

MoneyWorks4Me Opinion

Dr Agarwal Healthcare has a market share of ~25% of the total eye care service chain market in India. 50% of the facilities it operates are mature and the rest are emerging, this would give some room for margin growth. On the downside we don’t like that growth has been led by acquisitions and current return ratios (RoEs/RoCEs) are not robust.

We recommend avoiding this IPO.

Dr. Agarwal's Healthcare Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | January 29, 2025 |

| IPO Close Date | January 31, 2025 |

| Basis of Allotment Date | February 3, 2025 |

| Refunds Initiation | February 4, 2025 |

| A credit of Shares to Demat Account | February 4, 2025 |

| IPO Listing Date | February 5, 2025 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 35 | Rs. 14,070 |

| Maximum | 14 | 490 | Rs. 1,96,980 |

Dr. Agarwal's Healthcare Limited IPO FAQs:

When will the Dr. Agarwal's Healthcare Ltd IPO open?

Dr. Agarwal's Healthcare IPO will open for subscription on Wednesday, January 29, 2025 and closes on Friday, January 31, 2025.

What is the price band of Dr. Agarwal's Healthcare Ltd IPO?

The price band for Dr. Agarwal's Healthcare Ltd IPO is Rs. 382-402/share.

What is the lot size for the Dr. Agarwal's Healthcare Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 35 shares, up to a maximum of 14 lots i.e. Rs. 1,96,980/-.

What is the issue size of the Dr. Agarwal's Healthcare Ltd IPO?

The total issue size is ~ Rs. 3,027.26 Cr.

When will the basis of allotment be out?

Allotment will be finalized on February 3rd and refunds will be initiated by February 4th. Shares allotment will be credited in Demat accounts by February 4th.

What is the listing date of Dr. Agarwal's Healthcare Ltd's IPO?

The tentative listing date of the Dr. Agarwal's Healthcare IPO is February 5th, 2025.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks.

With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: