‘Risk toh Spiderman ko bhi lena padta hain’ – one of the lesser known dialogues from an Indian film. But this couldn’t have more apt than in the stock market. All of us know that stocks give us the highest returns however all of us have also heard stories of how you can lose even your shirt in this place! The equation therefore that we have become accustomed to is that if you want high returns you have no option but to take high risks by investing in stocks. But is this true? No, it isn’t!

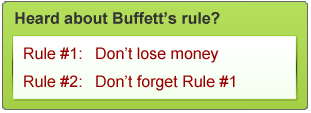

Investing in stock markets is risky but only if we haven’t done prior research. Like the famous investor Warren Buffet said, ‘Risk comes from not knowing what you’re doing’. Even then we have people all around us, advising us to increase our risk appetite if we want to see some hefty returns on our portfolio!

It is not necessary that taking high risk will lead you to higher returns. In fact the reason for the stock being termed a high risk investment is because there is an equally higher chance of you losing all your money! So, what are these factors that make some stocks riskier than the others?

What are high risk stocks?

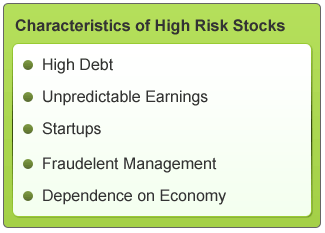

High Risk stocks will usually have one or more of the below characteristics:

1. High Debt- High debt levels can reduce the profitability of a business because such companies have to consistently pay interest. Also, if the company does not generate enough profits to repay its debt, it becomes difficult for it to attract additional investors or raise additional debt. For e.g. Orchids Chemicals and Pharmaceuticals which had a debt of around Rs. 2600 Cr. and eventually had to sell off off its core business of generic injectables to reduce it.

2. Unpredictable earnings – A company’s earnings may be affected by many reasons viz. extreme volatility in raw material costs, fluctuating product prices, exceptional/onetime gains, rising labor costs, poor sales, etc.

3. Startups – A startup has various concerns associated with it like an all together new project, unknown business model, unestablished products, uncertainty of profit margins, sustainability of earnings, etc. The risk of the business failure always looms large.

4. Fraudulent Management – A management with an infamous past or history of fraud increases your risk substantially.

5. Dependence on economy – Stocks that are more sensitive to economic news will tend to show more price fluctuations. For instance cyclical sector stocks go through alternate periods of boom and depression, depending on the demand for their products

Usually we tend to ignore these risks instead concentrating more on the prospective returns that we could get if the stock price rises. Especially, if the price of such a stock drops considerably, we feel that it is worthwhile to take the risk. However, what we investors tend to forget at such times is that there is still a high chance that we can end up making losses by investing in such risky companies.

So is there a way to take out the risk of losing our money and at the same time get high returns?

Let’s find out.

Low risk, High Return method

If it were indeed true that taking high risks is a necessity to earn high returns,, we would not have come across investors like Benjamin Graham and Warren Buffet. In fact these investment gurus have reiterated time and again that we should only invest when there is a low risk of loss and high probability of profits.

So, here are the value investing principles to help you invest the Low risk, High return way:

Look for a fundamentally strong company – A company with strong fundamentals i.e. an excellent financial track record and a competitive advantage provides surety of future financial performance to investors. Such companies will help us reduce risks associated with instability of earnings, startups, etc.

Ask for a Margin of Safety – Always buy stocks which are available at a discount. When you invest in stocks, you should be looking for a margin of safety of 50 %. You have to make sure you’re getting a rupee of value for only 50 paisa. There are two reasons why you should ask for a MOS.

Minimize Risk: A 50% MOS would reduce our risk drastically as it would protect us from the wide fluctuations of the market.

Great Returns: The other advantage by buying low is that you increase your returns. The lower you buy the stock, the higher return you get on the investment.

Thus, following these principles not only help you to minimize your risk considerably but also helps you earn high returns.

Let’s see if this method has worked in the past.

Parekh Aluminex, India’s largest aluminum foil and aluminum containers manufacturer is one such example of a fundamentally strong company which was available at a 50% margin of safety in October 2009. From its stock price of 106 in Oct ‘09 it appreciated to a high of Rs.512 (Oct’10), giving a return of approximately 384%.

Another example would be Havells India Ltd., a multi-product electric engineering and electrical goods manufacturing firm, is a good example. It was trading at a price as low as Rs. 151 in Oct’09 (bonus adjusted) due to the uncertainties regarding its Sylvania acquisition. It reached a high of Rs. 415 in Oct’10, once the fog cleared, giving approx 174% returns.

Thus, opportunities to buy a fundamentally strong company at a 50% MOS usually present themselves when the economy is in a downturn or when there are some short term problems with the company. But doesn’t that mean that there is risk associated with the company at such times? Yes,but the risk then would be minimal. What we need to analyse before investing is whether the company is capable of overcoming these problems. If the answer is yes, voila!! We can go ahead and invest!

So, where can you find such companies? You just need to log on to MoneyWorks4me.com where we give our subscribers 5 well-researched stocks at/below discount every month, which enable them to take the right buying decisions. The stocks mentioned above are just a few of our success stories that have appreciated and given our subscribers good returns.

Do you think low risk high return way is a better method of stock investing? Do share your ideas with us.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: