The new financial year just started and I was in a meeting with the team. The question that popped up was that are we doing enough to get new users to trust us enough to subscribe and fast enough? What else should we be doing?

Yes, we have loads of things that are very valuable to anyone wanting to invest in equity- stocks and mutual funds. And we are constantly looking at how to get users to see the immediate and large value so much so that in the last 24 months we have introduced solutions to do just that. But it’s still not enough.

What troubled me was that in the last few days, I have read about two major con jobs. One of them is a Pune-based Ashtavinayak Investments to the tune of 300cr and the other the called the World Startup Convention, Noida. Fantastic names. The first promised great returns and the second that great celebrities would attend. The latter was promoted by some ‘well-known’ influencers. What’s more troubling is that such scams keep happening regularly. It seems we never learn.

You don’t have to fall prey to a scamster to lose the money you will lose it also when you ‘listen’ to someone who is exaggerating, talking nonsense, lying, glamorous but incompetent, etc. And all of them adding to the information overload that is crippling you. I know it’s impractical to ask you to go off the internet and block everyone on your mobile. But there is a practical way to handle this.

It is called having a good BS Detector – a bullshit detector. In short, it enables you to recognize anything that is unreliable for whatever reason and is unsuitable, and will cause you to harm if you base your investing decisions on it. So if you want to invest successfully it is absolutely critical for you to be able to detect BS with ease. Ease because there’s too much of it happening and will land up on your mobile the moment you become interested in investing.

But how do you become a good BS Detector when you have a limited understanding of stock investing? You can’t unless you have a good BS Detector, a powerful tool, if one exists. But you must have a healthy level of skepticism, distrust, and doubt when consuming content on investing. And that includes what you are reading right now.

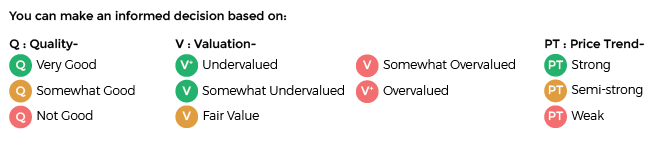

We didn’t plan to build a BS Detector for stock investing. But 18 months ago, we enhanced our data-driven system to answer the 3 essential questions that you need to answer to make an informed stock investing decision viz is it a good quality stock, investment-worthy stock, how attractive or unattractive is the price today and is it a good time to act now or wait. And we present that in our favourite 3 color-coded buttons format.

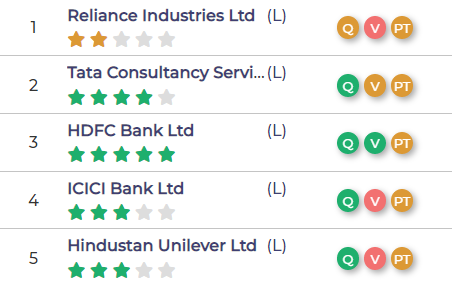

And this has turned out to be the BS Detector that you need. So, whenever, whoever tells you something about investing in a stock, you check it out on moneyworks4me.com and avoid those that are Red on quality and valuation and you will prevent yourself from making the wrong investment most of the time. Here are the ratings on the top 5 stocks.

And this has turned out to be the BS Detector that you need. So, whenever, whoever tells you something about investing in a stock, you check it out on moneyworks4me.com and avoid those that are Red on quality and valuation and you will prevent yourself from making the wrong investment most of the time. Here are the ratings on the top 5 stocks.

To understand how the rating, called DeciZen Rating, is done see this short 2 min video.

You can get unlimited access to this by subscribing to MoneyWorks4me Alpha which is designed to help you if you prefer to invest on your own. The least it will do for you is equip you with a simple-to-use, powerful BS Detector. It is not how I would like to describe it, but without it, you are not protected from making poor decisions. And by far, the key to investing successfully is to stop making poor decisions.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: